January 26th, 2023 | 20:07 CET

Gold and war - rethink now! Barrick Gold, Globex Mining, Rheinmetall

Gold is shining again. The weaker dollar and the existing geopolitical risks are boosting the precious metal. But how should investors invest? What opportunities are there off the beaten track? And: Given the crises, does gold have to be in the portfolio? We highlight three hot stocks and provide insights and outlooks on the gold price and the overall geopolitical situation.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

BARRICK GOLD CORP. | CA0679011084 , GLOBEX MINING ENTPRS INC. | CA3799005093 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] Our projects are at the initial, high reward exploration stage. [...]" Humphrey Hale, CEO, Managing Geologist, Carnavale Resources Ltd.

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Barrick Gold: Hope with problems

It does not always have to be physical gold: Compared to coins and bars, gold stocks are convenient to trade and also offer the chance that they anticipate future developments in the gold price. What is more, positive developments at the corporate level can provide additional leverage to returns. Those who bet on gold stocks usually think first and foremost of shares such as Barrick Gold. The Company is one of the largest gold producers in the world. At the same time, it is trying to expand its exposure around copper and thus position itself more broadly. In the past, Barrick Gold generated rich cash flows during positive months for the gold price and let these income streams also benefit shareholders, for example, in the form of dividends or share buybacks.

