August 7th, 2023 | 07:00 CEST

BP, Saturn Oil + Gas, Shell - Gains due to rising oil prices

The price of crude oil rose again last week. While Brent went out of trading on Friday at USD 85.45, the price for WTI stood at USD 81.53 per barrel. This could just be the beginning, as both Saudi Arabia and Russia have cut back production, which has tightened supply. In addition, US oil reserves fell by an unprecedented 17.1 million barrels, the most significant drop ever recorded. Only the downgrade of the US credit rating weighed a little on sentiment. But the risk that this will weigh on the economy seems small. The FED has let it be known that interest rates are not to rise for the time being, inflation is falling, and many company figures are above analysts' expectations. We, therefore, look at three oil producers that benefit from a rising oil price.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

BP PLC DL-_25 | GB0007980591 , Saturn Oil + Gas Inc. | CA80412L8832 , Shell PLC | GB00BP6MXD84

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

BP - Resumption of activities in Libya

BP is among the global energy giants and recently reported lower earnings for Q2 and H1 2023. The decline coincides with significant fluctuations in the energy market. Brent crude oil prices averaged USD 79.66 in the first half of the year, down from nearly USD 108 a year earlier. Accordingly, refining margins fell by around 18% to USD 26.40. The hardest hit was the free fall in gas prices from USD 6 to USD 2.77/MMBtu. Despite the weaker results, the Group raised its dividend by 10%.

With its investments in both traditional and new energy sources, the Company is well-positioned for the changing energy landscape. In mid-July, the Group secured rights to 2 offshore wind farms in the North Sea. The total capacity of both projects is 4 gigawatts, and they are also the first projects in the wind power sector within Germany. At the end of the month, BP secured a long-term sale and purchase agreement with OMV. This covers the supply of up to 1 million tons of liquefied natural gas (LNG) per year over a 10-year period starting in 2026.

In Lybia, the Group will resume operations after a 10-year absence, according to Lybian National Oil. While the current market volatility has impacted BP's financial results, its resilience, dividend growth and capital allocation strategy underscore its stability in challenging times. As the energy sector evolves, BP's approach is positioned to navigate changing trends and capitalize on emerging opportunities. The stock is currently priced at EUR 5.61 and comes in at a dividend yield of around 4%.

