February 11th, 2026 | 07:05 CET

Antimony Resources: This stock is impossible to ignore!

The strategic reserve of critical raw materials and rare earths announced by the United States underscores the profound transformation underway in the commodities sector. Geopolitics is becoming a decisive factor in the valuation of raw material assets. States and governments, as a new and, in the future, the most important investor group, are prepared to pay high and strategically motivated prices to secure supply. Antimony Resources is set to benefit massively from this development. The Canadian company owns the largest antimony deposit in North America. Antimony is indispensable, particularly in military and security-critical applications.

time to read: 3 minutes

|

Author:

Carsten Mainitz

ISIN:

ANTIMONY RESOURCES CORP | CA0369271014

Table of contents:

Author

Carsten Mainitz

The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Tag cloud

Shares cloud

Antimony – The little-known but practically irreplaceable critical raw material

The critical raw material antimony plays an important role in key industries of national economies and is gaining strategic importance due to the tense current geopolitical situation. The market is currently heavily dominated by China, Russia, and Tajikistan. Prices have already risen significantly in the past.

The most important area of application for antimony is in military and security-related fields, where antimony is practically indispensable. The list of applications is long and includes special alloys, ammunition, optical systems, infrared technology, and electronic components. Antimony is also widely used in flame retardants.

Initiatives such as those of the US government are now focusing on the occurrence of critical raw materials in Western industrialized nations, as their importance for economies and supply chains is enormous. At the same time, the dominance of China and other politically difficult regions in critical raw materials is overwhelming.

