August 30th, 2023 | 08:30 CEST

Better than Nel & Co.? Megatrend shares Redcare Pharmacy and Cantourage Group recommended as buy

Hydrogen has electrified investors for years. But pure-plays like Plug Power and Nel & Co. are struggling to get their numbers in order and are far from profitable business models. As a result, these shares are not much fun at the moment, and analysts see further downside potential. In such a situation, it is worth taking a look at other megatrend stocks. Redcare Pharmacy (formerly Shop Apotheke) is benefiting from online pharmacy and e-prescription trends. The share has already more than doubled this year. Investors can profit from the cannabis trend with the German Cantourage Group. The Company is growing strongly and the share price has come to rest (before the storm). Both shares are recommended to buy by analysts.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

NEL ASA NK-_20 | NO0010081235 , REDCARE PHARMACY NV | NL0012044747 , CANTOURAGE GROUP SE | DE000A3DSV01

Table of contents:

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Cantourage Group: Analysts and management optimistic

Sales +90% to EUR 11.1 million, and the leap into the black has already succeeded. Many growth stocks can only dream of such half-year figures. But the German Cantourage Group shows Nel, Tilray & Co. how to manage the balancing act of massive growth and profit. The Berlin-based company is one of Europe's leading producers and distributors of cannabis-based medicines. After the spectacular stock market debut at the end of 2022, the share has come to rest at around EUR 10. This presents an exciting entry opportunity for investors, as it will likely be the calm before the storm.

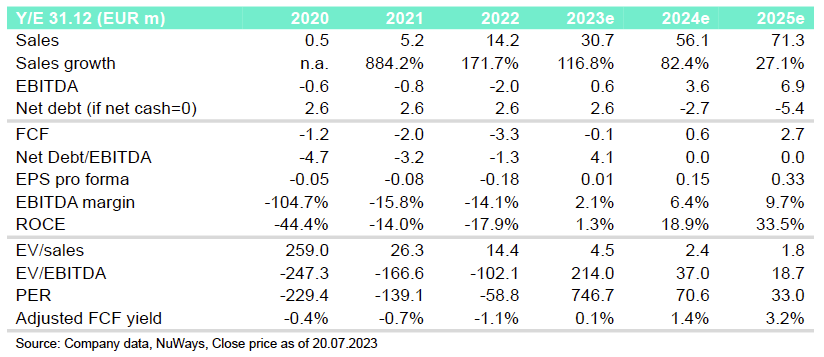

Analysts at NuWays by Hauck Aufhäuser Lampe expect Cantourage to significantly increase revenues and profits in the coming years and recommend buying the stock. In the current year, with revenues of EUR 30.7 million, a positive operating result (EBITDA) of EUR 0.6 million is to be achieved for the first time. The following year, sales are expected to reach EUR 56.1 million and EBITDA EUR 3.6 million. Then, in 2025, with revenues of EUR 71.3 million, the Company is expected to ring in with an EBITDA of EUR 6.9 million. The complete research report is available for download here.

The Company is not dependent on the intended legalization of cannabis in Germany. Cannabis has already been recognized as a medicine in Germany for several years. In addition to pain patients, cannabis flowers are prescribed under medical supervision to people with Parkinson's disease, chronic inflammatory diseases and even psychological ailments. Accordingly, the Company is looking to the future with optimism. Most recently, CEO Philipp Schetter was extremely optimistic in an interview with kapitalerhöhungen.de: "The extensive range of products and our innovations ensure that we can grow disproportionately in markets that are growing anyway. This applies to Germany and the UK, for example. Growth within Europe is also important for us. Just recently, we took an important step into Austria, where we can offer our dronabinol solution." Read the full interview here.

Redcare Pharmacy a buy after over 100% share price gain?

Redcare Pharmacy is one of the growth pearls from the healthcare sector on German share price lists. It is likely still known to investors as Shop Apotheke. In any case, the name change has not had a negative impact on the share price performance. The share price is still set to double in 2023, and analysts continue to see significant price potential for the online pharmacy. Most recently, Jefferies had confirmed a buy recommendation. The analysts are confident that the enterprise will exceed the estimates in the current year. At the same time, the Redcare management had only raised the forecasts for sales and margins at the beginning of August. The analysts have, therefore, also raised their price target from EUR 150 to EUR 160. The Redcare share is currently trading at around EUR 106.

The current price level of the MDAX group is also too low from Warburg's point of view. Their analysts have raised their price target from EUR 117 to EUR 130 following the convincing figures for the second quarter. The share is being driven by the developments surrounding e-prescription in Germany. In this regard, the regulatory environment is expected to improve further, according to the analysts.

Does Nel need capital? Analysts express concern

Positive analyst comments for Nel have been absent for a few weeks now. While the Norwegians surprised with reduced losses in their quarterly figures, the loss remains high and achieving profitability remains uncertain. Most recently, Credit Suisse lowered the price target for the shares of the hydrogen pure-play from NOK 10 to NOK 8. Currently, the security is trading between NOK 11 and NOK 12. Therefore, the analysts' recommendation is "Underperform". The experts anticipate that Nel will need fresh capital before reaching the break-even point. They noted that the order intake in the first half of 2023 was not convincing, leading to reduced estimates for 2024 and 2025.

Buying hydrogen stocks like Nel and Plug Power is not pressing at this time. While the technology is undisputedly a megatrend, the investor favorites are struggling to develop profitable business models despite being valued in the billions. Redcare and Cantourage show how to combine significant revenue growth and profit. However, while Redcare has a lot of share price fantasy attached to e-prescription, Cantourage has a lot of growth potential even without regulatory assistance.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.