May 17th, 2023 | 07:20 CEST

Withdrawal from Russia, Asia says thank you - shares of BYD, Canadian North Resources, and Volkswagen in focus!

The triumphant march of electrification is gathering pace. While European producers are abandoning their production facilities in Russia, a new axis of industrialization is forming between Moscow, Beijing and New Delhi. For symbolic prices, local technology leaders are selling their plants in Russia to investors and speculators. What is no longer delivered to Russia from Europe is now produced by others, such as the Chinese manufacturer BYD, which can hardly be stopped in its expansion policy. It is interesting how a competitive picture can change completely within months. We analyze this a little more closely.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , CANADIAN NORTH RESOURCES INC | CA1364271017 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

VW - Withdrawal from Russia now approved by Moscow

The Russian government has been pushing to modernize its backward car industry for years. For this reason, the Kremlin increasingly sought partnerships between domestic and foreign manufacturers. Moscow also relied on technology transfer and found willing investors in VW and Renault. But the invasion of Ukraine changed everything. After years of building up its business in Russia, Volkswagen is now withdrawing from the aggressor state in a politically correct manner. More than EUR 2 billion flowed into the Wolfsburg-based company's eastward expansion in recent decades. Now Russian authorities have apparently given the green light for Volkswagen to sell local assets.

According to media reports, VW will receive a total of EUR 125 million from Russian car dealer Avilon for the sale of its assets in Russia, which amounts to a 95% write-off. VW had been active in Russia for many years and, in 2007, opened its own factory in Kaluga, almost 200 km southwest of Moscow. In spring 2022, VW, among other Western carmakers, ceased production in Russia. Avilon will get complete control of Volkswagen Group Rus and its subsidiaries, including several companies selling Scania brand trucks. "Currently, Volkswagen AG is in the process of selling its shares in Volkswagen Group Rus and thus also the Kaluga plant with its more than 4,000 employees to a well-known Russian investor," the Wolfsburg-based company disclosed in a press release, without giving further details.

