September 28th, 2023 | 08:05 CEST

Attention: Extended correction - Buy the right stocks now! Bayer, Viva Gold, TUI, and BASF are on the list!

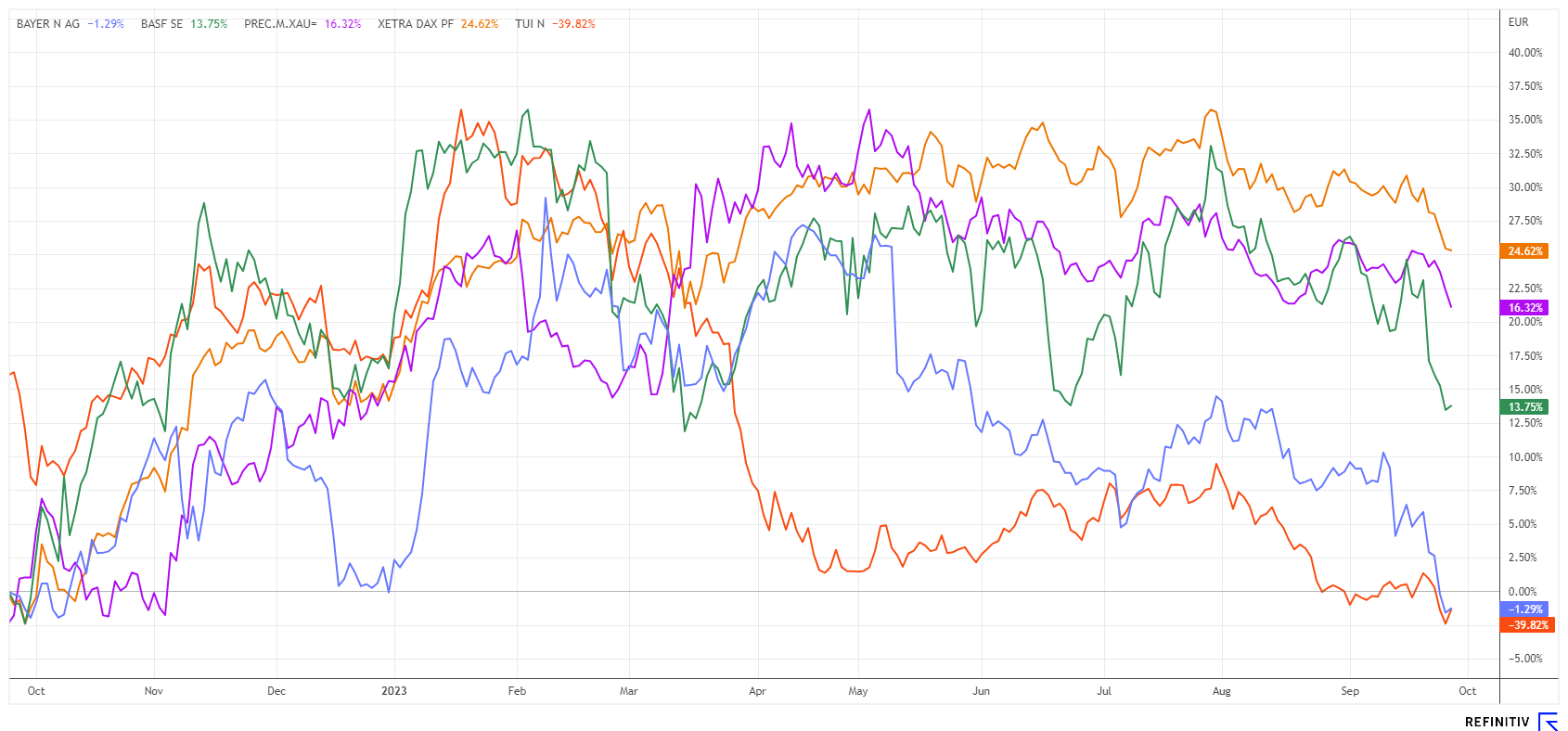

Higher inflation and rising interest rates - this connection should be clear to investors. The interest rate level in Germany has moved from negative territory to 2.77% in the 10-year range, but stocks continued to rise cheerfully. The party led to all-time highs of 16,528 points in July, but the fundamental situation of the companies deteriorated in parallel. Only after repeated warnings from the US Federal Reserve did the explosive NASDAQ also enter a correction. And it continues. Yesterday, the CEO of US investment bank JPMorgan, Dimon, warned that the world may not be prepared for 7% capital market interest rates. He and Dr. Jens Erhardt, the CEO of the asset management company DJE, warn of stronger setbacks on the stock markets. Some stocks have already undergone a strong correction. Here is a brief overview.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , VIVA GOLD CORP. | CA92852M1077 , TUI AG NA O.N. | DE000TUAG505 , BASF SE NA O.N. | DE000BASF111

Table of contents:

"[...] One focus will be on deposits near the surface. These would be good arguments for a quick production decision using the low-cost heap leaching method. [...]" Brodie Sutherland, CEO, Tocvan Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer and BASF - Now is the time

In an uncertain environment, investors seek stability for their portfolios. Two well-known DAX-listed stocks have undergone significant corrections in recent weeks and now appear attractive: Bayer and BASF.

