July 17th, 2025 | 07:20 CEST

Will Trump seize Greenland's resources? 300% opportunity with MP Materials, European Lithium, CRML, Glencore, and DroneShield

US President Donald Trump has recently reaffirmed his long-standing interest in acquiring Greenland. In April, he did not rule out military options and called control over the island an "absolute necessity" for US security. At the same time, negotiations are underway on the possibility of binding Greenland more closely to the US through a special agreement, a so-called Compact of Free Association (COFA), without formal annexation. However, the Danish government and the Greenlandic administration have signaled their clear rejection: Greenland is not "for sale" and its residents have no interest in becoming part of the US. Rising global tensions and the increasing scarcity of strategic raw materials are putting pressure on industry. The first effects are already being felt, particularly in the high-tech and defense sectors. A rush on strategic metals is underway - and investors are taking notice.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

MP MATERIALS CORP | US5533681012 , EUROPEAN LITHIUM LTD | AU000000EUR7 , CRITICAL METALS CORP | VGG2662B1031 , GLENCORE PLC DL -_01 | JE00B4T3BW64 , GLENCORE PLC ADR 2 DL-_01 | US37827X1000 , DRONESHIELD LTD | AU000000DRO2

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Glencore – Many important metals in its portfolio

Glencore is one of the world's leading producers and traders of copper, cobalt, nickel, zinc, lead, coal, aluminum, and steel coal, all of which are key raw materials for the energy transition and high-tech industries. In addition to mining, Glencore operates a growing recycling business, particularly for copper in Quebec, in order to sustainably meet the growing demand for raw materials. In the first quarter of 2025, copper production fell by around 30% to 168,000 tons due to poorer ore quality and water shortages in South America. This was offset by strong growth in cobalt (+44%), zinc (+4%) and lead (+14%). Notably, steel coal production increased by over 490% following the acquisition of Elk Valley Resources. Despite the weak start to the copper business, Glencore is sticking to its annual forecast of 850,000 to 910,000 tons and expects higher volumes in the second half of the year. Strategically, Glencore is focusing on its role as a supplier for global decarbonization, with an emphasis on stable supply chains, responsible raw material extraction, and the expansion of metal trading. After hitting a five-year low of EUR 2.57, the share price has recently started to recover. With a 2026 P/E ratio of 12.9, the entry point is currently attractive, with analysts on the LSEG platform expecting an average price of 378 GBp (equivalent to EUR 4.40). The chart also suggests more opportunities than risks.

European Lithium and CRML – Superbly positioned in Greenland

Anyone looking to invest in future technologies cannot ignore strategic metals. The West, in particular, is searching for secure sources of raw materials, with the US, Canada, and Greenland in particular becoming the focus of geopolitical interests. The Australian company European Lithium is already well-positioned with an attractive project portfolio: in addition to its flagship lithium deposit in Austria, the Company holds interests in deposits in Ireland, Ukraine, and the highly interesting Tanbreez rare earth project in Greenland. Notably, European Lithium currently holds 63.9% of the shares in US-listed Critical Metals Corp. (CRML), which is valued at approximately USD 418 million. This results in a calculated investment value of USD 267 million. The key point is that the Company's market value is only AUD 104 million, equivalent to approximately USD 67 million. European Lithium is still carrying a discount on its assets in Ukraine. This is not entirely understandable, as European Lithium has sold approximately 0.5 million shares to CRML in recent weeks to boost its liquidity, generating AUD 2.5 million in the process. This shows that the holding is highly liquid.

Meanwhile, work in Greenland continues. So far, drilling results have delivered convincing figures of up to 0.47% TREO with a high proportion of heavy rare earth elements (HREE) at great depths, ideal conditions for an early revaluation of the project. In July, the 2,000-meter diamond drilling program began at the Tanbreez rare earth metal project. It aims to increase the existing mineral resource estimate for the Fjord Eudialyte deposit, which currently has an indicated resource of 8.76 million tons and an inferred resource of 13.8 million tons, for a total of 22.56 million tons of ore. An optional letter of intent (LOI) for financing the development of the Tanbreez project has been received from the US Export-Import Bank (EXIM), subject to positive due diligence and all milestones and regulatory approvals being achieved on schedule.

Tony Sage, Executive Chairman of the Company, commented: "Our exploration and DFS study teams are now on site conducting detailed field work. The data collected will play a critical role in the completion of the BFS and comprehensive reports required by the Greenlandic regulatory authorities and our financial partners, including EXIM."

