May 16th, 2023 | 09:45 CEST

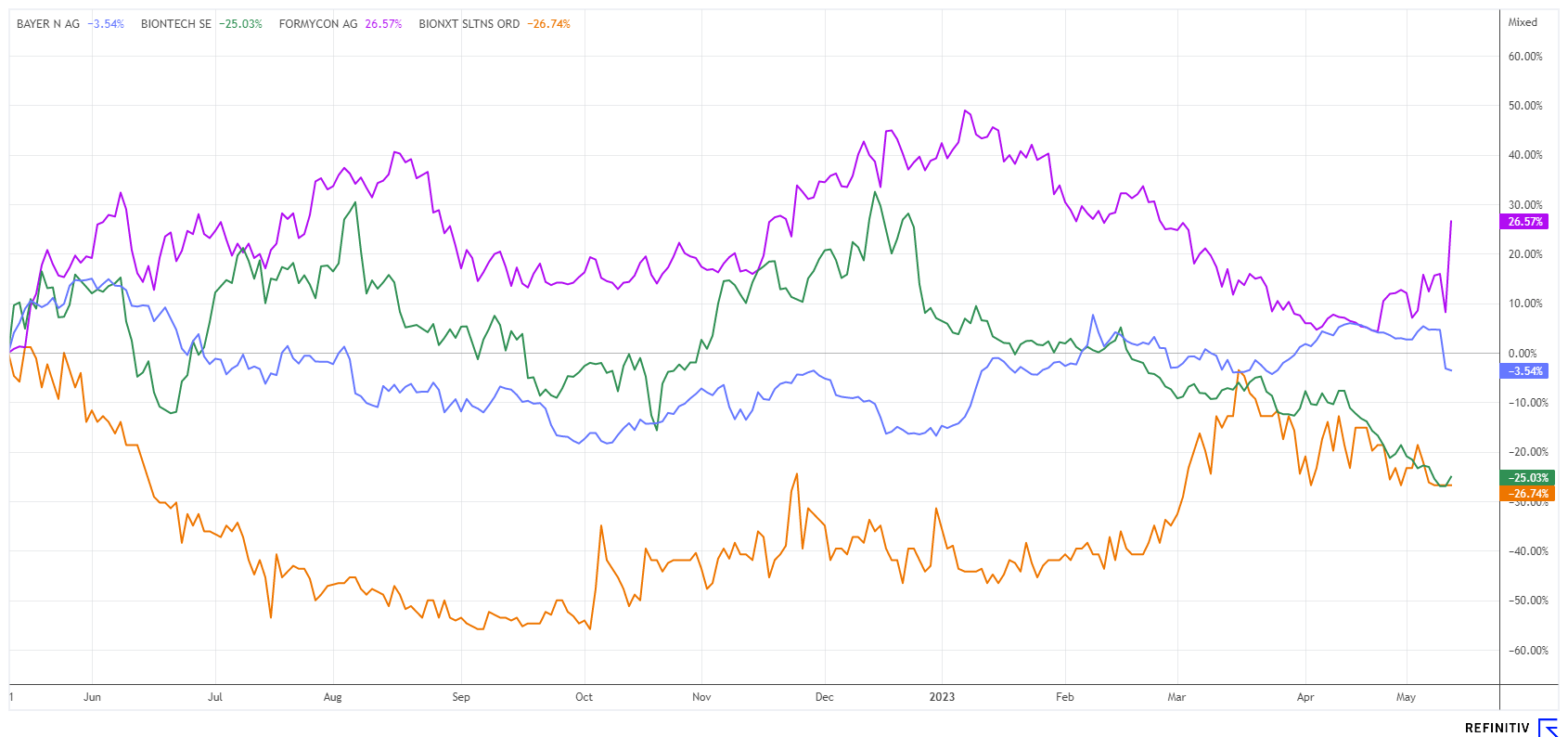

BioNTech, Bayer, BioNxt, Formycon - The next biotech wave is rolling in - select carefully now!

Even after Corona, the biotech sector remains an interesting investment sector because it is still important to keep an eye on the major widespread diseases. For many companies, this will probably mean a longer waiting game for investors. In addition to the promising research approaches and milestone plans, the cash reserves of these companies are also important. While having ample funding can lead to quick progress in the laboratory, it is crucial to have the necessary liquidity. In refinancing, however, things have become a little frostier since the rise in interest rates. Which companies should be put under the microscope?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , BAYER AG NA O.N. | DE000BAY0017 , Bionxt Solutions Inc. | CA0909741062 , FORMYCON AG | DE000A1EWVY8

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech - This could be the turnaround

While the Mainz-based biotech specialist BioNTech was still earning billions in the Corona era, the stock market is now expecting declining sales for the Company. In the end, the expected decline in revenues to EUR 1.27 after EUR 6.37 billion was the result. However, there were also some positive signals. Despite the lower business volume, the Mainz-based company is still making contracts with vaccine purchasers worldwide and earned a total of EUR 502 million after taxes in Q1. That is more than the experts had estimated, so the battered share price turned upwards with a plus of 3.5% after a loss of over 36% in 12 months. So there was no negative surprise. Moreover, BioNTech still expects billions in income from Corona vaccines in the future, even if at a much lower level than in past years. However, business still is better here than some would have expected, given the rapid termination of the pandemic status.

