June 30th, 2023 | 07:30 CEST

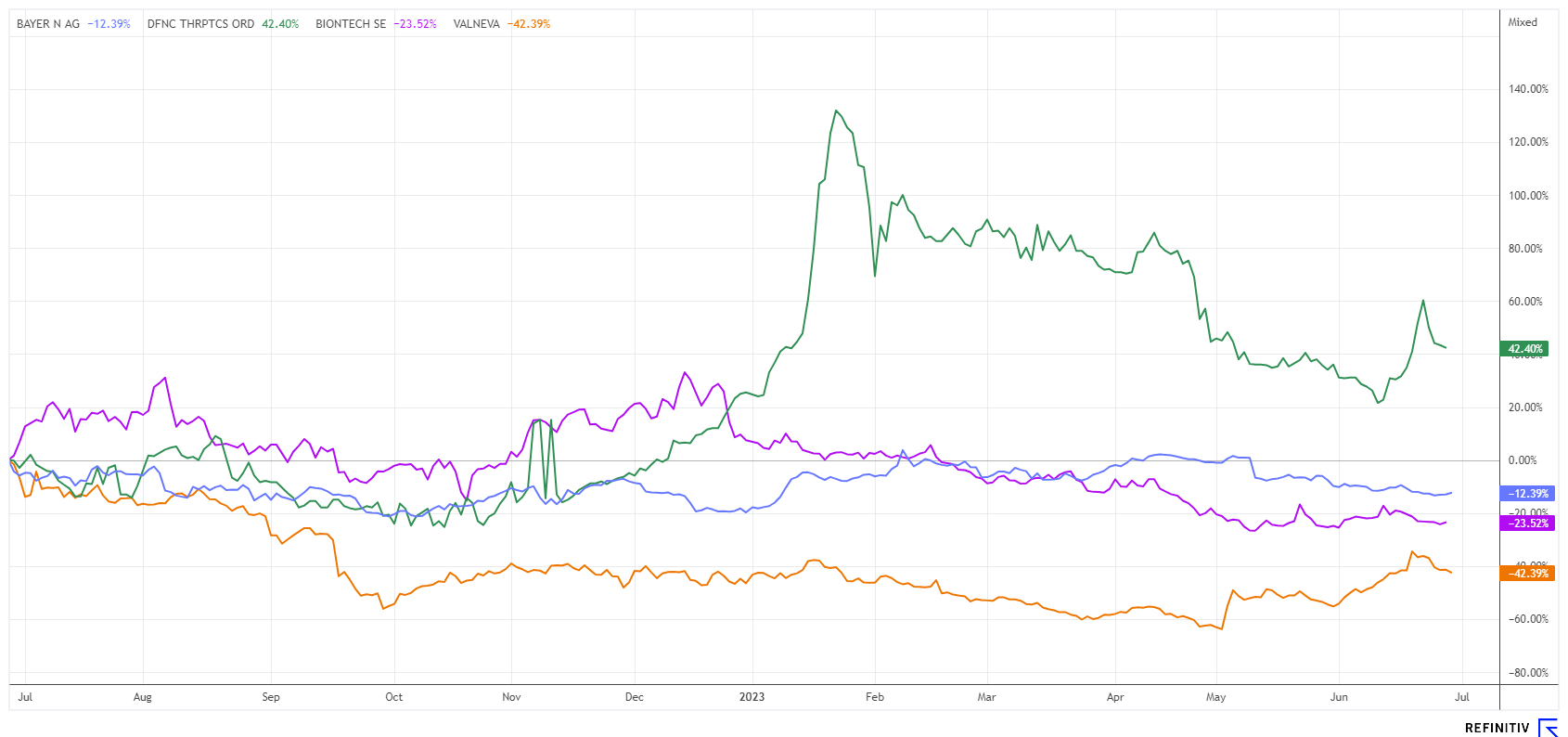

Doublers are possible! Bayer, Defence Therapeutics, BioNTech, Valneva - It is hard to believe!

In 2022, a total of 19.5 million people received the shocking diagnosis of "cancer". Current trends, unfortunately, suggest that this number will continue to rise in the coming years. However, thanks to growing research successes, there is hope that biotechnology will significantly increase the chances of survival for those affected. It is a matter of developing suitable active substances and launching modern therapies. mRNA technology has recently made a name for itself in cancer prevention. Innovative biotech companies are back on the radar of risk-conscious investors. We are on the lookout for doubling potential.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , DEFENCE THERAPEUTICS INC | CA24463V1013 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , VALNEVA SE EO -_15 | FR0004056851

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer - Is the breakthrough for Parkinson's coming now?

