January 19th, 2026 | 07:10 CET

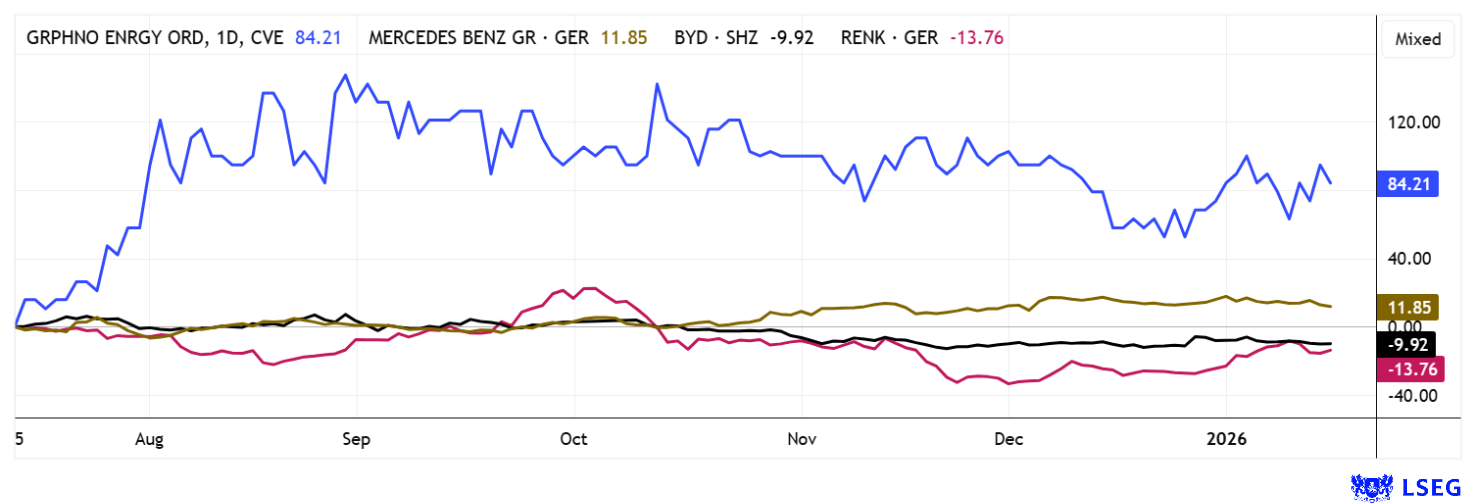

Explosive mix: Critical metals and e-mobility! BYD, Mercedes-Benz, Graphano Energy, and RENK in focus

E-mobility in Germany could gain fresh momentum in 2026, as the CDU wing of the federal government is pushing for the reintroduction of purchase incentives for electric vehicles, retroactively including those registered since the beginning of the year. There is still a need for discussion within the SPD due to other issues. German citizens are familiar with the nerve-wracking process of reaching compromises in Berlin, where a new law can only be passed with five other concessions to the coalition partner. This is how grand coalitions work: slowly and tenaciously. Regardless, the public has become accustomed to this carnival event, and for us, stock market traders, it is important to look at the possible effects of such subsidy decisions. According to estimates from the Federal Ministry for the Environment, available funding could support the purchase of up to 800,000 electric vehicles - roughly 1.6% of all registered vehicles in Germany. The planned incentives aim primarily to ease the transition to e-mobility for low- and middle-income households. Do not look a gift horse in the mouth! How are automotive stocks doing on the stock market?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , MERCEDES-BENZ GROUP AG | DE0007100000 , Graphano Energy Ltd. | CA38867G2053 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD steps on the gas, Mercedes defends its premium approach

The setup could not be more different. While BYD clearly started 2026 as a turnaround story, Mercedes-Benz is perceived more as a defensive premium and dividend stock. After a correction of around 40% in 2025, BYD is trading at around EUR 10.70, putting the expected 2026 P/E ratio on the LSEG platform at around 11. This means that the stock is valued significantly lower than in previous years. Mercedes-Benz, on the other hand, is trading at a single-digit P/E ratio of around 8 to 9, is hardly growing, but is at least managing to maintain its European market share.

BYD is different: operationally, the Chinese company continues to grow in the low double-digit percentage range as a vertically integrated EV group and primarily addresses the global mid-price segment in the electric vehicle sector. The Company already discontinued the production of combustion engines in 2022. Mercedes, on the other hand, is focusing on high-margin premium and luxury models and, despite declining results in 2025, is still achieving robust double-digit returns in the passenger car business. A key lever for BYD is the start of vehicle production in Hungary in mid-2026, which will eliminate the 17.4% EU punitive tariffs previously imposed on electric vehicles manufactured in China. Mercedes, on the other hand, is focusing more on model cycles and the gradual electrification of its successful core model series, such as the new electric CLA, which is considered a top growth driver in the premium EV segment.

