January 26th, 2026 | 07:30 CET

Biotech and life sciences are booming, and now Mercosur is joining the fray! Bayer, MustGrow, Novo Nordisk, and BioNxt Solutions in focus

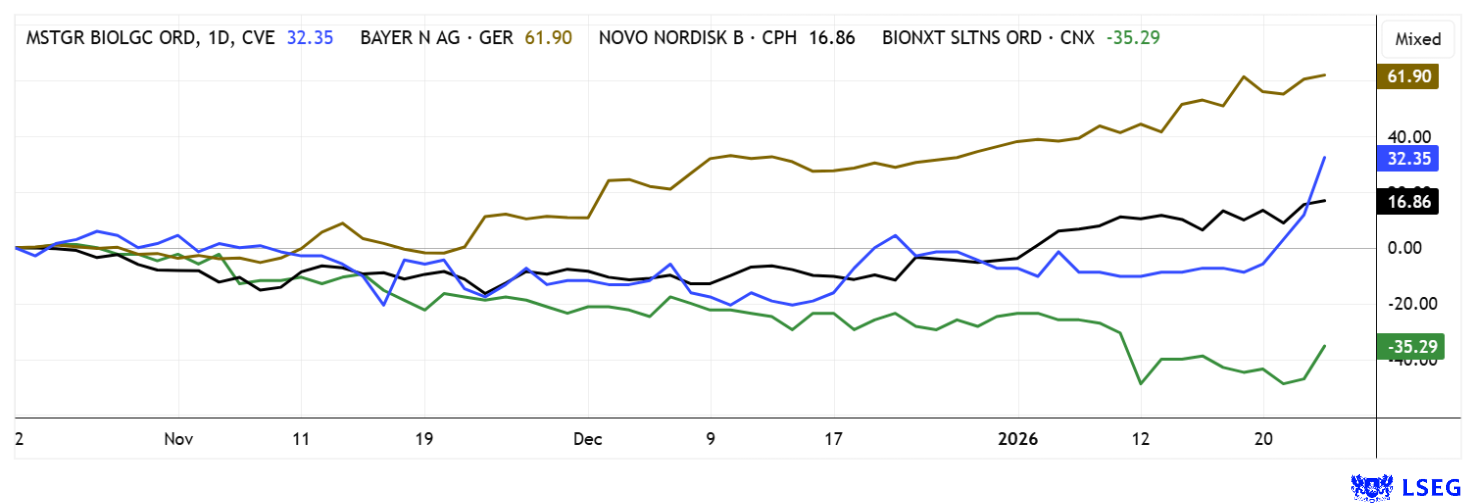

The 2026 stock market year has a few surprises in store for investors. In addition to a quick resolution to the Greenland dispute, the Mercosur trade agreement with several South American countries is also moving forward. This agreement is particularly significant for the agricultural industry. This global sector of human supply is increasingly characterized by regulatory pressure, which is effectively ending the use of many synthetic pesticides and fertilizers. This development is forcing established agricultural companies to integrate effective biological alternatives into their portfolios faster than planned. In this environment, MustGrow Biologics is positioning itself as a strategic technology provider whose active ingredients have already been validated by leading market players. An expanded sector view also covers the life sciences industry with the protagonists Bayer, Novo Nordisk, and BioNxt. Up 50% in just a few weeks, here they are!

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , MUSTGROW BIOLOGICS CORP. | CA62822A1030 , NOVO NORDISK A/S | DK0062498333 , Bionxt Solutions Inc. | CA0909741062

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Novo Nordisk and Bayer – The return of the titans

What a rally for Novo Nordisk and Bayer! The Danish obesity medication manufacturer had a challenging year in 2025. It fell by a full 60% from its peak to below EUR 40. At the end of December, however, the share price turned significantly to EUR 52.80, compared to over EUR 90 a year ago. Analysts have been somewhat overwhelmed by the strong bottom-up movement. The private bank Berenberg has left its rating at "Buy" with a price target of DKK 415 for the time being. It has been noted that current Google search data in the US indicates a sharp rise in interest in the newly introduced oral form of the weight loss drug Wegovy. 15 out of 32 analysts are giving it the thumbs up again, with Jyske Bank and Rothschild being very bullish with a target price of DKK 475 each – still just under 20% after the initial 30% recovery. German broker Baader takes the cake with an outstanding target of DKK 606. The figures will be released next week on February 4! As the Americans say: Amazing!

That is what you call a rally: from EUR 21 to EUR 45 in just 12 months. Bayer is emerging alongside Siemens Energy as a shining DAX star, supported by a positive US Supreme Court ruling that could curb glyphosate lawsuits under federal law and reduce liability risks by up to 80%. The whole thing is even backed by the Trump administration. Operationally, the Leverkusen-based company is shining with the success of the Phase III Oceanic Stroke study with Asundexian, which has proven effective in acute ischemic stroke patients for the first time and is now maturing into a potential blockbuster with peak revenue of EUR 2 billion, while Eylea HD's EU approval allows for longer 16-week application intervals. Analysts are now anticipating growth of 8% for the pharmaceuticals segment in the current year. With increased cash flows, Bayer would finally be able to repay the high debts incurred from the Monsanto acquisition. At the current price of close to EUR 45, we are looking at a rehabilitated risk profile, which even brings the experts at mwb research to target prices of EUR 54. Although other companies are already catching up strongly, the high momentum of the stock calls for further upgrades. Early investors may consider partial realization, but it is questionable whether the stock will consolidate below EUR 40 again. The 2025 annual figures and the outlook on February 25 are likely to be exciting.

