December 30th, 2022 | 10:04 CET

Barrick Gold, Globex Mining, Rio Tinto - Commodity supercycle continues in 2023

2022 was the year of energy commodities. Goldman Sachs expects commodities to continue to deliver the best returns for investors in 2023, with increases of over 40%. Goldman Sachs has been predicting a commodity supercycle since late 2020. In 2023, the price of Brent crude oil is forecast to rise to USD 105 per barrel in the last quarter, and the price of copper is forecast to rise from around USD 8,400 to USD 10,050 per ton. The main argument is the low level of investment in the commodity sector, which is unlikely to meet demand. Therefore, today we look at three companies from the commodity sector.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

BARRICK GOLD CORP. | CA0679011084 , GLOBEX MINING ENTPRS INC. | CA3799005093 , RIO TINTO PLC LS-_10 | GB0007188757

Table of contents:

"[...] We can make a big increase in value with little capital. [...]" David Mason, Managing Director, CEO, NewPeak Metals Ltd.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Barrick Gold - Good prospects

Barrick Gold should have a successful 2023 due to several favorable factors on account of its attractive valuation and dividend yield. In addition, there are improved industry fundamentals, including moderate operating costs, a positive outlook for gold prices due to high central bank demand and a potential recession, and potential geopolitical risks such as China's interest in Taiwan. If rumors of Russia selling 2 barrels of oil for a gram of gold prove true, gold prices will move toward $3,600.

In Q3 2022, Barrick Gold reported solid results that exceeded expectations and reaffirmed its full-year production targets. The Company also sold its non-core royalty portfolio and repurchased shares for USD 141 million, adding value for shareholders. Overall, Barrick Gold is considered a long-term value play due to its solid balance sheet, diverse assets and growth potential through the exploration and development of new projects.

On a positive note for the future, the Reko Diq project in Pakistan has been given the go-ahead. Production is expected to start there in 2028 in one of the world's largest undeveloped copper-gold projects. Since the beginning of November, the gold price has climbed from around USD 1,620 to over USD 1,800. That should keep Barrick Gold's fourth-quarter earnings steady despite a weak October. The stock matched the gold price and has also gained since the beginning of November and is currently priced at USD 17.21.