With a focus on western supply security, growing global demand, and unique project diversity, European Lithium offers an excellent investment story. Anyone looking to invest in rare earths with good prospects should take a close look here. In Germany, the share price jumped back above EUR 0.04 yesterday, and Critical Metals shares also seem to be comfortable at prices above USD 4. Keep buying!

MP Materials – That is how fast it can happen

In the wake of the general upturn in critical metals, US company MP Materials has also caught the wind in its sails. The Company is currently the talk of the town, and for good reason: within a few months, the rare earth specialist has developed into a strategically important supplier in the US. With the US Department of Defense investing USD 400 million for a 15% stake and Apple investing USD 500 million to secure magnet production, MP Materials has some good names on board to continue its success story. The new production facility in Texas is supplying NdPr metal for the first time in decades and is successfully testing magnets for the automotive industry. Despite the flurry of news, the short ratio remained at 25.8% as of the end of June. However, this should have decreased dramatically over the last two weeks, as the share price has shot up by 200%. An exciting stock, but already very expensive with a valuation of around USD 10 billion, even if revenue triples to over USD 600 million by 2027.

DroneShield – Too much of a good thing

We are seeing real "airborne prices" with Australian drone provider DroneShield. The share price has increased fivefold since January and has now reached a market value of just under EUR 2 billion. With revenue of around AUD 200 million, the stock is trading at a fabulous P/S ratio of 28. As the Company also has debts of over AUD 100 million, the book value is approximately AUD 0.40. Yesterday, the hyped stock stood at AUD 3.86 or EUR 2.18 in Australia. Considering the widespread NATO euphoria, this moon price is a clear sell. Short sellers are likely to enjoy themselves in the short term. Long speculators should keep a close eye on their stops.

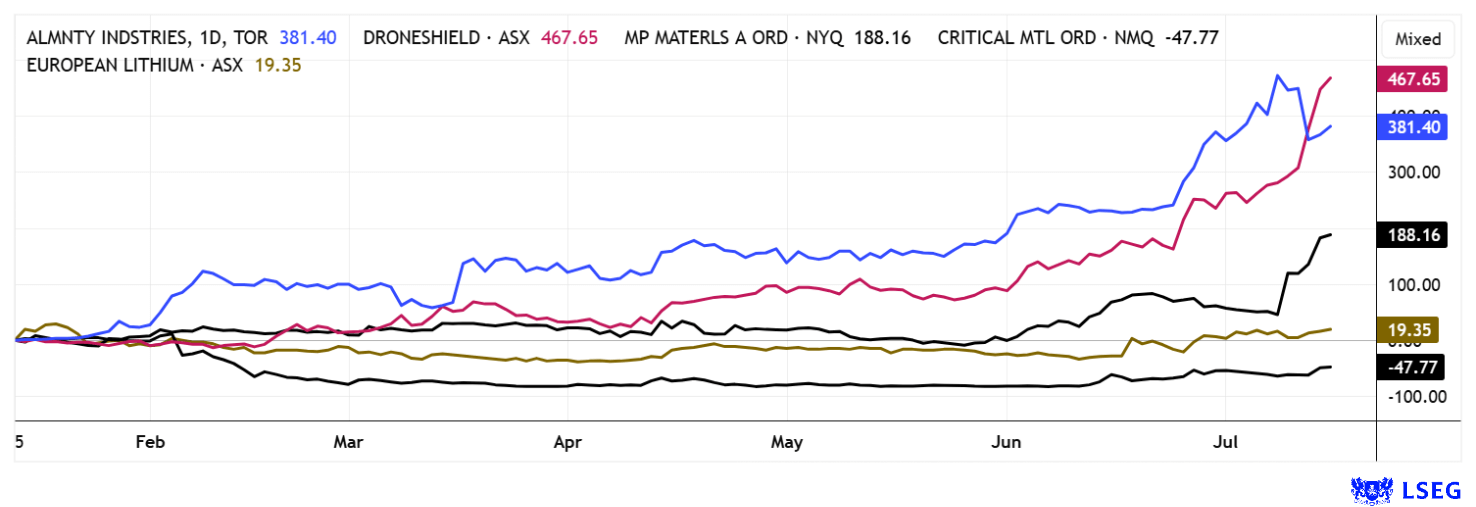

Strategic metals remain in the focus of investors, especially in the current geopolitical environment. Gains of 300 to 500% are no longer uncommon in this segment in 2025. Those who can time the market well and keep an eye on the defense and critical metals sectors are currently enjoying a performance boom. Nevertheless, portfolios should always comprise a mix of blue chips and promising small-cap stocks. This is easier on the nerves.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.