September 10th, 2025 | 07:00 CEST

Will Trump's tariffs be stopped by the courts? Gold and silver on the rise – Deutz, Desert Gold, Renk, and Hensoldt in focus

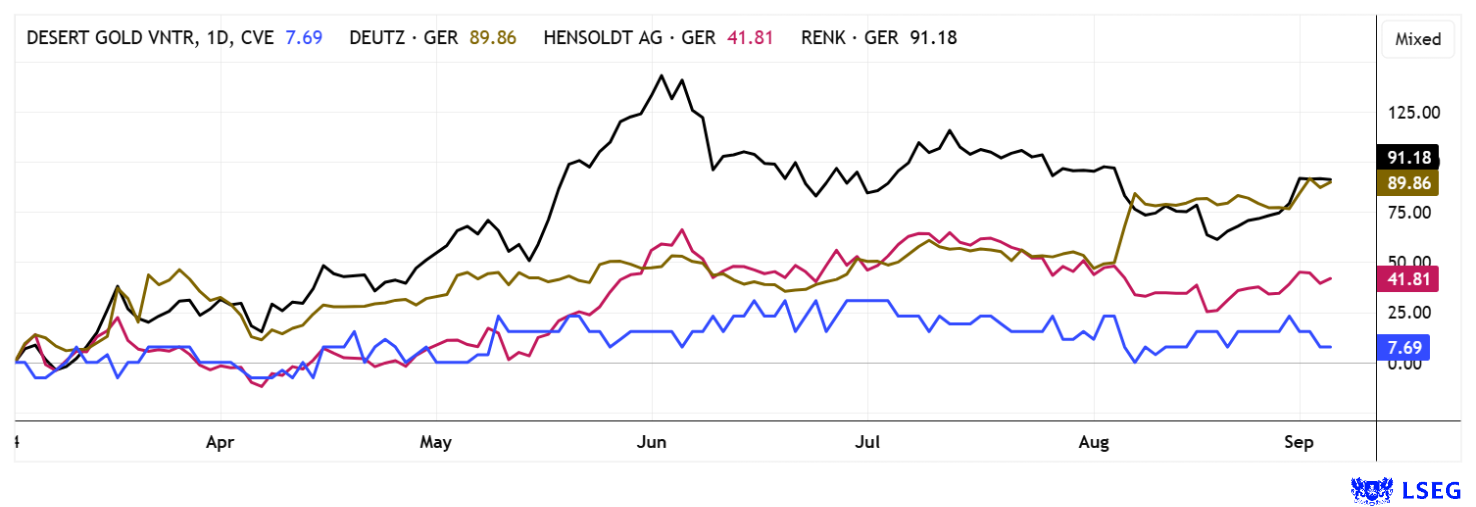

A US appeals court has declared most of Trump's tariffs unlawful under the International Emergency Economic Powers Act (IEEPA) of 1977. This law allows the president to take economic measures against foreign countries in the event of a declared national emergency. However, no such national emergency currently exists. Instead, the US economy is growing at a moderate pace, while benefiting from the energy supply emergencies in Europe and further defense support for Ukraine. The US is no longer simply giving these goods away; instead, it now provides loans or sells them to allied countries. This creates significant uncertainty in the markets, which in turn is fueling defense stocks as well as gold and silver. New highs were reached at USD 3,640 for gold and USD 41.5 for silver. Where do the opportunities lie for investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTZ AG O.N. | DE0006305006 , DESERT GOLD VENTURES | CA25039N4084 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Deutz – The new star in the defense industry

The long-established Cologne-based company Deutz, known as the world's oldest independent engine manufacturer, is starting a new chapter. With the acquisition of drone propulsion specialist SOBEK, the Company is making a targeted foray into the defense industry. With around 70 employees in Baden-Württemberg and Hesse, SOBEK has made a name for itself with highly specialized electric drives and control systems for drones. These technologies are already in military use in unmanned systems. While defense technology has only played a marginal role in Deutz's portfolio to date, this step marks a strategic entry into a rapidly growing market segment.

Deutz CEO Sebastian Schulte sees the acquisition as a logical response to the profound changes in modern warfare, which increasingly relies on unmanned systems. In view of NATO rearmament and ongoing geopolitical tensions, particularly in relation to Russia, the demands on drone technology are rising rapidly. With an expected operating profit of EUR 10 to 12 million in 2025, SOBEK is considered profitable and fast-growing. The purchase price, which is approximately eleven times EBIT, highlights the strategic importance of the transaction.

