August 18th, 2022 | 13:50 CEST

Apple, Tocvan Ventures, Valneva - More returns through innovation or risk hedging?

Innovations are hailed as market drivers. The more innovative a company is, the more likely it is to stay ahead of the competition. But this requires loyal customers who also support these innovations. And Apple has just such a customer base, setting a good example that loyalty must be rewarded for innovation. In contrast, pharmaceutical company Valneva has the challenge of exposure to different development cycles in the healthcare market. If only because of the duration of clinical studies, which rightly have to go well before a new product comes onto the market. This time, nature lovers could benefit. Those who find all this too volatile and unpredictable should once again turn to commodities as a hedge. With Tocvan Ventures, a candidate is in the running that looks very closely at optimizing the costs of its operations - to the benefit of investors.

time to read: 7 minutes

|

Author:

Juliane Zielonka

ISIN:

APPLE INC. | US0378331005 , TOCVAN VENTURES C | CA88900N1050 , VALNEVA SE EO -_15 | FR0004056851

Table of contents:

"[...] One focus will be on deposits near the surface. These would be good arguments for a quick production decision using the low-cost heap leaching method. [...]" Brodie Sutherland, CEO, Tocvan Ventures

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Apple - With loyalty to new share price highs

The developers from Cupertino in California are doing a great job these days. Step by step, new product launches, such as the latest Apple Watch, are making it clear just how much the networking of end devices will benefit loyal users. For example, the new Apple Watch Series 8 will offer numerous health functions, including body temperature measurement and sleep apnea detection. Blood glucose monitoring and blood pressure measurement are also two other valuable functions that will soon be available. Hypertension, in particular, is an insidious unnoticeable death. Worldwide, 9.4 million people die each year as a result of the untreated disease. Regular physical activity, a healthy diet and low stress are the best ways to prevent elevated blood pressure. Abstaining from alcohol also helps to reduce the risk.

From an investor's perspective, Apple's strong moat is one of the reasons why Credit Suisse analysts guaranteed the Company an "outperform" rating yesterday. The economic moat, popularized by Warren Buffett, refers to a company's ability to maintain its competitive advantages over its rivals and thus keep its profits and market share ahead of rival players over the long term.

These include high switching costs, for example. Suppliers and customers are exposed to high switching costs if they switch from Apple and its ecosystem to another supplier. That reduces the likelihood that competitors will be able to wrest significant share away from the market leader.

Brand loyalty is also a strong factor that puts Apple ahead of its competitors. Users would entrust their health data to the Californians rather than their own health insurance company. Apple fans are also enthusiastic about the product design, ease of use and innovative strength. And perhaps such a ten-bagger in the depot will later become part of the personal retirement provision. Apple also shows its loyalty to its shareholders.

Credit Suisse analyst Shannon Cross pointed out that Apple returned USD 100 billion to shareholders via dividends and share buybacks in fiscal 2021 alone. The Company has also increased its dividend for the tenth consecutive year and invested USD 90 billion in share buybacks. Cross raises its rating on Apple to "outperform" from "neutral." At the same time, the price target for the Company's shares is raised from USD 166 to USD 201.

Tocvan Ventures - Low production costs thanks to smart site selection

For some investors, data is the new gold. But gold itself, just like Apple, has countless loyal fans. Tocvan Ventures is a Canadian-based resource company dedicated to acquiring, exploring, and developing mineral properties. Tocvan Ventures was launched to address the ongoing crisis in the junior mining exploration sector.

The management team, led by CEO Brodie Sutherland, has spent considerable time and energy evaluating and identifying ventures that can become successful. Tocvan Ventures currently has approximately 36 million shares outstanding and is already generating profit with two projects in Mexico. The flagship Pilar gold project and the El Picacho gold project are in Mexico's Sonora state.

