July 22nd, 2025 | 11:05 CEST

Why Almonty Industries could be a better investment than MP Materials

Valuation gap with billion-dollar potential? Investors may be overlooking a sleeping giant. While MP Materials is riding high on media hype, an Apple partnership, and US government support, Almonty Industries (NASDAQ: ALM | TSX: AII) – a raw materials specialist focused on tungsten – continues to fly under the radar. However, a closer look reveals a striking valuation gap between the two companies, offering investors enormous upside potential. With a highly critical metal, strategically secured production, and extremely low valuation multiples, Almonty could prove to be one of the biggest success stories of the coming years. One analyst recently took a deeper dive into the numbers and fundamentals. Read the report to learn more.

time to read: 4 minutes

|

Author:

Mario Hose

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , MP MATERIALS CORP | US5533681012

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

Mario Hose

Born and raised in Hannover, Lower Saxony follows social and economic developments around the globe. As a passionate entrepreneur and columnist he explains and compares the most diverse business models as well as markets for interested stock traders.

Tag cloud

Shares cloud

Almonty vs. MP Materials – A comparison with explosive potential

Two companies – one strategic goal: Both Almonty Industries (NASDAQ: ALM| TSX: AII) and MP Materials supply essential raw materials for future technologies and defense. While MP Materials focuses on rare earths such as neodymium (for example, for electric motors and wind power), Almonty specializes in tungsten – a metal without which no aircraft can take off, no tank can brake, and no high-performance machine can run.

Lewis Black, CEO of Almonty, recently said in an interview with host Lyndsay Malchuk Interview:

"*I do not really want to talk about MP – they would probably not like that. But what I can say about Almonty is this: we process everything directly on site, operate in safe regions, and run multiple mine sites. Tungsten is extremely rare. The next major project outside of our company is located in the north of the Yukon, 200 km from the nearest road – and even according to their own statements, about ten years away from the construction phase. So in that sense, we have a pretty free playing field.

Tungsten is extremely difficult to process. Anyone coming from the gold, silver, or tin sector will fail with tungsten because it is so brittle. We have been doing this for decades – we are considered the market leader. And the difference to rare earths? In many applications of rare earths, one does not even see the material – it is in magnets, guidance systems, and so on. But without tungsten, no airplane can take off: no engines, no brakes, no ammunition – even guidance systems contain tungsten. Even the displays in the cockpit would not exist without tungsten.

However, until last year – when Biden imposed tariffs on this sector – no government had wanted to discuss it at all. Because if one publicly admits to not having enough tungsten, you are signaling to your opponents that you cannot manufacture ammunition. Incidentally, rare earths are not that rare – they are just difficult to process and have many toxic by-products. Tungsten, on the other hand, is both rare and difficult to mine.

And that, I think, is the fundamental difference between us and other producers of strategic metals."