For some time now, the focus has clearly been on the lush pipeline for cancer medication, from which market observers hope for a lot in the future. In line with the figures, BioNTech announced a Phase III trial for a compound to treat lung cancer for the current year. Of course, this process may take some time, but there seems to be progress already. The share price of the Mainz-based company turned around last week after hitting another low for the year at EUR 91.70 and quickly climbed back up to the EUR 97 hurdle. The cash register is bulging, and there are plenty of ideas if you want to follow CEO Ugur Sahin. Below EUR 100 is an interesting buyback level!

Bayer - Share price debacle after quarterly figures

Bayer, the Leverkusen-based pharmaceutical and agricultural technology group, is again suffering a quarterly setback. High cost pressure and weaker demand caused a noticeable drop in sales, especially for herbicides. Revenues of the entire group fell by 1.7% below the previous year's value. The weakness drastically affected the result, which was corrected downwards by a third due to numerous one-off effects.

Bayer is still feeling pressure in the Crop Sciences division, which it wanted to develop into its leading sector through the expensive Monsanto purchase. The hobbyhorse of outgoing Bayer CEO Werner Baumann was able to limit the decline in sales by 1% to EUR 8.35 billion, but profitability took a hit. In combination with high special expenses, EBIT fell by as much as 23% to EUR 2.32 billion. This was mainly due to the write-offs on the glyphosate business, as sales in this area fell by as much as a quarter. The pharmaceuticals business, however, had an even greater impact, with revenues falling by almost 5% year-on-year to EUR 4.41 billion. With high currency losses and rising research and development costs, Group EBIT was 33% lower at only EUR 806 million. The Health Division held up well, with a 4% increase in turnover. The net group result added up to EUR 2.18 billion, still a minus of 33.8%.

In its outlook, Bayer now expects to reach the lower range of the last guidance. The share price dipped by 6% and finally landed at EUR 53.70. Analysts have not yet reviewed their votes, only Jefferies lowered its target from EUR 70 to EUR 68. Before the dividend payment, the share price was still EUR 61. Hopefully, things will improve again for the Leverkusen-based company under new management.

BioNxt Solutions - Successful completion of a pilot study

Canadian bio-accelerator BioNxt Solutions continues to make progress. Last week, the Vancouver-based company announced the completion of a pilot study for a German generic drug manufacturer. The prerequisite for this was the successful development of an orally dissolvable narcotic.

"BioNxt is actively building a development pipeline of proprietary and contracted drug formulation programs," said Hugh Rogers, CEO of BioNxt, during last week's virtual IIF conference. "We are very pleased to see the recent success of our contract development products. This represents an attractive opportunity for BioNxt to expand its capabilities from drug development to commercial manufacturing as our proprietary and contract products move towards commercialization."

BioNxt Solutions is taking consistent steps towards commercializing its formulations. Its operational arm in Europe is its wholly owned subsidiary Vektor Pharma TF GmbH, a German drug development and manufacturing company with narcotic licences based in Baden-Württemberg. For over a decade, the Company and its team have been leaders in the development of innovative, non-invasive drug delivery systems, particularly transdermal patches and sublingual drug strips for the treatment of pain and neurological disorders.

According to Precedence Research, the global market for pharmaceutical drug delivery systems is expected to grow from USD 1.53 billion in 2022 to an estimated USD 2.05 billion. The Canadians expect a significant share from these sales in the coming years. At currently CAD 0.65 and a valuation of just under CAD 60 million, the stock is again enticing with an attractive risk-reward profile.

Formycon - A fabulous 17% jump in share price

Last week, the Formycon share price experienced a veritable fireworks display, rising by 17% to EUR 78. Before that, the share had been sold down to EUR 60 for no apparent reason. Currently, there is no news for this, so the inclined investor should pay closer attention to the announcements of the last few weeks. The biosimilar specialist from Munich has completed the clinical development program for the candidate FYB202 for the treatment of patients with moderate to severe psoriasis vulgaris with the results of a Phase I pharmacokinetics study.

"Compared to the reference drug Stelara, which is approved in the EU and the US, FYB202 showed bioequivalence in all primary endpoints," the Munich-based company said of the results of the relevant clinical trials. Regulatory filings are expected in Europe and the US before the end of Q3, and distribution partner Fresenius Kabi will then launch the drug in key markets. Interested investors are now buying again at this level; after all, the high for the year in 2023 was EUR 92.50.

The biotech sector remains an interesting subject even after Corona. BioNTech and Bayer are clearly among the standard stocks. The small-cap stocks Formycon and BioNxt could see a new wave of cyclical buying, as both companies reported good news recently.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.