January 7th, 2026 | 07:20 CET

Experts predict a silver boom up to USD 250! Should Rheinmetall, Silver Viper, and Aixtron be in your portfolio now?

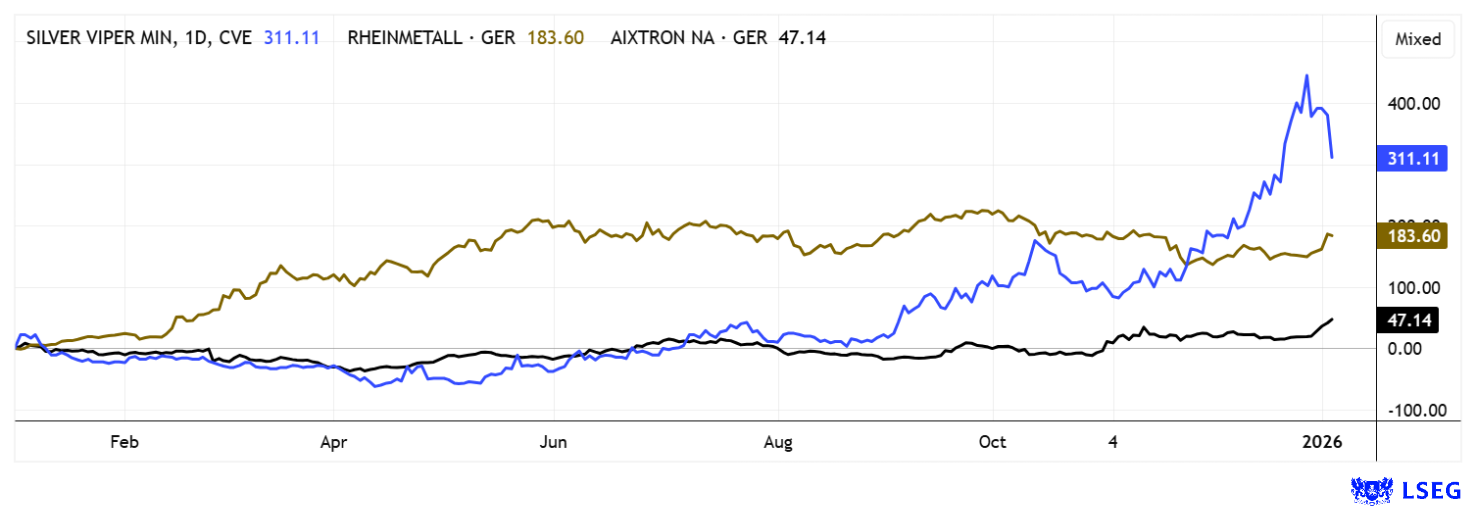

The rise in the price of silver by over 160% in just 12 months is already phenomenal. But the upward scenario now seems inevitable: reports of imbalances in the physical delivery of futures contracts by institutional investors are leading to renewed price increases at every settlement date. Since the precious metal generated a strong buy signal at around USD 38, the price has been trending upwards. In yesterday's trading, it even exceeded the USD 80 mark. Allegedly, more than 700 million ounces of silver will be missing for the March settlement, which corresponds to 90% of total annual production. In addition to the very interesting silver explorer Silver Viper, we are also looking at Rheinmetall and Aixtron, two high-tech consumers of this critical metal. If deliveries fail, production lines could be halted for some time! Here are a few insights.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , SILVER VIPER MINER. CORP. | CA8283344098 , AIXTRON SE NA O.N. | DE000A0WMPJ6

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall – Dependence on strategic metals is a given

Rheinmetall AG has been on nearly every European fund manager and private investor's shopping list for the past three years. During the major revaluation between 2022 and 2025, the stock increased twentyfold from around EUR 95 to a peak of EUR 2,005. However, since reaching its historic high at the end of September, buying momentum has dried up. Since then, the share price has been oscillating between EUR 1,500 and EUR 1,900, only occasionally rattled by reports on the "peace process" in Ukraine.

