August 21st, 2025 | 07:15 CEST

High-tech correction! A brief pause, then the party continues at Palantir, Deutsche Telekom, MiMedia, and SAP

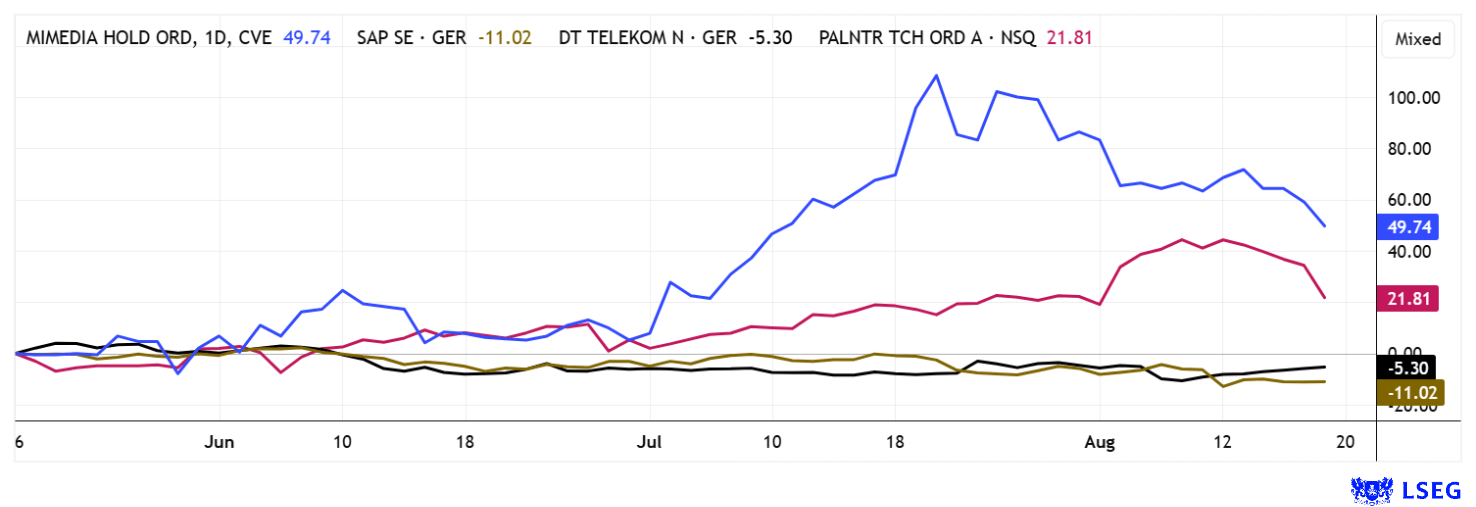

Oops – there it is. The first correction at Palantir was somewhat severe. But after a 1000% increase in 24 months – who cares? The blockbuster themes of artificial intelligence, cloud computing, and big data continue to dominate the stock market, leading to significant daily price gains. Investors seem to view the capital markets as an almost one-way success story in which valuations play hardly any role. Europe is increasingly taking the lead, with the EURO STOXX 50 rising by around 20% since the tariff dip in April. Despite apparent risks, many investors are sticking to the bull market, although the S&P 500's high Shiller P/E ratio of over 38 is sending out a clear warning signal. Deutsche Telekom is generating excitement with the announcement of another innovation push in the form of its first AI-based smartphone. The coming weeks therefore offer exciting opportunities for investors who, despite the warning signs, are betting on the continued momentum of the market. Where to invest?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , DT.TELEKOM AG NA | DE0005557508 , MIMEDIA HOLDINGS INC | CA60250B1067 , SAP SE O.N. | DE0007164600

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Deutsche Telekom – Own AI phone from Vietnam

Deutsche Telekom is showing its innovative side and launching its first AI phone, which largely does without traditional apps. Instead, an AI assistant from the US company Perplexity controls access to services. Users ask questions, and the answers appear directly on the screen. It can be used, for example, for translations or shopping tips with location functions. Standard apps continue to run in the background, but are no longer the central point of access. With a price tag of EUR 149, Telekom is deliberately focusing on an affordable entry-level model to compete with heavyweights such as Apple and Samsung. The device is manufactured in Vietnam and is also available in a tablet version.

