November 4th, 2024 | 13:45 CET

Desert Gold Ventures Special: A Jewel for the Well-Informed Investor?

With geopolitical tensions, a potential gold-backed BRICS currency, and declining interest rates, gold is experiencing a true renaissance – and the recent rally, which pushed the price towards USD 2,800 per ounce, has sparked investor interest like never before. As the gold market gains momentum, many investors are focusing on companies that could benefit from this favorable market environment. One of the most exciting players in this space is Desert Gold Ventures (TSXV: DAU), a rising star in the West African mining landscape. What makes Desert Gold a potential gold mine for investors? A well-informed investor should know these key factors! Read on to learn more.

time to read: 3 minutes

|

Author:

Armin Schulz

ISIN:

DESERT GOLD VENTURES | CA25039N4084

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Strategic Location and Resource Potential

Desert Gold Ventures (TSXV: DAU) holds an impressive land package of 440 sq km in West Africa, located near some of the region's largest gold producers. This area is situated in the fertile Birimian Greenstone Belt, known for its rich gold deposits. To date, the Company has identified about 1.1 million ounces of gold, with significant potential for resource expansion. The strategic location, combined with well-developed infrastructure, further enhances Desert Gold's attractiveness. The presence of major gold producers like Barrick Gold and B2Gold nearby fuels acquisition speculations.

Cost Advantages and Production Planning

A key advantage of Desert Gold is its ability to mine gold at comparatively low costs, with estimated production costs ranging between USD 800.00 and 1,300.00 per ounce. This competitive cost structure allows for substantial margins in the current market. Desert Gold plans to begin gold production in the second half of 2025. During the initial phase, two open pits will be developed to focus on the efficient extraction of approximately 200,000 ounces of near-surface oxide gold, using the cost-effective heap leaching method.

Strong Resource Management and Forward-Looking Production Plans

The Company follows a clear vision to identify and develop economically profitable resources. Its focus on oxide and transitional materials, which are easier and more cost-effective to extract, is a deliberate strategy to maximize return on capital. This approach is also evident in its resource expansion plans, which are based on sustainable and efficient utilization of existing deposits.

Infrastructure and Sustainability

Desert Gold benefits from well-developed infrastructure in West Africa, which facilitates access to the mines and minimizes additional investments in logistical support. Sustainability and environmental responsibility are integral to the Company's strategy, ensuring that mining activities adhere to ecological standards.