Bayer is one of the German flagships for cancer research. Currently, however, the Leverkusen-based company is also making its mark in the field of Parkinson's disease. One of the most important subsidiaries of the pharmaceutical and agrochemical group is the American biotechnology start-up Bluerock Therapeutics, which is working on novel cell and gene therapies. Valued at just over USD 1 billion when acquired in 2019, Bluerock is now achieving a first important intermediate step in the development of a Parkinson's therapy in the US.

As reported, the 12 patients participating in the Phase I clinical trial have consistently responded well to the therapeutic interventions. All subjects are in the advanced stages of Parkinson's disease and have now undergone the injection of living cell material into their brains, which is an irreversible procedure. In Germany, there is still no official approval for something like this, which is why such studies are only carried out outside Europe. The transplanted cells are intended to repair damage to the nerve cells caused by Parkinson's disease. So far, only a few treatments temporarily alleviate symptoms, but a curative drug would immediately bring Bayer on board as a blockbuster.

On the platform Refinitiv Eikon, there are 23 expert opinions on Bayer. Among them, there is currently no sell recommendation. The median price expectation on a 12-month horizon is around EUR 71.80, which is still 42% above the current level. In our opinion, Bayer shares at prices around EUR 50 are highly interesting for long-term investments with a dividend guarantee.

Defence Therapeutics - On the rise with further patents

The Canadian biotech specialist Defence Therapeutics (DTC) is an absolute joy to watch at the moment. With a series of positive news, the stock price has already gained over 40% in the past 12 months. Now, the Company is heading towards the NASDAQ. There, the financing conditions for high-growth companies are favorable. This will enable Defence to finance its extensive research projects more easily and to get closer to the ultimate goal of commercializing its products much faster.

With its patented Accum™ platform, Defence has developed a flexible technology that offers great hope in current cancer research. Combining mRNA technology with modern delivery methods to affected cells is a real advance within recent research. The recent international patent application underpins existing methods of intracellular delivery of various cargoes, bypassing the problem of endosomal containment. Defence thus illustrates its claim of rapid further development in the field of modern vaccination methods.

The results included in the PCT application specifically demonstrate the successful nuclear transfer of functional CRISPR/Cas9 and guide RNA-ribonucleoprotein complexes through Accum™ variants. These results not only demonstrate the broad applicability of Defence's Accum™-based platform technology but also pave the way for further strategic collaborations in the future, particularly in the fast-growing field of genome editing.

"The publication of this new PCT application is another important step towards the commercialization of innovative therapeutic and prophylactic candidates currently in Defence's arsenal", says CEO Sebastien Plouffe.

The stock has now corrected slightly at the end of June, offering interested investors a more favorable entry point at just above EUR 2.00. With a current market capitalization of about EUR 90 million, there is still huge potential for further progress. Please also refer to the recent article at www.researchanalyst.com.

BioNTech and Valneva - Is there more than "vaccination" in the quiver?

In the case of the heavily beaten-up biotech stocks BioNTech and Valneva, the experts are currently very divided about further development. While BioNTech is still sitting on extensive cash funds of around EUR 18 billion from the Corona pandemic and can thus blithely continue research, it looks somewhat more difficult with the liquidity at Valneva. At least the French-Austrian stock was able to recover relatively quickly from its sell-off level of around EUR 4. The stock was already one of the big losers from 2022, down more than 60%.

The desire to travel is back after the pandemic years, and not only tourism companies are benefiting from this, but also Valneva. Because just in time for the start of the season, the two approved travel vaccines, Dukoral and Ixiaroim, are on offer. CEO Thomas Lingelbach is therefore optimistic about achieving the annual targets, which have been revised several times. The 8 experts on the Refinitiv Eikon platform are consistently optimistic and set their 12-month price expectation at EUR 9.75 on average - which is still 50% higher than the last traded price.

The EUR 100 mark is proving to be a stubborn resistance line for BioNTech. However, this could change quickly if one of the many studies delivers good results. With its partner OncoC4, BioNTech is starting a Phase III clinical trial with the therapy candidate BNT316/ONC-392. The compound, designed for monotherapy, is used to treat metastatic, immunotherapy-resistant lung cancer. Since last year, they have obtained Fast Track status from the FDA. BioNTech and OncoC4 have been cooperating in therapy development since the first quarter of this year, but BioNTech alone holds the exclusive worldwide commercialization rights for the products. Among many other research approaches by BioNTech, this collaboration has true blockbuster potential. The stock market is currently waiting for such news, but the selling pressure due to falling sales after the Corona vaccination rush is still high. Our conclusion: Watch closely and quickly seize the opportunity if momentum drives it towards EUR 115! Valneva should also be kept in mind.

Volatility is particularly high in the biotech sector, as company prices fluctuate widely with published trial data. Everyone wants to be on board or not when things go wrong. Bayer and Defence Therapeutics are performing well from a technical chart perspective, while BioNTech and Valneva have yet to make a real technical reversal.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.