January 4th, 2024 | 08:00 CET

Focus on individual stocks: Why Saturn Oil + Gas, Siemens Energy, and JinkoSolar are scoring points in the energy poker game

Global demand for oil and gas is rising steadily, especially in high-growth economies. Saturn Oil & Gas is a Canadian company that is positioning itself as a promising investment in the energy sector. The Company is currently successfully producing light oil in Saskatchewan and has also completed horizontal drilling in Alberta. It also pursues a conservative accounting policy. Siemens Energy is in the focus of investors after a more than 50% drop in shares between June and November 2023. The damaged wind turbines from the Siemens Gamesa deal require a clear strategy from CEO Christian Bruch. Analysts are divided. While Morgan Stanley is optimistic about the development, Barclays lowers the price target. In an uncertain market environment for renewable energies, a differentiated view of individual values is crucial for investors. China is positioning itself not only as one of the leading industrialized oil and gas countries but also as a pioneer in the renewable energy sector. JinkoSolar, a Chinese company, is benefiting from its financial stability and the rising global demand for solar energy. Find out here which stock scores best.

time to read: 6 minutes

|

Author:

Juliane Zielonka

ISIN:

Saturn Oil + Gas Inc. | CA80412L8832 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Conservative accounting and steady growth: Saturn Oil & Gas as a promising investment in the energy sector

Global demand for oil and gas is rising steadily. This is especially true for economies with solid growth. The top five in oil and gas production are the US, followed by Saudi Arabia, Russia, Canada and Iraq. Countries with significant oil and gas reserves have strong political and economic power. Given the geopolitical situation, this helps investors decide which company in this sector they would like to invest in.

Saturn Oil & Gas (ISIN CA80412L8832) is a Canadian oil and gas company with longstanding roots in the exploration, extraction and production of these commodities. Through strategically valuable acquisitions, the management team also continuously increases the Company's value for its investors. The Canadians have a solid portfolio of owned assets in central Alberta and parts of Saskatchewan with stable cash flow. The portfolio offers many long-term drilling opportunities. In addition, the Company is strongly committed to an ESG-focused culture to continue to grow reserves, production and cash flows with good returns.

This includes what can be described as conservative accounting. Here, 60% of cash flow is used for debt repayment to ensure financial stability. By the end of 2023, net debt is expected to be around CAD 455 million, corresponding to a multiple of 1.2 times the EBITDA. At the same time, 40% of cash flow will be used to maintain production capacity, indicating a balanced strategic direction that considers both financial stability and operational effectiveness.

Current production includes light oil reserves in the Bakken area in the Viewfield region of Saskatchewan, averaging 113.8 barrels per day. Light oil - also known as light crude oil - is used in the production of plastics, fertilizers, solvents, and dyes. After a refining process, light oil is heavily used in the transportation sector as fuel for vehicles and aircraft. In Q3/2023, Saturn also completed three horizontal wells in the Lochend area of Alberta, averaging 279.0 boe/d. The share is currently trading at EUR 1.50.

Siemens Energy in transition: Strategies for repair and expansion after billions in losses

According to the https://www.telegraph.co.uk/business/2023/10/09/poland-vying-steal-germany-crown-heartland-europe/ British Telegraph, the German manufacturing industry's contribution to economic output will fall from 20.3% to 18.5% by 2022. The loss of cheap gas from Russia, the unresolved Nord Stream II pipeline blow-up and the ideologically driven energy policy, including the abandonment of the country's nuclear power, have made production costs in Germany extremely expensive. Listed companies are expanding their sites abroad in order to continue generating profits. Energy is affordable there.

Investors will still have Siemens Energy (ISIN DE000ENER6Y0) on their radar due to the damaged wind turbines from the Siemens Gamesa deal. Between June and the end of November 2023, Siemens Energy shares fell by more than 50% as rising input costs could not keep pace with electricity prices. This led to billions in write-downs and government support. However, Siemens Energy AG is a global energy technology company with Gas Services, Grid Technologies, Transformation of Industry and Siemens Gamesa. The Company offers gas and steam turbines, generators, heat pumps and services for power generation and transmission, including high-voltage direct current transmission, offshore wind farm connections, transformers and digital grid solutions.