Antimony Resources – It is only a matter of time

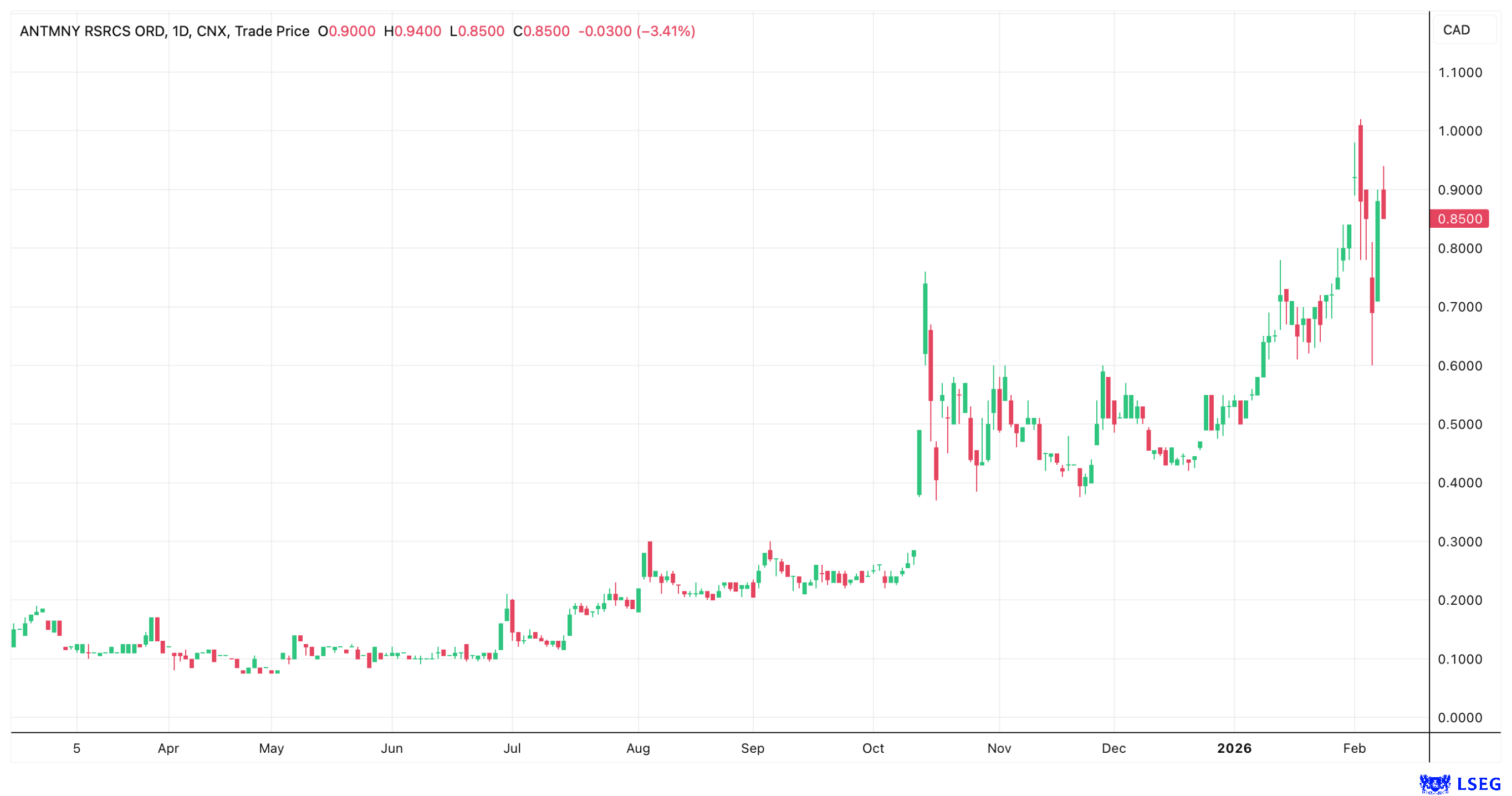

It is therefore only a matter of time before the stock undergoes a massive revaluation. The company is currently valued at only around CAD 80 million. The stock has already performed well. However, the facts and potential speak for themselves.

Antimony Resources' 1,100-hectare flagship Bald Hill project in the Canadian province of New Brunswick represents the largest antimony deposit in North America. A technical report last year already gave an initial impression of its potential value. The report highlighted that the Bald Hill project comprises around 2.7 million tons of rock with antimony grades of 3 to 4%. This translates into an "occurrence" of 81,000 to 108,000 tons of pure metal.

In terms of the project's economic viability and value, the resource determination in accordance with Canadian Standard 43-101, announced for spring 2027 at the latest, will be decisive. Along the way, new drilling data will provide further important indications and impetus. The company has already raised CAD 9 million for the drilling program and is thus fully financed.

It can already be stated that the past drilling data and the technical report prove that Bald Hill is a high-grade, world-class property with geopolitical significance that is increasingly on the radar of governments and states.

Large, high-grade antimony deposits

Extensive drilling programs totaling more than 13,800 meters have already been carried out on the property. The accelerated pace is also reflected in the fact that more than 8,000 meters were drilled last year alone. All results speak the same language and confirm a high-grade and extensive system with high antimony mineralization.

Current and historical results confirm that 75% to 80% of all drill holes contain high-grade antimony-bearing stibnite mineralization. In the recent past, Antimony Resources reported further massive antimony-bearing stibnite deposits ("Sb") with 5.10% Sb over 4.0 meters, 2.15% Sb over 6.85 meters, and 2.38% Sb over 9.60 meters.

Most recently, the company reported the expansion and delineation of further massive stibnite mineralization in the Marcus Zone - the mineralization was exposed in the bedrock over a length of 25 meters. The Marcus Zone is located west of the Main Zone and was discovered last year. The Canadians suspect that this is a separate zone with great potential and are planning additional trenching and sampling here for the 2026 exploration season. According to the company, delineation of the mineralization in the Main Zone at Bald Hill has recently begun with two drill rigs. A third drill rig will be added soon.

Main Zone as key

The key focus of the current campaign is extension drilling in the Bald Hill Main Zone over a length of 600 meters and to a depth of at least 300 meters. The Main Zone was significantly expanded last year and now extends over a length of more than 700 meters and a depth of more than 400 meters.

Sufficient and high drilling density is essential for the preparation of an initial resource estimate. Drilling density describes how closely or how frequently drill holes are distributed within an area - that is, the spacing of the holes in both horizontal and vertical dimensions. Only with this information can ore deposits and mineralization grades be accurately determined.

The enormous revaluation potential of the share is striking. The share should be among the top performers of the small caps in the next 12 to 15 months. Currently, Antimony Resources is only granted a modest company valuation of CAD 80 million. New drilling data and the gradual approach to the first resource estimate will likely lead to a successive revaluation of the stock. The geopolitical weight of North America's largest antimony deposit is simply too great. Governments and states will change the market and drive up prices for strategic assets.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.