February 21st, 2025 | 07:10 CET

Global stock boom, Germany votes – Watch out for Mercedes-Benz, Argo Living, thyssenkrupp, Rheinmetall, and Hensoldt!

The stock market started the new year at full speed. The DAX index reached 22,900 points in February, which is in line with some analysts' year-end targets. Liquidity is high and sentiment remains buoyant despite all the negative events in the real world. The federal elections are just around the corner, with the prospect of a grand coalition with green or yellow enrichment. The people of Germany hope for a big change, but none of our politicians have the stature of a Donald Trump, who establishes new conditions by the second. The likelihood is high that coalition negotiations will take longer than we believe today, and the uncertainty surrounding the German economy will likely continue for a while. It will be interesting to see whether Germany ever experiences a real "double whammy". After all, there are enough problems to solve, but so far, the will and courage are lacking. Here you will find a selection of titles that could cause a stir even after the election.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

MERCEDES-BENZ GROUP AG | DE0007100000 , ARGO LIVING SOILS CORP | CA04018T3064 , THYSSENKRUPP AG O.N. | DE0007500001 , RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Mercedes-Benz – Around 30% to come from abroad in the future

More bad news from the automotive sector. Yesterday, the Stuttgart-based premium manufacturer Mercedes-Benz announced its figures for 2024. The much-publicized EBIT fell by more than 30% compared to 2023 to EUR 13.6 billion. Revenues also shrank significantly by 4.5% to EUR 145.6 billion, and the operating margin in the automotive business was just 8.1%, considerably less than the 12.6% from the previous year. In 2021 and 2022, margins had been even higher. In China, the most important market, where one-third of revenue had previously been generated, deliveries fell by a solid 7%. In addition, the electric vehicle business collapsed worldwide, with global sales falling by almost a quarter. Another problem area is the high-margin luxury segment, where sales here shrank by a painful 14%.

CEO Ola Källenius remains positive: "Thanks to outstanding products and strict cost discipline, the Mercedes-Benz Group has achieved solid results in a very challenging environment. To ensure the Company's future competitiveness in an increasingly volatile world, we are taking measures to make us leaner, faster, and stronger." This includes relocating capacities to Hungary. BYD has already found a factory location there. The share of production in low-cost countries will double from 15% to 30% in the coming years. However, without closing any plants, production capacity in Germany will be reduced by 100,000 units and increased to 200,000 at the Kecskemét plant in Hungary. Expenses there are a whopping 70% lower than in Germany. The Stuttgart-based company plans to cut production costs by a full 10% by 2027. The share price initially plunged by 5%, falling below EUR 60.

thyssenkrupp – The naval division in focus

After thyssenkrupp's share price almost inconspicuously doubled to over EUR 6 since the fall of 2024, rumors are growing that the marine division TKMS (thyssenkrupp Marine Systems) will be spun off. The order situation is currently extremely good. The budget committee of the German parliament has awarded TKMS the contract for 6 submarines. The individual order is expected to bring the Company EUR 4.7 billion, and Norway is also placing an order. According to board member Oliver Burkhard, TKMS is thus fully booked until the end of the 2030s.

Meanwhile, the restructuring of the entire group is still ongoing. Of the 27,000 jobs currently in the steel sector, only 16,000 are to remain. By the end of 2030, 5,000 jobs in production and administration will be cut and a further 6,000 will be eliminated through outsourcing or business sales. These measures are being driven by weak demand, to which the Company wants to react by significantly reducing its steel capacity from the current 11.5 million tons per year to 8.7 million tons per year. Now, the rearmament of NATO has led to new orders for the entire group, a blessing for the ailing Duisburg-based company. Negotiations with financial investor Carlyle failed last year, but there are said to be further interested parties for TKMS in the form of Deutz, Rheinmetall, and competitor Lürssen-Werft. This should continue to fuel speculation about thyssenkrupp's shares. Bank of America analysts believe in an IPO of the marine division, which will fuel trading volumes in thyssenkrupp AG. We had already discussed the stock at EUR 3.20 and recommend staying invested.

Argo Living Soils Corp. – Biological agricultural products and green concrete

Our new discovery from Canada is very interesting. It is the sustainability stock Argo Living Soils Corp. The Company specializes in the production and development of organic fertilizer products. The vision of the agricultural company is to create an established brand for organic and environmentally friendly products. The Company was founded in 2018 and has been enjoying great popularity for several weeks. The Company's focus is the production and development of organic agricultural products, including soil conditioners, living soils, biofertilizers, worm castings, and compost teas, which have been specially developed for high-value crops. Argo was founded with a strong commitment to sustainability and is primarily focused on developing products that improve soil health and fertility while supporting sustainable agricultural practices.