Saturn Oil & Gas - Quarterly figures ahead

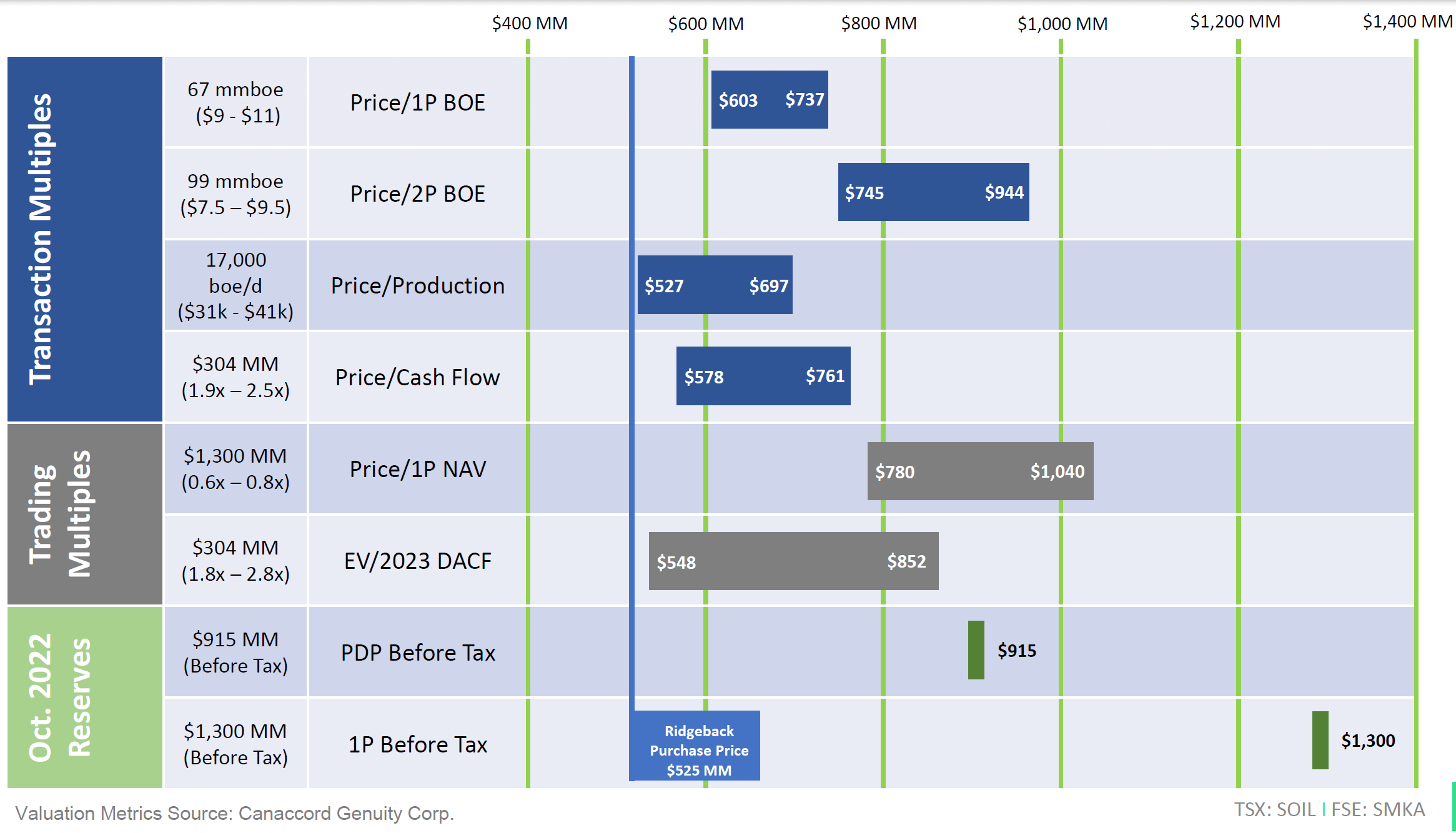

A rising oil price plays into the cards of Saturn Oil & Gas, an oil producer that has grown rapidly recently. In the last 27 months, production has been expanded from a few 100 barrels a day to around 30,000 barrels of light oil equivalent. To get to the current level, a total of 4 transactions were made. Most recently, the Ridgeback acquisition was completed on February 28, which is also the largest acquisition in the Company's history. For the 17,000 barrel production, USD 475 million and approximately 19.4 million Saturn shares were paid. The deal is a bargain when you compare the purchase price to all the standard M&A valuation metrics.

Even though the Q1 report only includes one month of the Ridgeback acquisition, new record numbers were reported once again. Adjusted EBITDA was CAD 70.4 million, free cash flow was CAD 30.2 million, and production climbed to 17,783 barrels. The figures for Q2 should be available by the end of the month, which should have been even better despite the forest fires in Alberta, which caused a production stop of 10,000 barrels for about a month. However, management is so far sticking to its EBITDA full-year guidance of CAD 475 million and expects cash flow per share of CAD 3, which is higher than the current share price of CAD 2.69.

Meanwhile, the Company is now listed on the Toronto Stock Exchange (TSX), which increases its visibility. At the same time, the stock exchange change may be good to better target institutional investors. The Company already has an anchor investor in GMT Capital Group, which held nearly 25% of Saturn Oil & Gas as of June 30. Also announced in the July 19 announcement was the expiration of approximately 30.5 million warrants, which is good news for existing shareholders as it reduces potential dilution. The Company's debt should be paid off by the end of 2025, and a dividend should be paid by then at the latest.

Shell - Alignment with shareholders

As with all oil and gas companies, 2022 was a record year. So, too, for Shell, which made USD 278.3 billion in sales last year, resulting in adjusted earnings of USD 42.3 billion. The dividend per share was USD 1.52. As with BP, the 2nd quarter figures are significantly worse than last year. Revenue was just over USD 75 billion, and profit was USD 3.13 billion. Nevertheless, management increased the dividend by 15% and announced a share buyback program of USD 3 billion, which should be completed by the time the Q3 results are announced.

With new management in the form of Wael Sawan as CEO and Sinead Gorman as CFO, the Company has become much more shareholder focused. Unprofitable projects are being cancelled, and everything is being trimmed for performance, cost discipline and optimization. At the same time, the goal of becoming a climate-neutral company by 2050 is to be pursued further. In addition to expanding renewable energies, the Group is investing in future innovations such as hydrogen, biofuels, electromobility and artificial intelligence (AI).

The Group is relying on drones and AI to monitor inspections at its largest German site in the Rhineland, aiming to save costs. Most recently, there were positive analyst opinions from Berenberg and JPMorgan, who rated the stock as a buy and issued price targets of around EUR 33. The share currently trades at EUR 27.55, resulting in a dividend yield of 3.8%. The share buyback program could provide the share a tailwind.

Rising oil prices inevitably lead to rising share prices at oil companies. With the US economy showing resilience and inflation declining, a recession seems less likely. Accordingly, oil demand is expected to remain stable. BP has raised its dividend and, like all oil multinationals, is trying to reduce its environmental footprint. Saturn Oil & Gas is making more and more money, most of which is currently going into debt repayment. The repayment is hedged, and in 2.5 years at the latest, there should be a lavish dividend. Currently, among all three candidates, this one presents the highest growth potential. Shell has put its shareholders in the spotlight with new management, and analysts also see further potential here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.