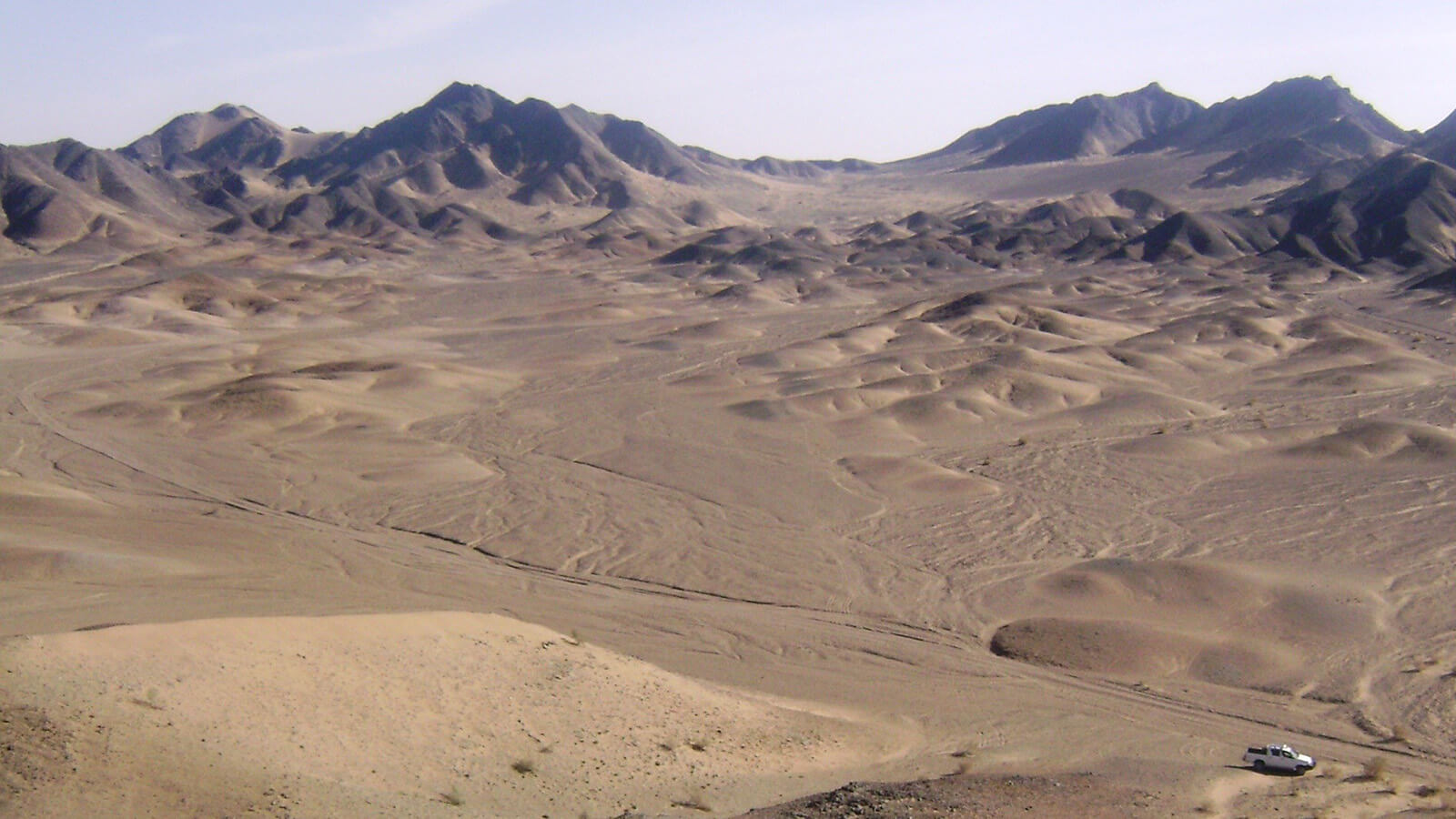

But this was not enough for the market - growth and new investments were loudly demanded. With the giant Pakistani project Reko Diq, which is to produce gold from 2028, Barrick Gold finally wants to get back on the growth path. Within the first five years of production, an average of 280,000t of gold is to be unearthed annually. But growth is not without risk: as current company figures show, costs are also rising for Barrick Gold. However, the research portal researchanalyst.com sees this cost pressure abating and believes the overall operating picture around Barrick can brighten. At the current level, the experts believe there could be long-term potential.

Globex Mining: More than 200 projects in one share

The share of Globex Mining is also full of potential - in the truest sense of the word. The commodity conglomerate stands for more than 200 promising projects. Although most are early-stage properties, Globex has projects in its portfolio for which feasibility studies already exist. Globex's goal is clear. To gradually develop and advance projects. As supporters, Globex Mining often relies on joint venture partners. They invest and take over the operational work; in return, Globex receives stakes in the event of success. For years, experienced commodity investors had Globex Mining on their radar, but the stock suffered from the typical problems of conglomerates: No project stood out, and the Company's value and, above all, its prospects were difficult to communicate to the market.

With commodity prices picking up, things look different now. Especially the gold hype attracts investors. Globex Mining has numerous projects that are suitable for the gold miners of tomorrow. In addition, the strategic direction of focusing only on North America is becoming an advantage right now. Uncertain jurisdictions are hardly in demand anymore in a world full of geopolitical tensions - Canada and the US have an advantage. Globex Mining, with a market capitalization of around CAD 50 million, is a flawless small-cap and thus also fraught with risk. However, the share price development since the turn of the year indicates that momentum is picking up. What has held back Globex's share price for years could now boost it. The reservoir of promising projects is huge, and the individual parts will likely be worth more than the big picture. The stock is worth considering for speculative investors.

Rheinmetall: Territorial gains for the stock?

Investors who buy Rheinmetall must also be speculative. Although weapons are booming in the current times, the Rheinmetall share has already risen sharply. The research portal researchanalyst.com recently took a detailed look at the Company. Given the global situation surrounding the war in Ukraine and the ailing supply situation of the German Armed Forces, it sees potential for the German arms company. From a chart perspective, the starting position also looks positive. Rheinmetall could end up in the DAX, which should attract further attention to the stock.

Investors looking for crisis investments should not pin everything on the war in Ukraine. Although the general conditions for stocks like Rheinmetall are rosy right now, there are other trouble spots around the world. Investments in commodities, especially gold, are still a good idea in order to spread the risk in the portfolio. While Barrick suffers from rising costs, project collectors such as Globex Mining largely ignore this factor. In addition, the gold bull market has yet to really take off for small stocks. Those with experience with this form of investing can look into corresponding values.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.