August 16th, 2023 | 05:25 CEST

Hydrogen scams and hard facts: Nikola, Plug Power, First Hydrogen

The somewhat macabre story behind a dead cat bounce is quickly explained: When a stock rises rapidly after a long sell-off, investors from the bear camp often refer to it as a dead cat bounce. The underlying idea is the somewhat tongue-in-cheek saying that even a dead cat would bounce off the ground if dropped from a great height. The best example of such a dead cat bounce is currently shown by the share of the hydrogen specialist Nikola. While investors are discussing the Company from the US, a success story is emerging in the background around a second-tier company.

time to read: 2 minutes

|

Author:

Nico Popp

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , NIKOLA CORP. | US6541101050 , First Hydrogen Corp. | CA32057N1042

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Nikola: Dead cats don't climb trees

Many investors still remember Nikola for a promotional video in which the manufacturer let a truck roll down a hill instead of powering it with hydrogen or battery electricity. Since that incident, the Company has been hard hit. Four new CEOs within four years speaks volumes. Most recently, there were signs of a turnaround - the share climbed from EUR 0.48 to over EUR 2 within a very short time. However, a recall for e-trucks recently sent the share back into the cellar. Although the stock still has catch-up potential from a purely technical point of view, the Company is also in serious trouble - its image and products are viewed skeptically. Nikola is, therefore, only something for gamblers.

First Hydrogen: Hydrogen van test runs with positive interim results

By contrast, things are looking much better for First Hydrogen. The Company focuses on light commercial vehicles powered by hydrogen. It has ambitious goals: Starting in fiscal 2025/2026, First Hydrogen aims to deliver between 10,000 and 20,000 units of its First Hydrogen Utility Van annually. To this end, First Hydrogen is cooperating with Ballard Power and AVL Powertrain and is currently conducting tests under real road conditions in the UK.

As the research portal researchanalyst.com reports, so far, two out of sixteen fleet operators have tested the first-generation prototypes on British roads. Other interested parties are yet to come forward. Telematics data to date gives reason for hope. First Hydrogen's van achieved a range of 630 km on just one tank - comparable electric vans would only manage around 240 km, according to researchanalyst.com. Users who have already driven the prototype also point to the short refueling time** compared to the charging breaks typical of e-cars.

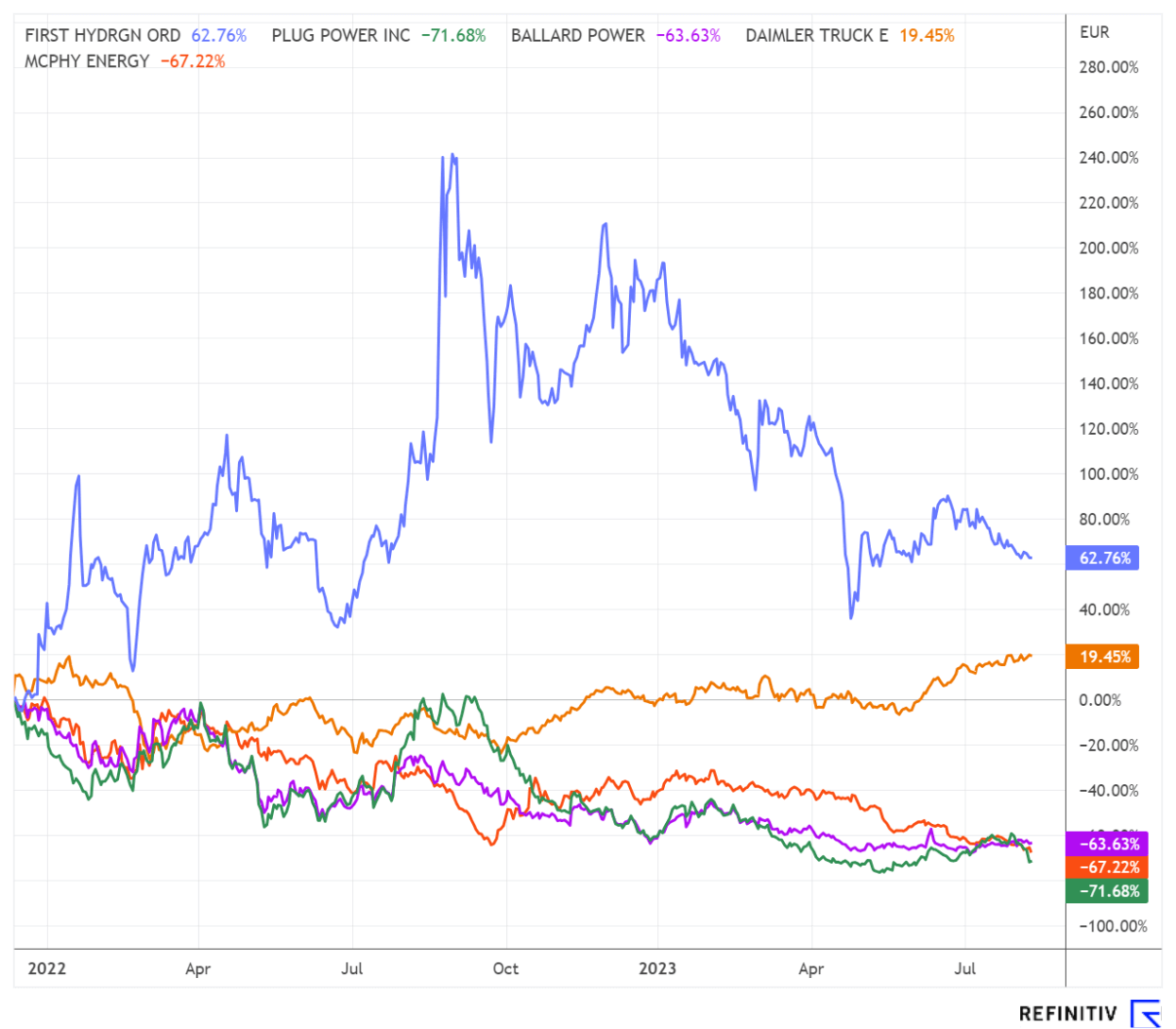

First Hydrogen also outperforms competitors on the stock market

First Hydrogen's stock impresses with its great relative strength compared to other companies in industry. A chart by researchanalyst.com shows that the stock significantly outperformed the competition from Plug Power, Ballard Power, Daimler Truck and McPhy. "With the extremely successful start of test drives of the prototypes under real road conditions, entry into the mass market should take place by 2026 at the latest, which should bring the Canadians a sales volume of around EUR 1 billion. Compared to the stock market value of around EUR 90 million, First Hydrogen is thus not overvalued compared to other companies in the sector", according to researchanalyst.com.

Recently, stocks like Plug Power have not been performing well. The company's stock on the Nasdaq declined significantly due to weak quarterly results. Since the losses have turned out larger than expected, investors worry about the financing for Plug Power. Even from a chart technical perspective, the stock appears weakened below the EUR 10 mark. Analysts have also been more negative in their assessments recently.

The tense situation around industry giants like Plug Power could ensure that the market does not fully recognize First Hydrogen's prospects for the time being. For investors with patience and vision, this may be an opportunity. However, there are risks to First Hydrogen as well - for example, the business has yet to develop, and production capacity has yet to be created. However, given the interesting niche and positive response from potential customers, First Hydrogen remains an exciting second-tier hydrogen stock. The relative strength of the past few months also suggests that the market believes in a positive development for the Company.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.