May 31st, 2023 | 08:30 CEST

Biotech in turnaround mode! BioNTech, Defence Therapeutics, MorphoSys, Formycon - Take a close look at these shares!

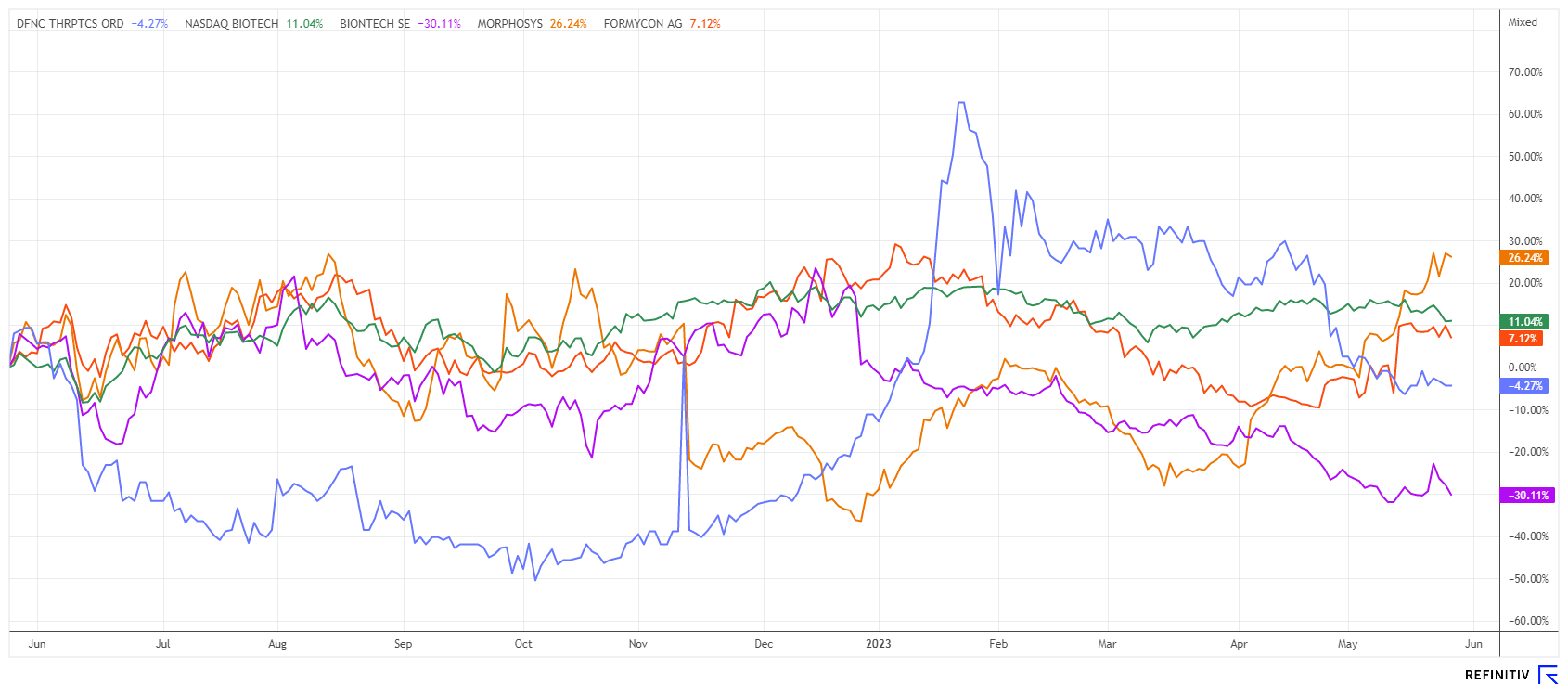

Since the major pandemic wave in the biotech sector, most industry players have had to come to terms with normality again. Scolded investors quickly learned their lesson and are now looking warily at an industry that experienced its heyday between 2019 and 2021. Today, it is no longer the small announcements of hope that lead to significant price swings. After months of sell-offs, however, the sector is stabilizing for the first time, and some protagonists can report minor progress. When the sector trend weakens, selection is the trump card. Here are some suggestions.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , DEFENCE THERAPEUTICS INC | CA24463V1013 , MORPHOSYS AG O.N. | DE0006632003 , FORMYCON AG | DE000A1EWVY8

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech - Back to normal

While vaccine maker BioNTech is preparing an upgraded COVID-19 vaccine for next autumn, its research is primarily focused on developing cancer therapies. "We have made substantial progress and are preparing to start our first Phase III clinical trial in the field of oncology," reported CEO Ugur Sahin at the annual general meeting in Mainz. A Phase III trial is crucial for approving a compound and the subsequent drug launch. It tests the efficacy of a drug with a significantly higher number of test persons than in the test phases before.

