January 26th, 2026 | 07:15 CET

Record highs for gold, silver, and copper! But tungsten is really taking off! Almonty shares are eclipsing Barrick Mining and MP Materials!

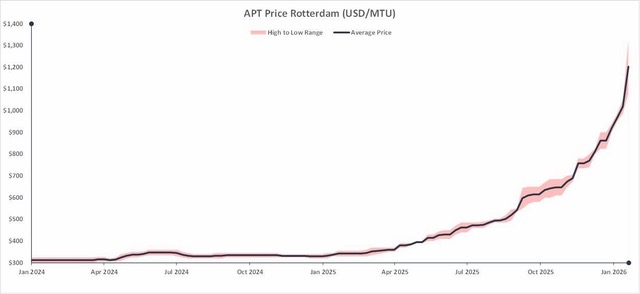

Commodity prices are running wild. But anyone who thinks that developments in gold and silver are record-breaking should take a look at tungsten. It is increasingly becoming the number one critical metal. Within a year, the price has surged from just over USD 300 to more than USD 1,200. Almonty Industries is benefiting from this. Almonty Industries is benefiting from this. From the perspective of CEO Lewis Black, however, the price itself is not the decisive factor, but something else entirely. Although tungsten is increasingly emerging from the shadow of rare earths, it is still the rare earths that dominate the headlines. MP Materials has both the US government and Apple on board, and analysts continue to see outperformance. Barrick Mining should also be making a fortune at the moment. Not only is gold at record levels, but copper is too.

time to read: 5 minutes

|

Author:

Fabian Lorenz

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , BARRICK MINING CORPORATION | CA06849F1080 , MP MATERIALS CORP | US5533681012

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Almonty Industries: Tungsten price unstoppable

Last week, Almonty shares shot to a new all-time high. On Friday, the leading Western tungsten producer's stock closed at USD 11.12, an all-time high. This means that the stock has gained around 25% in value in the young year of 2026 alone. The share is being driven by a price that eclipses gold. Tungsten is increasingly becoming the number one critical metal. In a world where supply chains are used as weapons, tungsten has become a critical metal that neither governments, companies, nor investors can ignore. As a result, the price is skyrocketing. About a year ago, a MTU (equivalent to 10 kg) was trading for between USD 300 and USD 400 on the Rotterdam Stock Exchange. Currently, it is around USD 1,200 – and the trend is still rising. Almonty CEO Lewis Black had already predicted prices of over USD 1,000 at the end of 2025. At that time, the market hardly reacted – but now it is reacting all the more.

But from Lewis Black's perspective, it is not the price development that makes tungsten so exciting. Instead, it is its availability and demand. The reason lies in tungsten's properties and applications: exceptionally dense, extremely hard, and indispensable for armor-piercing ammunition, high-quality tools, and electronics. The amount of tungsten contained in an end product is often so small that the respective producer barely notices the cost. What matters to them is being able to source that small quantity from a reliable, non-Chinese supplier.

And when it comes to availability, the West has been naively asleep for decades. People were happy to buy from China at subsidized dumping prices. This forced Western tungsten producers out of the market and created a virtual monopoly. Even in the US, not a single kilogram of this metal, so critical for the military, is currently produced. Almonty is set to change this as early as this year. The active tungsten mine in Portugal is being expanded, the likely largest tungsten mine outside China has been ramping up in South Korea since December 2025, and Almonty plans to bring a mine into operation in the United States later this year.

Incidentally, the mine in South Korea was planned at prices well below USD 500 per MTU. Analysts' estimates are also far from the current level. Almonty's profit development and the potential for rising price targets are likely to be correspondingly massive.

Note: Those who would like to learn more about the prospects for Almonty Industries firsthand can register for the virtual International Investment Forum ii-forum.com taking place on February 25, 2026. CEO Lewis Black will be presenting live.

Barrick Mining: Tailwind from record high gold and copper prices

Barrick Mining's stock also continues to rise – not as strongly as Almonty, but still by 11% since the beginning of the year. The gold-based investment is primarily driven by the price of gold. Driven by the geopolitical turning point, the price per troy ounce is now above USD 4,900. It seems only a matter of time before the USD 5,000 barrier is broken.

While the Company is operating at full throttle and even appears to have solved the problems in Mali, a personnel change was recently announced. Helen Cai will take over as CFO on March 1. She has been a member of Barrick's board since November 2021 and has more than two decades of experience in equity research, corporate finance, strategic planning, capital markets, and M&A in a wide range of industries. Among other things, she has worked for Goldman Sachs and China International Capital Corporation (CICC). Cai succeeds Graham Shuttleworth, who is stepping down as CFO after around seven years.

Barrick CEO Mark Hill commented: "I would like to welcome Helen to the leadership team as CFO. Helen's deep financial expertise and decades of experience in the mining sector will be invaluable as we focus on improving performance and shareholder value."

MP Materials: Analysts say "Outperform"

MP Materials is also performing strongly again in 2026. At just over USD 70, however, the stock is still a long way from its all-time high in October 2025. At that time, it briefly traded above USD 100. However, even at its current level, the Company is already valued at over USD 12 billion. This is significantly more than Almonty, for example, which is valued at around USD 4 billion.

Like Almonty, MP Materials is benefiting from the rush for critical raw materials. At MP Materials, everything revolves around rare earths. These are not only to be mined in the US, but also processed there. William Blair recently added MP Materials to its research coverage and recommends the stock as an "Outperform." Analysts justify the start of coverage primarily with MP's strategic positioning as an integrated US supplier along the value chain (from mining to processed products) and the resulting increased visibility for purchase and mining programs in the US. William Blair also highlights the recent significant improvement in predictability through partnerships and agreements in the security and industrial policy environment as a key catalyst, which could reduce risks and lead to further supply deals. The analysts did not specify a concrete price target.

There has been no news from the Company for some time. The last announcement dates back to November 2025, when a cooperation with the US Department of Defense and the Saudi Arabian Mining Company was announced. The two companies plan to jointly build a rare earths refinery in Saudi Arabia. This is intended to be an important step toward restoring balance in the global rare earths supply chain. The plant will be designed to process rare earth raw materials from Saudi Arabia and other regions of the world and will produce significant quantities of separated light and heavy rare earth oxides. These refined products will support the manufacturing and defense sectors in the US and Saudi Arabia and will be marketed to allied nations. However, it is likely to take several years to complete.

Tungsten is currently perhaps the most exciting and critical metal. Although more and more countries, companies, and investors are becoming aware of its importance, decades of neglect cannot be made up for quickly. Almonty has become active at just the right time, and shareholders should continue to benefit from this. Gold is, of course, also part of the commodity boom. It would come as no surprise if the price were to fall below USD 5,000 per troy ounce this week. Barrick should continue to benefit from this trend. It should not be forgotten that the mining giant is also benefiting from record copper prices. MP Materials is a top player in rare earths and is supported by the US government and Apple. However, its market capitalization already appears to be quite high.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.