While BYD has already pushed its market share in Europe above the 1% mark and aims to double the number of EU sales outlets by 2026, the Stuttgart-based company is suffering from weaker demand in China. Ten years ago, growth in Asia was described as a pillar of the group. BYD management is targeting sales growth of over 20% per year in Europe, which could make the region the next growth anchor. Mercedes, on the other hand, is showing declining volumes and profits in 2025, but hopes for a margin recovery in 2026, supported by a focused portfolio and further cost-cutting programs. Mercedes' annual figures will be available on February 12, while BYD will not report until mid-March. Investors should allocate both stocks, as guaranteed growth and high dividends from one sector are rarely available as an attractive package!

Graphano Energy - Security policy reassessment of graphite as a raw material

High-tech has a great need for graphite as a raw material, especially when it comes to energy storage. Canadian company Graphano Energy focuses on the exploration of natural graphite, a critical raw material for batteries, energy storage, and security-related applications. Three projects are currently being developed in Québec. The flagship Lac Aux Bouleaux project is located in the immediate vicinity of Canada's only producing graphite mine and comprises a large exploration area with proven near-surface mineralization. Drill results there included intersections of 4.81% graphitic carbon over 12.25 meters and 6.63% Cg over 7.07 meters, indicating robust grades in economically relevant thicknesses. In addition, an airborne geophysical program covering approximately 637 sq km was launched to systematically delineate structural trends and new target zones. A potential connection to existing processing infrastructure in the region could significantly reduce future investment costs.

With the Standard Mine, Graphano has a flagship project with already defined resources totaling approximately 1.93 million tons with average grades between 6.27% and 7.16% Cg. Individual drill holes there achieved peak grades of up to 15.95% Cg – impressive! An updated resource model has been announced for the current year, with a feasibility study to follow. The Black Pearl area, with 84 claims covering approximately 4,149 hectares, is developing particularly dynamically and has only been partially explored to date. Initial drilling confirmed high-grade zones with 11.33% Cg over 8.61 meters and 17.9% Cg in several channel samples. A recently completed 473-km airborne geophysical survey identified a continuous conductive trend approximately 1.2 km long and numerous additional target areas.

Against the backdrop of growing North American demand and the classification of graphite as a security-relevant raw material, the project portfolio is gaining strategic importance. Government funding instruments and tax incentives in Québec further improve the economic conditions. The stock is tradable in Canada and Germany and has sufficient liquidity despite the early project phase. With prices ranging from CAD 0.14 to CAD 0.18, the stock (ticker: GEL) has gotten off to a good start in 2026, with speculative investors adding this interesting lever from the critical metals sector to their portfolios.

RENK – 15% growth with a P/E ratio of 36

Energy storage systems are now used across all industries. In military and mobility-oriented applications, the focus is on storage capacity, resilience, and reliability. The RENK Group is one of the leading suppliers of highly specialized drive solutions for military tracked vehicles and is structurally benefiting from the global increase in defense demand. A significant operational boost is coming from the US, where RENK America has been awarded a framework agreement by the US Army with a potential total volume of up to USD 75.5 million over five years. The supply contract covers technical system support for hydromechanical transmissions on key platforms such as Bradley, AMPV, MLRS, and Paladin, which continue to play an important role in the US Army's operational planning. The gradual commissioning over the term of the contract indicates long-term capacity utilization for the US organization and strengthens the visibility of the service business.

At the same time, RENK is strategically positioning itself in Germany and underlining this by joining the "Made for Germany" initiative. By 2028, the Group plans to invest up to EUR 325 million in Germany, which reflects around 40% of the total investments announced by the initiative's growth-oriented member companies. The capital expenditure will focus on digitalization, innovation, unmanned tracked vehicles, and capacity expansion at the Augsburg and Rheine locations. On the capital market side, the share price already reflects a significant portion of the growth scenario. According to the consensus, analysts expect revenue to increase from EUR 1.34 billion to around EUR 1.55 billion by the end of 2026, which is not particularly much for the recently formulated offensive. Based on estimates on the LSEG platform, the Company is valued at an expected 2026 P/E ratio of around 36.4 and around four times revenue. This reflects high expectations of further growth in order momentum and successful operational implementation. Ambitious!

As a fast-growing EV market leader with a favorable valuation and expansion in Europe, BYD offers great potential but remains vulnerable to risks in China and margin pressure. The RENK Group is an impressive defense supplier with programmed growth and price targets around EUR 70, but it is cyclical and dependent on defense budgets. Mercedes-Benz scores with a high dividend yield and low P/E ratio, while explorer Graphano Energy has made graphite its mission and is perfectly positioned in the commodity super cycle.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.