May 30th, 2025 | 10:15 CEST

Defense boom, tungsten shock, Nasdaq listing: Is Almonty the most exciting stock of 2025?

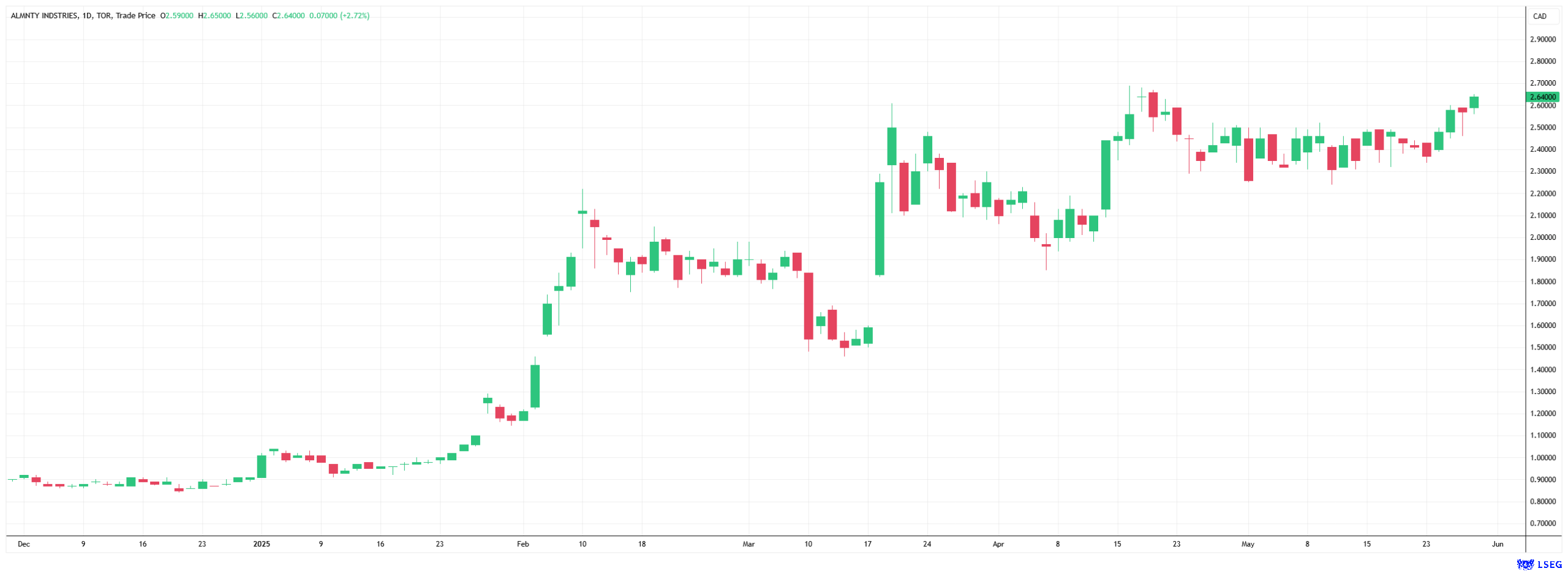

Many investors dream of getting in on a stock at the right time - just before it takes off. Shares in tungsten producer Almonty Industries have already staged a unique rally this year. The revaluation is, therefore, in full swing. But how much further can the stock go? While analysts at Sphene Capital see further upside potential of 100%, events are unfolding rapidly – at Almonty and around the world. We explain what makes Almonty Industries such an interesting investment story.

time to read: 4 minutes

|

Author:

Nico Popp

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Almonty supplies tungsten from secure regions – The US is snapping it up

Almonty Industries is a global tungsten producer that mines high-grade tungsten concentrate from politically stable, conflict-free regions. Almonty currently operates the Panasqueira tungsten mine in Portugal and has other projects in Spain. The flagship Sangdong project in South Korea is scheduled to go into production this summer. This geographical diversification in legally secure regions makes Almonty's offering unique – around 90% of the world's tungsten supply currently comes from China, North Korea or Russia. China has made exports more difficult several times in recent months, and the US National Defense Authorization Act even prohibits the US Department of Defense from purchasing tungsten mined or processed in China or Russia from 2027 onwards. Almonty is, therefore, one of the few remaining suppliers.

