April 18th, 2023 | 08:50 CEST

With the shutdown of nuclear power plants comes the end of nuclear power! Siemens Energy, Defense Metals, Rheinmetall, E.ON - Greentech stocks on the rise

Now it is done. The German government is implementing the decision from 2011 with a slight delay due to the crisis and is taking the last three remaining nuclear power plants off the grid. Those who expected a blackout were proven wrong, at least over the weekend. Federal Economics Minister Habeck predicts a complete CO2 renewal for Germany and believes that Germany as an industrial location does not need nuclear power to be profitable. He also believes that electricity prices will fall again in the long run. The primary utility E.ON, however, did not hesitate to combine the nuclear phase-out with a hefty increase in electricity prices by about 45%. After all, what is currently easier to sell to end consumers than an imposed price squeeze that they no longer want to carry on their own books? Politically highly questionable, but a good opportunity for Greentech shares.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , DEFENSE METALS CORP. | CA2446331035 , RHEINMETALL AG | DE0007030009 , E.ON SE NA O.N. | DE000ENAG999

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Siemens Energy - If not now, when?

It is annoying when large electricity suppliers jump on the nuclear phase-out bandwagon immediately and increase the prices significantly when switched off, even though the current purchase price on the electricity exchanges has long since been on its way down again. At least publicly, the billion-dollar enrichment of electricity companies at the expense of the worried end consumer, who has to accept another budget increase for their household expenses due to the ongoing crises, is being sharply debated.

