August 2nd, 2023 | 09:30 CEST

Barrick Gold, Desert Gold, Deutsche Bank - Revolution through a new gold-backed currency?

As expected, last week, the FED and the ECB raised interest rates by 0.25% each in an effort to further fight inflation. The US dollar also showed strength. These factors are typically considered negative signals for the gold price, yet gold futures recently rallied and are preparing to test the all-time high. What could be the reason for this? One possible explanation could be the meeting of BRICS countries in Johannesburg from August 22 to 24. There are rumors that the participants want to introduce a new gold-backed currency to compete with the US dollar. Such a move could drive the price of gold to unprecedented heights. Additionally, many central banks have been increasing their gold purchases recently.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

BARRICK GOLD CORP. | CA0679011084 , DESERT GOLD VENTURES | CA25039N4084 , DEUTSCHE BANK AG NA O.N. | DE0005140008

Table of contents:

"[...] The transaction offers benefits to all parties: Shareholders now have three promising projects in their portfolio. [...]" Bradley Rourke, President, CEO and Director, Scottie Resources Corp.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Barrick Gold - Everything will be better in H2

If the gold price rises, this is good news for one of the largest gold producers, Barrick Gold. The Company sold 1 million ounces of gold and 101 million pounds of copper in Q2, down slightly from a year ago. The average selling price for gold was USD 1,976 per ounce, while for copper, it was USD 3.84 per pound. Despite the moderate declines in production, Barrick has a positive outlook for the full year and expects higher production in the second half of the year. The cost of sales per ounce of gold in Q2 is expected to be 3% to 5% lower than in Q1, and all-in sustaining costs are also expected to decline.

Barrick also plans to significantly improve margins going forward. All-in sustaining costs (AISC) are expected to be reduced by up to 2% compared to the previous quarter. The Company expects significant margin expansion in Q3 2023, resulting in a significant increase in free cash flow. Despite some challenges in the first half of the year, including difficult weather conditions in Nevada and disruptions to production from the Pueblo Viejo mine expansion, Barrick is showing confidence in the year ahead.

Barrick's share prices have suffered in recent years, but the Company expects a positive performance as margins improve and gold prices recover. Also, free cash flow should increase in the coming year as quite a few investments will be completed this year in excess of USD 2.4 billion in solar farms, etc., and costs in this area should decrease. The stock is currently trading at USD 17.29, down over 30% from last year's highs.