Bayer has caught another lawsuit in the US for alleged late effects of the chemical PCB, which has been banned for decades. The city of Chicago is suing the Company for alleged water, air and soil pollution by PCB chemicals. Bayer has recently been able to settle out of court, but in the current allegations, it sees third parties as responsible. On the Refinitiv Eikon platform, there are 13 buy recommendations, 8 neutral votes and 2 sell recommendations. The average target price for 12 months is a high EUR 66.25, 44% above the current level of EUR 46. Those who buy now will have a 2023 estimated P/E ratio of 7.4 and will also receive a 4.5% dividend yield.

The ifo Business Climate Index reading at 85.7 points has not been favorable for BASF stock. In the course of the week, the title lost over EUR 4 to currently EUR 42.2 without a new outlook. Nevertheless, rumors are increasing that some negative aspects may come to light on October 31 when the Q3 figures are reported. Reflecting the challenging situation, Swiss bank UBS has downgraded the stock to "Sell" with a target price of EUR 37. Weak sales and margin figures are expected in the current quarter.

Berenberg and Jefferies have at least left their vote at "Hold", but the price targets are also not exhilarating at EUR 50 and EUR 42, respectively. Somewhat higher than in the case of Bayer, BASF shares are currently bought with a 2023 P/E ratio of 11.5. Management has not yet corrected the expectation of a 7.3% dividend. **Bayer and BASF are a long-term buy, in our view, but could give up a few more euros in the course of a major correction.

Viva Gold - A lot of gold in Nevada

The US Federal Reserve temporarily calmed nerves by suspending interest rate hikes after 11 consecutive increases. However, they verbally indicated that future inflation data will remain a determining factor for the rate hike trajectory. Since inflation is widely expected, the stock markets started a temporary correction. The precious metals gold and silver have so far not been able to benefit from monetary devaluation; relative price stability prevails here in the corridor of USD 1,860 to 1,930 and USD 21.70 to 23.50, respectively. However, more is needed for a higher valuation of gold assets. Experts warn that if interest rates continue to rise, there will be problems for the liquidity of banks and insurance companies. The shift from below zero to the current 4.5% in the long-term interest rates has created significant losses in bond portfolios.

Canadian explorer Viva Gold (VAU) does not have to rush to bring its holdings to light. The Company has scaled back some activity on its 4,250-acre Nevada property and is keeping cash balances high. However, we expect drilling activities to continue in the fall. The Company's Tonopah project lies within the historically prominent Walker Lane, where Kinross, Coeur Mining, Augusta and Centerra also operate. A preliminary economic assessment is evaluating a potential open pit operation with gold recovery by heap leaching. The area hosts approximately 600,000 ounces of gold. Management is looking to reduce risk in the Company through further development and resource build-up but is also considering value-enhancing asset sales. Currently, the Company is working on engineering and environmental baseline studies. The project's location in Nevada is prime.

Viva Gold has issued 106.7 million shares, with Dundee, RAB Capital, Pointillist and Myrmikan Capital strategically on board and 40% remaining in free float. A price of CAD 0.13 is reasonable and values the Company at a low CAD 14 million. **With a renewed Preliminary Economic Assessment (PEA) in the fourth quarter of 2023 and a bullish gold price, Viva Gold has the potential to make a rapid upward turn. Stay vigilant and keep an eye on it.

TUI - Another new low

The TUI share reached a new all-time low of EUR 4.90 on September 26. The strong pressure on the tourism stock is not very catchy for inclined investors. After all, the huge capital increase in April raised more than EUR 1 billion, which brought the balance sheet back into line. According to management, travel activity is also very high in 2023, with increased prices even bringing sales close to the level of 2018/19, the pre-pandemic season. Despite a well-running summer business and positive statements about the beginning winter season, the mood for the share does not want to improve. The overlying reason, of course, could be economic fears, as declining household budgets primarily weigh on travel.

There has been a lot of news on the Refinitiv Eikon platform in recent days. While Barclays advises "Underweight", the price target was raised to around EUR 7.50. Jefferies, UBS and Bernstein only see a "Neutral" rating, but the price targets were adjusted upwards, in some cases drastically, such as Jefferies from EUR 2.10 to EUR 6.10 per share. For earnings per share, the ratings are between EUR 0.37 and EUR 1.21, i.e. on average around EUR 0.80. This gives a current P/E ratio of 6.2. After a good two years of share price debacle, strong nerves are needed, but the level is attractive for an initial or subsequent purchase.

September rarely shines with rising prices. In addition to geopolitical risks, there are strong doubts about a growing economy. This weighs on the standard stocks in the DAX and also brings second-tier stocks under pressure. However, laggards such as TUI or Viva Gold can quickly experience a revaluation due to the low price level.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.