January 21st, 2026 | 08:35 CET

Critical raw material stock poised for revaluation! Antimony Resources benefits from geopolitical tensions!

Is this stock about to take off? The recent escalation surrounding Greenland highlights once again that critical raw materials are at the center of massive geopolitical tensions. The US and China, in particular, are acting decisively to secure strategic resources. Antimony is a commodity that is often overlooked in public debate, yet it is all the more important. Investors can benefit from this through Antimony Resources. The exploration project in North America is shaping up to be a real standout. A strategic partnership with a company or even a government would be the next logical step. Such a move would further accelerate the long-overdue revaluation of Antimony Resources' stock.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

ANTIMONY RESOURCES CORP | CA0369271014

Table of contents:

"[...] Having Investors like Robert Friedland and Rob McEwen come in with CVMR and Terra Capital really was terrific. [...]" Terry Lynch, CEO, Power Nickel Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Antimony: The geopolitical weapon

Antimony is at the intersection of geopolitics, industry, and technology. This critical raw material is essential for military technology and semiconductors. It is urgently needed as a flame retardant in plastics, textiles, and electronics. The problem: 70% of global production comes from China, and the West's dependence is likely to be even greater when it comes to processing capacities. The Chinese government has been using antimony products as a geopolitical lever since 2024 at the latest, through export controls. Incidentally, the remaining 30% often comes from Russia or other rather unreliable trading partners.

Australia prioritizes antimony

The West is responding and trying to establish reliable supply chains. Last week, Australia announced that antimony will be among the prioritized raw materials in its strategic reserve, worth around USD 800 million. In addition, a meeting of the finance ministers of the Group of Seven (G7) leading industrial nations on the topic of critical raw materials took place in the US capital, Washington, that same week. The topic was problematic access and uncertain supply chains. Among other things, minimum prices were discussed in order to prevent state-supported dumping prices in the future. In recent decades, dumping prices have been a key means for China to force raw material producers out of the market worldwide. As a result, China has succeeded in establishing an almost monopolistic position in many segments today. Minimum prices could force the necessary billion-dollar investments in production and processing and break the monopoly.

Will the US government take action?

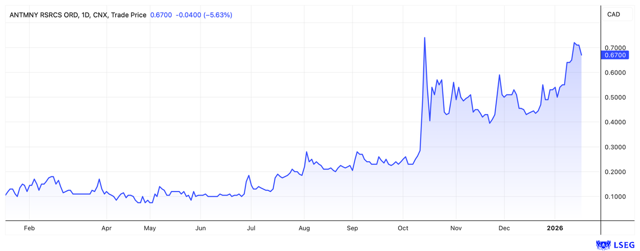

The US government is very active in securing critical raw materials. This does not always have to be as aggressive as the current covetousness surrounding Greenland. Last year, the US participated in numerous projects and companies. It not only invested in domestic companies, but also in Canadian ones. It is a perfectly realistic scenario that this could also happen with Antimony Resources in the future. The US plans to build up processing capacities, and these must then, of course, be filled with material. For example, from Antimony Resources' Bald Hill project. This project has become increasingly exciting over the past year. A total of 34 holes were drilled in 2025, covering over 8,000 meters. The data reported regularly from this was convincing time and time again. In addition, two unexplored zones with antimony-bearing stibnite mineralization were identified south (Bald Hill South) and west (Marcus Zone) of the main zone. These discoveries suggest a significantly larger mineralization system at Bald Hill. Since the fall, the stock has more than doubled, but with a market capitalization of less than EUR 50 million, it still appears to be inexpensive.

Antimony Resources is going full throttle with development

The drilling program for 2026, announced last week, is expected to bring the final breakthrough. Antimony Resources plans to implement a 10,000-meter program in the first half of this year alone. Thanks to the capital increase last November, it is already fully financed. The definition drilling is intended to determine the main zone to the north and south, as well as at depth. In addition, Bald Hill South and the Marcus zone are to be explored and further developed through trenching and drilling. A resource estimate is expected to be published in late 2026 or early 2027. A roadmap for the approval process, including an environmental impact assessment, is also already being developed.

Conclusion: The stock appears to be too cheap

Critical raw materials will likely remain one of the most interesting investment trends in 2026 and beyond. However, the importance of antimony still seems to be underestimated by many investors. If Antimony Resources can even come close to matching last year's positive news flow, the stock currently appears to be far too cheap. A revaluation is very likely. And if a corporation or government were to come on board as a strategic partner, the stock could quickly reach a different price level.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.