September 8th, 2025 | 07:25 CEST

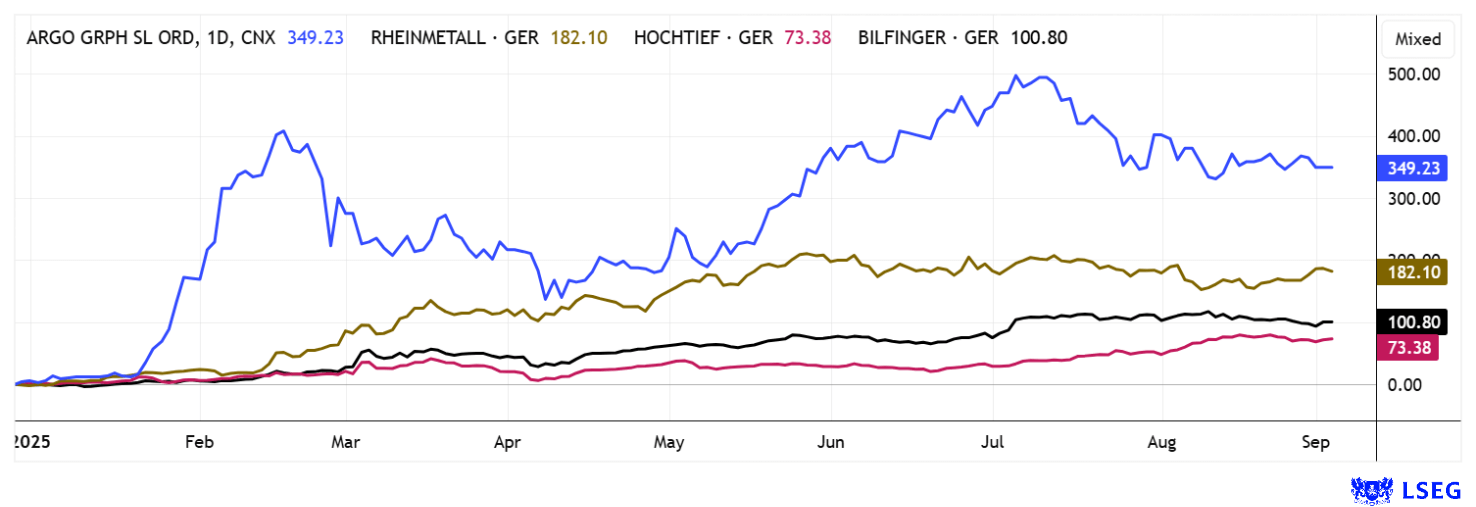

Berlin's billion-euro programs are making shareholders rich! Rheinmetall, Hochtief, Argo Graphene and Bilfinger

The money-printing machine is running! The 2026 federal budget has now been approved at EUR 521 billion. The defense budget is set to rise from EUR 62.4 billion to EUR 82.7 billion. In addition, there will be an additional EUR 25.5 billion from the special budget for the German Armed Forces. Federal investments – including the Climate and Transformation Fund and new special assets – will amount to approximately EUR 126.7 billion in 2026. New borrowing is expected to rise to EUR 89.9 billion, and if the so-called "special assets" are included, new borrowing will rise to EUR 174.3 billion – a historic figure. This is a windfall for companies in the defense and infrastructure sectors. Which stocks are now taking center stage?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , HOCHTIEF AG | DE0006070006 , ARGO GRAPHENE SOLUTIONS CORP | CA04021P1018 , BILFINGER SE O.N. | DE0005909006

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall – The next bull market surge?

Order boom expected! Rheinmetall is currently on a significant growth trajectory and is at the center of the European defense industry. The Company expects a sharp jump in revenue of 25 to 30% for the 2025 fiscal year. Driven by high demand from the military sector and expansion projects in Europe, this trend is expected to continue at a similar pace through 2030. The latest half-year figures confirm this trend. Consolidated sales climbed to EUR 4.7 billion, while the order backlog shot up to a record level of over EUR 63 billion. Now the German government is also finalizing its investment plans – does this mean the rocket is primed for another 100%? As a reminder, Rheinmetall is the best-performing German stock, having increased twentyfold since February 2022, exactly three and a half years ago when Russia invaded Ukraine.

What do the analysts say? The experts at mwb research continue to rate Rheinmetall as an attractive buy with target prices around EUR 2,280, around 30% above the current level. DZ Bank also emphasizes the Company's dominant role in the upcoming investment surge by European NATO countries. The operating margin remains stable at around 15.5%, and adjusted EBITDA could reach up to EUR 2.5 billion in 2025, according to consensus estimates. Incidentally, the consensus of all analysts on the LSEG platform is EUR 2,057, but this is constantly changing upwards as new studies and updates are released.

