Commented by Carsten Mainitz on January 26th, 2026 | 07:35 CET

2026 – The comeback of hydrogen stocks: Now it is substance that counts, not hype! The hidden potential of dynaCERT, Ballard Power, and VW

For years, hydrogen stocks were considered the promise of the future. The hype was followed by a hangover. Valuations have fallen sharply, and after a phase of exaggerated expectations, the focus is now shifting to robust business models and industrial scaling. dynaCERT stands out with its innovative bridge technology that meets high environmental standards. Its ready-to-use solutions for reducing emissions are convincing more and more customers from industry. As an established player, Ballard Power is driving the further development of fuel cells in heavy-duty transport. Volkswagen is taking a different approach. A few days ago, the automaker published key data for the past fiscal year, which came as a positive surprise.

ReadCommented by André Will-Laudien on January 26th, 2026 | 07:30 CET

Biotech and life sciences are booming, and now Mercosur is joining the fray! Bayer, MustGrow, Novo Nordisk, and BioNxt Solutions in focus

The 2026 stock market year has a few surprises in store for investors. In addition to a quick resolution to the Greenland dispute, the Mercosur trade agreement with several South American countries is also moving forward. This agreement is particularly significant for the agricultural industry. This global sector of human supply is increasingly characterized by regulatory pressure, which is effectively ending the use of many synthetic pesticides and fertilizers. This development is forcing established agricultural companies to integrate effective biological alternatives into their portfolios faster than planned. In this environment, MustGrow Biologics is positioning itself as a strategic technology provider whose active ingredients have already been validated by leading market players. An expanded sector view also covers the life sciences industry with the protagonists Bayer, Novo Nordisk, and BioNxt. Up 50% in just a few weeks, here they are!

ReadCommented by Stefan Feulner on January 26th, 2026 | 07:25 CET

NEO Battery Materials positions itself for the battery revolution

Artificial intelligence, autonomous systems, drones, and robotics are causing global energy demand to skyrocket. But this is precisely where the weak point of digitalization becomes apparent. Conventional lithium-ion batteries are reaching their physical limits in terms of charging time, energy density, and cost. NEO Battery plans to break through this bottleneck. With innovative silicon anode technology, the Company promises significantly higher capacities, ultra-fast charging, and massive cost advantages. Initial partnerships with major customers, concrete supply agreements, and the expansion of production capacities are fueling imagination and increasingly bringing the battery specialist into the focus of investors.

ReadCommented by Nico Popp on January 26th, 2026 | 07:20 CET

Gold finally goes green: How RZOLV Technologies is solving the cyanide dilemma for Orica and Agnico Eagle

The gold market is currently in a historic supercycle that is driving prices to levels that were considered utopian just a few years ago. But behind the industry's shiny facade lurks a toxic problem that is increasingly becoming a matter of survival: since the introduction of the MacArthur-Forrest process in 1887, the majority of global gold production has been based on cyanide. This highly toxic salt efficiently extracts gold from rock but poses immense environmental risks. In a world where social acceptance is increasingly determining the fate of billion-dollar investments in mining, this chemical dependency can become a strategic trap. Authorities from the EU to US states such as Montana are tightening regulatory screws. This is the area of tension that technology company RZOLV Technologies is entering. With a validated, pollutant-free alternative, the Canadians are challenging the cyanide monopoly and providing precisely the key that industry needs to ensure that its reserves remain eligible for approval in the future.

ReadCommented by Fabian Lorenz on January 26th, 2026 | 07:15 CET

Record highs for gold, silver, and copper! But tungsten is really taking off! Almonty shares are eclipsing Barrick Mining and MP Materials!

Commodity prices are running wild. But anyone who thinks that developments in gold and silver are record-breaking should take a look at tungsten. It is increasingly becoming the number one critical metal. Within a year, the price has surged from just over USD 300 to more than USD 1,200. Almonty Industries is benefiting from this. Almonty Industries is benefiting from this. From the perspective of CEO Lewis Black, however, the price itself is not the decisive factor, but something else entirely. Although tungsten is increasingly emerging from the shadow of rare earths, it is still the rare earths that dominate the headlines. MP Materials has both the US government and Apple on board, and analysts continue to see outperformance. Barrick Mining should also be making a fortune at the moment. Not only is gold at record levels, but copper is too.

