June 6th, 2024 | 07:30 CEST

First Hydrogen, RWE, Rheinmetall - Sustainable investments with hydrogen and armaments

According to estimates, the global hydrogen production market will reach USD 230.81 billion by 2030. Both governments and industry are, therefore, in favour of the rapid development of this technology. The Canadian company First Hydrogen has already successfully tested a hydrogen fuel cell-powered van specially developed for the logistics sector. International logistics companies and vehicle manufacturers are now signaling their interest in working together. The energy company RWE is also focusing on hydrogen. The construction of hydrogen power plants in Germany is to be driven forward with two European partners. Rheinmetall, on the other hand, is expanding into the Baltic States. A new ammunition plant is being built in Lithuania. This will result in many lucrative advantages for the German group. Which investment is most likely to yield returns?

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

First Hydrogen Corp. | CA32057N1042 , RWE AG INH O.N. | DE0007037129 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] dynaCERT's HydraGEN™ device offers a retrofit solution for diesel engines designed to protect the environment while providing economic benefits. [...]" Bernd Krueper, President & Director, dynaCERT Inc.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Hydrogen drive: First Hydrogen secures two strategically valuable international partners

India is in the top 5 of the world's largest economies. The driving economic sectors include agriculture, technology and the military. With around 2.4 million soldiers, India's armed forces are among the third largest defense forces in the world. Now, the Indian Army is partnering with Indian Oil Corporation Limited (IOCL) to conduct the first hydrogen fuel cell bus trials. The bus seats 37 people and has a range of 250 to 300 km on a full 30 kg hydrogen tank. Numerous economies have made plans for hydrogen solutions. Broad global support and opportunities are driving this significant investment opportunity.

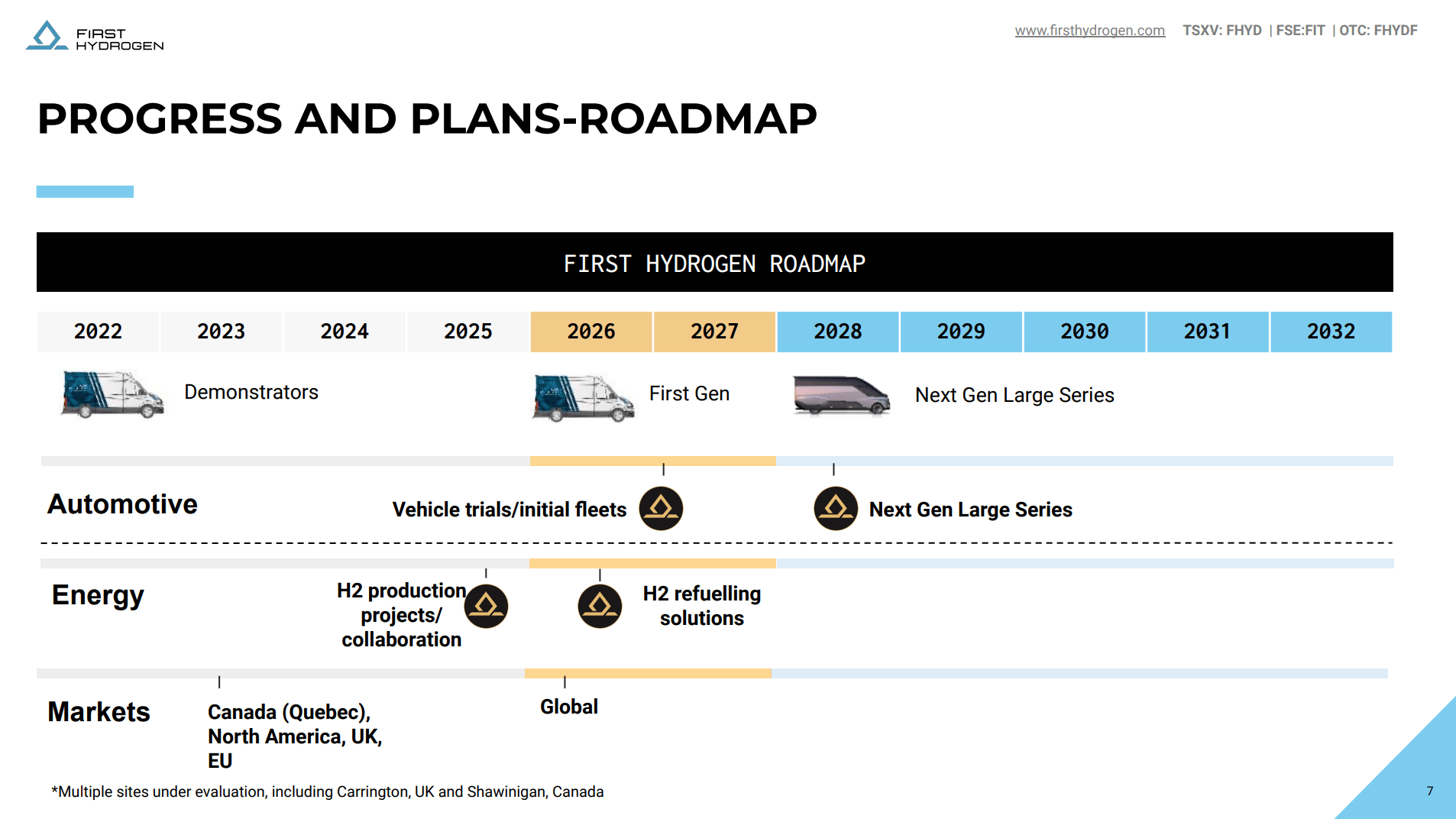

For the West, First Hydrogen is an exciting candidate from the world of hydrogen mobility. First Hydrogen, based in Vancouver, Montreal and London, develops innovative hydrogen propulsion technologies for the booming logistics sector. Hydrogen fuel cells are characterized by zero emissions and a long range on a single tank of fuel. In several tests, the vehicle developed by First Hydrogen (FCEV) achieved a range of 630 km on a single refueling. India is focusing on buses, while First Hydrogen is initially focusing on the transportation of goods.