How dependent is the defense contractor on silver? As a large defense contractor, it is heavily dependent on various strategic metals, but silver itself plays a rather minor role in the supply chain. In modern weapon systems – especially in the "Electronic Solutions" division, which specializes in electronics and sensor technology – silver is used for its excellent electrical and thermal conductivity, for example, in contacts, conductor tracks, and heat dissipation, which explains the demand for the precious metal in certain components. However, the exact quantities are not publicly known. However, rare earths and high-tech raw materials are of greater strategic importance to Rheinmetall. These are largely sourced from China and are indispensable for precision-guided weapons, sensor technology, communications technology, and electronics.

Is Rheinmetall now worth investing in? There is consensus on the LSEG expert platform about the growth path of the Düsseldorf-based company, which now has a P/E ratio of 41 on a 2026 basis. However, the expected revenue growth from 9.7 in 2024 to around EUR 36 billion in 2029 appears much more important. That is a fourfold increase in five years. This means that the market capitalization of EUR 73.5 billion no longer seems so high. It is surprising that investors are already reflecting the growth of the next five years in the share price today. There is actually no reason for this, and it carries risks of operational disappointment, which could certainly cause the share price to suffer heavy losses. We believe it makes more sense to buy in the EUR 1,200 to 1,500 range, which, according to analysts, offers up to 50% upside potential. The last such buying opportunity was in November. A moderate entry requires a lot of patience, as the stock is extremely tight in the market.

Silver Viper – On a strong expansion tour in Mexico

With a gain of over 400% in 12 months, Silver Viper outperformed the commodity itself, even outshining other high-performing stocks like Rheinmetall. The Canadian exploration company has clearly focused its activities on gold and silver projects in Mexico, particularly the La Virginia and Coneto properties. The recent capital increase of approximately CAD 17 million has enabled the Company to secure a solid financial base and attract the interest of institutional investors. The fresh funds are sufficient to continue surface work at La Virginia and ultimately prepare for an extensive drilling campaign. Management believes that the existing resource estimate can be further expanded. The regional location speaks volumes in terms of history. At the same time, Silver Viper is working to take full control of the Coneto project, which is located in one of the most important silver regions in the country. A strategic advantage is the participation of Fresnillo and Orex, which contribute both industrial credibility and regional expertise to the further development of the projects. In addition, the capital structure with warrants strengthens financial flexibility, as further capital can flow in when prices rise.

A further governance impetus has been added: Jeff Couch, an experienced capital market and commodities specialist, has been appointed to the board. Couch brings in-depth experience from international mining and private equity structures and has held senior positions in investment banking for many years. His appointment is intended to support the next phase of growth and further professionalize the capital market orientation. Silver Viper is thus positioning itself as a growth-oriented explorer with a clear strategy in a highly attractive silver zone. At CAD 2.56, the share price reached unprecedented heights in December and is currently consolidating at around CAD 1.87, creating new entry levels. The medium-term outlook for the dynamic company is outstanding and presents an attractive accumulation range between CAD 1.70 and 2.00.

IIF moderator Lyndsay Malchuk talks to Silver Viper Chairman Adam Cegielski about the further exploration strategy in Mexico.

Aixtron – Back on the growth path

With its recent break above EUR 20, the Aixtron share price surprised market participants, temporarily overshadowing analysts' lower estimates. The reason for the optimism is the conviction that the Company has good AI growth prospects. With 800 V architectures, state-of-the-art MOCVD systems, and GaN and optoelectronics products, the Herzogenrath-based company is meeting the needs of a new generation of mainframe infrastructures. These are materials that are needed for energy-efficient semiconductors and data communication lasers.

Bank of America stands out with its price target of EUR 25.10. The investment house upgraded the stock to "Buy" in December and announced a significantly higher price target than the LSEG market consensus of around EUR 18.50. Barclays and Berenberg are still lagging behind somewhat at EUR 20 and EUR 21, respectively, but have also provided positive comments. Yesterday, the popular German tech stock rose 5% to EUR 21.25. **From a technical perspective, the price could now very quickly advance into the EUR 23 to EUR 25 zone. The 2023 high stands at around EUR 38. Well then!

The stock market is ruthless and shows no mercy for weakness. Even more extreme is the silver market, which vividly demonstrates a massive short squeeze that could escalate into an epic move. Dynamic investors should diversify broadly across defense, security, and commodities, while strictly adhering to disciplined stop-loss limits. Silver Viper is well-positioned in Mexico and offers substantial medium-term potential.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.