June 23rd, 2025 | 07:05 CEST

High-tech boom 3.0! Is another 100% possible with Palantir, SAP, MiMedia, and TeamViewer?

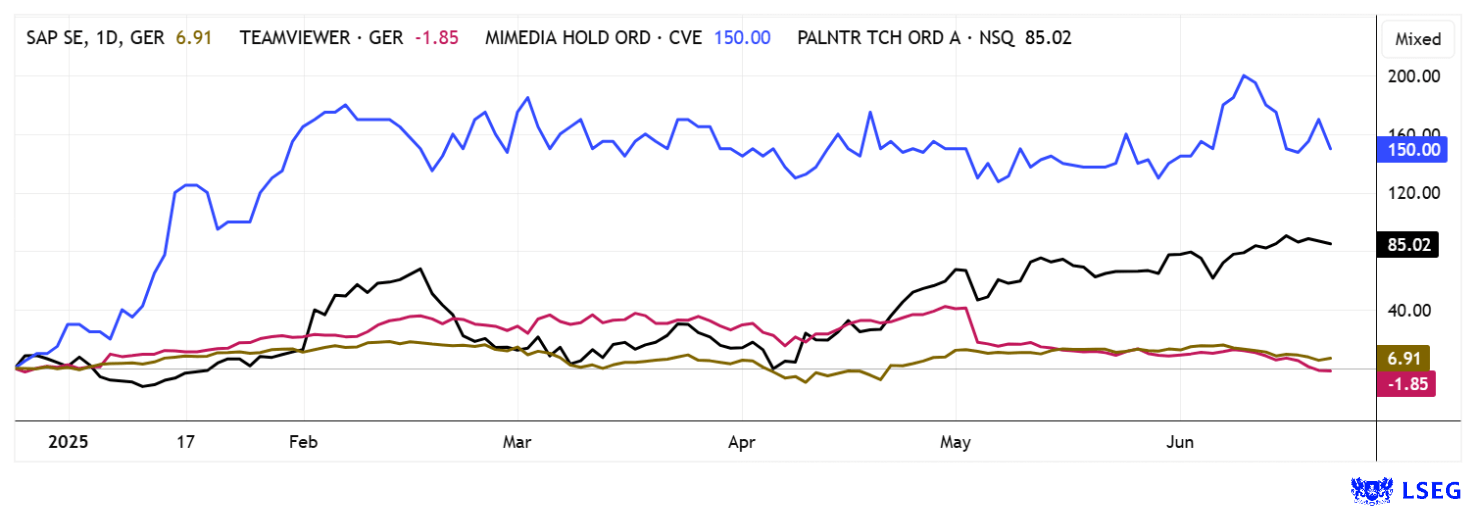

Artificial intelligence and big data remain the big topics on the stock markets alongside defense. This is leading to daily gains for high-tech and defense stocks. Investors increasingly appear to view the capital markets as a one-way street, with valuations seemingly taking a back seat. Interestingly, Europe is ahead of the US. Since the tariff dip in April alone, the EURO STOXX 50 has gained around 20%. With Israel's attack on Iran, some uncertainty is now entering the market. However, many investors do not believe the big bull market will change. Only the Shiller P/E ratio for the S&P 500, at over 36, is a cause for caution, given that the long-term average is around 17. But does anyone care? The party is in full swing, and critics are not welcome. So, where do the opportunities lie in the weeks ahead?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PALANTIR TECHNOLOGIES INC | US69608A1088 , SAP SE O.N. | DE0007164600 , TEAMVIEWER AG INH O.N. | DE000A2YN900

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TeamViewer – Sell-off after disappointing quarterly figures

TeamViewer is a German technology company in the field of remote working. Its key product is a software platform for remote access, remote control, and support, which can be used to connect devices worldwide, regardless of location. The Company targets both private users and businesses, particularly in the areas of IT support, remote work, and industrial digitalization. In the enterprise segment, TeamViewer increasingly offers integrated solutions such as remote monitoring and management (RMM), augmented reality applications, and IoT services. Monetization is primarily driven by subscription-based licensing models with recurring revenue streams (ARR). Through strategic acquisitions, most recently, the British company 1E, TeamViewer, has expanded its platform with new features in the area of digital workplace management, thereby strengthening its market position in the enterprise segment.

In the first quarter of 2025, TeamViewer continued to perform strongly in the cloud and data business, driven primarily by the enterprise segment. Pro forma revenue, including the acquisition of 1E, rose by 7% to EUR 190.3 million, while total ARR also grew by 7% to EUR 759.5 million. The EBITDA margin reached an impressive 43%, supported by optimized marketing expenses and increased profitability. TeamViewer also strengthened its management team by appointing two new top executives to promote customer loyalty and SMB business. Despite this progress, the market reacted with high trading volumes, causing the share price to fall from EUR 13.30 to EUR 9.40. As a result, the lows of December 2024 have almost been reached again. With revenue growth of 10% per annum and earnings per share of 1.02 in 2025, the stock now only has a 2025 P/E ratio of 9. This is too cheap for a growing software company. Warburg Research rates the stock as a "Buy" with a 12-month price target of EUR 17. Collecting up to EUR 9.75 makes sense!

