October 9th, 2025 | 07:25 CEST

E-mobility tax-free through 2035! Keep an eye on BYD, NEO Battery Materials, NIO and BASF

In the third quarter of 2025, the global market for electric mobility continued to develop dynamically: over 4.2 million new electric vehicles were registered, an increase of around 28% compared to the previous year. While China confidently maintained its leading position as the largest single market, Europe also grew strongly with double-digit growth rates. Driven by manufacturers such as BYD, Tesla, and Volkswagen, NIO is also slowly entering the scene. At the same time, more and more capital is flowing into innovative battery technologies to meet rising demand in the long term. NEO Battery Materials is emerging as a specialist in the innovative battery solutions business. This rapid development illustrates how closely technology, raw material markets, and the electric mobility boom are intertwined. We present some ideas for investors.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , NEO BATTERY MATERIALS LTD | CA62908A1003 , BASF SE NA O.N. | DE000BASF111 , NIO INC.A S.ADR DL-_00025 | US62914V1061

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD and NIO – Now established in Germany

BYD ("Build Your Dreams") has evolved from a battery manufacturer to the world's leading producer of electric vehicles and plug-in hybrids and is a key driver of the mobility revolution. In addition to vehicles, the Company produces its own batteries and semiconductors, which ensures technological independence and high added value. While BYD has long been the market leader in China, Europe is increasingly becoming the focus: new distribution partners, fleet cooperations, and a plant in Hungary are intended to circumvent customs barriers, shorten supply chains, and accelerate growth. With its advanced blade battery, BYD is gaining technological advantages, while record sales of over 1.5 million vehicles in Q3 2025 underscore the momentum. In Germany, its market share grew to 2.9% for electric vehicles and 6.9% for plug-in hybrids, a significant step towards establishing itself. At the same time, the dealer network will be expanded to around 300 locations by 2026.

NIO is also pushing ahead with its expansion and increasingly targeting a broader customer segment. With its new sub-brand "Alps," the Company is addressing the mid-range segment in Europe and China for the first time. At the same time, the battery replacement infrastructure continues to grow with over 2,400 stations, supported by a cooperation with Shell. A successful convertible bond secures additional funds for autonomous driving and international expansion. Analysts expect this to result in a significant growth spurt from 2026 onwards. While BYD is focusing on economies of scale and cost leadership, NIO is concentrating on premium features and customer experience. These two different strategies highlight the enormous potential of the e-mobility market and open up exciting opportunities for investors.

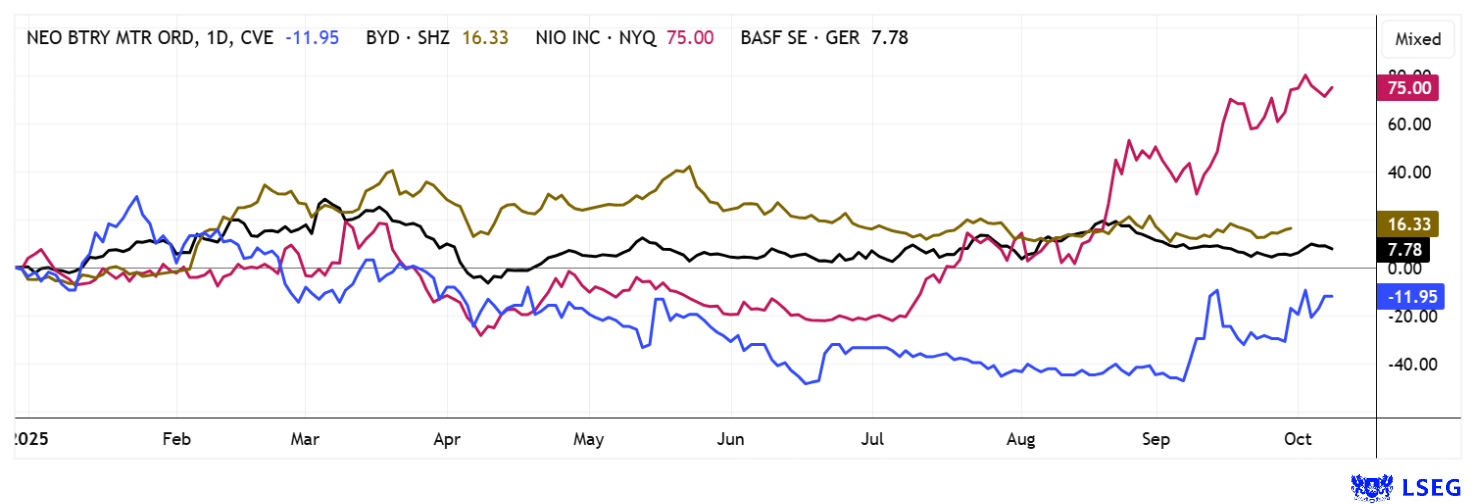

BYD shares underwent a 40% consolidation in 2025, which now appears to be coming to an end. The Q3 operating figures will be released on October 29, with NIO reporting three weeks later. Both stocks are suitable for risk-conscious investors. In the case of NIO, it should be noted that, according to current plans, profits are not expected until 2029.**

