July 15th, 2025 | 07:00 CEST

Attention! MULTIPLICATION potential! Hensoldt, D-Wave, and naoo shares with Buy recommendations

German defense stocks appear to have quickly ended their consolidation phase. Driven by Buy recommendations, they are marching back toward their all-time highs. Hensoldt is recommended by Deutsche Bank, among others. However, the Company could face significant challenges ahead! Meanwhile, there is a bombshell from naoo: for the first time, analysts have taken a closer look at the Swiss social media insider tip. Experts see strong growth in the coming years and believe a multiplication of the stock price is possible. D-Wave's share price has already multiplied. Nevertheless, analysts see further upside potential for the quantum high-flyer.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

HENSOLDT AG INH O.N. | DE000HAG0005 , D-WAVE QUANTUM INC | US26740W1099 , NAOO AG | CH1323306329

Table of contents:

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

naoo: Analysts see potential for multiplication

A bombshell at naoo. For the first time, analysts have taken a close look at the stock market newcomer from Switzerland. The experts at GBC Research have come to a clear conclusion: "Buy". Based on a DCF (discounted free cash flow) model, the analysts consider naoo to be fairly valued at EUR 28.48 per share. The security is currently trading at around EUR 6.15. Accordingly, there is potential for the stock to multiply in value.

In their study, the analysts highlight three key investment highlights: First, the Company operates a latest-generation AI-powered social media platform that offers a new type of value for users and advertisers through a reward system (naoo points) and strong local integration. Second, naoo has reached a strategic milestone with the acquisition of Swiss influencer agency, Kingfluencers. This acquisition complements the platform business with a high-margin agency model with an established customer base and brings immediate revenue and synergy effects. Third, the business model is highly scalable: advertising on the platform, SaaS revenues from the business solution planned for 2026, and targeted AI personalization are expected to enable exponential growth.

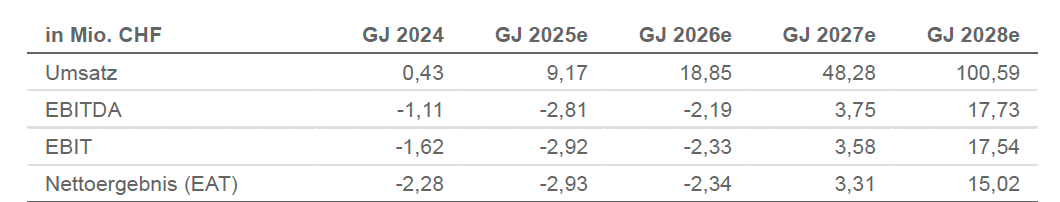

GBC therefore expects naoo to grow rapidly in the coming years: from CHF 9.2 million (2025) to over CHF 100 million by 2028. The lion's share of revenue will come from the digital advertising business of the naoo platform from 2027 onwards. The current user acquisition is key to this: while around 35,000 monthly active users are forecast for 2025, this figure is expected to rise to 4.36 million by the end of 2028. At the same time, increasing user numbers are expected to lead to higher advertising revenues. The influencer business (Kingfluencers) is also expected to grow at double-digit rates and contribute to profits.

After the current development phase, naoo is expected to be profitable at all levels and scale rapidly from 2027 onwards. For 2027, analysts expect operating profit (EBITDA) of CHF 3.75 million, which is expected to rise to CHF 17.73 million by 2028. For context: naoo is currently valued at around EUR 27 million on the stock market. to the GBC study

D-Wave: Soon to hit USD 20?

D-Wave Quantum has shown just how quickly a tenfold increase can happen. It took less than a year for the quantum high-flyer. The Company is now worth an impressive USD 4.6 billion on the stock market. Is there more to come? "Yes," says Cantor Fitzgerald. Despite increased price volatility and a noticeable setback last week, they are clearly optimistic.

Cantor Fitzgerald recently added D-Wave to its coverage. The analysts recommend the technology stock as "Overweight" and see its fair value at USD 20. The stock is currently trading at around USD 15. Analysts believe that quantum computing is still in its infancy but offers enormous potential. D-Wave is delivering impressive growth rates, more than doubling its revenue year-on-year. Overall, the valuation is ambitious in the short term, but the long-term potential of quantum computing justifies this.

Hensoldt: Sell instead of Buy?

Analysts are divided when it comes to Hensoldt. What is clear is that the stock of the radar systems and other defense electronics provider has quickly recovered from its consolidation phase. The stock is currently trading at EUR 103, not far from its all-time high of around EUR 109. For context: at the beginning of the year, the share price was still just under EUR 34.

Yesterday, Deutsche Bank raised its target price significantly. Analysts believe that Hensoldt is strategically well-positioned. Due to its focus on the German defense market, the Company should benefit from possible budget increases and new defense projects. They therefore continue to recommend Hensoldt shares as a "Buy" and have raised their target price from EUR 62 to EUR 111.

Jefferies points out one risk. The analysts refer to the European air combat system, FCAS. As is almost always the case with European defense projects, there are strong political interests at play here. France, in particular, wants to give preference to its domestic industry. This could be to the detriment of Hensoldt. Jefferies' price target for Hensoldt shares is only EUR 60. Therefore, they consider the stock to be an "Underperformer".

Social media, quantum computing, and defense are industries of the future. With its AI approach, naoo could become a European alternative to the large networks. Then, a multiplication should be possible. The consolidation at Hensoldt, RENK, and Rheinmetall came to a quick end. Perhaps too quickly? D-Wave still appears to be the core investment in the field of quantum computing.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.