January 23rd, 2025 | 07:00 CET

F3 Uranium, Plug Power, RWE - Opportunities and challenges from Trump's energy emergency

The election of Donald J. Trump as the 47th President of the United States is already having an impact on global energy policy and its players. Shortly after taking office, Trump declared a "National Energy Emergency" to secure the country's energy supply and reduce reliance on foreign energy companies. This presents a new opportunity for the Canadian explorer company F3 Uranium to accelerate its uranium exploration in Canada, as relaxed environmental regulations can speed up approval procedures. With 95 nuclear power plants, the US is an ideal consumer of the valuable raw material. Hydrogen expert Plug Power, on the other hand, has already seen its share price fall on the stock market. Just two days before Trump's inauguration, the Company secured a multi-billion-dollar loan guarantee under former President Biden for the expansion of its hydrogen facilities. The German energy company RWE appears largely unfazed by the change of government. Analysts at Deutsche Bank remain optimistic about the stock's growth potential, noting that existing wind farm projects seem unaffected by the energy emergency. We look at what the current developments mean for investors.

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

F3 URANIUM CORP | CA30336Y1079 , PLUG POWER INC. DL-_01 | US72919P2020 , RWE AG INH O.N. | DE0007037129

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

F3 Uranium in focus: Simplified approvals in sight due to new US policy

The 47th President of the United States has barely taken office before declaring a "national energy emergency". What sounds dramatic makes sense for the benefit of US citizens and local industry. The supply situation in the land of opportunity is critical, energy prices are high, the energy infrastructure is insufficiently developed, and international dependencies on Russia and China characterize the market.

The sweeping presidential order of the energy emergency enables simplified approval procedures for energy projects and loosens environmental regulations. This presents an enormous opportunity for the Canadian exploration company F3 Uranium to expand its business faster than expected.

The Company was founded in 2013 as a subsidiary of Fission Uranium. The number three in its name represents the third generation of experienced uranium exploration experts. The team already has significant experience in the local area. In total, F3 Uranium holds three uranium deposits in Canada, covering an area of 42,961 hectares. With the PLN project, the explorer boasts a promising resource in Saskatchewan, where the JR zone is estimated to contain 25-30 million pounds of uranium. Further exploration targets in the deposits promise additional potential.

The executive order issued by President Trump on the day of his inauguration could save F3 Uranium time in the exploration and mining of this energy-intensive raw material. Relaxed environmental testing makes this possible. In order to reduce dependence on other countries for uranium supplies, F3 Uranium's properties in Canada are becoming even more of a focus.