Desert Gold - Reaching the target with exploration expertise

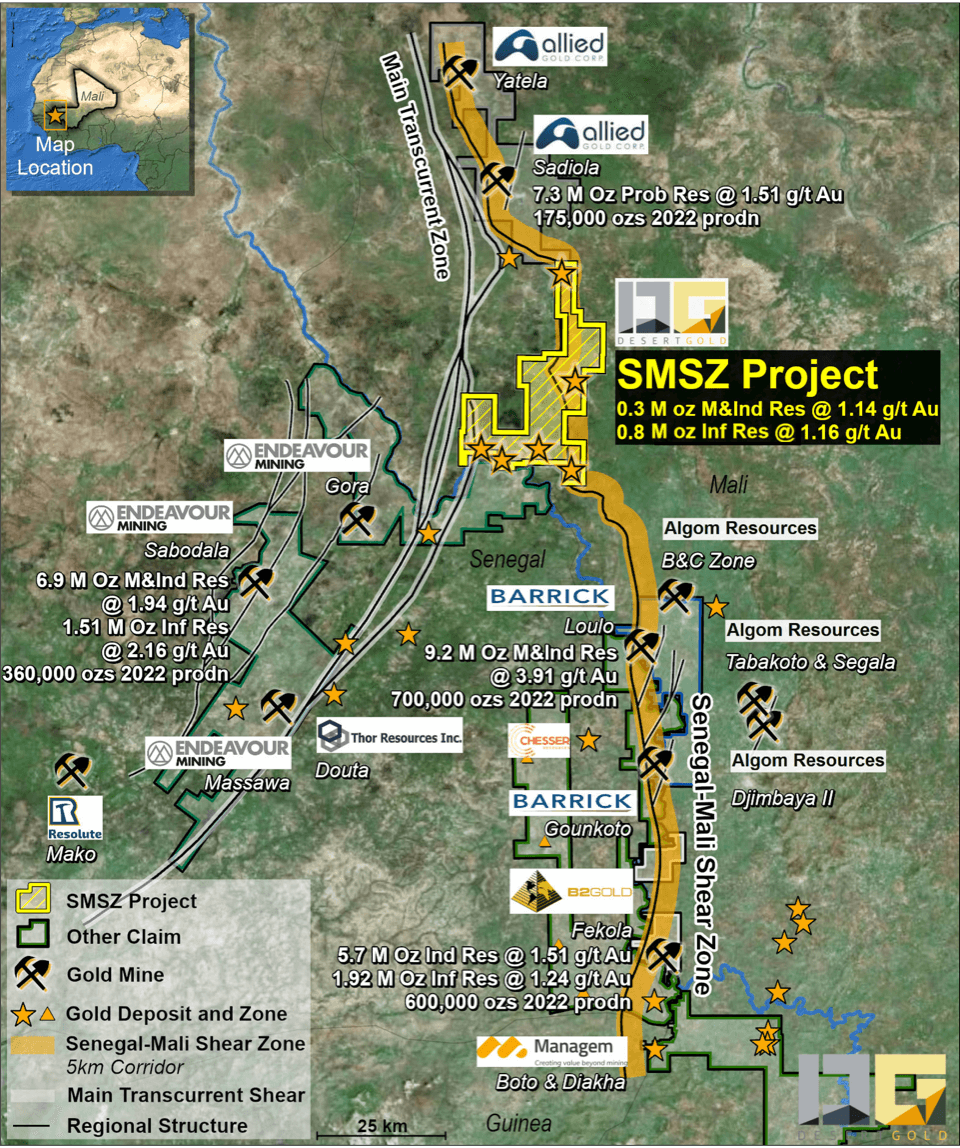

Gold explorers have not yet been able to profit from the rising gold price, but this could change quickly if the gold price continues to rise. This is especially true for low-cost explorers, including Desert Gold, with a market capitalization of just CAD 11.7 million. The Company owns one of the largest land packages in West Africa, with the 440 sq km Senegal-Mali-Shear Zone (SMSZ) project in Mali. The property hosts a measured and indicated mineral resource totaling 310,300 ounces and inferred 769,200 ounces of gold. Only smaller portions of the property have been explored. Well-known gold producers such as Barrick Gold, B2 Gold and Allied Gold are also active in the area.

M&A activity has picked up steam recently, with average takeover prices of CAD 210 million being paid, which equates to around CAD 91 per ground ounce. Desert Gold, on the other hand, is valued at only about CAD 11 per ounce. This shows a clear undervaluation. To counteract this, the Company has added an exciting personnel to its Board of Directors. The addition of Doug Engdahl, an experienced geology expert with over 15 years of experience, brings valuable expertise to Desert Gold. With his Axiom Exploration Group, he has already assisted many explorers in better determining their drilling targets. His expertise can help minimize potential risks, save valuable time, and reduce costs for the Company.

The Company has planned to drill approximately 30,000 m this year, focusing on its largest gold zones to date, Gourbassi West North and Mogoyafara South. In April, auger drilling found 2,680 ppb of gold, offering the opportunity to expand the Mogoyafara South gold deposit. It will be interesting to see when the company will issue an update on the upcoming exploration work. Mr Engdahl's knowledge should then already have been incorporated into the planning. The share has yet to be able to profit from the increased gold price and is quoted at CAD 0.06.

Deutsche Bank - Strongest half-year result for over 10 years

Rising interest rates should be good for banks at first glance. But if, like Silicon Valley Bank, you have invested your money unfavorably and customers withdraw their funds because they get more interest for their money at other banks, it can lead to a collapse. When Deutsche Bank's credit default swaps rates spiked in early March, there was panic among shareholders and the stock plunged. On July 26, the bank released its 2nd quarter numbers. Pre-tax profit in H1 was EUR 3.3 billion, the best result since 2011.

Looking more closely at the quarterly figures, pre-tax profit fell 9% year-on-year to EUR 1.4 billion, but this was due to non-operating charges such as restructuring costs and legal cases. Without the extraordinary costs, a plus of 25% would emerge. Earnings were also up 25%, with all business areas posting at least double-digit growth. The after-tax return on tangible equity was 14.8%. There was also a net inflow of EUR 9 billion at DWS Asset Management.

CEO Christian Sewing sees the Group on a good path to reducing costs. More than EUR 1 billion of the EUR 2.5 billion savings target has already been achieved. On July 28, the Company exceeded all minimum regulatory requirements in the latest bank stress test conducted by the European Banking Authority, even though the test was even tougher this time, according to the Company. Since July 6, the stock has been on the upswing, gaining more than 18% to EUR 10.70 at its peak. Since then, the value has consolidated, and one share certificate currently costs EUR 10.15.

Rising interest rates are not a problem for Deutsche Bank. The excitement about CDS rates has subsided, and with the best half-year result since 2011 the bank has demonstrated that it is on a promising path towards the future. Despite the interest rate hikes, the gold price has remained resilient and is once again heading towards its all-time high. This helps Barrick Gold because it means margins are getting bigger and in the 2nd half of the year total costs per ounce are expected to fall and production is expected to pick up. Significantly undervalued, on the other hand, is Desert Gold. The explorer is active in an area where there have been repeated takeovers recently. At this valuation, it could quickly become a takeover target.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.