MiMedia – Private data comes first

Canadian company MiMedia (MIM) has evolved with a diverse offering in the global cloud business. Its in-house platform is aimed specifically at Android users. It is based on state-of-the-art AI technology to permanently secure personal media such as photos, videos, and documents via subscription, regardless of location. Demand for this solution is highly dynamic. Once stored, content can be accessed anytime across all systems, whether on a smartphone, tablet, or PC. The platform impresses with intuitive organization tools, an appealing media interface, and numerous options for private sharing. MiMedia cooperates with international smartphone manufacturers and telecom providers to enable them to achieve stable revenue models, stronger customer loyalty, and a differentiated market presence. The current B2B focus is on the US, Latin America, Africa, Europe, and Southeast Asia. Particularly noteworthy is the acquisition of Walmart Latin America as a major customer in the first quarter. Existing contracts already secure 35 million software installations for the next two years.

After several years of development work and investments of over CAD 50 million, MiMedia is now growing rapidly under the protection of numerous patents. The collaboration brings its telecommunications partners revenues in the triple-digit million range, while MiMedia itself achieves solid margins through storage subscriptions and mobile advertising. The cloud market is booming, and innovative providers such as MiMedia are finding an ideal environment for further growth. Most recently, the Canadians signed a global distribution agreement with leading device manufacturer Coolpad. Founded in 1993, the Chinese company has been manufacturing affordable smartphones for the global market for decades. Under the agreement, MiMedia is expected to integrate its platform into up to five million Coolpad mobile devices over the next two years.

MiMedia is currently placing a convertible bond of up to CAD 3 million with a conversion price of CAD 0.50. Warrants with strike prices ranging from CAD 0.65 to CAD 1.00 and varying exercise periods are also attached. The share price has already risen from CAD 0.20 to CAD 0.60 since the beginning of the year and is currently trading at around CAD 0.50. With a market capitalization of only CAD 29.6 million, the share is not too expensive. Get in now!

SAP and Palantir – Growth is almost inevitable

SAP is also set to benefit greatly from its cloud investments in recent years. In Q1 2025, the Walldorf-based company achieved an 8% increase in total revenue to EUR 8.73 billion, with the cloud business growing particularly strongly at 25% to EUR 3.93 billion. This sector now accounts for the largest share of revenue. The cloud gross margin improved significantly to 73%, driven by economies of scale and efficiency gains. Surprisingly, operating profit under IFRS fell by 2% to EUR 1.15 billion, attributable to higher restructuring costs. Adjusted operating profit, however, was EUR 2.06 billion, an increase of 16%. SAP confirmed its recently announced annual forecast but emphasized that 2025 is seen as a transition year with a focus on operational streamlining and profitability. Experts on the LSEG platform expect an average target price of EUR 287, representing a potential upside of 14% for the Walldorf-based software company's shares.

Nasdaq star Palantir Technologies is undoubtedly one of the most remarkable IPO stories of the past five years. The Company, led by co-founder and CEO Alex Karp, has established itself as a highly specialized data analysis and AI solutions provider, particularly for government agencies and security-related institutions. Palantir supplies its technology to support military operations, border protection, and conflict data analysis, among other things. The software is also used in Ukrainian defense.

Since its IPO in 2020 at an issue price of USD 10, the share price has risen rapidly, peaking at just under USD 145. However, in the wake of the April market correction, the stock fell to USD 65, a temporary decline of around 50%. In Q1 2025, Palantir again recorded impressive revenue growth of 39% year-on-year to USD 884 million, slightly exceeding experts' expectations. At USD 373 million, the US government segment delivered a 45% increase in orders from 2024. Operating profitability was robust, with Palantir generating adjusted operating income of USD 391 million, representing a dream margin of 44%. Based on the strong figures, Palantir raised its forecast for the full year 2025 and now expects revenue to increase by 36%, with an expected annual revenue of approximately USD 3.9 billion. The price-to-sales ratio of 72 is currently not deterring true fans from continuing to buy the stock. A fascinating rally!

The stock market is not taking any prisoners at the moment - as can be seen with TeamViewer. The Q1 figures did not meet analysts' expectations, and the stock plunged by 30%. SAP and Palantir, on the other hand, offer solid growth models, which justify their high valuations. Cloud specialist MiMedia is also strongly in the race - given the sharp upswing in the MIM share price, the rally likely still has room to run.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.