ReadCommented by Armin Schulz on January 26th, 2026 | 07:10 CET

The critical metal: Why Antimony Resources could become a geopolitical player

While the stock market revolves around AI chips, precious metals, and lithium, another crisis is brewing beneath the surface of global industry. The supply of antimony, a metal essential for flame retardants, the defense industry, and semiconductors, hangs by a thread due to Chinese export policy. This is bringing projects in stable regions into focus. In the midst of this strategic realignment, Antimony Resources from Canada is delivering remarkable drilling results. The question is no longer whether the West needs alternative sources, but how quickly special projects such as Antimony Resources can provide them.

ReadCommented by Nico Popp on January 26th, 2026 | 07:05 CET

Silver boom for First Majestic & Co.: How Silver Viper Minerals could become the next big takeover story following the Vizsla playbook

The silver market is experiencing a structural supply deficit so severe that it threatens the industrial supply chains of the future. While the photovoltaic and electric vehicle industries are absorbing every available ounce of the precious metal, geologists and investors are looking intently at the Sierra Madre Occidental in Mexico. This mountain range is not only historically the heart of global silver production, but it is also still the place where exploration successes can make investors rich. There is a dynamic reminiscent of the great gold rush: anyone who strikes high-grade veins here can multiply the value of their company in no time. But the easy deposits have long since been found. Today, the key to success lies in applying modern geological models to forgotten or overlooked districts. In this environment, Silver Viper Minerals is positioning itself as an explorer that has precisely the ingredients that have already led to spectacular price gains for its competitors in recent years. While the market is still focused on the big producers, Silver Viper is preparing the next big discovery story in the shadow of the giants.

ReadCommented by Armin Schulz on January 26th, 2026 | 07:00 CET

The strategic move – How American Atomics is securing fuel for the AI age

Artificial intelligence is changing our world, but its enormous appetite for energy threatens to push power grids to their limits. Tech giants are faced with the fundamental question of how to reliably supply data centers with clean electricity. Data centers will soon consume double-digit percentages of total electricity. The answer leads directly to a renaissance of nuclear energy. But this restart has a sore spot: the fragile global fuel chain. American Atomics is positioning itself in this gap between exploding demand and scarce supply with a clever two-pronged approach.

ReadCommented by Fabian Lorenz on January 26th, 2026 | 01:35 CET

BASF under PRESSURE! BUY RECOMMENDATIONS for BioNTech and WashTec shares!

Market leadership, increased efficiency, dividends, and share buybacks - all good reasons to buy WashTec shares. Analysts at M.M. Warburg share this assessment. Their earnings estimates for the coming years may even be too conservative. Unfortunately, nothing about BASF is conservative; rather, it is disappointing. The chemical company has once again failed to meet analysts' forecasts. Its strong free cash flow is based on lower investments, which is also not a good sign. How are analysts reacting? BioNTech is facing a groundbreaking year. Analysts see potential for share price growth. News from the bulging product pipeline is likely to have a significant impact on the share price.

ReadCommented by André Will-Laudien on January 23rd, 2026 | 07:20 CET

Greenland crisis averted! Boom in gold, silver, and critical metals boosts Antimony Resources

Donald, Donald, Donald! What more is there to say? The recent conflict over Greenland is causing considerable unrest in the markets, especially in the defense and raw materials sectors. The palpable tensions between the major powers over influence and resources have led to wild fluctuations in defense stocks and have intensified the psychological pressure to secure critical metals. Many stocks feel like hot potatoes, while others reveal a deeper, more solid upward trend beneath the short-term price movements: the race for strategic raw materials has long since become a geopolitical chess game. The US player sees itself as the queen with a triple life on the chessboard, turning all other participants into obedient pawns. But the day before yesterday came the big castling move, and the fog briefly cleared. Risk-conscious investors should now take a closer look at commodity stocks such as Antimony Resources because this is where the polar bear is raging!

ReadCommented by Nico Popp on January 23rd, 2026 | 07:15 CET

Revolution in agricultural chemistry: How MustGrow Biologics is benefiting from the plight of Bayer and Corteva

Global agriculture is at a historic turning point, driven less by a belief in technological progress than by regulatory necessity. For decades, global food security has been based on synthetic pesticides and fertilizers, but that era is rapidly coming to an end. Authorities from Brussels to California are tightening the screws and banning established active ingredients one after the other because their ecological collateral damage is no longer tolerated. For the agricultural giants, this poses an existential threat: their full warehouses are in danger of becoming worthless if they do not find effective biological alternatives quickly enough. In the current extremely hectic environment in industry, which is characterized by billion-dollar acquisitions and strategic alliances, new power structures are emerging. While Corteva Agriscience is aggressively buying market share with its chequebook and Bayer is pushing ahead with its portfolio restructuring, the Canadian company MustGrow Biologics has carved out a position that is considered the "sweet spot" in the industry. The Company is the technology partner whose active ingredients have already been validated and licensed by the market leaders.