"Not only tourists but also mining companies are happy about lower costs in Mexico. While you often have to take a helicopter in Canada to reach projects, in Mexico, you take a normal vehicle. This advantage becomes even more obvious when it comes to bringing drilling equipment to the property. In Canada, this sometimes takes a week. In Mexico, it takes a day. The costs for exploration are also significantly lower. For example, we pay around CAD 50 per meter for drilling. Elsewhere, this amount is significantly higher. The bottom line is that our costs are about 25% lower than in other well-known mining regions," says CEO Sutherland, explaining the advantages of the location in the interview. It is clear that the production costs also already consider the shareholders, who also benefit from the low costs through optimized operating costs of the young company.

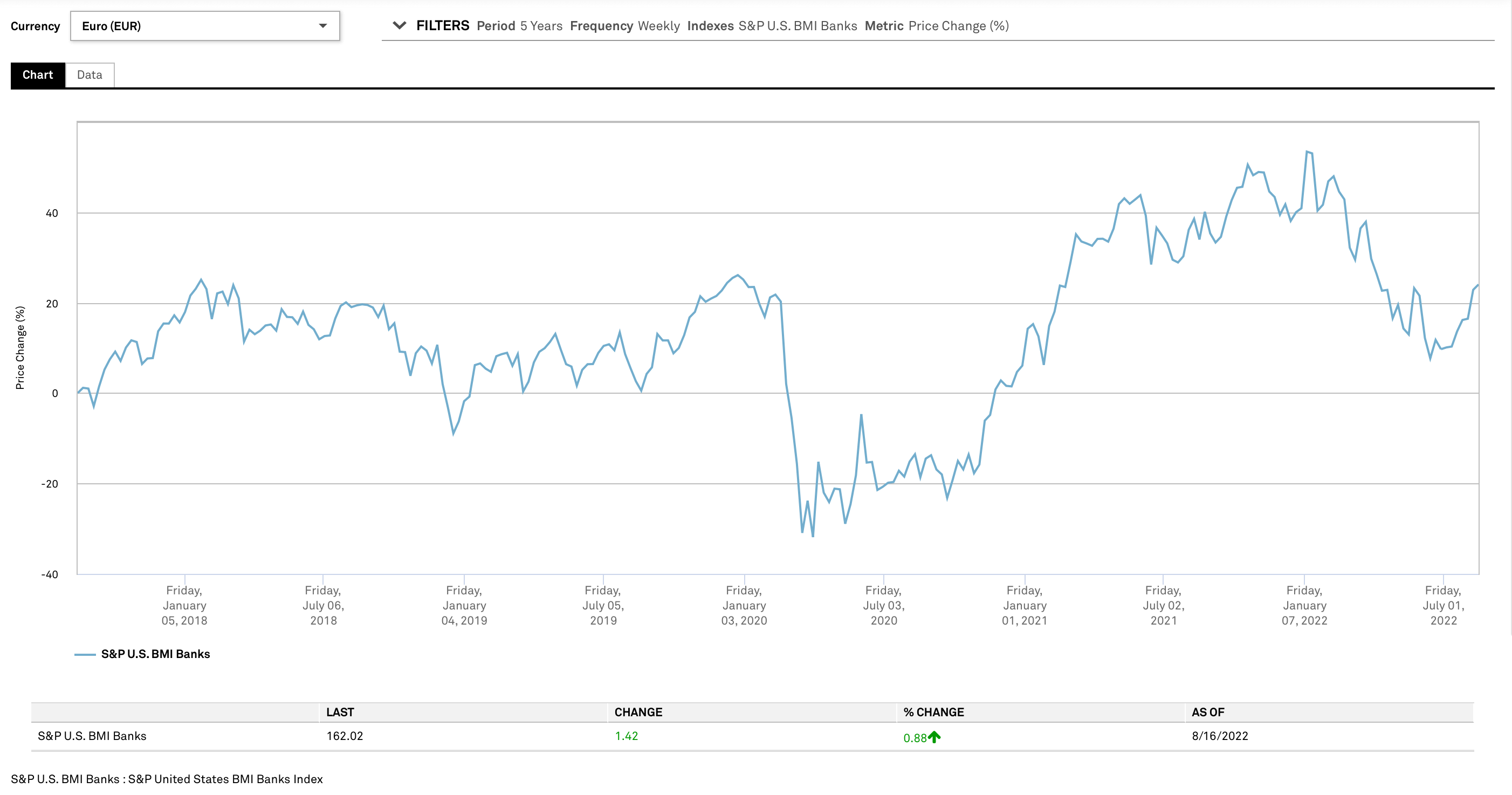

A chart from S&P Capital IQ Pro illustrates how the gold price has developed over the last five years. The development of the gold price is strongly influenced by the US currency and US yields. Once the US dollar and yields reach or approach a peak, it is likely that the price of gold will rise in the coming years. Gold continues to serve as a safe haven for portfolio diversification.

According to Bloomberg, FS Investments believes that gold prices will recover after about a year when the US Federal Reserve shifts to a looser monetary policy. However, prices could fall before then as the central bank continues to shrink its balance sheet.

Valneva: With the scare factor for the next vaccine development

Nature lovers and dog owners know the problem: after a nice excursion through fields, forests and meadows, unpleasant guests often make themselves felt the next day: Ticks. Inconspicuously, they bite into the skin of their host and suck themselves full of the blood of their new carrier. In the process, their bodies can expand fivefold. In no time at all, the little crawling dot turns into an arachnid over 1 cm in size with eight legs - and correspondingly scary potential because ticks love wet areas such as armpits, private parts or the bends of the knees.

Removing ticks can lead to infection with Lyme disease. It is an infectious disease caused by bacteria of the species Borrelia burgdorferi (Borrelia). In Europe, there are about 200,000 cases per year. Worldwide, more than 14% of the world's population has tick-borne Lyme disease.

The disease manifests through symptoms such as fever, headache, fatigue and a characteristic skin rash. If left untreated, it can spread to the joints, heart and nervous system, leaving permanent damage.

