March 15th, 2023 | 17:38 CET

Bayer, BioNxt, BioNTech - Biotech is on the rise again, bring on the blockbusters!

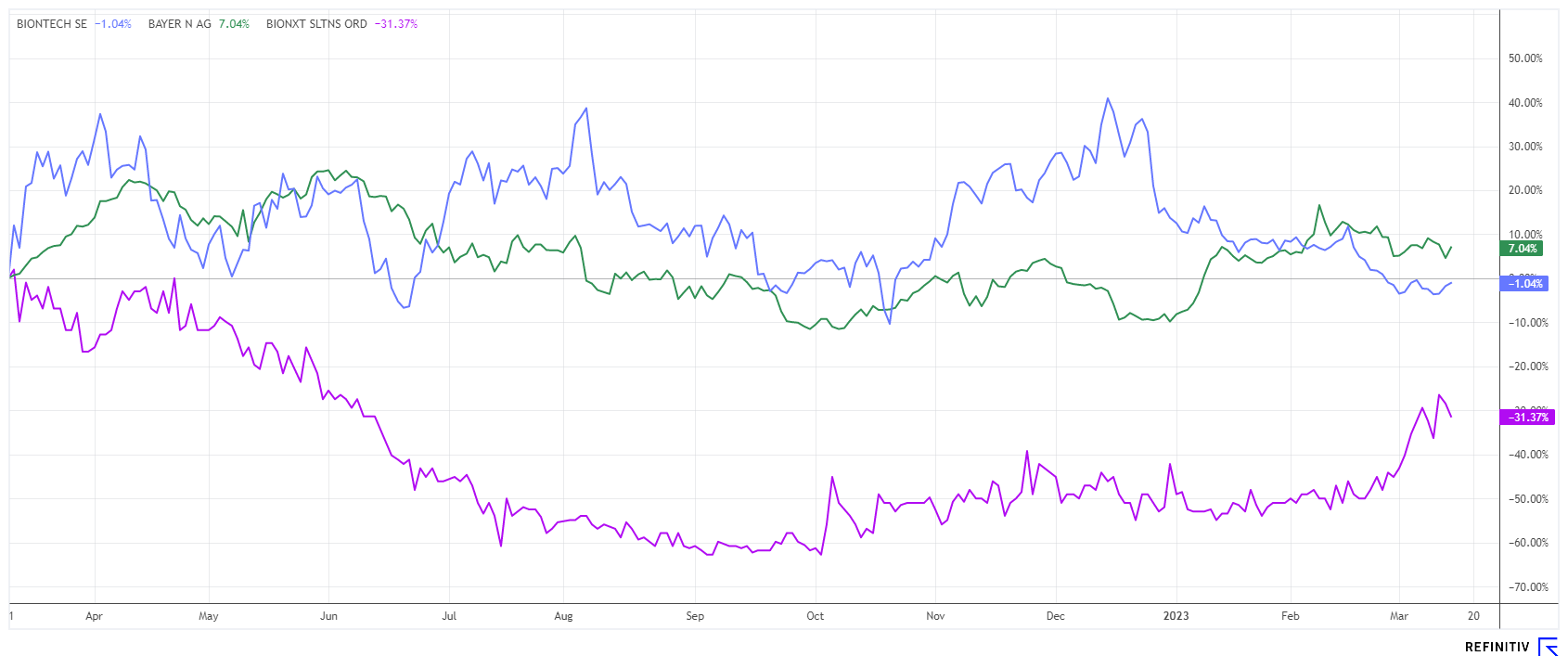

The time of the vaccine producers is over because the willingness to vaccinate is declining worldwide. As a result, the entire biotech sector has entered a strong correction phase since the pandemic mode for COVID-19 ended. In the process, sector leader BioNTech suffered a loss of over 70% from its high. Complicating matters for companies is the significant increase in interest rates for long-term financing of their pipelines. When refinancing costs rise, this often leads to lower valuations. However, some companies are impressing with their innovations and have recently shown significant outperformance to the market. We evaluate the opportunities of some well-known biotech protagonists!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , Bionxt Solutions Inc. | CA0909741062 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer - Massive investments in the pharma sector

Bayer plans to spend USD 1 billion on the research and development of new drugs in the US this year. By the end of this decade, the Company wants to double its sales in the US in this way, and the group has already increased the number of US employees working in marketing for the pharmaceutical business by about 50% in the past 3 years. In the future, Bayer intends to sell the drugs developed by the Company independently in the US itself instead of entering into partnerships with US companies as in the past.

