June 12th, 2024 | 07:15 CEST

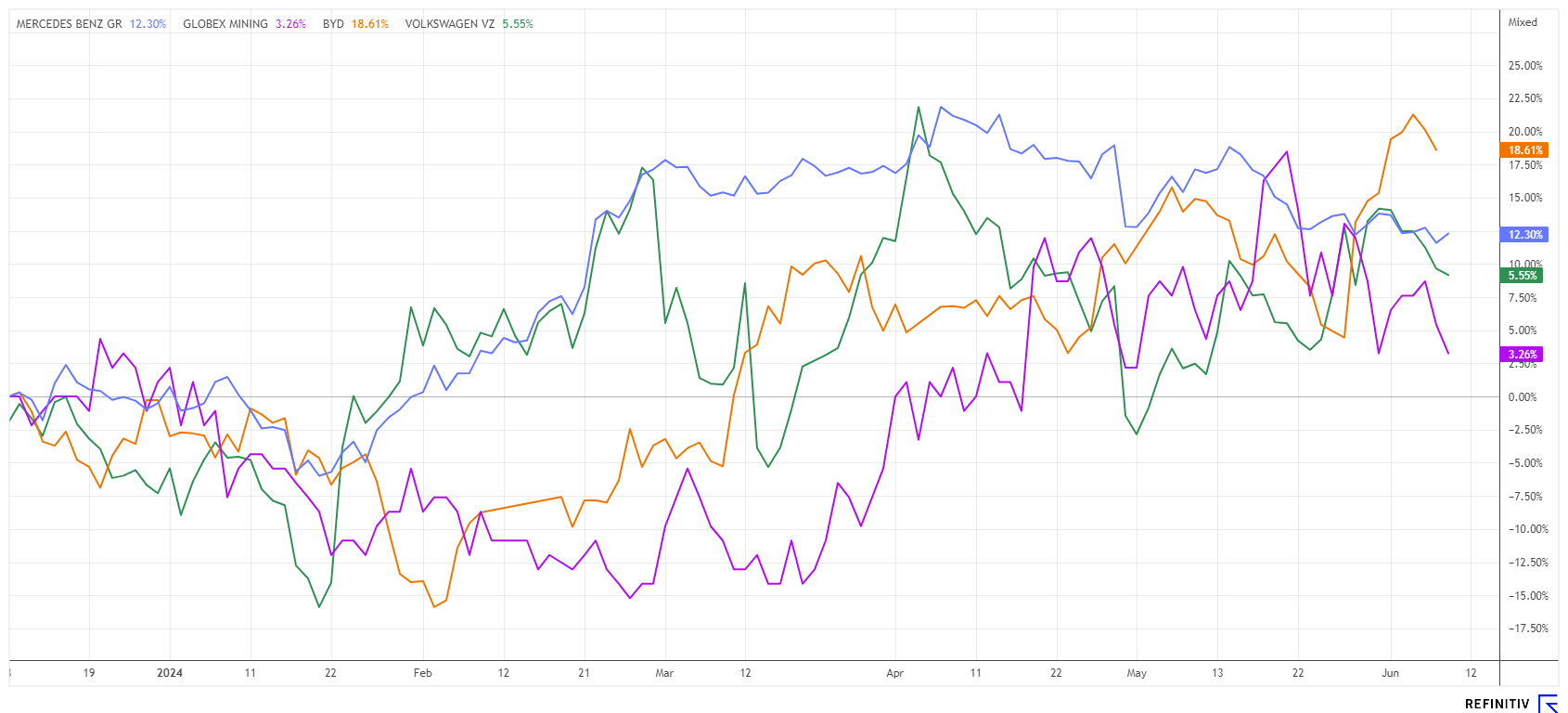

After the election, buy a combustion engine now? Mercedes-Benz, Volkswagen, Globex Mining and BYD on the test track

The crushing defeat of the green camp in the EU elections has caused a stir in the automotive industry. Will the ban on combustion engines be overturned in favour of a general openness to technology? It is well known that the best conventional vehicles come from Germany, and they are demonstrably no more harmful to the climate than current e-vehicles. Voters have finally lifted the green veil, and the doctrine of the know-it-alls is now in retreat. From a climate perspective, investing in battery storage systems makes sense, but they do not necessarily have to be installed in vehicles. How can investors benefit from the current situation?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , MERCEDES-BENZ GROUP AG | DE0007100000 , GLOBEX MINING ENTPRS INC. | CA3799005093 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] We have a clear strategy for neutralizing sovereign risk in Papua New Guinea. [...]" Matthew Salthouse, CEO, Kainantu Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Volkswagen - Entry into the energy storage business

