August 8th, 2025 | 07:15 CEST

Ceasefire in Ukraine? Now earn 100% profit with Heidelberger Druck, Argo Graphene Solutions, and Deutsche Post

A personal meeting between Donald Trump and Vladimir Putin, which, according to the Kremlin, is to take place in the coming days, is sparking new hope for a possible ceasefire in the Ukraine war. Diplomatic preparations are in full swing, accompanied by growing international pressure. President Trump recently gave Russia an ultimatum to cease hostilities. At the same time, a large Russian troop build-up in Belarus – officially for military exercises – is causing uncertainty. Observers see these developments as a signal to NATO to continue its defense program. In this dynamic environment, the stock markets are booming. Investors are once again looking at infrastructure stocks, because everyone wants a piece of the pie!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

HEIDELBERG.DRUCKMA.O.N. | DE0007314007 , ARGO GRAPHENE SOLUTIONS CORP | CA04021P1018 , DEUTSCHE POST AG NA O.N. | DE0005552004

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

DHL Group – A strong partner for reconstruction

In recent years, the DHL Group has been particularly active in providing humanitarian aid in Ukraine, working with the Ukrainian postal service to send over 60,000 aid packages from Germany. This service ended in April 2025, as professional aid organizations increasingly took over transport and the organizational situation became more complex due to the closure of the logistics hub in Poland. At the same time, DHL Global Match has long been involved in international freight forwarding for Ukrainian companies. This cooperation ensures reliable trade flows to North America and other markets, which remain essential for Ukrainian exporters after the war.

The DHL Group's possible post-war involvement in the Ukrainian postal service could serve as a contribution to reconstruction and modernization. Pilot projects are already underway to this end: Together with Nova Post and GIZ, mobile post offices and security capsules will be set up in conflict regions by 2025 to enable fast postal delivery with increased security standards. The DHL Group is contributing its international expertise, technical solutions, and network advantages to make reconstruction more sustainable and efficient.

The DHL Group's latest quarterly figures show strength despite global economic volatility. Operating profit rose by 5.7% to EUR 1.4 billion, and the EBIT margin improved to 7.2%. Although total revenue declined slightly to EUR 19.8 billion, strong cost control and high cash flow underpin the upward trend. The outlook for the full year 2025 remains positive. The DHL Group is consolidating its position as a key player in the global postal industry and a potential factor in Ukraine's reconstruction. With a 2025 P/E ratio of 12.9 and a dividend yield of 4.8%, DHL Group shares are a solid anchor for any portfolio.