A clear strategic plan from CEO Christian Bruch now envisages increasing the profitability of the problem child Siemens Gamesa by rectifying the obvious quality problems in the onshore sector and driving forward expansion in the offshore sector. At the same time, the Company is keeping a close eye on repair costs to ensure that the balance sheet remains stable.

Analysts at Morgan Stanley Bank are confident about the development of Siemens Energy AG and have raised their price target from EUR 17.40 to EUR 18.20. Our colleagues at Barclays Bank, on the other hand, seem to have different information: they have lowered the price target for Siemens Energy from EUR 19 to EUR 15.

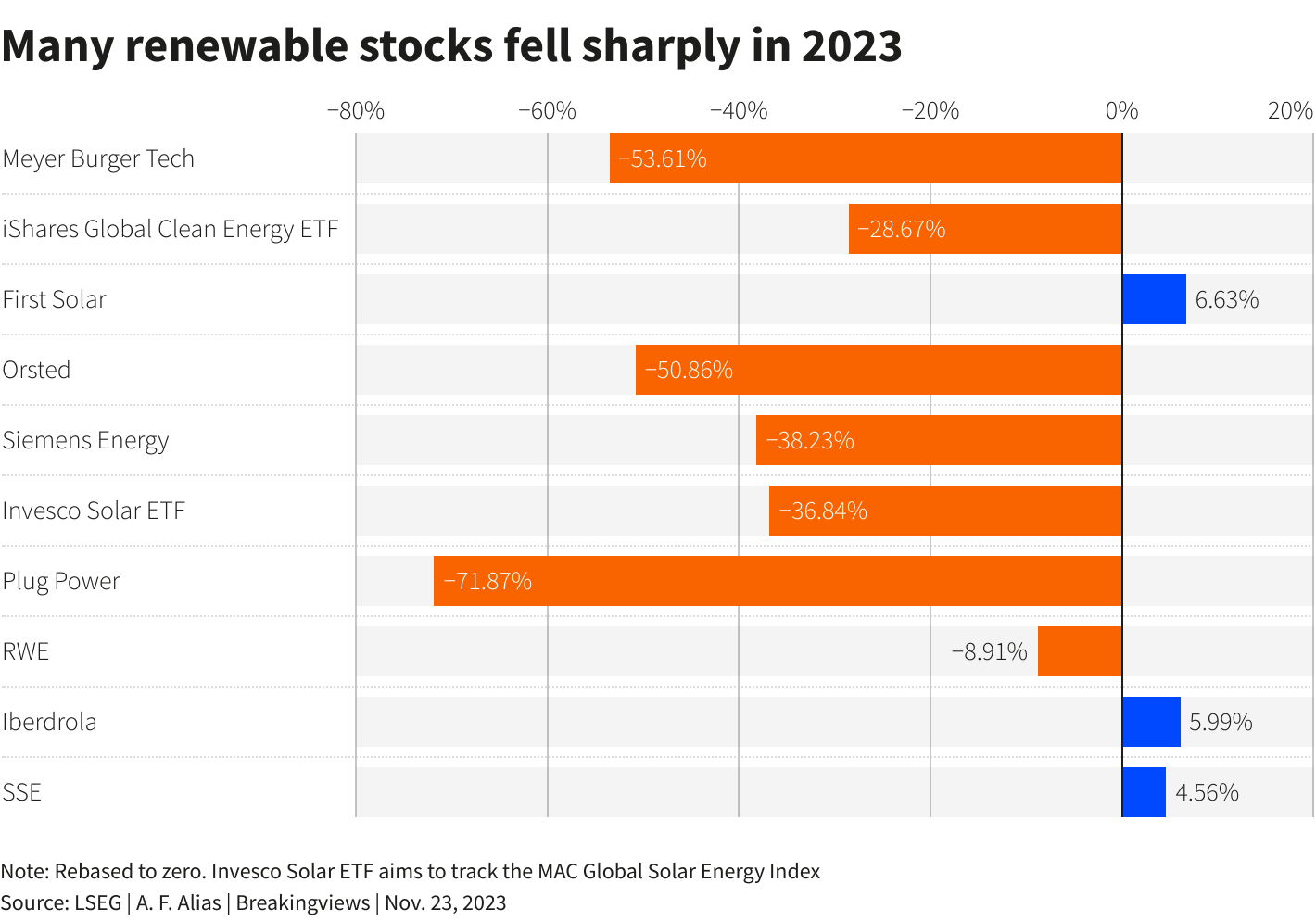

The renewable energy sector remains a mixed bag for investors. Those who rely on ETFs as diversification within the segment also have the black sheep on board. According to Reuters, by the end of November 23, the MAC Global Index of solar companies (SUNIDX) had fallen by almost 40% in the same year, and the iShares Clean Energy ETF (ICLN.O) had fallen by nearly 30%, even as the benchmark indices in Europe and the US both rose. Investors should, therefore, focus on individual stocks and consider the macroeconomic context to identify high-growth companies. Siemens Energy shares are currently trading at EUR 11.38. So, there is still upside potential to achieve the analysts' estimate.

Sustainable growth: JinkoSolar outperforms industry average in ROE and debt ratio

China is in 6th place of the world's leading oil and gas industrialized countries. Due to its valuable natural resources for renewable energies, the country is in a leading position in the solar sector. As a manufacturer of solar products, the Chinese company JinkoSolar is benefiting from its stable financial position and the rapid increase in demand for this form of energy. In addition, the Company has a dominant position in its own country, accounting for 40% of its total module shipments.

The solar panel and energy storage manufacturer (ISIN US47759T1007) also recorded an increase in module shipments in North America and the Asia-Pacific region in Q3/2023. At the end of the third quarter, JinkoSolar shipped 190 GW of solar modules to 190 countries and regions. Analysts estimate a global demand for solar modules. Based on this and a solid return on equity (ROE), JinkoSolar can become a promising addition to the portfolio.

