July 16th, 2025 | 07:20 CEST

Does Trump love hydrogen after all? The sector is celebrating! Plug Power, Nel, dynaCERT, and MP Materials are in rocket mode

Global pressure to reduce climate-damaging emissions is growing, and the hydrogen sector is increasingly coming into focus. Although US policy under Donald Trump does not prioritize climate protection, Europe and Asia are resolutely pushing ahead with the transformation in mobility, logistics, and mining. Hydrogen technologies offer enormous potential here, especially in the heavy-duty sector. Innovative providers such as dynaCERT are focusing precisely on this area with tried-and-tested solutions for reducing emissions and increasing efficiency. The technologies are mature and ready for use, global demand is rising, and decision-makers are under growing public pressure to support sustainable alternatives. The sector remains relatively quiet, but with a bit of industry rotation, the pendulum could swing quickly in the other direction.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235 , DYNACERT INC. | CA26780A1084 , MP MATERIALS CORP | US5533681012

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power – Back and Forth, Up and Down!

Attractive opportunities are currently emerging for investors with foresight. For example, those who bet on the right hydrogen stocks now may be right in terms of trading, but they may also catch a trigger point for global changes in investor preferences. Anything seems possible in our distorted and overly politicized environment. It is not uncommon for minor success stories to lead to breathtaking price movements. Take Plug Power as an example: A simple announcement that the Company remains hopeful about receiving the promised multi-billion-dollar funding packages under the Biden administration - combined with the claim of having built the world's largest electrolyzer - was enough to send the stock soaring from a low of around USD 0.70 to about USD 1.70. However, because the Company still urgently needed capital, the high price was quickly used for ATM offerings, causing the share price to drop again. Nevertheless, at USD 1.55, the low is now a distant memory, and speculators are back on board! After all, 6 out of 24 analysts on the LSEG platform are voting "Buy" and expect a 12-month price target of USD 1.85. Plug Power will likely have to work hard to earn this 20% premium!**

Things are not going so well for its European counterpart, Nel ASA, which is ten times smaller. Public orders are still lacking, and the EU is also lagging miles behind its promises from the "Green Deal." In the first quarter of 2025, revenue fell to NOK 155 million, a decline of 44% compared to the previous year, while EBITDA ended up in the red at NOK -115 million. In January, Nel decided to temporarily halt alkaline production at its Herøya site and cut around 20% of its workforce in order to stabilize its cost base. At the same time, however, the medium-term outlook remains positive: Nel secured a reservation for more than 1 GW of alkaline electrolyzer capacity for the Mississippi Clean Hydrogen Hub, a potential order worth around NOK 3 billion that could be realized in production from 2025. In addition, Nel received funding of up to EUR 135 million from the EU Innovation Fund to scale up its new alkaline technology in Norway with a delivery potential of 25 MW by 2027. CEO Håkon Volldal confirms that, despite significant market challenges, the Company has solid liquidity and sufficient production capacity to grow opportunistically. The partnership with Samsung E&A from South Korea further strengthens the market opportunities in Asian markets. Investors are beginning to feel hopeful again, with Nel shares trading at NOK 2.66, at least 20% above their all-time low. There is currently no "Buy" recommendation on the LSEG platform. If that is not a good sign, what is!

dynaCERT – On the launch pad

dynaCERT reported a successful capital increase of CAD 5 million at the beginning of July. The Canadian hydrogen specialist is thus well prepared for a hot summer, both technologically and financially. After a long wait, the Company received the coveted VERRA certificate in fall 2024. This will enable users of the Company's HydraGEN™ systems, which make diesel combustion more efficient and cleaner, to generate CO₂ credits in the future. This is an attractive added benefit for customers in logistics, transportation, construction, and energy. The technology combines hydrogen and oxygen in real-time during the combustion process, reducing emissions and saving fuel. With an investment of around CAD 6,000 per machine, operating costs can be significantly reduced, which is a strong ESG argument for fleet operators. Following successful discussions at trade fairs and international sales meetings, many market participants now expect a series of sales announcements.

The new funds will be invested directly in the global expansion of HydraGEN™ products. After years of preparation, industrial capacity expansion is now proceeding according to plan, led by an experienced German management team. Pre-production of 1,000 units following the "bauma 2025" trade show demonstrates the high level of market readiness. In addition to its core product, dynaCERT is also advancing its HydraLytica™ telematics solution, which records fuel consumption and CO₂ savings, essential for certification and reporting purposes. With applications ranging from refrigerated trucks to mining vehicles, the Company covers a wide range of heavy-duty vehicles. The latest capital inflow strengthens its position in the billion-dollar market for CO₂ reduction, making dynaCERT a potential winner in the green industrial transformation. The new listing on the NASDAQ OTCQB Venture Market is boosting investor interest. The stock has now completed all preparations for launch, and the countdown is on!

