July 5th, 2023 | 07:55 CEST

666% rally in 5 years - can Nucera do even more? BioNTech, BioNxt Solutions, and Plug Power could be the winners!

The story of the Mainz-based biotech company BioNTech has set a precedent over the last 5 years. With a remaining gain of 666%, it still ranks among the best performers on the German stock market, even after a 75% price decline. Such movements usually take place on the NASDAQ, where it is easy for highly innovative technology or biotech stocks to raise the necessary growth capital. But not every stock market story is so positive. We go on a pearl diver's journey.

time to read: 3 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , Bionxt Solutions Inc. | CA0909741062 , PLUG POWER INC. DL-_01 | US72919P2020 , THYSSENKRUPP AG O.N. | DE0007500001 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nucera and Plug Power - Power plays in the hydrogen sector

With great anticipation, investors are looking towards Duisburg. Steel and technology group ThyssenKrupp, based there, is currently floating its hydrogen subsidiary Nucera on the stock market. The 30 million shares are being offered in a price range of EUR 19.00 to EUR 21.50, with the books closing today. For ThyssenKrupp, there will only be a few euros from the placement, as the bulk of the issue proceeds of EUR 494 million to EUR 560 million will go to the subsidiary as growth capital. The IPO is taking place in a tense environment. Although almost all indices worldwide are at all-time highs, the H2 sector is still struggling with sell-off prices. ThyssenKrupp Nucera has had a higher market capitalization than its Norwegian competitor Nel ASA from the outset and is still some 100% behind sector leader Plug Power.

However, the entire sector is still ambitiously valued. Price-to-sales ratios of 10 to 15 are not uncommon. Nucera is a notable exception. Since 2020, it has increased its sales by 50% to EUR 383 million. Unlike its competitors, Nucera was already profitable in 2022, even if no money is currently being made in the industry. The Company is debt-free and already holds EUR 300 million in liquidity even before the listing. It is, therefore, exciting to see how the new value will fit into the industry. There is already one winner: the balance sheet of the parent company, ThyssenKrupp, gets a nice boost, as 66% of Nucera shares remain in the vault!

BioNTech - Plenty in the till, hardly any movement on the stock market

As of Monday, two courts will be dealing with claims for damages against manufacturers of Corona vaccines. The lawsuit of a 58-year-old man is being heard in Baden-Württemberg because of damage to the health of one eye, which he attributes to a Corona vaccination from BioNTech. The sum claimed is EUR 150,000, and it is also to be determined whether the vaccine manufacturer is liable to pay compensation for possible material damage. Thousands of lawsuits are reportedly in the pipeline worldwide, primarily against BioNTech, Pfizer, Moderna and AstraZeneca, all based on insufficient research into the vaccines administered.

The negotiations are likely to span over several years. Whether the plaintiffs will actually succeed remains uncertain, as public institutions had deemed the vaccination as "suitable and safe." Perhaps this is where the plaintiffs should start; BioNTech, at any rate, considers the accusations to be unfounded. On the other hand, the Mainz-based company has made almost EUR 20 billion in profits from the vaccination business, so there should also be room for demonstrably incurred damages. Meanwhile, the chart level of EUR 100 is proving to be a stubborn resistance line for BioNTech. Should it ultimately fall, it should only go up dynamically and abruptly.

BioNxt Solutions - A lot in the pipeline

Strong price movements can currently be seen in BioNxt Solutions because things are moving fast in the pipeline of the Canadians. The specialist for novel coating and delivery technologies for oral drugs is looking for an industrial partner for commercial production. If rumors are to be believed, negotiations are close to completion.

BioNxt Solutions has done a lot of research in recent years and has been active in the Parkinson's disease indication, for example. Nearly 6 million people worldwide currently suffer from this disease, and there is as yet no cure. We hear worrying forecasts from the scientific community: By 2040, more than 17 million people worldwide could have Parkinson's - almost three times as many as today. In addition to the ageing world population, environmental factors such as increased pesticide exposure are also to blame for this development. Researchers are even talking about an impending "Parkinson's pandemic" given the rising numbers.