Through the use of innovative technologies and advanced research, Argo aims to help facilitate the agricultural sector's transition to more environmentally friendly and resource-efficient methods. Argo's strategic initiatives include a partnership with Connective Global SDN BHD, a company based in Malaysia, to jointly research and develop biochar for agricultural and industrial applications. This collaboration leverages the research facilities of the University Putra Malaysia, a renowned institution with a strong focus on agricultural sciences. It also includes the Indonesian company PT Aplikasi Grafena Industri & Consulting Ltd (AGIC), with its sustainable technology for the production of synthetic bio-graphene and graphene-NP composite materials, as a key partner. Argo is strategically advancing the development of biochar-enriched products tailored to the Southeast Asian and Middle Eastern markets. These regions present significant opportunities for sustainable agricultural practices to increase food security, driven by initiatives to convert drylands into arable land.

Also promising is the recently announced entry into the green, i.e. carbon-reduced concrete business. Robert Intile, CEO of Argo Living Soils Corp., stated: "The formation of Argo Green Concrete Solutions Inc. is an important milestone in our company's growth strategy. By combining our expertise in organic materials with cutting-edge graphene technology, we aim to revolutionize the construction industry with greener, stronger, and more durable concrete solutions." With 16.1 million shares issued, the Company is currently valued at CAD 12.7 million. With a good 260% price increase since December, investors continue to celebrate the share, which is also listed in Frankfurt. Exciting!

Hensoldt and Rheinmetall - Caution at the platform edge

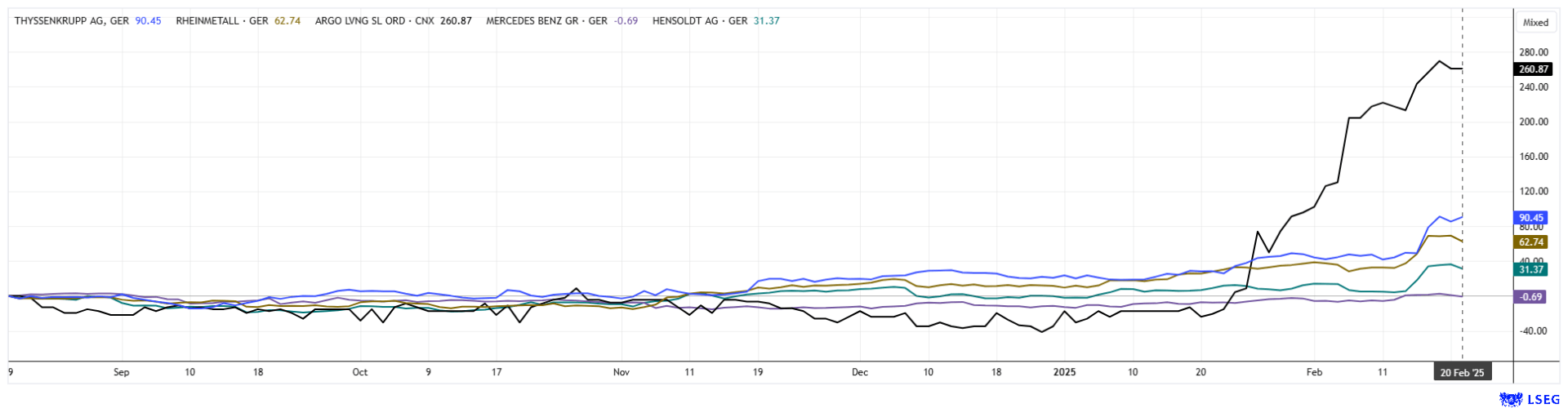

What investors are not fully taking into account in the current arms euphoria is that military spending must first be approved by the many government bodies. That said, revenue in the defense industry will naturally increase year after year, by around 25% per annum at Rheinmetall, and an estimated 10% in additional revenue at Hensoldt. The reaction to Trump's words that Europe must pay for its own security is understandable. However, if a solution for Ukraine emerges in the coming weeks, the 50% price increases of recent times would be quickly eroded. So be sure to consistently move your stop limits. Yesterday's events show how quickly the euphoria premiums can evaporate again when the stock market tends toward normalization.

The rise on the stock markets is quite advanced. The dilemma only really becomes apparent when figures are published that fall short of expectations and the shares enter a free fall. Highflyer Palantir was hit yesterday with a minus of 25%. Within our selection list, we are focusing on thyssenkrupp AG and Argo Living Soils. These stocks should continue to rise significantly. Caution is advised with Rheinmetall and Hensoldt, as the valuation is unusually high.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.