In this context, the Sangdong project is unique: it is one of the few new large-scale tungsten projects outside China and is being developed in a country considered a close ally of the US. This fits perfectly with the strategy of the United States and other Western countries to build resilient supply chains for critical raw materials. Almonty's collaboration with Washington-based consulting firm ADI, whose team consists of former government and military experts, highlights the political dimension of the project. The fact that Almonty has relocated its headquarters to the US also fits into this picture.

Unique conditions – Tungsten already sold with no price cap

Almonty currently produces around 900 tons of tungsten per year at its Panasqueira mine in Portugal. Although the mine has been in operation for 136 years, Almonty CEO Lewis Black expects it to remain active for another 20 to 30 years. According to Black, the mine remains solidly profitable thanks to the high quality of the material. The Sangdong project in South Korea will contribute an additional 4,000 tons of tungsten per year starting this summer. However, Almonty has the option to double this production in the short term. Compared to the mine in Portugal, Sangdong offers grades of 0.47% tungsten trioxide. This is still around six times more than the Panasqueira mine, which has been profitable for over a hundred years. The US relies on 10,000 tons of tungsten yearly to meet demand in the defense and high-tech industries. Almonty has already sold more than half of the tungsten production from the Sangdong mine. The buyers are a subsidiary of the Austrian Plansee Group and the US defense supplier Tungsten Parts Wyoming. Almonty considers the terms of these purchase agreements to be very good – they include minimum prices but no price caps. For Almonty and its shareholders, this means planning security and stable cash flows without having to forego positive surprises.

Additional potential: Molybdenum lies beneath the tungsten

When Lewis Black talks about Sangdong, he primarily highlights the convincing figures despite conservative calculations. The project investment costs amount to around USD 105 million, 70% of which was financed by a loan from the German KfW-IPEX Bank. According to the feasibility study, the project has a net present value (NPV) of around USD 156 million and a pre-tax profitability of approximately 26%. In addition, Sangdong offers long-term upside potential through an underlying molybdenum deposit, which could also be exploited in the future.

Own refinery turns Almonty into a high-tech supplier

In order to achieve an even greater share of the value chain, Almonty will also enter the tungsten processing business. According to Black, this element is not only challenging to mine but also difficult to process further. Thanks to the many years of experience of the Almonty Industries team, which was already working with tungsten when Western industry had not even noticed its dependence on China, the Company has the necessary expertise. Almonty signed a letter of intent in 2024 to build its own refinery in South Korea by 2027. The Sangdong Downstream Extension Project is expected to have an annual capacity of 4,000 tons of tungsten and produce ammonium paratungstate (APT) and nano-crystalline tungsten oxide. This would mark Almonty's first step from a pure mining operator to a fully integrated tungsten producer. Through this vertical integration, Almonty will achieve significantly greater added value and could also supply highly refined tungsten products - such as powders and alloys - to the South Korean battery and semiconductor industry.

Tungsten: Analysts see a 16% supply gap in 2025

Demand for tungsten has been rising steadily for years – analysts at ResearchAndMarkets.com predict an annual increase of 4.6% through 2030. However, since the war in Ukraine, sanctions against Russia, and the consequences of the US National Defense Authorization Act, supply has been very limited. New tungsten projects have been rare for many years – Sangdong is considered an exception. Analysts at The Oregon Group expect a significant supply gap of up to 16% for tungsten in 2025. The commissioning of the Sangdong mine later this year is very timely.

Key figures + Nasdaq listing = New momentum?

With peace efforts surrounding the war in Ukraine having temporarily collapsed and the signs continuing to point to arms deliveries and rearmament, tungsten will continue to be needed for the defense industry in the near future. However, the unique element with the high melting point is also indispensable in aerospace, modern batteries, and heavy equipment in mining. The stock of Almonty Industries has consolidated at a high level in recent months and has recently been poised to reach new highs. Almonty's key operating figures are looking good. The planned listing on the US Nasdaq stock exchange, set to coincide with the start of operations at the Sangdong mine, should give this unique investment story additional momentum. There are many reasons to believe that Almonty shareholders are in the right place at the right time.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.