The Volkswagen Group started its electrification efforts relatively late but is now stepping on the gas. The ID.2 e-vehicle, which costs less than EUR 25,000, is now scheduled to be launched in 2026, potentially allowing VW to compete with affordable Far Eastern manufacturers. The Wolfsburg-based company also plans to increase its involvement in the energy storage sector. A EUR 10 billion gigafactory is being built in Valencia, where over 3,000 jobs will be created. Furthermore, the Company has announced its entry into a new business segment with the charging and energy brand Elli. Elli will develop large, universal battery storage projects. The initial projects with 350 megawatts of storage are already in the pipeline. VW is thus opening the door to commercial and industrial energy storage. As the mass automobile business has been causing margin problems for years, diversification into other areas is not the worst idea for the Company.

At current prices of around EUR 112, the share price is not far off its low for the year of EUR 108. Fundamentally, a closer look should now be taken at the VW share because if you believe the experts on the Refinitiv Eikon platform, the P/E ratio based on the 2024 estimates is only a low 3.7. Although the expected sales of EUR 325.4 billion are only 1% higher than in 2023, it should not be forgotten that Germany is on the verge of a recession. Private household budgets are groaning under the high tax burden from Berlin, and little will change in the short term.

Mercedes and BYD - EU tariffs on Chinese e-vehicles in the pipeline

According to Mercedes CEO Ola Källenius, automotive circles expect a decision from the EU Commission on introducing punitive tariffs on electric vehicles from China soon. There are currently many rumors about the outcome of the investigation, which has been ongoing for months. The EU Commission accuses China of distorting competition by subsidizing domestic electric vehicle manufacturers. Källenius has publicly advocated for free trade, provided the rules are fair.

The German government and the German vehicle industry are very critical of higher tariffs against Chinese vehicle imports out of concern about retaliatory measures by the government in Beijing. China is the most important sales market for German vehicle manufacturers, who produce locally for the Chinese market but also import many vehicles from there. Currently, every second vehicle imported into the EU from China comes from European manufacturers. It remains to be seen whether the EU will find the right course of action here, as German imports should theoretically also be subject to these tariffs. This is because German manufacturers are taking advantage of the favorable cost ratios in Asia.

Interest in Chinese e-vehicle models has increased significantly among German customers in recent months. Manufacturers such as BYD, until recently virtually unknown, are enticing customers with attractive models that are putting German manufacturers under noticeable pressure. The Chinese manufacturer's pricing policy is based on the assumption that government subsidies will be extended beyond 2025. As a result, BYD offers vehicles in the EU at an average of 20 to 25% cheaper. The market share is admittedly still homeopathic, but this could change quickly if the high prices for European products are no longer readily paid by consumers.

A valuation comparison is interesting. VW and Mercedes-Benz are analytically valued at less than half the value of BYD. Analysts on the Refinitiv Eikon platform estimate Mercedes's 12-month price targets at an average of EUR 87, representing a premium of 34% to the current share price.

Globex Mining - Profiteer of the metal shortage

The metal rally in the commodities market is not passing Globex Mining's stock unnoticed. The Canadian explorer and asset manager's share price has already risen by over 30% at times. In recent days, falling spot prices for precious metals have triggered some profit-taking. Currently, CEO Jack Stoch oversees 248 projects and has easily liquidatable stocks and cash totaling around CAD 25 million.

On the Lac Escale license property (James Bay), cooperation partner Brunswick Exploration is drilling for lithium. Highlights include 1.64% lithium oxide (Li2O) over 69.3 meters in hole MR-24-61 and 1.17% Li2O over 28.3 meters in hole MR-24-50. Globex will receive a 3% royalty on the Lac Escale lithium claims when the project goes into production. With rising lithium prices, this is certainly a medium-term issue.

There are plenty of reasons to invest in Globex. On the one hand, there is the exploding demand for copper, which should remain high due to increasing global electrification. In the current year, the copper price has already shot up from USD 8,500 to USD 11,200 per tonne, recently consolidating again slightly, but the upward trend is well established. With 55.2 million shares issued, Globex's market capitalization is currently only around EUR 35 million. This low valuation continues to attract new groups of buyers in addition to commodity fans.

2024 is establishing itself as a commodity year. Industrial metals like copper, nickel, and uranium have already seen major upward movements. Precious metals are also becoming more relevant due to high inflation. Automotive stocks process all types of metals and are very concerned about the stability of supply chains. The situation is completely different at Globex Mining, where what others urgently require is lying dormant in the ground.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.