Even during the Corona pandemic, people were drawn out into nature. You can prevent tick bites or increase protection in the future with a vaccination from Valneva. Valneva is a pharmaceutical manufacturer focused on producing specific vaccines against infectious diseases. Now that the race for the Covid vaccines seems to have run its course, a vaccine candidate with high potential could be in the pipeline here.

Valneva's planned VLA15 is the only Lyme disease vaccine candidate currently in clinical development. It can target up to six subtypes of Lyme disease, the most common in the US and Europe.

Interestingly, Valneva is collaborating with Pfizer in the development of this vaccine. Data from the Phase 2 studies continue to show strong immunogenicity in adults and children, with acceptable safety and tolerability profiles in both study populations. In order to protect against Lyme disease, it is best to prevent tick bites. Not by refraining from nature walks, but by wearing closed shoes, long socks, and long pants and shirts. From an investor's point of view, this vaccine development is just a drop in the bucket of increasing the Company's value.

Innovations thrive on trial and error. This phase should be carried out by the Company within its research and development department so that no customer is disappointed when it enters the market. Apple always manages to inspire its loyal buyers anew. The in-house ecosystem is growing, and health data processing will soon be professionalized. These benefits, combined with brand loyalty, increase the economic moat that puts the Company ahead of its competition. Without patents and without speed in market penetration, an innovation can also become a burden. For example, Valneva suffered setbacks in the battle for the COVID-19 vaccine because development took too long and the market already seemed saturated. Now the pharmaceutical company is focusing on small niches, such as the fight against Lyme disease, in order to be the first in the market to achieve economic supremacy. They are not entirely alone because joint venture partner Pfizer accompanies them. The big pharma player is well versed in negotiating with governments as a contractual partner in vaccine purchasing. Those who want some peace of mind in their portfolio to set up a counterweight should take a closer look at Tocvan Ventures. The young Canadian company has two promising gold projects in Mexico. Its choice of location optimizes its running costs, which in turn benefits shareholders. Gold as a risk offset in the form of exploration and production companies serves as diversification. The gold price has been on an upward trend for the last five years.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.