June 30th, 2022 | 12:44 CEST

BYD on board with Apple? Rebound at Nordex and Defense Metals?

The end of the combustion engine is the next driver of electromobility and thus also of renewable energies. After all, the electricity for e-cars has to come from somewhere. The EU has agreed to ban the sale of diesel and gasoline-powered cars from 2035. That should give further impetus to carmakers like BYD. This is just one of the many good news stories from the Chinese group. In the future, it is reportedly known that it will supply Apple. But from a chart perspective, investors need to pay attention. Nordex also has to be careful not to miss the boat with the competition. To this end, the wind turbine manufacturer has raised fresh capital. Both electromobility and wind and solar technology need selenium earths. And Defense Metals is benefiting from this.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , NORDEX SE O.N. | DE000A0D6554 , DEFENSE METALS CORP. | CA2446331035

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

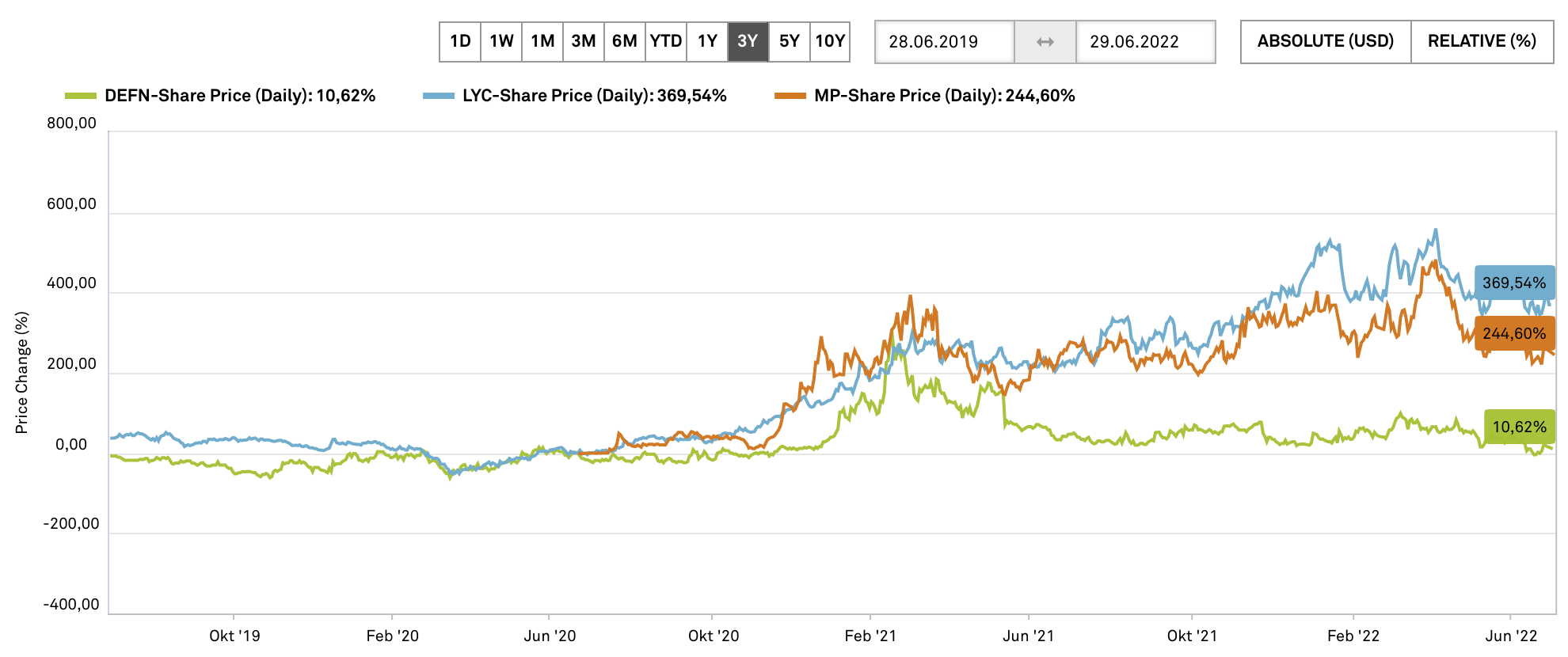

Defense Metals: Rebound with strong drilling results?