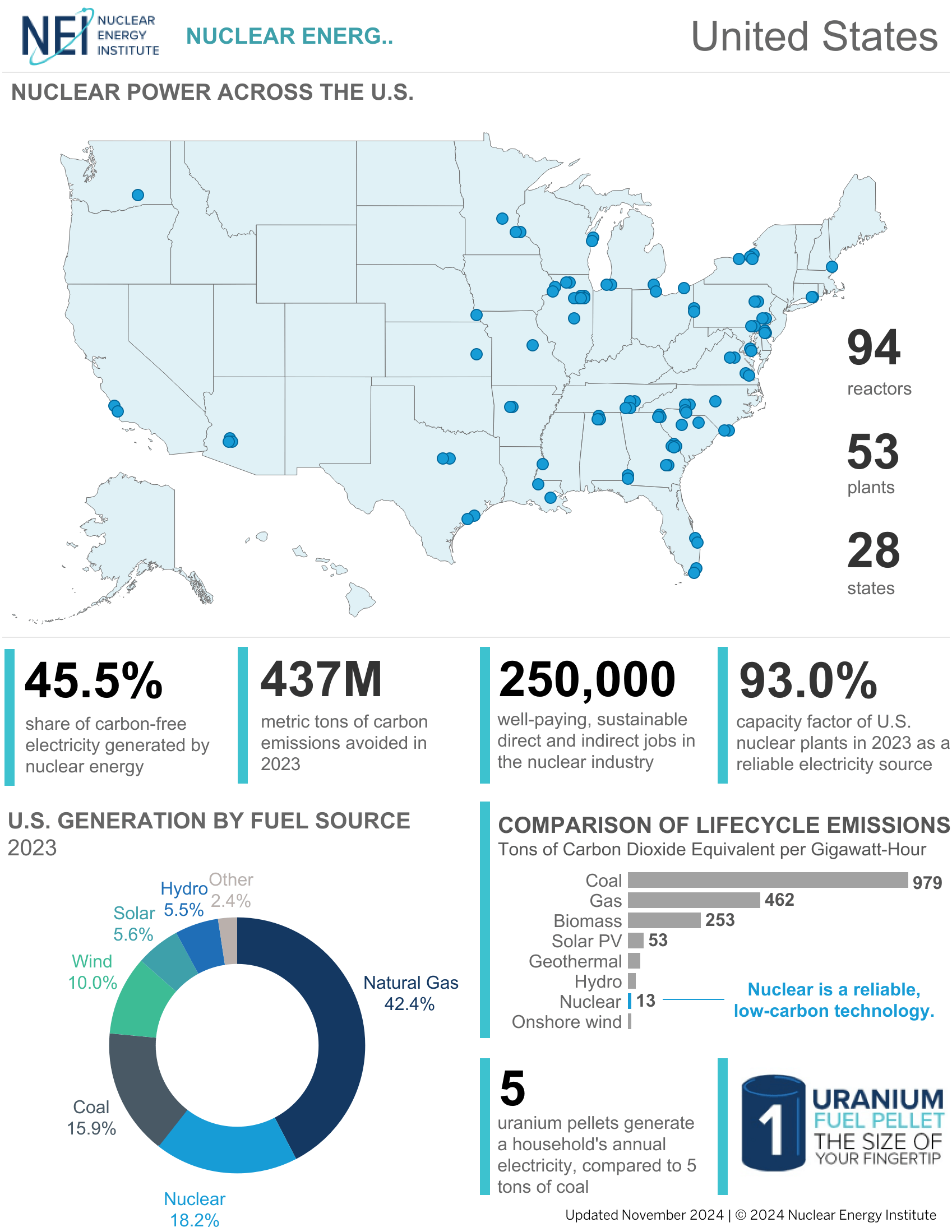

Haywood Securities Analysts are setting the price target at CAD 0.55 per share, corresponding to a growth potential of 112%. Currently, 94 nuclear power plants are operating in the US, providing millions of homes and businesses with CO₂-neutral energy. Nuclear power accounts for 45.5% of the US energy supply and has avoided 437 million tons of CO₂ emissions in 2023 alone. Uranium-powered nuclear power plants are significantly more reliable in terms of supply than wind or solar plants.

Two days before Trump: Biden quickly secures billions in loan guarantees for Plug Power

For companies like Plug Power, the new energy emergency order led directly to a drop in the share price. On January 17 2025, the security was still trading at EUR 2.50, but on Wednesday, it was down to just EUR 2.09. This is because of the new Republican administration's further measures to increase its focus on oil and gas instead of hydrogen or other renewable energies. "The inflation crisis was caused by massive overspending and escalating energy prices," said Trump in his inaugural address. "That is why I am declaring a national energy emergency today. We are going to drill, baby, drill!" said Trump at his swearing-in on January 20, 2025. In doing so, he is advocating the extraction of oil and gas and takes the entire country out of the ( link: https://edition.cnn.com/2025/01/20/climate/trump-paris-agreement-energy-orders/index.html text: Paris Climate Agreement), the so-called Green Deal.

The mining industry can, therefore, look forward to support during this term in office. However, the Plug Power team has taken precautions. During the Biden-Harris term, the hydrogen company was able to secure a loan guarantee of USD 1.66 billion to build several hydrogen plants. These commitments were approved just two days before Donald J. Trump took office.

The loan is intended to secure the production of green hydrogen in several US states. Plug Power is equipping the hydrogen plants with its electrolyser technology. The hydrogen produced in the future is to be used increasingly for fuel cell vehicles in the industrial and transport sectors.

Deutsche Bank remains optimistic: RWE share still rated "Buy"

The global energy company RWE appears to be completely unfazed by the change of government. In contrast to its Danish competitor Ørsted, which had to write down around USD 1.69 billion on renewable energy projects in the US, RWE currently sees no need for write-downs on its offshore wind farms in the US. "We had already announced at the end of the year that we would postpone investments in offshore wind in the US," explained an RWE company spokesperson on Tuesday this week. "We will now await the results of the US government's review."

President Trump sees no benefit in expanding future offshore wind farms and has immediately suspended the awarding of new offshore wind farm projects. Instead, he is convinced that these wind farms damage both flora and fauna. The first scientific studies already exist that show that the noise, for example, particularly disturbs whales in their habitat. However, the findings are still sparse, and further research is necessary.

RWE has wind farm projects both on the Californian west coast and in the waters off New York and New Jersey. The approximately 2.4 GW of advanced offshore wind projects in the US that have already reached a final investment decision and are under construction are unlikely to be directly affected by the new order.

Analysts at Deutsche Bank see further growth potential for RWE shares. The change of power in the US seems to have little influence on the Company. Although the analysts are lowering the target price from USD 41 to EUR 38, the signal remains "Buy" because the US issues are overestimated by the market. The share is currently trading at EUR 29.18.

F3 Uranium is a uranium exploration company that is benefiting from the latest regulations of the 47th US president. With three projects in the Canadian Athabasca Basin, F3 has strategically important uranium deposits that can be developed more quickly thanks to the relaxed environmental regulations. Analysts therefore see enormous growth potential. With 94 nuclear power plants and more in the planning stage, the US, with its demand for uranium, is an ideal market for the deposits that F3 Uranium can extract in its areas. Despite the political return to fossil fuels, Plug Power was able to secure an important financial hedge in time. Shortly before the change of power, Plug received a loan guarantee of around USD 1.7 billion for the construction of new hydrogen plants. RWE is unfazed by the political changes in the US. In contrast to its Danish competitor Ørsted, the German energy giant is not writing down its US wind farm projects. The offshore wind projects already under construction with a capacity of 2.4 GW do not appear to be affected by the change of course. Deutsche Bank is maintaining its "Buy" recommendation for RWE, as it believes the developments in the US market are overstated.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.