MustGrow Biologics – Regenerative agricultural solutions as a long-term ESG growth story

Perhaps Novo Nordisk's drugs would be dispensable if there were more focus on good nutrition. Canadian agricultural innovator MustGrow Biologics pursues a growth-oriented business model in the field of biological and regenerative agricultural solutions. These solutions are designed to replace or supplement synthetic chemicals and fertilizers, which is clearly in line with global regulatory and sustainability trends. The Company monetizes a fully owner-managed, patent-protected platform based on mustard plant extracts, which can be used both as a soil biocontrol agent against pests and as a bio-based fertilizer. High, IP-driven barriers to entry currently protect the Company from followers.

Revenue sources come from direct product sales, in particular through the Company's own sales unit, NexusBioAg, in North America, which sells MustGrow's products together with third-party products to farmers and distribution partners, thereby bundling economies of scale and market access. On the other hand, MustGrow relies on capital-light licensing and partnership models with global agrochemical companies, such as the exclusive commercialization agreement with Bayer for soil biocontrol in Europe, the Middle East, and Africa. This enables the Canadians to scale their own technology internationally with limited capex.

TerraSante™, an organic biofertility and soil improvement product, serves as the first platform for which approvals and OMRI and OIM organic standards have already been obtained in the US, including in Washington, Oregon, and California. This opens up recurring revenues in the high-quality fruit and vegetable crop segment. Regulatory trends, in particular the ban or deregistration of synthetic active ingredients, are providing strong tailwinds. MustGrow leverages its positioning as a provider of natural, regulatory-compliant solutions and even has pricing power in niche markets. Additional growth potential lies in the expansion of IP to applications such as weed control, nematodes, storage potatoes, and animal and human health, thereby establishing optional, as yet unpriced future revenue sources.

With just 62.9 million shares outstanding, the current market value is still CAD 56.6 million, with Company founders and insiders holding a 20% stake. The business model combines technology-driven R&D with a scalable licensing framework and integrated distribution. Partnerships, such as with Germany's Bayer, are now important before moving on to the commercialization of license agreements. With the recently raised CAD 2 million, the Company can now continue to focus on its goals. Extremely exciting!

BioNxt Solutions – This is the ODF breakthrough

BioNxt Solutions is highlighting a clearly measurable development step with the final results of the preclinical pig study on cladribine and is now underpinning its investment story with reliable quantitative data for the first time. In the large-volume, non-rodent model, the sublingual oral dissolvable film (ODF) formulation achieved approximately 40% higher systemic drug exposure compared to a conventional cladribine tablet. Specifically, the measured AUC over 48 hours was 39.46 ng·h/ml for the ODF formulation, compared to 28.11 ng·h/ml for the tablet formulation, demonstrating a significant increase in efficiency. The AUC is considered a key pharmacokinetic parameter because it reflects both the amount absorbed and the duration of systemic availability, thus providing a robust basis for comparison.

The choice of a pig model with a body weight of 40 to 50 kg increases the transferability of the results, as its anatomy and metabolism are much closer to those of humans than classic rodent models. Under controlled conditions, it was also ensured that absorption took place exclusively through the mucous membrane, which further strengthens the significance of the results. From an analytical perspective, this data significantly reduces the development risk for the planned human studies, as the mechanism of action of the improved bioavailability has already been clearly demonstrated. At the same time, the approximately 40% higher exposure opens up scope for a potential dose reduction without compromising therapeutic efficacy, which is particularly relevant for immunomodulatory therapies.

Strategically, BioNxt is thus addressing a market that already generates substantial revenues today: cladribine-based MS therapies achieve annual revenues of over USD 1.2 billion worldwide, with sustained double-digit growth. BioNxt is therefore positioning itself not as a drug developer, but as a provider of efficiency and convenience within an established billion-dollar market. The sublingual, swallow-free approach also addresses a real care problem, as a significant proportion of neurological patients suffer from dysphagia, which measurably impairs treatment adherence.

With the transition to planned pharmacokinetic and bioequivalence studies in humans, the focus is now shifting to the next value driver. Parallel GMP production and regulatory preparation potentially shorten the time to partnerships or licensing models. Beyond multiple sclerosis, the platform opens up prospects in other neuroimmunological indications such as myasthenia gravis, thereby expanding the addressable market volume. Overall, BioNxt's profile is consolidating into that of a data-driven platform company with clearly quantified added value. The BNXT share is currently breaking out upwards, and its market value of only EUR 35 million is a joke compared to the milestones achieved. Jump on board!**

After an extended sideways movement, the biotech sector is coming back to life, supported by solid chart developments for key stocks such as Bayer and Novo Nordisk. In the 2026 stock market year, the rotation from overheated tech stocks to undervalued life sciences and biotech stocks is likely to accelerate further, as fundamental attractiveness and growth potential clearly outweigh other factors here. Among the promising candidates, agricultural innovator MustGrow Biologics stands out with its patented mustard technology, as does BioNxt Solutions, a specialist in orodispersible films (ODF) with a good risk/reward profile.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.