Globex Mining - Still strongly undervalued

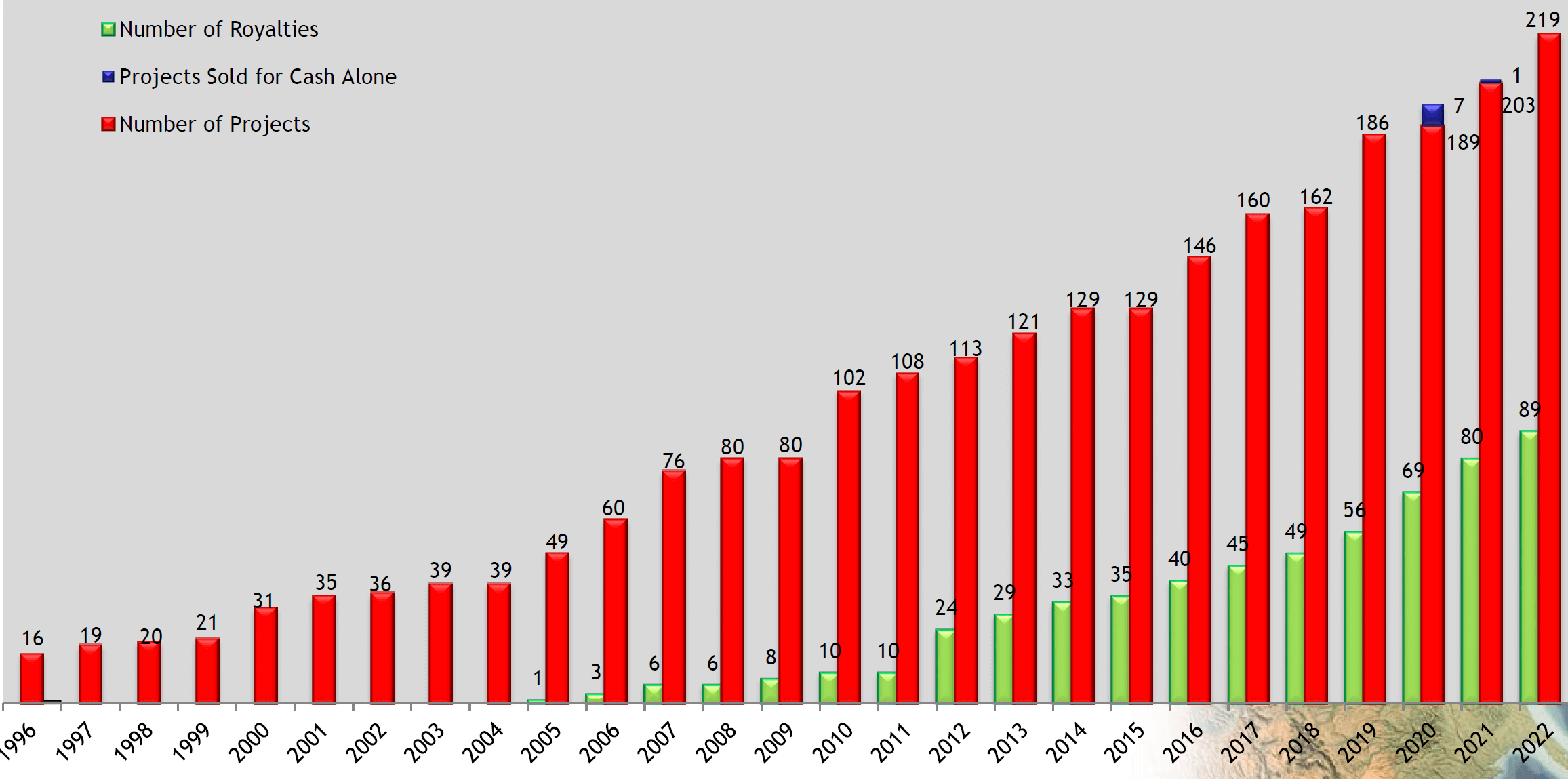

High commodity prices are good for Globex Mining's business. The Company is a "mineral property bank" that has been acquiring resource properties for over three decades. When commodities are running poorly or explorers are running out of money, it is a good time to acquire promising projects on the cheap. Following this principle, CEO Jack Stoch has brought 219 projects into Globex's portfolio. Projects are then upgraded through exploration and placed with partner companies, which receive an option on a project in exchange for cash, shares, a minimum work commitment and a royalty. The portfolio includes 113 precious metals projects, 62 nonferrous metals projects, and 44 projects with special metals and minerals that host, among other things, rare earths, cobalt or lithium, which are essential for the energy transition.

With so many projects optioned, it is no wonder that there is a steady newsflow. In December, for example, there was an option payment of CAD 100,000 and 1,428,571 shares from partner company Orford Mining for the Joutel project. At the Harricana gold project, 55 drill holes were drilled by Kiboko Gold. Maple Gold reported gold discoveries of up to 24.4 g/t from its exploration work at the Eagle Gold Mine property. At the Kukamas project, the partner company uncovered high-grade mineralization of up to 47.2 g/t gold, 62 g/t silver and 10.96% copper. Beginning in the first quarter of 2023, Sayona Mining will resume lithium production. Globex will receive a 0.5% gross metal royalty from that date. Emperor Metals, after financing, can begin its exploration work on the Duquesne West-Ottoman property, in which Globex holds a 50% interest.

All of this good news has not helped the stock in the tax-loss season. Currently, the stock is trading at CAD 0.66. At the same time, the Company is debt-free, has more than CAD 20 million in cash, and owns shares in Yamana Gold worth almost CAD 5.4 million. The market capitalization is about CAD 36.8 million. More than 200 promising projects and royalty income are thus valued at just CAD 11.4 million. Further information on the Company can be found in a detailed analysis on researchanalyst.com.

Rio Tinto - China is the key to success

Rio Tinto is one of the largest mining companies in the world, producing and selling mainly minerals such as iron ore, aluminum, copper, gold, uranium, silver, diamonds and titanium. It operates in twelve countries and is a signatory to the Paris Climate Agreement, in which it pledges to phase out fossil fuel extraction. The Company's most important segment is iron ore, and its success depends heavily on Chinese demand for this commodity. China is the largest importer of iron ore, taking about 70% of global production.

Rio Tinto's success is thus closely linked to the Chinese economy, and the Company's revenues are expected to decline in 2022 and 2023 due to lower iron ore prices. However, the revival of the Chinese market could lead to an increase in demand and higher prices for iron ore, which would positively impact Rio Tinto's share price. If China manages to overcome the numerous challenges, including a real estate crisis, an economic slowdown and tensions with the US, there is hope that the Chinese economy will recover in 2023.

Despite the large share of iron ore in sales, rising commodity prices would benefit the Group. Investors have enjoyed good returns via dividends in recent years. Currently, the dividend yield is around 9%. This year, the Group has already paid out EUR 6.77 in dividends. After a triple test of EUR 52.50, the share has recovered significantly from its lows for the year and currently costs EUR 66.93. However, many analysts have become cautious with buy recommendations. Most advise holding due to the uncertainties in China.

As long as there is no global recession, commodity prices should continue to rise. If one wants to become less dependent on Russia and China, alternative sources of raw materials are necessary. Barrick Gold is well positioned to benefit from a possible scenario where Russian oil may only be paid for with gold. That would also help Globex Mining because half of all projects have precious metal deposits. Above all, the stock is extremely cheaply valued. The downside should be limited. Rio Tinto produces different commodities. But iron ore remains the primary sales driver. If China's economy gains momentum, Rio Tinto will also benefit.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.