First Hydrogen has just completed further tests with a large multinational logistics company whose partners use commercial vans for parcel deliveries. The test took place in London, UK, where the FCEV was operated over 8 hours per day with several deliveries per hour. For logistics companies, the results of FCEV operation mean greater range, more efficiency, fewer charging breaks and therefore more productivity. The tests also show that the First Hydrogen vehicle is capable of handling more demanding tasks, such as transporting heavy loads, driving over rough terrain, or operating auxiliary equipment (onboard power). It may also potentially be used for transporting people, as seen in India.

Internationally active German vehicle manufacturers are now showing great interest in the FCEV van. Last month, First Hydrogen signed a non-binding letter of intent (LOI) to integrate its hydrogen fuel cell drive system into German brand vans. The cooperation with the German vehicle manufacturer gives First Hydrogen access to its stable supply chain. This opens up the opportunity to offer fleet operators a customized, hydrogen-powered fuel cell light commercial vehicle in the near future. The next scaling stage for the innovative Canadian company has been ignited.

Energy giant RWE backs hydrogen power plants in Germany

The German government has announced that its power plant strategy will soon create a regulatory framework for tenders for hydrogen-capable gas-fired power plants. The world's third-largest economy urgently needs energy supply solutions. RWE is keen to participate in these tenders and is, therefore, planning to build hydrogen-capable gas-fired power plants at German sites to contribute to Germany's successful coal phase-out by 2030.

An H2-capable combined cycle gas turbine power plant (CCGT) with a nominal capacity of around 800 MW could be built at the Gersteinwerk power plant. RWE has assembled an Italian-Spanish consortium for the planning. The consortium comprises Ansaldo Energia (Italy) and Tecnicas Reunidas (Spain). The contract signed by the three partners includes the approval planning for the power plant as the first step. Work on the planning process is already underway. This creates the framework conditions for RWE to implement the project as soon as an investment decision is made following the award of the tender.

According to current planning, the plant in Werne could start generating electricity by 2030. A fuel mix with at least 50% hydrogen could be used for commissioning. In addition, it is to be operated entirely with hydrogen in the future. RWE is, therefore, building something that may not be launched until after the election of the new German government and is relying on public funding to do so. The next change of government is due in 2025.

Rheinmetall expands: Go-ahead for ammunition plant in Lithuania

Lithuania is to become a new strategic partner of the German defense company Rheinmetall. The country - nestled between the Baltic Sea, Belarus, Poland, and Latvia - is strengthening its defense sector through an agreement with the German company. The Minister of Economy and Innovation, Aušrinė Armonaitė, has now signed an agreement granting the project the status of "state importance". The establishment of Rheinmetall in Lithuania is intended to help meet the immediate defense and security needs of the country. The new plant is to be financed with around EUR 180 million in state funds and create around 150 new jobs. The plan is to produce tens of thousands of rounds of ammunition per year.

In order to facilitate the investment, Lithuania has quickly introduced legislative changes that support the development of large-scale projects in the country. These changes are also intended to benefit Rheinmetall and other investors. Under the name "Green Corridor", the Ministry of Economy and Innovation is creating an initiative for large investment projects. It is intended to accelerate and facilitate the establishment of investors and offer tax benefits for up to 20 years. In total, contracts have been signed for 14 major investment projects that will create almost 4,000 jobs and attract over EUR 1.25 billion in investment. Rheinmetall is one of the pioneers.

Lithuania is a member of NATO, the EU and the OECD. The Lithuanian economy is dominated by oil refining, food processing, energy supply, chemicals, and the manufacture of wood and textile products. Lithuanian laser technology is used by NASA, CERN and global companies such as IBM, Hitachi, Toyota and Mitsubishi. Rheinmetall has chosen the Baltic country as a valuable strategic location.

First Hydrogen is focusing on developing hydrogen propulsion technology for the logistics sector and has already successfully conducted further tests with a large multinational logistics company. An international German vehicle manufacturer has also expressed interest in integrating First Hydrogen's technology into its eVans. This would give First Hydrogen access to the German partner's tried-and-tested supply chain and thus accelerate its own marketability. RWE is also focusing on hydrogen. The energy company wants to build hydrogen power plants in Germany in order to contribute to the coal phase-out. Plans for the new power plants are already being explored with Italian and Spanish cooperation partners. Construction could begin after a new government is formed in Germany if RWE wins a tender. It remains to be seen to what extent this will actually happen and whether state subsidies will flow. Rheinmetall is expanding into Lithuania, thereby strengthening the country's defense sector. The new ammunition plant will receive a financial injection of EUR 180 million and is expected to create around 150 jobs to ensure the security of the Baltic country.** With the amendment to the law to support major projects, Lithuania is sending out a signal to international investors to settle in the country. Among other incentives, 20 years of tax benefits are offered. Compared to the plans of Rheinmetall and RWE, First Hydrogen's strategy appears to be the most feasible, meaning that investors there can expect results soon.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.