At the same time, the upcoming inclusion in the MDAX is attracting additional interest from institutional investors. With its presence in the German mid-cap index, Deutz not only gains visibility but also strengthens its position in the competition for investor capital. With an estimated revenue of EUR 2.5 billion for 2026, the P/E ratio is only a low 10. This makes Deutz currently the cheapest German stock with a defense kicker!

Desert Gold – West Africa in Focus

Desert Gold has reached a key milestone with the recent progress at its Senegal Mali Shear Zone (SMSZ) project. The initial Preliminary Economic Assessment (PEA) outlines a low-cost open pit mine with projected annual production of approximately 5,500 ounces of gold starting in 2026, and expected gross cash flows of over USD 5 million. Economic data from the Barani and Gourbassi deposits indicate a net present value (NPV) of USD 24 million and an internal rate of return (IRR) of 34% at a gold price of USD 2,500 per ounce, with a payback period of just over three years. If the current gold price is assumed in the PEA, the value could increase to USD 54 million and the return to 64%. The project is modular in design, with a new mobile processing plant to be acquired, which will initially be deployed at Barani and later at Gourbassi. Financing negotiations are already underway.

At the same time, Desert Gold has expanded its footprint in West Africa with the acquisition of the Tiegba project in Côte d'Ivoire. Covering 297 km², the project is located in a well-established gold belt alongside renowned producers such as Barrick and Endeavour Mining. While Tiegba remains undrilled, surface sampling has revealed values of up to 900 ppb gold over a length of more than 4 km, indicating a promising trend length. The political and infrastructural situation in Côte d'Ivoire is considered stable and investor-friendly, which promises fast approvals and low operating costs.

With a market capitalization of only around CAD 20 million, Desert Gold is a small but growing player in West Africa. If financing for the Mali project is secured quickly, the Company will transform itself from a little-known explorer into a regionally relevant player with significant growth potential. CEO Jared Scharf believes there is significantly more expansion potential in West Africa than the stock market currently assesses. Analysts at GBC are very optimistic about the future and have given the stock a "Buy" rating with a 12-month price target of CAD 0.43. At CAD 0.07, it is an absolute bargain with 10-bagger potential!

RENK and Hensoldt – Profit-taking does no harm

Back to the defense sector once again. RENK and Hensoldt shares have already enjoyed a phenomenal rally in 2025. The RENK Group has reached a significant stock market milestone with its rise to the MDAX and can establish itself as a high-growth player in the defense market. Major investor Triton has now placed all its shares on the market, while tank manufacturer KNDS recently increased its stake to 16%. With good reason, as the stock has posted impressive gains of up to 400% since its IPO and continues to make progress with innovations in digital sensor technology, AI-supported systems, and green drive technologies. The crux of the matter lies in the valuation: Analysts on the LSEG platform see further potential, but also point out that the latest valuations already reflect high expectations.

At the same time, Hensoldt is developing very promisingly in strategic terms, benefiting from EU defense programs such as SAFE and "ReArm Europe" and leveraging its leading role in sensor technologies for networked mission systems. Despite the recent confirmation of the 2025 annual targets and a robust order situation, some analysts are warning of overvaluation here as well, as prices have already priced in extensive future growth. Investors should therefore take a differentiated view. The market environment remains fundamentally strong and offers long-term growth, with attractive entry points likely to emerge after possible setbacks or consolidations. Both companies are currently valued at price-to-sales ratios of 4 to 5. Strong growth in net profits is not expected until 2027, when important structural changes will have been completed. We currently recommend taking profits on RENK in the range of EUR 65 to 67 and on Hensoldt in the range of EUR 87 to 92. A 25% pullback would make both stocks attractive buying opportunities again!

The financial markets remain subject to strong fluctuations, fueled largely by the multitude of geopolitical conflicts and uncertainties. In this environment, companies in the defense and commodity sectors are increasingly coming into the spotlight of investors. For Canadian explorer Desert Gold, this could be a decisive moment. With a current market capitalization of only around CAD 20 million, the Company appears significantly undervalued. The discrepancy between market value and underlying assets could attract strategic buyers who want to secure favorable resources in the current environment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.