Economic Assessment and Potential for Price Gains

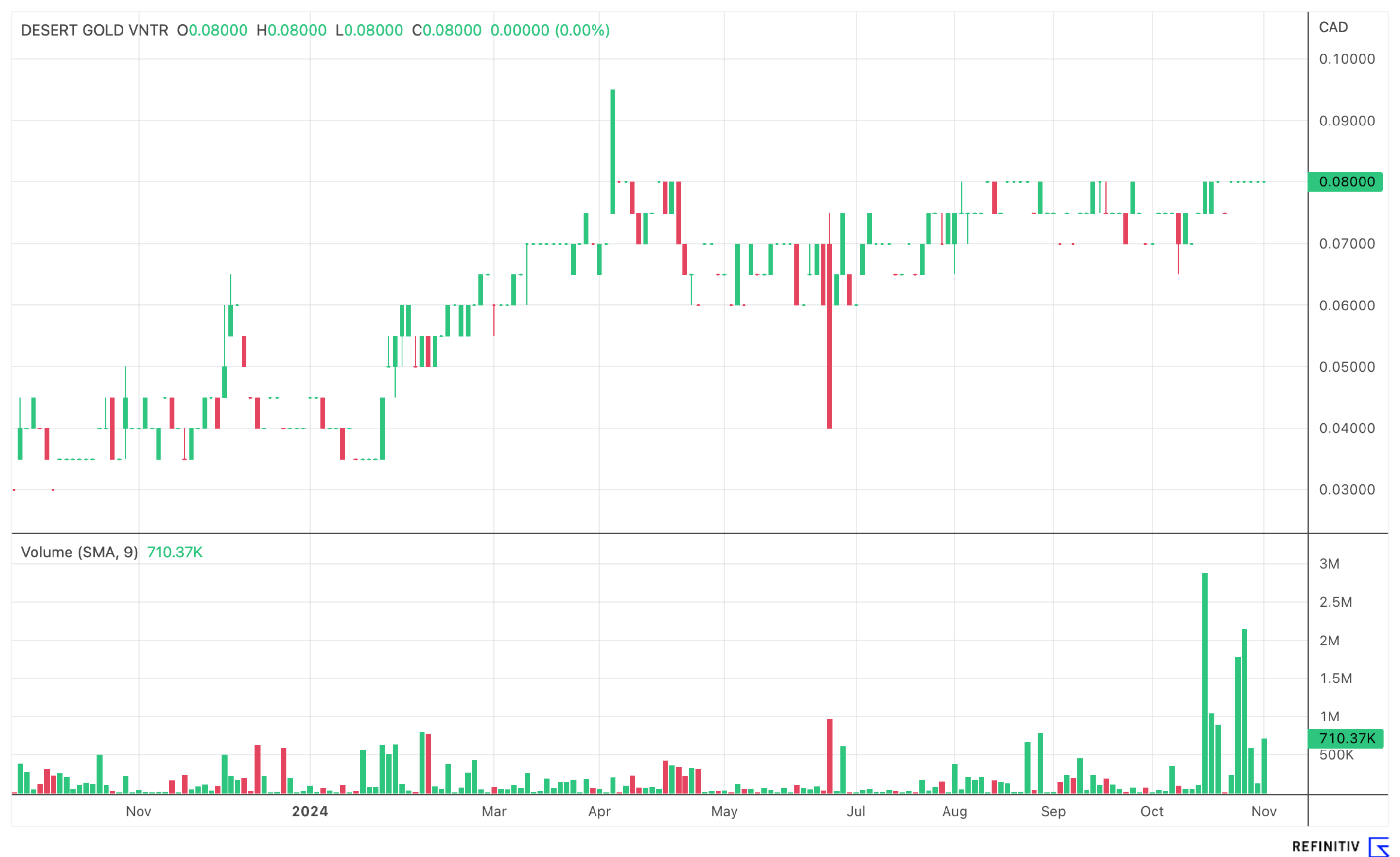

Currently, Desert Gold is preparing a Preliminary Economic Assessment (PEA), which many view as a catalyst for a revaluation of the Company. At present, each ounce of gold is valued at only USD 11.76 at Desert Gold – suggesting significant potential for a valuation increase. Analysts at GBC Investment Research also see this potential, projecting a share price increase to CAD 0.425, well above the current price of CAD 0.08. With a market capitalization of approximately CAD 18 million, even moderately positive news could substantially impact the stock's value.

Strong Management and Prominent Support

Desert Gold is led by an experienced management team with a successful track record in the resource sector. For those interested in learning more about CEO Jared Scharf, the presentation from the International Investment Forum on October 15 is available on YouTube (Link). In addition to the active operational team, the support of experienced investors plays a central role in the Company's growth strategy. A noteworthy supporter is the successful commodity investor Ross Beaty, whose investment is seen as a vote of confidence in the Company's potential.

Conclusion and Outlook for Investors

Overall, Desert Gold Ventures offers an intriguing investment opportunity for those looking to benefit from the current gold-based market growth. The combination of strategically located resources, an experienced leadership team, and solid production plans in a region with low production costs creates an attractive overall scenario for investors. The upcoming PEA is highly anticipated by the financial community, as it has the potential to significantly increase the Company's market value and attract new investments. Desert Gold could represent a golden opportunity for investors willing to take on the risk of an early-stage investment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.