March 27th, 2025 | 07:20 CET

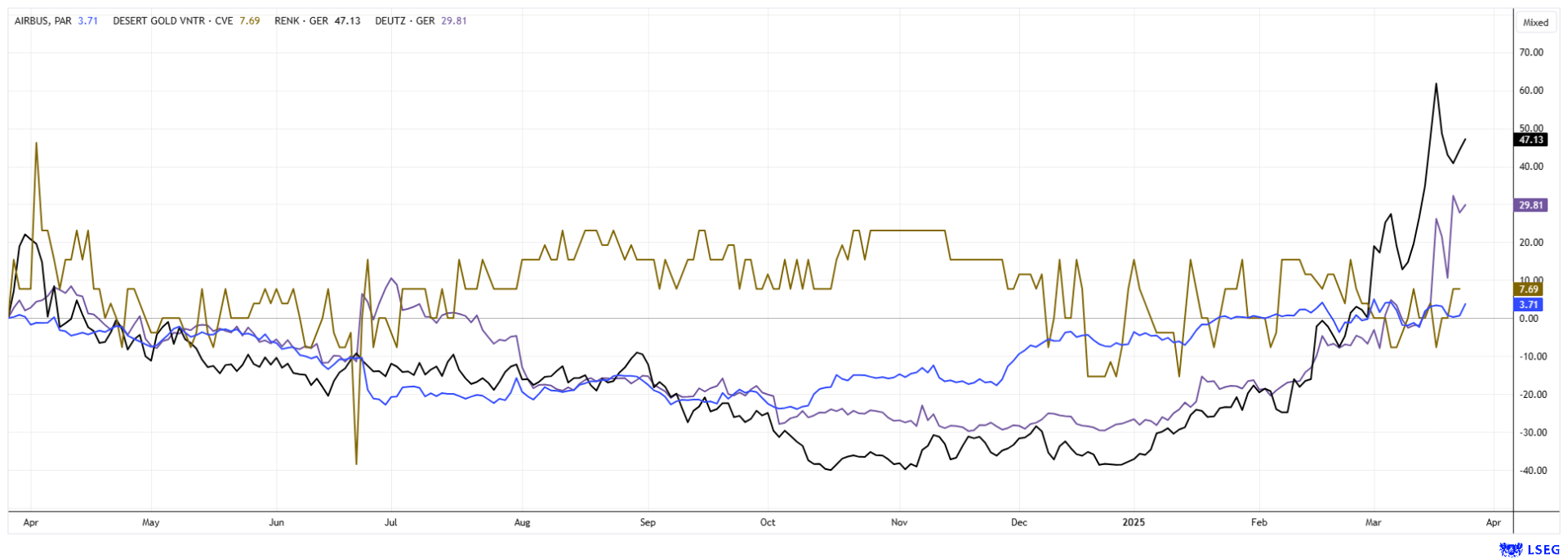

Big Short on defense? Long in gold! Caution with Renk, Deutz, and Airbus - Revaluation for Desert Gold imminent

After a record quarter on the stock markets, caution is now called for. Inflation remains stubbornly high, and the growing national debt is fueling the rising prices. This will worsen the situation for growth stocks, particularly, as hopes of interest rate cuts look bleak in the short term. Defense stocks have soared on the back of the government's trillion-dollar check, with heavenly balance sheet figures expected for them in the future. In the short term, however, they have already priced in the year 2030 in their share prices, which will result in a slowdown in the current 2025. In this environment, gold can no longer be held back because when currencies offer less and less purchasing power, precious metals are in demand. We take a critical view of Renk, Steyr, and Airbus. For Desert Gold, the boosters should ignite soon!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RENK AG O.N. | DE000RENK730 , DEUTZ AG O.N. | DE0006305006 , AIRBUS | NL0000235190 , DESERT GOLD VENTURES | CA25039N4084

Table of contents:

"[...] Troilus has the potential to be an entire gold belt. All of our work to date points to this, and each drill hole makes the picture we have of the Troilus project much clearer. [...]" Justin Reid, President and CEO, Troilus Gold Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

RENK and Deutz – A few more engines and transmissions

Defense fantasy aside, some stocks go through the roof without the topic of armaments significantly impacting the balance sheet figures. Renk is a specialist in armored transmissions and chassis and is even considered a market leader in this field. The Company expects potential orders of around EUR 12 billion over the next six years, including projects for a new US armored personnel carrier and the modernization of the US Abrams main battle tank. Thus, it is quite possible that, with the inclusion of further NATO orders, the defense business could account for a significant share of RENK's total revenue. Whether the doubling of the share price since February is sustainable remains to be seen in the coming weeks.

