May 30th, 2023 | 10:00 CEST

Barrick Gold, Desert Gold, Deutsche Bank - What happens after the US debt ceiling is lifted?

In the US, the Democrats and Republicans have agreed on a compromise in the debt dispute. This means that the US can take out more loans, which will ultimately result in an increasing money supply. This could further fuel inflation, while on the other hand, it could boost the gold price. In recent months, the gold price has soared due to the turbulence in the banking sector and was able to mark a new high. Nevertheless, this is remarkable because the FED had raised interest rates significantly, which would typically have tended to argue for a falling gold price. If interest rates do not rise further or even fall, this would be another positive signal for gold. We, therefore, look at 2 gold companies and analyze Deutsche Bank.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

BARRICK GOLD CORP. | CA0679011084 , DESERT GOLD VENTURES | CA25039N4084 , DEUTSCHE BANK AG NA O.N. | DE0005140008

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Barrick Gold - In search of takeover targets

For one of the largest gold producers in the world, Barrick Gold, the news from the US should be positive. With more debt, the dollar, which has been strong lately, should weaken again. On May 3, the group released its Q1 figures. Net income was USD 120 million, or USD 0.07 per diluted share, down from USD 438 million, or USD 0.25, in the year-ago quarter. Gold production was 952,000 ounces, and copper production was 88 million pounds. Thus, both gold and copper production declined compared to the previous year.

The Company nevertheless believes it is on track to meet its forecasts of 4.2 to 4.6 million ounces of gold and 420 to 470 million pounds of copper, as production is expected to increase significantly in H2. Among other things, the expansion of the Pueblo Viejo plant is expected to start operations in July. Total revenue of USD 2,643 million represents a decrease of 7.4% YOY. Adjusted net income was USD 247 million, and net cash flow from operating activities fell 22.7% YOY to USD 776 million. The Company declared a quarterly dividend of USD 0.10 per share and approved a new share buyback program.

Speaking to the Financial Times, Barrick Gold CEO Mark Bristow said the Company is on the hunt for acquisitions. With its low production costs, Africa could come into focus here. In addition, the forecast copper price is expected to rise in the near future, partly due to the recovery of the Chinese market for base metal imports. The energy transition is also creating increased demand for copper. With the recent decline in the price of gold, the stock price of Barrick Gold has also decreased. Currently, one share is priced at USD 16.99.