Before electric cars are on the road and solar and wind energy can be produced, raw materials are needed. And not only here, but rare earths are also present in almost all technologies: Smartphones, electric cars, and even modern military technology. The problem from a strategic point of view: China dominates the world market. Alternatives are almost non-existent. Defense Metals is working to change that. The Canadian explorer could offer around 10% of the current global production in the future. From the point of view of the experts at researchanalyst.com, the Canadians should be considered an attractive takeover candidate by larger companies such as Lynas or MP Materials.

Defense Metals is currently pushing ahead with the development of the Wicheeda project. The deposit, after Defense Metals has staked additional claims, totals 4,244 hectares and is equipped with world-class infrastructure. For 2021, a PEA indicated an after-tax net present value (discounted at 8%) of USD 517 million at an internal rate of return of 18%. Several positive drilling results have already been reported in the current year, not only for rare earths but also for diamonds. For example, diamond drilling is currently underway for up to 5,000m in the northern resource area. The first results should be reported soon. Should these turn out positive again, the share price should also experience a stronger rebound. Since the end of February, the share price has almost halved from EUR 0.23 to EUR 0.125. It is now trading at over EUR 0.15 again. But with positive drilling results, the recovery should continue because the shortage of raw materials will remain. A detailed analysis of the Company can be found here.

BYD: Soon to supply Apple and Tesla?

Yesterday, BYD's stock corrected quite significantly, falling more than 3%. After the significant gains - including all-time highs - of the past days and weeks, this was quite healthy. However, it must go up again, so it does not become a bull trap. The newsflow of the Chinese vehicle and battery manufacturer speaks for rising prices. BYD's new passenger car models are in high demand, and the Company has a full model pipeline. In addition, the Company is expanding strongly. For example, BYD is taking a stake in chip designer Tauren Semiconductor, with around EUR 7 million paid for a 2.5% share. BYD also manufactures components for smartphones and other electronic products as well as renewable energies. In this area, Apple could soon become a customer. Various media have reported that BYD could likely supply network adapters to the American group in the future. That would be the second American technology giant. After all, BYD will probably soon supply batteries to Tesla. BYD is also expanding geographically. In Shenzhen - where the group's headquarters are located - a site with an area of 550,000 sqm was purchased. An industrial park with around 18,000 employees is to be built there to produce car parts and other preliminary products.

Nordex: Capital increase does not solve structural problems

There has been little sign of expansion at Nordex in recent weeks, even though the wind industry is facing golden times. Plant closures, profit warnings and supply chain problems dominated the headlines at the wind turbine manufacturer. Then, at the beginning of the week, Nordex surprised with a 10% capital increase. The EUR 139 million inflow of funds is intended to strengthen liquidity and the balance sheet in order to hedge the Company against the short-term risks to which the sector is exposed, Nordex said. It said it remains well-positioned to achieve improved profitability in the medium term with a strategic target of a consolidated EBITDA margin of 8% once the market environment stabilizes and the updated pricing systems start to impact new orders. "We very much welcome that our anchor shareholder Acciona is again strengthening its commitment and supporting Nordex with additional equity. This step is an important pillar of our future business development," said Nordex CEO José Luis Blanco. "In addition, this is a clear vote of confidence in the enormous potential of the onshore industry and in our company."

Electromobility and renewable energy offer investors tremendous opportunities. However, there seem to be structural problems at Nordex. In contrast, BYD is doing well, even if the chart is slightly battered in the short term. Defense Metals regularly delivers positive drilling results, and after the price slide of the past weeks, the share is anything but expensive - if the drilling results remain positive.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.