Two relevant companies in the GBC comparison

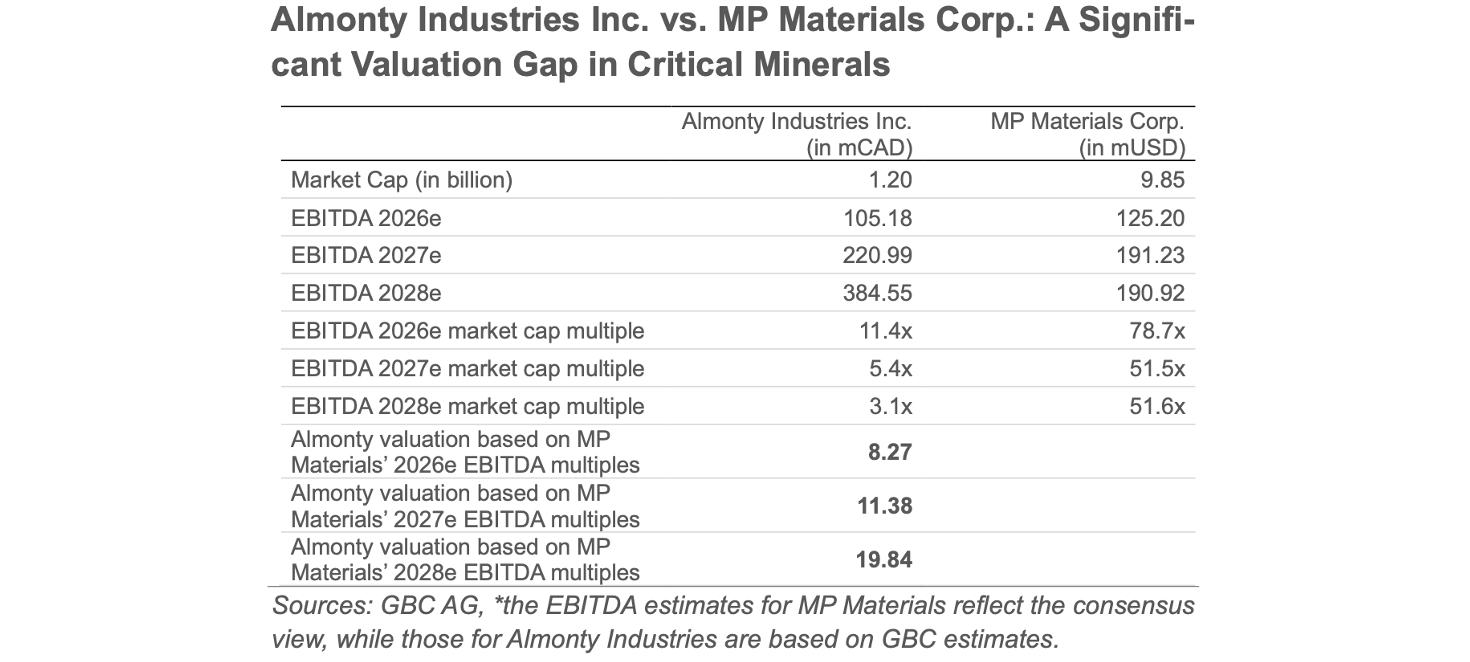

GBC conclusion: Almonty is projected to achieve twice the EBITDA of MP Materials by 2028 – yet it currently trades at just one-seventeenth of MP's valuation multiple. Applying MP Materials' EBITDA multiples to Almonty's expected earnings would result in valuations of approximately CAD 8.27 billion for 2026, CAD 11.38 billion for 2027, and up to CAD 19.84 billion for 2028. This analysis suggests that Almonty's market capitalization could develop significantly above its current level if it were to receive a comparable valuation relative to MP Materials. - Source: Research Comment dated July 21, 2025.