The most recently formulated outlook for 2023 disappointed stock market players, as growth is likely to slow somewhat. There are many reasons for this. On the one hand, the strong tailwind from exceptionally high prices for the crop protection product glyphosate is weakening, and there are now higher costs and price pressure for some medicines. Bayer is calculating sales of EUR 51 billion to EUR 52 billion for the current year, with adjusted EBITDA reaching EUR 12.5 billion to EUR 13.0 billion.

Despite expressed skepticism, experts on the Refinitiv Eikon platform are still positive about the Bayer share. The good mood is also driven by the ongoing splitting fantasy. The median price target for 12 months is valued at EUR 74.83. The share trades with a 2023 P/E ratio of 7.7 and offers a dividend yield of 4.3%, which will be paid out as early as April.

BioNxt Solutions - Acquires drug coating and delivery platform

Things are finally moving forward for BioNxt Solutions. The Vancouver-based company has signed a final technology transfer and patent assignment agreement to secure certain technology and intellectual property rights related to a novel coating and delivery technology for oral solid dosage form drugs. BioNxt is thus steadily expanding its proprietary drug delivery platform.

"With BioNxt already having established platforms for transdermal and oral soluble drug delivery, this acquisition of a novel coating technology for oral drugs is a significant step in expanding and solidifying our drug delivery expertise," said CEO Hugh Rogers. "This coating system could significantly improve oral drug delivery via tablets and capsules through more precise drug release and predictable dosing."

BioNxt aims to out-license the new processes with a net revenue share of 3% to 6% and will also reimburse licensees for patent filing and prosecution costs. Currently, the Company is in the early planning stages for a pilot comparative human bioavailability study to assess potential applications of the technology.

According to Fact.MR Research and Consulting, the global oral solid dosage pharmaceutical market was valued at USD 525 billion in 2021 and is expected to reach USD 1.03 trillion by the end of 2032, growing at over 6% per annum. Revenue from sales of oral solid dosage pharmaceuticals accounted for 23.8% of the global pharmaceutical drug market in 2021. As it stands, prices below EUR 0.37 are finally history, as the stock gained a good 50% in Canada in just 4 weeks. With overcoming the resistance at EUR 0.50, the stock is now going into the next round, and an additional CAD 2.5 million could be raised very quickly among interested investors. Although there is still some room to the old highs of over EUR 2, the high level of momentum promises a lot of drive in the current upward trend. Another plus point is that the market capitalization of EUR 47 million is still very manageable.

BioNTech - The market is waiting for the 2022 annual figures

Biopharmaceutical New Technologies, or BioNTech for short, is a next-generation immunotherapy company pioneering the development of therapies for cancer and other serious diseases. The Company combines a variety of advanced therapeutic platforms and bioinformatics tools to rapidly advance the delivery of novel biopharmaceuticals. To this end, BioNTech works side-by-side with world-renowned pharmaceutical industry collaborators.

Although the vaccination wave in Europe has long since subsided, it is again getting a little closer with the arrival of the first special containers in Rwanda on African soil. Six shipping containers were received by the Rwandan Ministry of Health. However, production of the vaccines is not scheduled to start until 2024 at the earliest. The so-called "BioNTainers" will then be able to produce around 50 million doses of the COVID-19 vaccine per year, as well as other mRNA vaccines against tuberculosis and malaria. In addition to the site in Kigali, BioNTech is planning further modular production facilities in Africa in Senegal and possibly in South Africa. Both the malaria and tuberculosis vaccine candidates are currently undergoing clinical trials and moving into registration studies.

BioNTech's share price continues to move in a narrow corridor between EUR 115 and EUR 124. On March 27, the Mainz-based company will report on the past year. It should be exciting to see how much additional net liquidity was generated with the latest Comirnaty contracts. There should also be an update on the outlook here. According to Refinitiv Eikon, the price targets of the experts are still around EUR 199 on average. If the outlook turns out well, BioNTech is again an interesting portfolio addition.

For biotech companies, it is important to know which results will become relevant beyond the research cycle. Only a final approval creates room for sales and profits. BioNTech and Bayer have a lot of liquidity for further study series. Smaller companies like BioNxt are dependent on veritable collaborations and good financing partners. After a long downward phase, the BioNxt share is shifting into the next gear in parallel with the good news.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.