The situation is different at Deutz AG in Cologne. The Company is known for its robust engine solutions and has gained almost 40% in the past week. Investors' optimistic expectations are based on statements made by the management board regarding future business development. Changes are now to be made to the product mix in order to benefit from planned government investments in the defense and infrastructure sectors. Investors are speculatively jumping on board even though the latest business figures for 2024 and the forecasts for the current period have not been fully convincing.

Desert Gold – Significant resource appreciation expected

Eurozone inflation has now fallen somewhat more than initially expected. In February, consumer prices in the 20-member states rose by only 2.3% year-on-year, although inflation remains above the target 2% mark. The measurement was taken in February before the German government's mega-debt package was even discussed. Gold rallied after the historic economic stimulus package was passed and briefly reached the USD 3,060 mark.

With the price of gold higher, investors are now looking to explorers who have already defined a resource. In Africa, the focus is particularly on the West because countries such as Ghana, Mali, Burkina Faso, and Ivory Coast are already among the 20 largest gold producers. According to data from 2022, Ghana ranked 11th with a production of 90 tons, and Burkina Faso and Mali followed with 70 and 50 tons, respectively, ranking 13th and 18th.

The Canadian explorer Desert Gold Ventures has been focusing on the Senegal-Mali Shear Zone (SMSZ) for several years. Here, 1.1 million ounces of gold have already been identified near surface. CEO Jared Scharf and his team of geologists are confident that they will soon be able to bring potential strategic partners on board. A pre-feasibility study is already in progress and, together with the latest positive drilling results, could identify a surprisingly large resource. Gold production in Mali is cost-effective, with mines calculating all-in costs of between USD 700 and 800 per ounce. This results in a huge margin over the current spot price. Of course, the Malian military government must now finally come to an agreement with the local miners on taxes and development contributions. However, according to insiders, the last talks were positive.

If an agreement is reached and a contractual solution to the dispute is found, the focus will automatically shift to the local promoters. These are well-known names such as Barrick Gold, B2 Gold, Endeavour, and Allied Gold. Desert Gold is, therefore, in pole position for a quick takeover deal with its SMSZ project. With a market capitalization of CAD 15.6 million, Desert Gold is one of the most affordable explorers relative to available resources. The rocket could, therefore, take off from the launch pad very soon without a countdown - the stock is incredibly cheap!

Airbus – Back to all-time highs

The European aviation and defense group Airbus is also benefiting from the armaments wave. In 2024, the Company had to overcome delivery and margin issues, but management now expects profits to rise again. This is because orders from abroad are currently coming from flourishing countries such as India and China. The industrial decline in Europe is not being felt there; it is quite the opposite: India alone has ordered over 1,000 aircraft for the next 15 years.

However, US customs policy is raising doubts. This is reigniting the eternal feud between Boeing and Airbus. However, the punitive tariffs threatened by the US are currently changing from day to day. Therefore, it is difficult to estimate what President Trump's threatening gestures mean for Airbus, especially as business with Asia is flourishing and new orders can also be expected in the armaments and defense sectors. Long speculators have already pushed the price above EUR 177 at the beginning of May. With a P/E ratio of 17.8 for 2027, the technology stock is not yet overpriced, especially since analysts are expected to upgrade it soon.

New highs on the DAX and EURO STOXX are now directing the international focus more towards European stocks. The new US president, Donald Trump, is currently doing his country a disservice with his verbal attacks, as his pronouncements snub important international allies. The US dollar is coming under pressure as a result, which is boosting the price of gold. Investors should keep an eye on the junior explorer Desert Gold and consider adding to their positions, as things could move quickly here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.