December 12th, 2024 | 07:30 CET

Find the 100% opportunities for 2025! Rheinmetall, Renk, Globex Mining, C3.ai and Palantir in focus

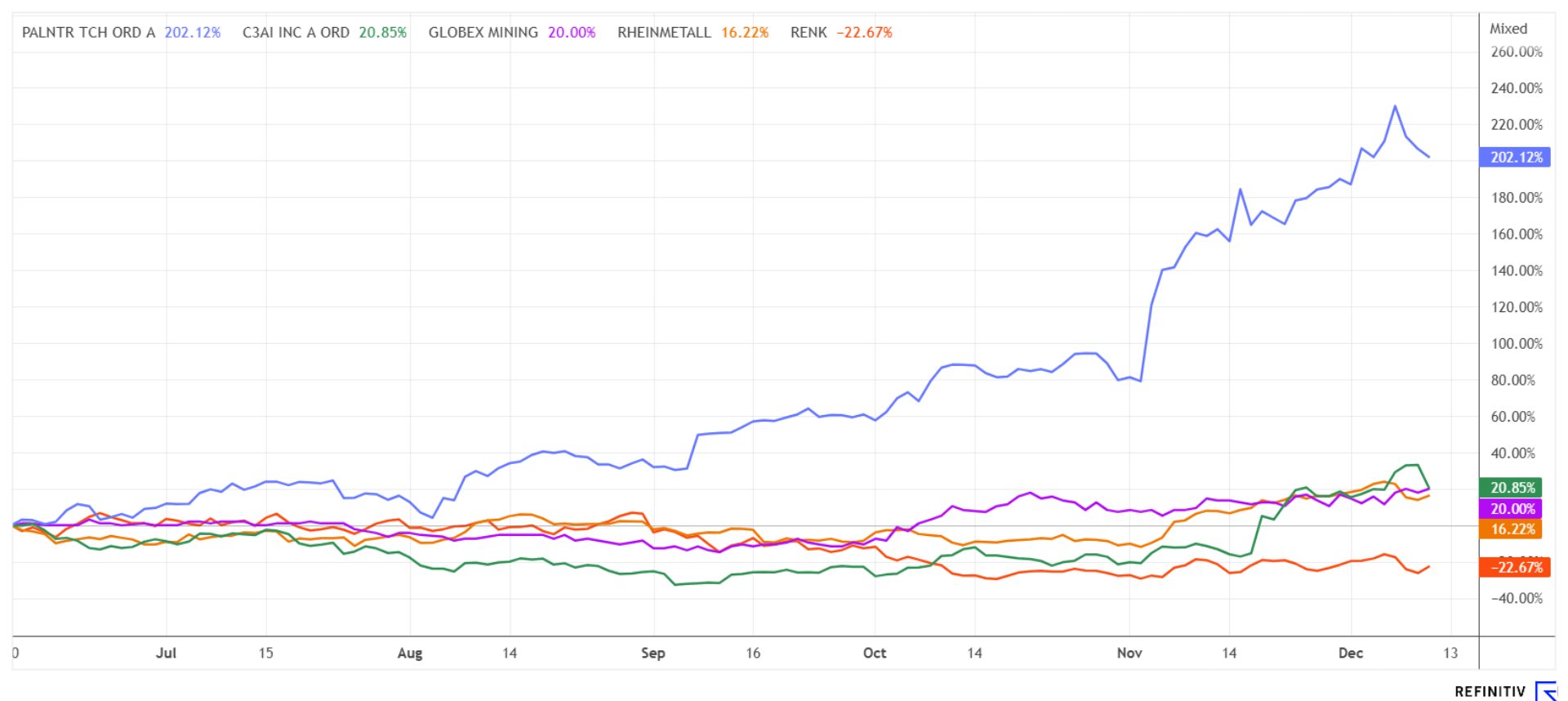

After a 30% rise in prices in the major indices since the beginning of the year, investors are asking themselves how they can weatherproof their portfolio for 2025. On the one hand, a well-defined stop strategy for overheated high-tech stocks is an option. Therefore, the topic of trailing stops should be studied in more detail and implemented. For new investments, there are always interesting setbacks to get back in on the next party. This scenario currently applies to the defense stocks Renk and Rheinmetall. Globex Mining covers almost the entire range of strategic metals that are indispensable for high-tech and defense manufacturers. Furthermore, some AI stocks like Palantir or C3.ai deserve a critical look. Accumulated profits could quickly disappear again here. We are delving deeper into the analysis.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , RENK AG O.N. | DE000RENK730 , GLOBEX MINING ENTPRS INC. | CA3799005093 , C3.AI INC | US12468P1049 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

"[...] Our projects are at the initial, high reward exploration stage. [...]" Humphrey Hale, CEO, Managing Geologist, Carnavale Resources Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall and Renk – A minor correction is no cause for alarm

EUR 661.60 marks the new all-time high for Rheinmetall shares in December 2024. As a reminder, the title traded around EUR 90 in January 2022. Then Russian troops invaded Ukraine, and the world changed dramatically for German defense stocks as well. The significant increase in military uncertainty in Europe led to a boom in the defense sector. Rheinmetall benefited from major orders, particularly from European countries. Collaborations with international players have helped to capture global market share for armored vehicles, right up to state-of-the-art weapons and protection systems. Today, Rheinmetall is synonymous with technological excellence in highly sensitive areas. Recently, the Düsseldorf-based company formulated ambitious targets for the coming years up to 2027: revenues are to rise to EUR 20 billion and deliver an operating margin of 18%. So far, this is around EUR 1 billion above analysts' estimates and has boosted the share price in recent days. If these targets are achieved, Rheinmetall, currently trading at EUR 619, would have a 2027 P/E ratio of 12, compared to 28 for 2024. For those confident in steep growth and NATO's pressing needs, adding to positions at current levels could be a strategic move.