In the further development of the COVID-19 vaccine, preparations are underway to make a variant-adapted vaccine available in the autumn. The next-generation vaccine is designed to protect against severe COVID-19 disease and could be of particular interest to high-risk groups. Therefore, the management expects good seasonal demand. After contracts with governments in the past years, commercial orders are likely to increase. However, they will, of course, no longer reach huge dimensions.

With expected sales now shifting to the year's second half, BioNTech had no big surprises to report for the first 3 months of 2023. As expected, sales decreased by 80% from EUR 6.37 billion to EUR 1.27 billion, but a net profit of EUR 502 million was still achieved. The executive board confirmed the outlook for the year of achieving revenues of about EUR 5 billion. The Company plans to invest EUR 2.6 billion in research and to set up a sales organization for oncology products in the EU and the US.

The BioNTech share fell below the EUR 100 mark several times in May and is currently trying to form a bottom. After the price rush in 2021 and the subsequent crash, the share is suffering from reduced perception today. If one subtracts the ample cash balance of EUR 17.8 billion from the market capitalization of around EUR 23.6 billion, the stock market still values the operating business at EUR 5.8 billion. Too high or too low, that is the question here.

Defence Therapeutics - Breakthrough in solid tumors

The Canadian biotechnology company Defence Therapeutics (DTC) has developed the Accum™ platform, a patented technology that holds great hope in current cancer research. Now the Company reports the successful completion of a preclinical study to evaluate the therapeutic efficacy of a second-generation ARM vaccine targeted against solid tumors.

Accum™ technology offers excellent future potential due to its versatility in developing different products. Accum™ acts as an endosome-targeting agent that can enhance the accumulation of the biopharmaceutical in the target cells. The trump card here is flexibility, as the Accum™ molecule can be adapted to produce a range of variants with novel and sometimes unexpected pharmacological properties. For example, Accum variant A1, when added to antigens, can cause protein aggregation and trigger various stress responses in mesenchymal stem cells (MSCs), turning them into effective antigen-presenting cells.

The Defence team recently developed a new dimer form of A1, named the A1-2 variant, which, when used to stimulate the MSCs of all treated mice with pre-existing lymphomas, cured them. "This is a significant achievement in our ARM vaccine program as we have reached three important milestones: Ease of production of A1-2, improved stability and optimization with a 60% reduction in the dose required to generate the second generation ARM vaccine," said CEO Sebastien Plouffe. Following the completion of the upcoming trial runs, Defence intends to file its clinical trial application (CTA) in the third quarter of 2023.

DTC shares are currently consolidating at a high level, but with the recent success stories, the share price should move upward again very quickly. The Defence Accum™ technology would currently be available to large pharma companies for a low CAD 132 million. Stock up!

MorphoSys and Formycon - Now it is getting really exciting

From a chart perspective, interesting parallels exist between the two Munich-based biotech companies, MorphoSys and Formycon. After a recent sell-off in March, there were strong buybacks in the following period. MorphoSys dropped from its February high of EUR 19 to EUR 14 as if by magic, only to rocket from there to almost EUR 25. The known short positions reduced sharply, with the latest reports coming from Cube Research (0.98%) and Citadel Advisors (0.48%). The stronger the technical movement now goes up, the more the short sellers have to cover. This is driving prices even higher.

Formycon received new coverage from Jefferies with a "buy" rating and a 12-month price target of EUR 101 after the presentation at the spring conference in Frankfurt. The technical condition of the share is currently somewhat unstable, but it should stabilize above the EUR 70 line with the present news situation. There are now already 5 buy recommendations on the Refinitiv Eikon platform, with a median price target of EUR 117.68. First Berlin and Hauck Aufhäuser are unanimous in putting the price at EUR 130. That would be a 70% chance from the current level of EUR 76.70.

Opinions are divided on MorphoSys. The 12-month price targets vary from EUR 10 to EUR 42, with only 4 of 11 analysts issuing a buy recommendation. The Munich-based biotechs are still operating in the red, while Formycon has at least two marketable biosimilars on the ramp. MorphoSys is expected to present new data on its blockbuster project Pelabresib in mid-June. Both stocks currently have an interesting risk-reward profile.

The biotech sector underperformed the NDX and DAX 40 index until the end of May. After years of fighting pandemics, the stock market is now looking again at the traditional operational issues of the protagonists. In addition to the standard stock BioNTech, Defence Therapeutics, MorphoSys and Formycon are on a good path. Biotech investors should diversify across several stocks, significantly reducing the portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.