Return on equity (ROE) indicates how efficiently a company has deployed its resources to achieve higher returns. Currently, JinkoSolar's ROE is 14.14%, which is higher than the industry average in this segment of 6.72%. It indicates that the Company has utilized its resources more effectively than its peers in the solar industry.

According to Zacks Investment Research, at the end of the third quarter of 2023, JinkoSolar's total debt-to-capital ratio was 30.51%, putting the Company in a better overall position than the industry average of 60.18%. The interest coverage ratio at the end of the third quarter was 8.25. The ratio, which is greater than one, demonstrates JinkoSolar's ability to meet future interest obligations without difficulty.

JinkoSolar's shares rose 17.1% in the last three months, while the broader industry fell 0.4%. The share price currently stands at EUR 31.50.

Saturn Oil & Gas, Siemens Energy and JinkoSolar present themselves as investment opportunities in the energy sector. Saturn Oil & Gas is characterized by conservative accounting, strategic acquisitions and solid growth. The Company pursues a balanced approach that combines financial stability and operational effectiveness. Recent light oil wells show promising results. Siemens Energy, with its diversified energy mix, is facing challenges that CEO Christian Bruch wants to overcome with a clear plan for repair and expansion. The focus on quality optimization in the onshore segment and the accelerated expansion in the offshore segment are evidence of a strategic change. Analysts are ambivalent about a buy, which means that Siemens Energy shares harbor both opportunities and risks. JinkoSolar from China is an industry leader in the solar energy sector. With a superior return on equity and a favorable debt ratio, the Company stands out from its competitors. The increasing global demand for solar modules and the stable position in the Chinese market make JinkoSolar a promising addition for investors in the sustainable energy sector. Investors can decide for themselves who scores best based on the information provided.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.