NEO Battery Materials – Key technologies for the batteries of tomorrow

A powerful battery solution is the linchpin for many technical applications. NEO Battery Materials Ltd. is a Canadian battery technology company specializing in silicon-enhanced lithium-ion batteries for drones, UAVs, robotics, electric vehicles, and energy storage systems. With a patented, cost-effective manufacturing process, NEO Battery offers end-to-end solutions from material selection and cell architecture to process optimization. The Company's focus is on playing a leading role in the North American battery value chain, which has come under intense discussion in recent months following Donald Trump's return to Washington.

At the heart of the technology is the NBMSiDE® silicon anode, which uses a nanometric coating to control the volume expansion of silicon during charging. The result: significantly improved cycle stability, ultra-fast charging times, and energy densities with specific capacities of over 2,000 mAh/g and an initial efficiency of over 88%. The proprietary one-step process and the use of cost-effective metal silicon enable a cost reduction of over 60% compared to standard competing solutions. The four product lines (NBMSiDE® P100, P200, P300, and P300N) are flexibly scalable and cover a wide range of applications. NEO Battery thus addresses the key requirements of future energy storage systems: longer runtimes, faster charging cycles, greater safety, and lower costs per kilowatt hour.

The Company is in a strong financial position. With a CAD 5.5 million capital increase completed in September 2025, NEO Battery is strengthening its production capacities for UAV and robotics batteries, investing in scale-up facilities, and accelerating the commercialization of its technology. Management aims to enter the defense business very quickly, with a strong focus on drone manufacturers for future order acquisition. The successful capital raise and the focus on scalable industrialization create the best conditions for the next growth spurt. The stock can be purchased in Canada under the ticker symbol NBM for approximately CAD 0.70 or at a low cost on Tradegate. A highly interesting early-stage investment with considerable potential.

BASF – Global leadership role in battery materials expanded

BASF is one of the world's leading suppliers of battery materials and has massively expanded its market position in recent years. The group specializes in high-quality cathode materials for lithium-ion batteries and, together with partners, is developing innovations for solid-state batteries, which are considered a key technology for the electric mobility of the future. In a global comparison, CATL, LG Energy Solution, and Panasonic currently lead the market for battery materials and cells, with CATL from China being the absolute number one with the largest production capacity. BYD follows in second place and plays a significant role, especially in lithium iron phosphate.

Through targeted collaborations, particularly with Chinese battery manufacturers such as CATL and WELION, BASF has succeeded in establishing itself in the central supply chains and benefiting from the dynamics of the world's largest battery market in China. Through the joint venture BASF Shanshan Battery Materials (BSBM), both innovation and production are being realized directly in the Chinese market. In the past quarter, BSBM delivered the first industrial batches of special high-nickel cathode materials for semi-solid-state batteries, a significant milestone for the efficiency and safety of modern batteries. In addition to innovations such as solid-state technologies, BASF is also addressing issues of battery recycling and the security of supply of base materials, which provide additional competitive advantages.

On October 22, the Ludwigshafen-based company will report on Q3, with experts expecting revenue to decline from EUR 65.3 billion to EUR 63.8 billion in 2025. Following good progress in job cuts, earnings are expected to improve significantly again in the current year to around EUR 2.55 per share, up from EUR 1.45 in 2024. The high dividend payout of over 5% is to be maintained. With a 2027 P/E ratio of 11.5, BASF shares are once again attractive in the long term. Investors can look forward to attractive prospects thanks to the Company's global technology leadership, strong integration in the Chinese market and the growing importance of sustainable energy storage.

The stock markets continue to reach new highs almost daily. The momentum is slowing down somewhat, but it remains strong. Investors should tighten stop-loss levels and consider reducing positions in stocks that have already performed very well. BASF and NEO Battery Materials, on the other hand, still offer attractive opportunities, as they have so far seen only marginal gains.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.