BioNxt is already prepared for future market dynamics and is steadily expanding its proprietary drug delivery platform. In its negotiations, the Company is targeting net revenue participation of 3 to 6% if the patented processes are licensed out. Currently, the Company is in the early planning stages of a pilot comparative bioavailability study in humans to assess the technology's potential applications. In Germany, the Canadian stock is being traded briskly in some cases in anticipation of further progress. It could be that some investors have already positioned themselves for the next quantum leaps. Highly interesting!

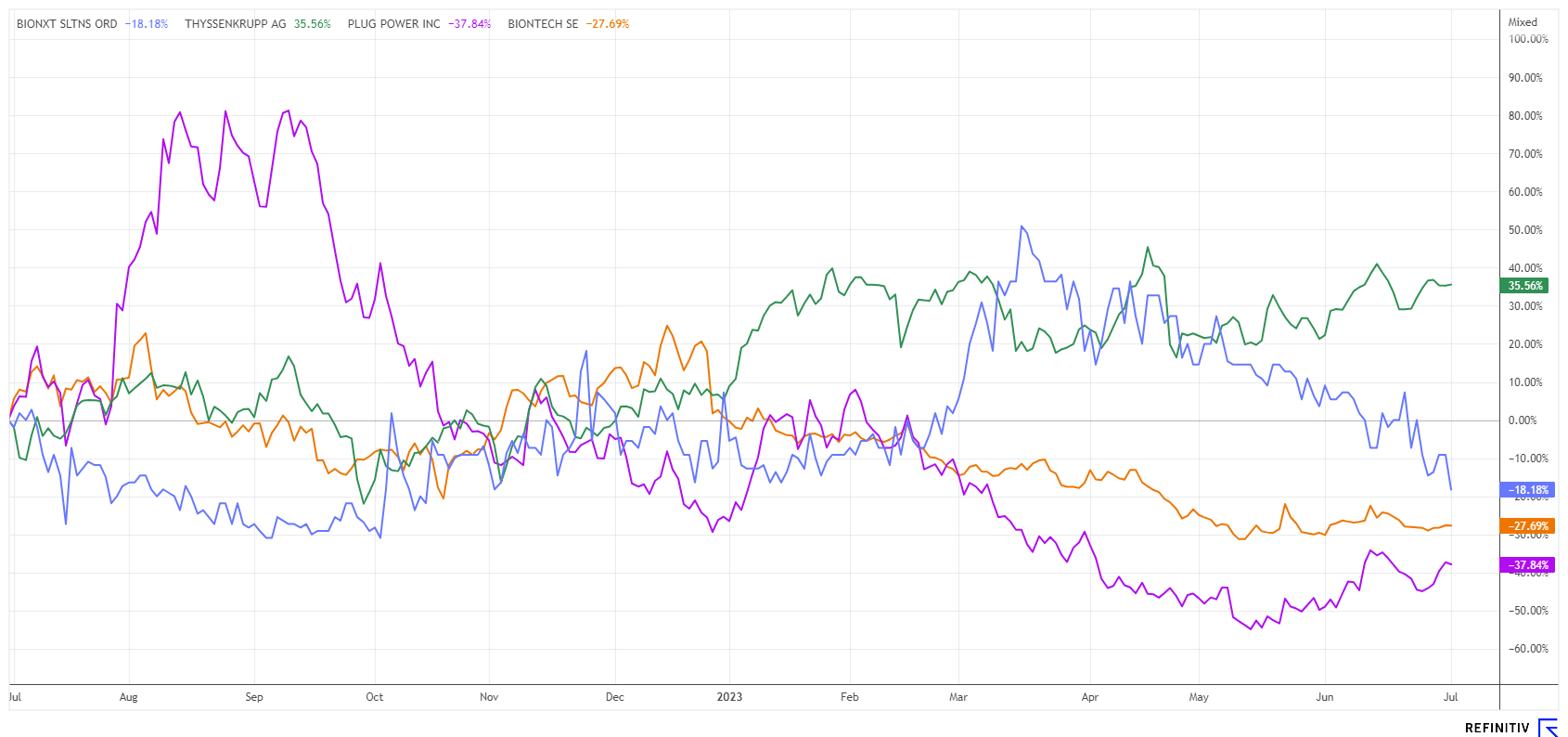

After strong rises, the stock market usually rotates through the sectors. After hydrogen in 2021 and e-mobility in 2022, the artificial intelligence and cloud computing sectors now appear in shining light. Perhaps Biotech, a sector that has so far lagged, will soon be back in focus.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.