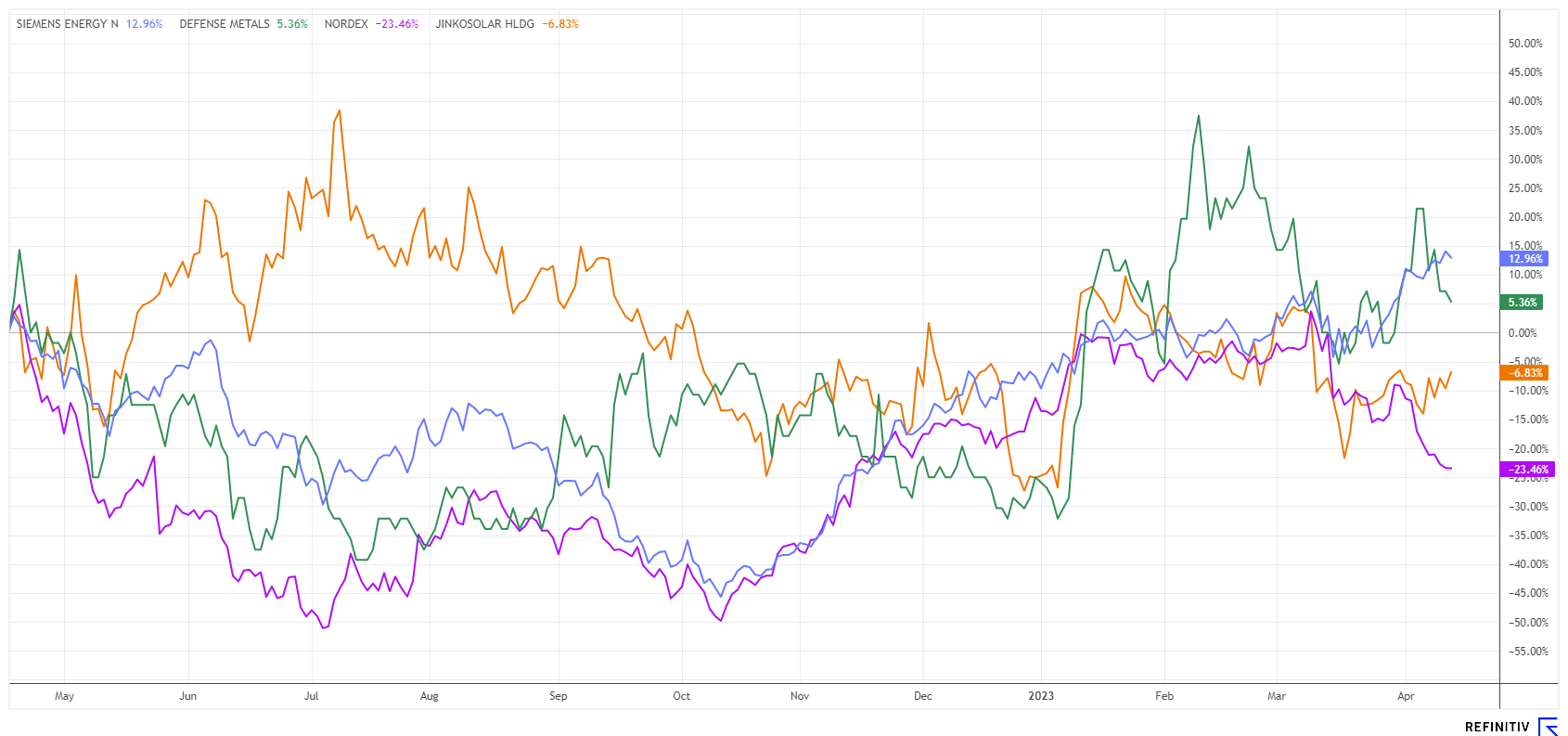

The fact is that fossil fuels are becoming more and more expensive. One might think this is an excellent opportunity for alternative energy producers, which is why Greentech solutions are more in demand than ever, especially wind and solar plants remain the focus of investments in the climate protection sector. Siemens Energy is a specialist in the construction of energy plants and is very well positioned, especially in the wind sector. On the first day of the nuclear phase-out, the Greentech company managed a new 52-week high on the stock exchange with a rise to EUR 21.70. The share price has thus risen 117% from its low of EUR 10.25 in autumn 2022.

On May 15, the Munich-based company announced its second-quarter results, with experts estimating earnings per share at EUR 0.06. The share price rose by 117% from its low of EUR 21.25 in autumn 2022. However, because the first quarter saw a loss due to the write-downs on the Gamesa buyback, the annual profit will only be around EUR 0.02, rising to EUR 1.04 next year, 2024. According to consensus estimates, the stormy growth will continue by 70% in 2024. Then the share would also be classified as cheap again with a P/E ratio of 12.7, but currently, the price has run hot technically and should consolidate more strongly on the chart. Watch out for the critical chart support at around EUR 18.

Defense Metals - If you want high-tech, you need rare earths

In times of crisis, like now, the urgency in the supply of strategic metals becomes very present again. Currently, China is the majority owner of these elements. With the simmering conflicts in Russia and a Western interference in Taiwan, there could be an export stop for the critical rare earths. Unfortunately, they are essential for various modern technologies - from smartphones to wind turbines. China's three largest state-owned rare earth companies merged in December 2021 to form the China Rare Earth Group. The Company is now the world's second-largest rare earth mining and refining group, producing almost a third of China's output. This should make it easier for Beijing to use the wishes of Western industrialized nations as political leverage and, if necessary, to limit supplies in order to protect its own industries.

It is a challenge for Europe and North American governments to take the matter into their own hands. British Columbia is home to one of the few promising rare earth projects outside China. Defense Metals, an exploration company based there, is focusing on further developing the Wicheeda Rare Earth Project, which covers about 2,008 hectares. Currently, a pilot plant has been completed and tested. In various stages, the steps included sulphuric acid burning, water leaching, impurity removal, rare earth precipitation, regeneration, magnesium recycling and process water recycling. The plant ran continuously and without interruption for 24 hours a day, delivering extraction grades of over 90%. The process is being optimized further to move into Phase II at the end of April.

Shares in Defense Metals (DEFN) are currently trading between CAD 0.30 and 0.40. That values the project at around CAD 62 million - a pittance when, with a mine life of 16 years from start-up, a calculated net present value of CAD 517 million after-tax can be achieved.

Rheinmetall - First orders from China

The largest listed defence stock, Rheinmetall, can sing a song about the availability of raw materials and international supply chains. Since 2020, it has been stalling in the processing of significant orders. It is only now, in 2023, that the Düsseldorf-based company is really getting into the swing of using the German government's 100 billion package for upgrading the Bundeswehr for the first time. The Company holds significant technological supply shares in important political processes, such as the delivery of the Leopard 2 main battle tank, but it must finally make headway.

But foreign countries also have their eyes on the technological qualities of the German technology company. The Chinese start-up car manufacturer Xiaomi has surprisingly placed an initial order in the field of electromobility worth a mid-double-digit million euro sum. Rheinmetall's Materials and Trade Division is to manufacture triangular beams suitable for e-mobiles to support the suspension strut mounts and the associated mounting plates. So vehicle technology "Made in Germany" remains in demand.

The Rheinmetall share recently corrected from its all-time high of around EUR 281 down to EUR 258. The technical shock resulted in a price target being reached after many analysts had recently revised their estimates sharply upwards. The average expectation is now EUR 288; at the current price of EUR 267, the stock is trading at a 2023 P/E of 18.7, about 8% below the consensus target. So not an extraordinary bargain, but an intact growth story.

The Greentech industry relies on the supply of critical strategic metals. Leaving the field to China without a fight would be grossly negligent. Defense Metals will soon be one of the new suppliers, and the potential buyers, Siemens Energy and Rheinmetall remain sought-after investment vehicles in the current political environment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.