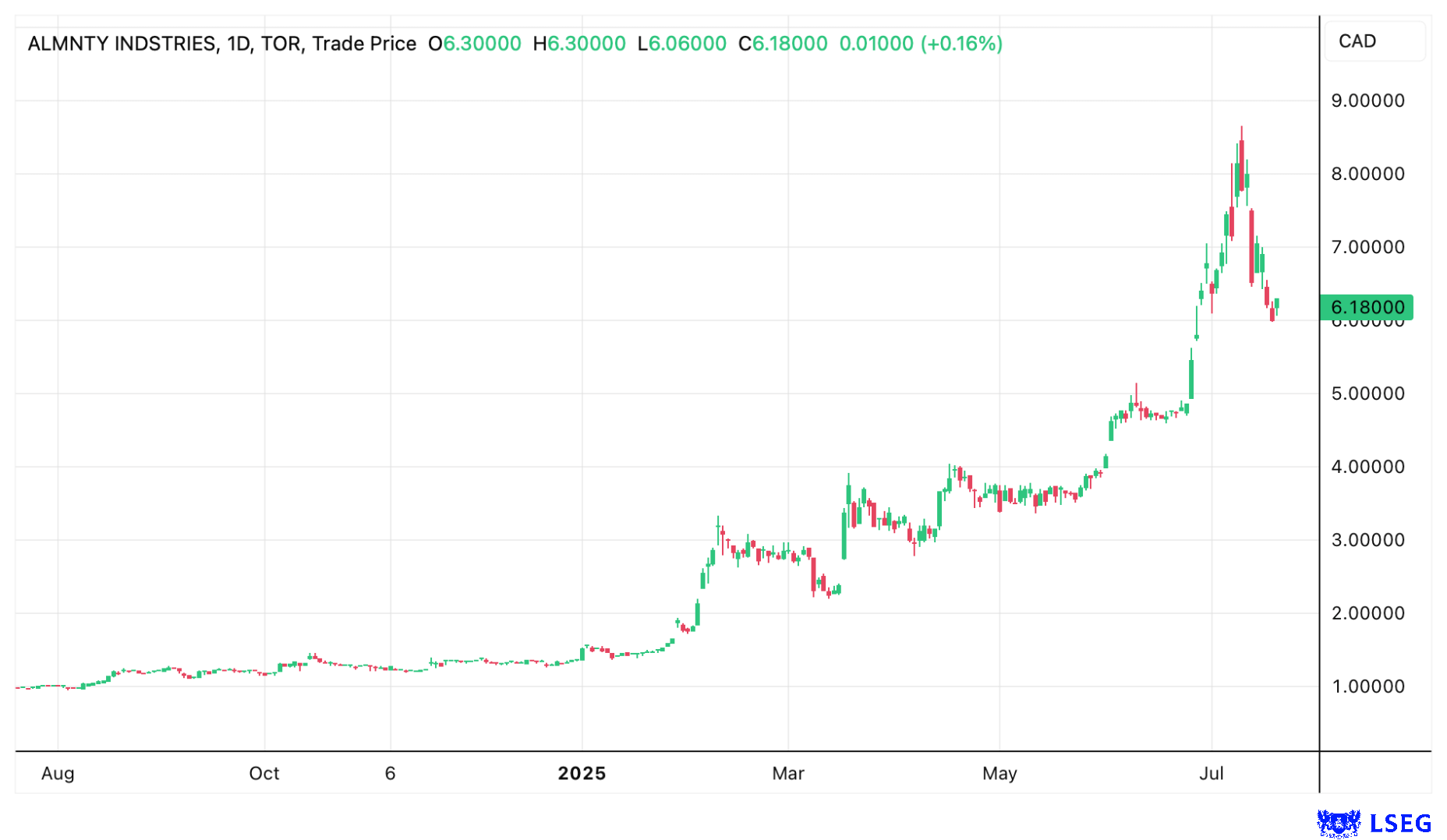

At the current share price of CAD 6.18, Almonty is valued at just CAD 1.33 billion.

Rare growth momentum

Almonty is set to commence operations at the Sangdong mine in South Korea, which will be one of the world's largest tungsten mines outside of China. Capacity is set to be massively expanded by 2027. In contrast, according to a GBC comparison, growth at MP Materials is stagnating from today's perspective, with EBITDA rising only moderately over the same period.

Global tungsten dynamics: China cuts back – prices explode

The global tungsten market is in a state of flux. China – with over 80% of the global market share and thus the leading supplier – has reduced its production quotas for 2025 by 4,000 tons from 62,000 tons in 2024 to 58,000 tons, a decrease of 6.8%. At the same time, demand from sectors such as semiconductors, aerospace, and defense is rising significantly.

The result:

APT prices rise to USD 440/mtu (+USD 20 compared to the previous week)

Ferro-tungsten reaches USD 57/kg – and the trend is rising

Supply bottlenecks are forcing many traders to only serve domestic markets (source: Fastmarkets Global Ltd.)

Where to get it?

According to Techcet, global demand for tungsten is expected to grow by 3–5% annually from 2025 to 2030, with an increase of 8% annually in the semiconductor sector, and a 4–6% increase in the defense sector. High tech vs. defense: It will therefore be exciting to see who will ultimately get their hands on the hardest metal on earth. It is precisely this situation that makes Almonty Industries a classic takeover candidate.

Conclusion: Get in now before the market realizes the difference

The combination of geopolitical tailwinds, growing demand, supply bottlenecks, and a currently absurdly low valuation of CAD 1.33 billion makes Almonty Industries (NASDAQ: ALM| TSX: AII) one of the most intriguing commodity bets of the coming years. While MP Materials, with a market capitalization of USD 9.34 billion, is already receiving a valuation bonus for its strategic role, Almonty is in no way inferior – only the stock market has not yet recognized this. Price setbacks have historically been excellent entry opportunities in the past.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.