CEO Armin Papperger reports on new plant locations and Europe's largest ammunition factory, which Rheinmetall is currently opening in Lower Saxony. The Company is converting civilian capacities to military production at record speed, benefiting from political support in the form of faster approval of subsidies and framework agreements worth billions. The focus is on the key areas of military vehicles, ammunition, air defense systems, and technologies for new EU and NATO projects, which are currently undergoing massive expansion, consolidating Rheinmetall's position as a key strategic supplier. New partnerships, digitalization, and the planned expansion of international business are also strengthening the outlook for the future. The stock remains attractive for investors, with the projected 2025 P/E ratio expected to drop from 59 to 16 by 2029. Well then – let's get started!

Argo Graphene Solutions – Innovation in infrastructure

Argo Graphene Solutions from Canada is positioning itself emphatically as an innovator in climate-friendly building materials. In a new cooperation with Ceylon Graphene Technologies from Sri Lanka, the Company has secured long-term supplies of high-quality graphene oxide paste, a key material for use in concrete, cement, and asphalt. Just one ton of this paste is enough for around 50 tons of liquid dispersion, which gives the building materials higher compressive strength, longer durability, and significantly lower CO₂ emissions. Initial tests confirm that graphene concrete can increase strength by up to 40% and massively reduce cracking. This opens up the growth market of sustainable infrastructure for Argo, supported by an end-to-end supply chain from Asia to North America. The agreement with Ceylon Graphene underscores the strategic direction: Argo commits to gradually purchasing up to 4,000 kg of graphene oxide paste. In return, Ceylon contributes its extensive test data and technical expertise. Both partners are jointly developing new mixing and processing methods that could be introduced in North America and later scaled globally. A joint venture for cost-effective manufacturing is also already part of the discussions. The advantages are tangible: 30% higher compressive strength, 24% more tensile strength, and up to 70% better abrasion resistance. These are properties that make buildings more durable and sustainable.

Argo Graphene Solutions combines technological innovation with rapidly growing market demand. At a time when the construction industry is demanding low-carbon solutions and many infrastructures need to be renewed, the Company scores with practical applications and strong partnerships. Following a consolidation of the share price to the CAD 0.72 to 0.78 range, the current level presents an opportunity to enter a sector early on that combines sustainability with profitability and thus also promises long-term upside potential.

Hochtief and Bilfinger – Who will benefit from the big pie?

Hochtief and Bilfinger are currently key players in the implementation of the German government's infrastructure package, which envisages investments of over EUR 500 billion in transport, energy, and digitization by 2036. Hochtief is benefiting in particular from the acceleration of approval procedures as part of the so-called "Bau-Turbo" (construction turbo), which allows large-scale projects such as bridges, roads, and the renovation of the rail network to be realized more quickly. A current major contract worth several hundred million euros concerns the second trunk line of the Munich S-Bahn. This project will significantly modernize urban transport and is considered a nationwide pioneer.

Bilfinger is focusing on industrial and energy infrastructure. At the beginning of 2025, a strategic ten-year framework agreement was signed with Gasunie for the development, maintenance, and transformation of pipelines, gas storage facilities, and hydrogen networks. Orders for the retrofitting and modernization of existing facilities in Germany and the Netherlands are significantly driving the development of sustainable networks. Bilfinger is also playing a leading role in the energy-efficient renovation of public buildings and the expansion of climate-neutral infrastructure, which is in line with the German government's Climate and Transformation Fund. Both companies are also active in the field of digitalization. Hochtief is currently building new data centers and telecommunications networks, while Bilfinger is involved in the modernization of signal boxes and the construction of control centers for energy and industrial sites.

The increased order situation is already reflected in the business figures. Both Hochtief and Bilfinger have significantly raised their forecasts for 2025. Analysts expect that with the start of fund distributions in the fall, the volume of applications will continue to rise and companies will benefit from a flood of orders for years to come. The ongoing transformation is opening up new profit opportunities for shareholders, especially as political support and subsidies are creating the basis for stable business development. Both shares have doubled since September to EUR 225 and EUR 92, respectively, with current 2026 P/E ratios of 11 and 14. That is cheap!

The defense and infrastructure segment is currently receiving a large number of public contracts. Even though taxpayers have to foot the bill for these upgrades and renovations, the current situation offers a lot of potential returns for shareholders. Nevertheless, flexibility is required, as there are sometimes significant profit-taking movements in the charts. Rheinmetall and ARGO appear to have turned the corner, while Hochtief and Bilfinger are likely to cool off somewhat in the meantime.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.