President Bernd Krüper provided interesting insights into the dynaCERT business model at the 15th International Investment Forum: https://youtu.be/novEu4ekJjA

MP Materials – Sprinting from USD 15 to USD 60

Another rapid four-bagger. Rare earth specialist MP Materials has established itself as a strategically important supplier of rare earths in the US within just a few months. With the US Department of Defense acquiring a 15% stake for over USD 400 million at elevated prices, the Company gained significance overnight. At the same time, Apple is now investing USD 500 million in domestic magnet production, securing MP's products. The new production facility in Texas is supplying NdPr metal for the first time in decades and is testing magnet products for the automotive industry. Delivery figures reached record levels in the fourth quarter of 2024, which was rewarded by analysts with price targets of up to USD 55. Government subsidies, the development of the entire value chain, and geopolitical trends toward independence from China remain key factors influencing the share price. Despite improving fundamentals, the short ratio remains around 25%, indicating high market skepticism. The stock is consequently highly volatile, but will benefit in the long term from political tailwinds and growing demand in the e-mobility and defense sectors. The price is therefore unlikely to turn around until the short ratio returns to normal levels through covering. A stock for trading specialists!

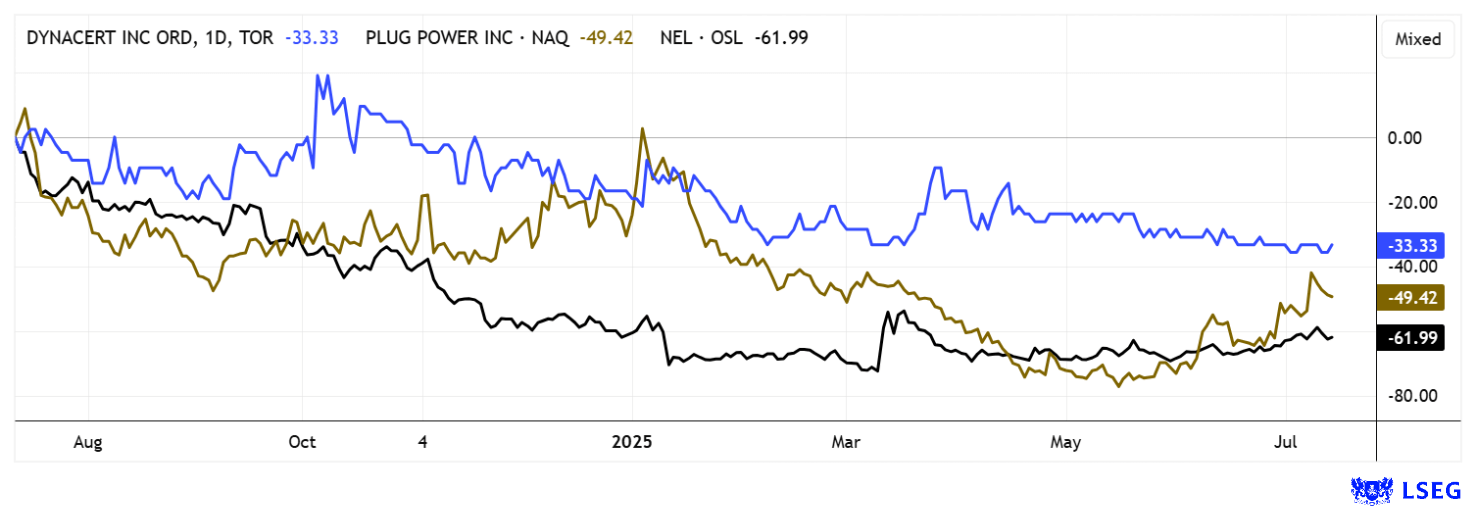

**The stock markets are proving resilient in the face of political turmoil, with global hotspots seemingly driving prices higher. Not much has happened yet in the hydrogen sector, but the key players are showing the first signs of stabilization. While Plug Power and Nel ASA are at least technically forming promising bottom formations, dynaCERT could soon fire up its operational turbo. MP Materials is a textbook example of the current state of the stock markets: a mix of hysteria and greed!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.