Desert Gold - Exploring the possibility of production

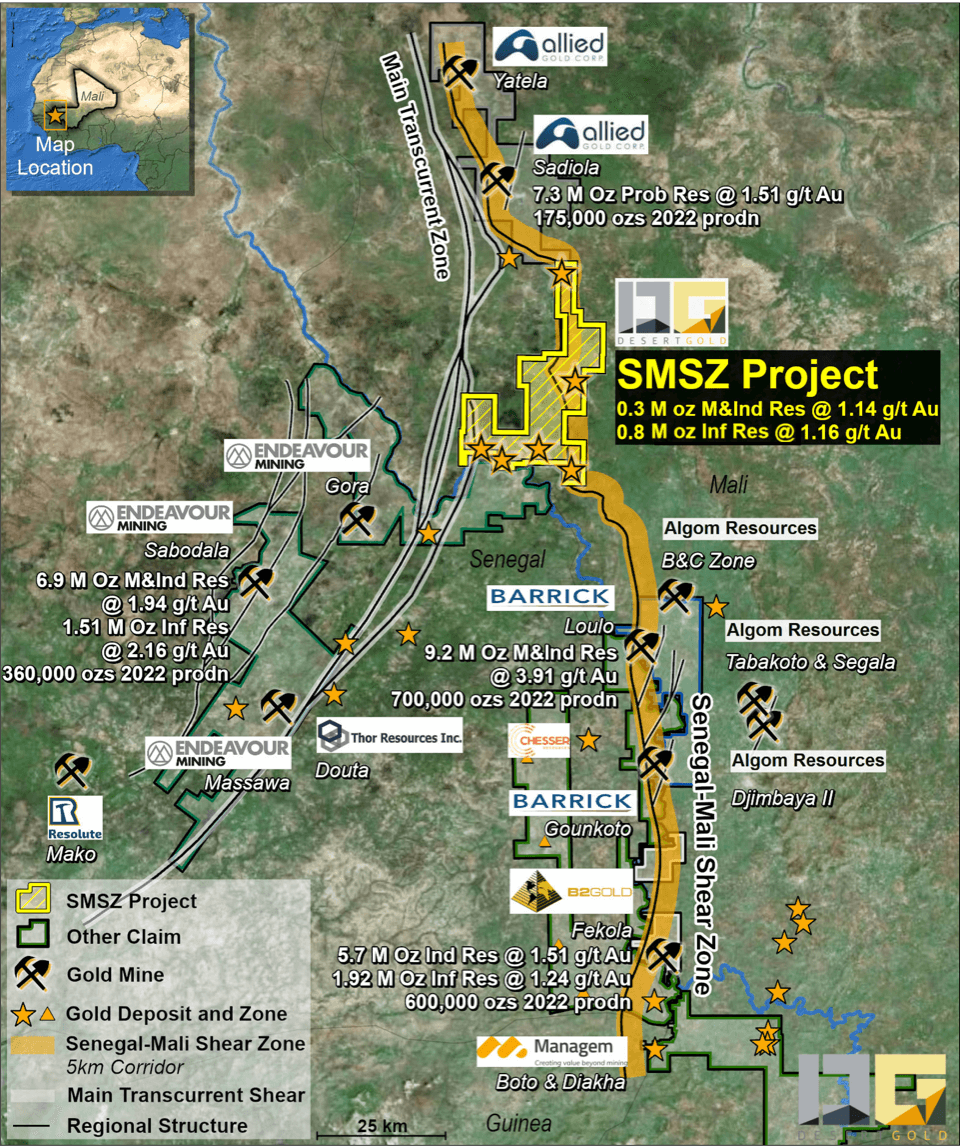

Desert Gold Ventures, a gold exploration and development company, is active in the gold belt of West Mali. In recent years, the African country has attracted billions of dollars in infrastructure investments from some of the world's largest gold companies. No wonder, as gold production in Africa is considered cheap. With its flagship project, the 440 sq km Senegal-Mali Shear Zone (SMSZ) project, Desert Gold Ventures is located in the heart of the region's main mining structure and surrounded by large gold mines from producers such as Barrick Gold and B2 Gold. M&A activity has increased in the area, with Fortuna Silver acquiring Chesser Resources recently for USD 60 million. Allied Gold's IPO on the London Stock Exchange is also creating takeover fantasies, as their Sadiola mine is adjacent to Desert Gold's property.

The SMSZ project released a mineral resource estimate of about 1.1 million ounces last year at an average grade of about 1.15 g/t. These resources are from 5 deposits, 4 of which are in close proximity to each other in the southern part of the project. In addition, drilling has discovered over 21 gold zones with economic potential and limited exploration. The upcoming 30,000 m drill program is expected to increase the mineral resource to over 2 million ounces. The latest company announcement on April 25 already reported a gold-in-auger drill value of 2,680 ppb near the Mogoyafara South gold zone, which could significantly expand the deposit.

The Company is currently assessing the economic feasibility of establishing a small heap leach mine at the Barani East deposit, which has high-grade mineralization and a near-surface oxidized component. The start of production would provide a re-rating for the stock. The share is currently trading at CAD 0.07, giving it a market capitalization of just CAD 13.7 million. Those wanting to know more should watch the Company presentation on YouTube from the 7th International Investment Forum recently. Click here.

Deutsche Bank - Cost-cutting program

The US remains solvent, which is good news for Deutsche Bank. This takes a lot of uncertainty out of the market. With the exception of Credit Suisse, the turbulence in the banking sector is limited to the US. The Association of German Banks also gave the all-clear for the German financial institutions in its quarterly report and does not see lending at risk. So the Basel III guidelines are having an effect. The CDS, which were responsible for the crash of the Deutsche Bank share, have meanwhile also returned to a normal level.

In Q1 2023, the bank beat analysts' expectations on earnings with EUR 7.31 billion and earnings per share of EUR 0.61 and plans possible share buybacks starting in Q3. CEO Christian Sewing said he was confident of meeting or exceeding 2025 targets, with potential revenues of around EUR 30 billion and pre-tax profit of more than EUR 10 billion. To achieve this, it plans to save millions of euros, among other things, by reducing its office space and creating more home-office jobs.

To settle a lawsuit filed by Jeffrey Epstein's abuse victims, the group has agreed to pay USD 75 million. This should take the issue off the table. The Deutsche Bank share has performed worse than its competitors. Yet it is favourably valued with a price-to-book ratio of 0.3 and a price-to-earnings ratio of less than 5. The share has not yet been able to close the gap that opened up in the chart after the CDS explosion. The share is currently trading around EUR 9.65.

With the resolution of the debt ceiling dispute, a great deal of uncertainty disappears from the market. Already on May 29, the stock markets opened significantly higher. The USD should now show weakness again, which will benefit the gold price. Barrick Gold had a weak first quarter but is expected to significantly increase its production in the second half of the year. A high gold price also benefits Desert Gold, as they aim to increase their mineral resources by the end of the year with their current drilling program. Deutsche Bank should also benefit from the decision and is currently favourably valued anyway.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.