At industry peer Renk, there has been an unusually strong consolidation in recent weeks. The primary driver of this uncertainty is the unexpected departure of board member Susanne Wiegand. Delays in order processing and problems with supply chains led to a reduction in revenue targets for 2024. Nevertheless, the order backlog increased to around EUR 4.7 billion at the end of Q3. Renk expects that over the next 10 years, around 90% of NATO's tank fleet will need to be replaced due to aging equipment or fleet sales - a scenario that promises substantial growth opportunities. Analysts on the Refinitiv Eikon platform expect an average 12-month target price of EUR 30.90, around 57% higher than yesterday's closing price.

Globex Mining – Strategic metals as a scarcity factor

Strategic industrial metals such as copper, nickel, lithium and rare earth elements play a crucial role in North American national security. These raw materials are essential for high-tech applications, military equipment and the energy transition. The increasing demand in the defense and energy industries makes their availability particularly critical. In the United States, the Department of Energy (DOE) added copper to the list of critical raw materials in 2023 because it could become a bottleneck factor due to its scarcity. Copper is needed for electrical wiring, batteries, and military systems. The US and Canada have been heavily dependent on imports and are trying to diversify their raw material supply and increase the number of domestic mining operations to reduce geopolitical risks.

Globex Mining holds over 250 resource concessions across Canada, spanning gold and metal projects throughout Quebec. These deposits, considered secure, are at various stages of development and are sometimes tied to partnerships through option and royalty agreements, leading to a constant deal flow within the portfolio. Additional drill results from the infill drill program at the Ironwood gold project in Cadillac Township, approximately 2.6 km east of the city of Cadillac, are currently available. As reported in the press release dated December 4, Globex intersected significant gold mineralization in a pyrite, pyrrhotite and arsenopyrite sulfide replacement zone. At the nose of an oxide iron formation fold between 9 and 225 m depth, grades of 16.63 g/t Au over 11.08 m true width were encountered at a vertical depth of 165 m. In a previously reported drill hole, SIW 24-01, 21.78 g/t Au over 2.62 m, true width was identified at a vertical depth of 142 m. Work continues, and the Company anticipates further promising results in 2025.

Globex's shares are currently trading at around CAD 1.15, which, at 56,294 million shares, results in a market capitalization of CAD 62.5 million. The highlight: around 30% of this valuation is backed by cash. This makes Globex one of the most interesting explorers on the Canadian stock exchange. With rising commodity prices, a significant revaluation should take place.

C3.ai and Palantir – Riding the AI wave

Despite all doubts, the AI stock Palantir Technologies continues to rise steeply, while all analysts' average price targets of around USD 39 have already been exceeded by 80%. This is hardly surprising, given that the IT and Big Data company from Denver has brought Microsoft on board as a partner. The aim of the collaboration is to sell specialized cloud, AI and analytics capabilities to the US defense and intelligence communities. Palantir, known for its data analysis software and close government partnerships, is positioning itself for strategic integration of its highly sensitive products, such as Gotham, Foundry and Apollo, into Microsoft's cloud environments. But caution: Due to the sharp upward trend of the PLTR stock, the short-term sentiment is somewhat overheated. Analytically, newcomers are now paying a 2025 P/E ratio of 145 at a price of around USD 70. Therefore, raise your stop-loss from USD 48 to USD 64 to secure significant price gains.

Industry peer C3.ai generated revenues of USD 94.34 million in Q2, an increase of 29% year-on-year or 21% quarter-on-quarter. Operating income amounted to minus USD 75.3 million, leaving a negative cash flow of around USD 39.5 million. Nevertheless, C3 still has cash and cash equivalents of USD 121.3 million, which provides a range of around two quarters. Overall, analysts were satisfied with the figures, and the share price promptly rose by almost 20% to USD 44. Yesterday, however, the price fell back to USD 39 on high turnover. Investment bank JPMorgan published an "Underweight" study with a 12-month target price of USD 28. While analysts acknowledge that the Company is pursuing significant and rapidly evolving opportunities in the field of artificial intelligence (AI), they express disappointment with its revenue growth and profit margins. They also pointed to rising costs, as the Company appears unable to achieve sufficient profitability improvements during its expansion. Even after yesterday's major setback, the stock is still up about 33% this year. Therefore, proceed with caution.

The momentum continues at full speed! The appreciation of the NASDAQ has continued for days; yesterday, it even broke through the 21,700 mark. In September, the index was still at around 18,000 points. Optimism in tech stocks remains unbroken. In Europe, defense stocks remain in demand. All high-tech applications continue to require strategic metals. With its portfolio of properties, Globex Mining is at the forefront here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.