ReadCommented by Armin Schulz on January 23rd, 2026 | 07:10 CET

The new hydrogen turbo: How Plug Power, First Hydrogen, and Nel ASA are benefiting from the AI boom

The course has been set for the hydrogen revolution. Following a consolidation in 2025, clear regulations, groundbreaking production technologies such as SMRs, and entirely new sources of demand, from AI data centers to heavy-duty transport, will drive the market into a new, potentially profitable growth phase. This momentum is now positioning pioneers in the value chain for exceptional opportunities. We analyze the promising strategies of Plug Power, First Hydrogen, and Nel ASA.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:05 CET

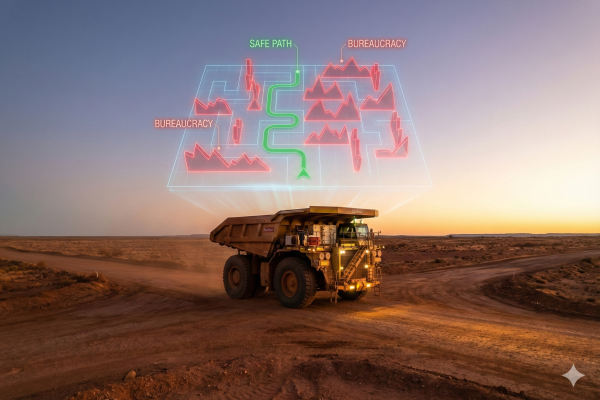

The battle for resources is being fought in the data room: How Aspermont Uses AI to Boost the Returns of Rio Tinto, Alamos Gold & Co.

It is the greatest paradox of the modern economy: while demand for copper, lithium, and rare earths is exploding due to trade wars and the insatiable appetite of the AI industry, building a new mine has never been more difficult. Large mining corporations are increasingly failing not because of geology, but because of bureaucracy, environmental regulations, and, in remote regions of the world, geopolitical pitfalls. In this new era, where a legally binding permit is often more valuable than spectacular drilling results, validated information is becoming the most critical resource in the commodities sector. Analyst firms such as McKinsey and the International Energy Agency (IEA) warn of a massive structural supply deficit, as the development of new mines in the West often requires more than a decade of legal wrangling. It is precisely in this area of tension that the Australian media and tech company Aspermont is positioning itself as the decisive problem solver. With a treasure trove of data spanning centuries of industrial history and a new alliance with industry giant Rio Tinto, the Company is transforming itself from a media company into a kind of "Google of mining" – offering investors an opportunity based on intelligence rather than luck.

ReadCommented by Fabian Lorenz on January 23rd, 2026 | 07:00 CET

World class! Over 80% upside potential! RENK, TKMS, and Power Metallic Mines in focus

Once again, world-class results from Power Metallic Mines. The NISK multi-metal deposit in Canada is delivering exceptional data for gold, silver, copper, palladium, and platinum. Analysts are enthusiastic and recommend the stock as a "Buy" with upside potential of more than 80%. Analysts have never seen such grades before, especially for copper. Like commodities, defense companies are also beneficiaries of geopolitical uncertainty. Most recently, US President Donald Trump's speech at the World Economic Forum in Davos confirmed that old alliances are no longer reliable and that billions must be invested in commodity security and self-defense. RENK and TKMS stand to benefit from this. The shipbuilding group is currently riding a wave of success.

ReadCommented by Nico Popp on January 22nd, 2026 | 07:20 CET

Gas boom Down Under: Omega Oil + Gas and Elixir Energy becoming increasingly expensive – balance sheet treasure at Pure One Corporation

There is a strange discrepancy in the global energy markets that is nowhere more tangible than on Australia's east coast. While politicians and ESG funds have been rehearsing the demise of fossil fuels for years, reality is now hitting the economy with full force. Sentiment in trading rooms from Sydney to Perth has shifted markedly. A gold-rush mood has returned – this time for natural gas. In its "Gas Statement of Opportunities 2025," market operator AEMO warns in an almost alarmist tone of an impending supply gap. Gas explorers such as Omega Oil & Gas and Elixir Energy have already risen sharply. But away from the obvious investments, hydrogen company Pure One presents a classic arbitrage opportunity that is still largely ignored by the broader market. The Company is preparing to spin off its gas division, and a detailed comparison with its peers suggests that investors can currently acquire this asset at virtually no cost – a gift for anyone who knows how to read balance sheets.

Read