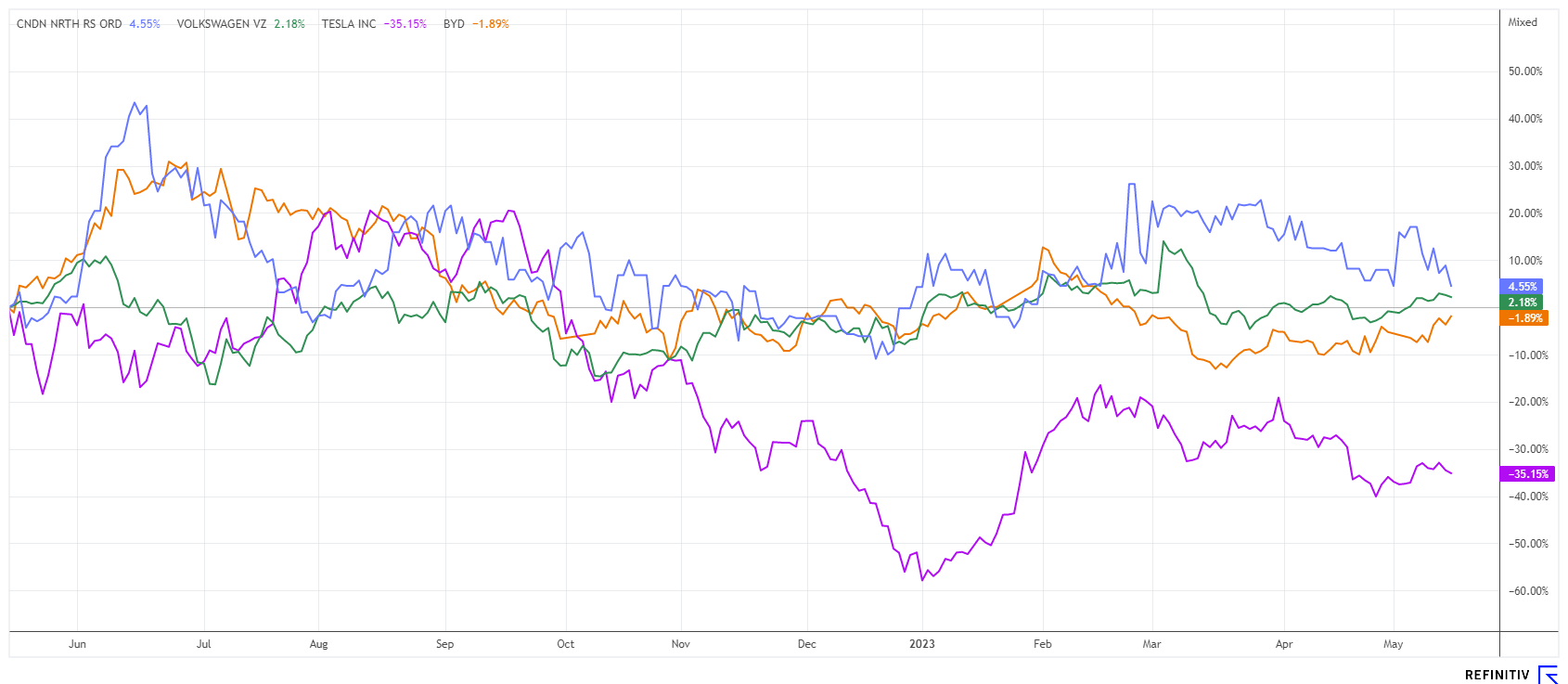

According to the consulting firm Inovev, Chinese carmakers have already conquered the Russian car market. After the withdrawal of European, American, Japanese and Korean carmakers, they have already captured a market share of 42% in the first quarter of this year. International industrial policy has unfortunately become a risky undertaking when geopolitical conflicts are involved. After years of euphoria about Russia, Volkswagen is now getting the receipt. Although the Company is earning more than EUR 15 billion this year, it is losing massive market share, especially in Asia. It is not without reason that the share, down 19.5% in 2023, is one of the worst performers in the DAX. However, a 2023 P/E ratio of 4 is considered too cheap in the medium term.

Canadian North Resources - Exploration plans confirmed by public subsidies

International Greentech manufacturers are under increasing pressure in the supply chain to secure the necessary quantities of critical metals for their high-tech products. Time is of the essence in the climate transition. Western countries are stepping up target-oriented investment programs to generate clean energy and accelerate the construction of electric vehicles and modern energy storage systems. The Biden "anti-inflation act", for example, sets an important course for a CO2-reduced future. With the European Climate Change Act, achieving the EU's climate target of reducing emissions by at least 55% by 2030 becomes a legal obligation.

For this, it needs access to important metals. Canadian explorer Canadian North Resources Inc (CNRI) has identified extensive granitic pegmatites on its Ferguson Lake property that may contain lithium-bearing minerals. "This year, we will continue to expand and upgrade the mineral resources at the Ferguson Lake project," said CEO Dr Kaihui Yang. He added: "We have commenced a 20,000-metre drill programme in 2023 to focus on the high-grade base metal and PGM targets along the 15 km main mineralized horizon and test the lithium potential of the pegmatites on the 256.8 sq km area of mining concessions and exploration prospecting rights." The prospecting zone is located in the southern part of Nunavut within the northern Canadian Shield, which after extensive preliminary exploration, has shown world-class potential for critical minerals such as nickel, copper, PGM, diamonds, lithium, uranium and rare earths.

The Company had about CAD 11 million left in its coffers at year-end 2022. The Nunavut government is now adding CAD 250,000 as a grant for upcoming exploration under the Discover-Invest-Grow (DIG) program. The CNRI share has so far held its ground well in a generally volatile market and is trading at about CAD 2.40. With appropriate exploration results, a breakout to the upside can happen quickly.

BYD - The international triumph of "Build Your Dreams"

It should be well known by now that the Chinese carmaker BYD has grand ambitions. The technology group is already a force to be reckoned with in its home market, and now the management is setting its sights on the international markets. The pace is fast; VW and Tesla have already been overtaken in the Middle Kingdom. An analysis of current satellite images shows a dramatically rapid construction of the factory in Hefei. Barely two years ago, there were mainly fields and a few villages there, but today there are already two fully equipped factories, and a third is under construction.

Industry experts expect a similar pace for foreign market entries. When it comes to electric cars, BYD is already No. 2, right after Tesla. In 2023, more cars could roll off the assembly lines than those of the German premium manufacturers BMW and Mercedes. The fact that the brand is not yet known to many people in this country is all the more proof of the potential that still lies dormant in the Chinese company. In any case, the product range is already very competitive and can entice with a 35% discount to purchase a similarly equipped vehicle "Made in China". BYD manufactures essential components such as batteries and chips itself, making production much cheaper than many competitors and increasing margins accordingly.

On the Refinitiv Eikon platform, 30 experts give verdicts on the Chinese stock. There is currently no sell recommendation among them, and the 12-month price target is CNY 353 on average - 33% above the current price of CNY 265. With a 2023 P/E ratio of 24.8, BYD shares are not cheap, but they are a clear darling of investors.

The fight against global warming is leading to completely new conditions in the field of mobility. Germany has always been a guarantor of good engine technology, but this now seems to have become unimportant, as the triumphant advance of the e-mobile has already begun. This increases the demand for critical metals. Canadian North Resources can therefore be a good addition for speculative investors. VW and BYD are internationally known blue chips with high substance.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.