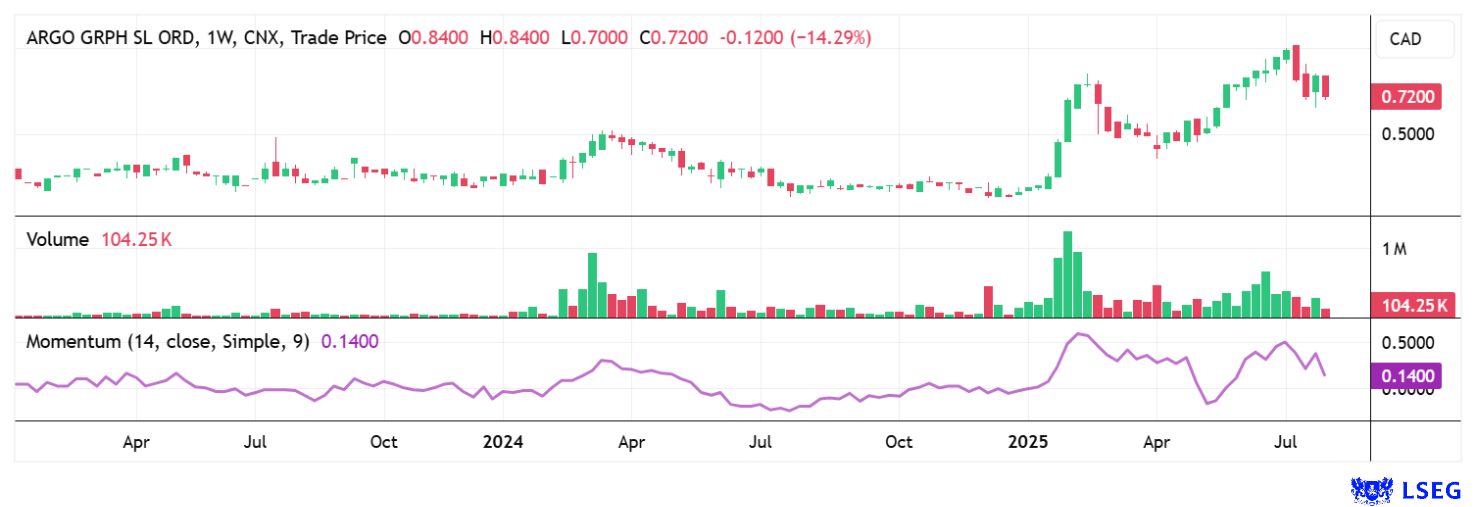

Argo Graphene Solutions – This could be the big break

Argo Graphene Solutions from Canada is emerging as a strong player in climate-friendly, innovative building materials. In its latest agreement with Ceylon Graphene Technologies of Sri Lanka, the Company has set a visible milestone in expanding its position as a pioneer in sustainable and high-performance building materials. Under the current purchase agreement, Argo will acquire one ton of high-quality graphene oxide paste, enough to produce around 50 tons of liquid dispersion, a crucial additive for ready-mixed concrete. This advanced technology enables Argo to manufacture concrete products with significantly improved strength, longer durability, and significantly reduced CO₂ emissions, a clear competitive edge in the growing market for green building materials.

The product will be further processed at Argo's mixing plant in Louisiana and prepared for distribution, creating an end-to-end supply chain between Sri Lanka and North America. CEO Scott Smale emphasizes that the partnership with Ceylon Graphene not only meets the demand for high-quality graphene materials, but also establishes a long-term strategic collaboration. It positions Argo in the global construction industry. Scientific studies confirm the enormous performance capabilities of graphene-reinforced concrete: Up to 44% higher compressive strength, improved thermal conductivity, and twice the protection against micro-cracks. This not only creates technically superior building materials, but also a sustainable solution for industry.

With this technology, Argo is responding to the growing demand for environmentally friendly and durable building products. The combination of an innovative product, international partnerships, and direct market application positions Argo Graphene Solutions as one of the most promising companies in the field of green construction. Following a 500% rally and subsequent consolidation at around CAD 0.75, investors now have an attractive opportunity to enter a future-oriented growth sector with high innovation potential.

Heidelberger Druck – Rapid gains fuel hope

Due to ongoing euphoria in the defense sector, shares in engineering company Heidelberger Druck are skyrocketing. The Company is starting the 2025/26 financial year with momentum and is focusing on a clear realignment after years of declining revenues. Moving away from its traditional printing business, the group is increasingly focusing on growth areas such as energy supply and, in particular, defense technology. An important signal of this is the long-term partnership with Vincorion, a specialist in military energy systems. This strategic realignment was well received on the stock markets: the share price climbed from EUR 1.60 to EUR 2.85 within two days, but then fell back to around EUR 2.15.

The figures are impressive. In the first quarter, revenue rose by 15% to EUR 466 million, with demand particularly strong in Europe and Asia. Adjusted EBITDA also improved significantly from EUR –9 million to EUR 20 million, while order intake remained relatively flat at EUR 559 million. Earnings after taxes improved from EUR –42 million to EUR –11 million, remaining in negative territory. Heidelberger Druck confirms its forecast for the full year: Assuming stable global economic growth, revenue of around EUR 2.35 billion is expected, with an adjusted EBITDA margin of up to 8%.

"Thanks to our global market position and an improved cost base, we have made a good start to the new fiscal year," said Jürgen Otto, CEO of Heidelberg. "With the implementation of our strategic measures in our core business and new options in the technology environment, such as those currently available in the defense sector, we are very confident about the course of the year as a whole."

Although the defense division is still relatively small with an estimated revenue of EUR 100 million, the new focus on defense technology opens up long-term opportunities. Three out of five experts on the LSEG platform recommend buying the stock, although the recent surge has already brought the average target price to EUR 2.17. However, the stock becomes interesting on weakness.

Selecting attractive stocks will become increasingly challenging after a good 20% index gain in 2025. A possible end to the war in Ukraine opens up new prospects for investors. Among the winners is likely to be the innovative Argo Graphene Solutions, which is benefiting particularly from sustainable concrete additives in the current construction and infrastructure market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.