For the Company, the AI phone is primarily an image project designed to demonstrate its innovative strength, similar to the earlier T-Phone, for which, however, no sales figures are available. What is new is the attempt to incorporate AI-supported accessibility. Visually impaired users can film their surroundings and receive a description of what they see. At the same time, Telekom emphasizes the role of such devices as a bridge for users who find AI exciting but are still wary of it. Other network operators such as Vodafone and O2 are foregoing in-house developments and instead relying on partnerships with established manufacturers. This leaves open the question of whether the Bonn-based AI phone will become more than a PR tool. However, there are opportunities, as the integration of AI into smartphones could actually create added value for Telekom customers and, in the medium term, also strengthen their loyalty to the Company's data and network services.

**With revenue growth of 3% per annum and earnings per share of EUR 1.96 in 2025, the DTE share has a current 2025 P/E ratio of 15.8. No less than 19 of 23 analysts on the LSEG platform rate the stock as a "Buy" – with a 12-month average price target of EUR 37.70. Investors can also expect a solid dividend yield of 4.4%. Collect up to EUR 32!

MiMedia – To the top with new partnerships

The Canadian company MiMedia (MIM) has established itself as a versatile provider in the global cloud business. With its AI-powered platform, the Company primarily targets Android users. It enables location-independent backup and cross-device access to personal media such as photos, videos, and documents via a subscription model. The platform impresses with smart organization tools, an attractive user interface, and extensive sharing options. MiMedia has built successful partnerships with international smartphone manufacturers and telecom providers, securing stable revenue streams and enhancing customer retention. After investments of over CAD 50 million and numerous patents, the Company is now targeting around 35 million installations within the next two years. Its strong strategic positioning is starting to pay off.

MiMedia recently announced a new global distribution agreement with Coolpad, an experienced Chinese smartphone manufacturer that has been producing affordable devices worldwide for decades. Within just three months, the first ten thousand Coolpad smartphones with MiMedia technology were shipped to Latin America and the Caribbean. Further sales are planned to open up additional markets in various regions. CEO Chris Giordano praises the rapid integration and efficient collaboration with Coolpad and sees significant growth potential for 2025 and 2026 with this partnership. "The integration process went smoothly, and we are working intensively on the upcoming deliveries with Coolpad," said Chris Giordano, CEO of MiMedia.

With OEM partnerships such as this, MiMedia is strengthening its market position in the booming cloud sector and offering its partners recurring revenue and competitive differentiation. The combination of modern AI technology and global sales strength makes MiMedia an interesting player in the mobile world's cloud ecosystem. The MIM share has already risen from CAD 0.20 to over CAD 1.00 since the beginning of the year and, after a minor correction, is now trading at CAD 0.74. With a market capitalization of only CAD 45 million, the share is far too cheap for its obvious growth prospects. Buy!

SAP and Palantir – An unlikely pair

In the cloud and cybersecurity sector, SAP and big data analytics expert Palantir Technologies are emerging with distinct yet complementary strengths. Both are major players in the high-tech space, but with differing core focuses. SAP has evolved from an ERP provider to an integrated cloud and AI platform, with solutions such as the Business Technology Platform and S/4HANA, which combine data integration and automation. SAP's cloud revenue recently grew by over 28%, with profits up 35%, supported by partnerships such as with Alibaba. Palantir specializes in big data analytics for sensitive industries such as defense and finance and holds a near-monopoly position thanks to strong integration and security standards. With revenue up 48% to over USD 1 billion in the last quarter, it is further expanding its market position in the US. By comparison, analysts expect SAP to generate revenue of over EUR 37 billion in 2025.

SAP and Palantir have been cooperating since May 2025 to make it easier for customers to switch to modern cloud architectures with Palantir's data integration. The partnership strengthens process optimization and increases user-friendliness, but each company retains exclusive rights to its customers. This significantly expands the market opportunities for both companies. While Palantir's share price has already risen by over 200% in 2025 and is extremely highly valued with a P/E ratio of 215, SAP remains significantly more moderate with a P/E ratio of 33. The share price has fallen back from EUR 284 to its starting level at the beginning of the year and is now very attractive again at EUR 234. According to the majority of analysts on the LSEG platform, Palantir is still a sell. Notably, short seller Andrew Left of Citron Research summed up the downside potential with the words: "Even USD 40 is still too high!" Well then - good luck!**

Deutsche Telekom surprises with its own AI phone. The low share price is encouraging buyers, and long-term investors should also keep an eye on SAP. From a valuation perspective, it even makes sense to swap the heavily overvalued Palantir for SAP or Deutsche Telekom. Cloud expert MiMedia is also clearly in focus, as cooperation with hardware manufacturers such as Coolpad and others could generate rapid growth.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.