August 1st, 2023 | 08:20 CEST

Which now? Battery power or hydrogen? BYD, Altech Advanced Materials, BASF, Nikola Motors

The question of what future mobility will look like has yet to be entirely resolved. Currently, the governments in office are propagating the electric drive. However, after the fire on the "Fremantle Highway" in the North Sea, the question of the safety of the Li-ion batteries currently in use has arisen again. And who will pay for the EUR 500 million damage to the wrecked freighter? This does not even take into account the possible ecological inferno for the North Sea. EV batteries are expensive and require enormous resources to produce, yet there is no legal obligation to dispose of used batteries properly. Very short-term thinking, but Berlin is currently shining on issues of a curious nature. Where are the opportunities for us investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , BASF SE NA O.N. | DE000BASF111 , NIKOLA CORP. | US6541101050

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF - Fundamentally weaker, but share price hard to beat

In a challenging market environment, BASF Group sales fell 24.7% year-on-year to EUR 17.3 billion in Q2, with revenue declines across all sectors except automotive. According to BASF, the main reason for the sales decline was lower prices, particularly in the Chemicals, Surface Technologies and Materials segments. In addition, currency losses dampened sales. As a result, EBIT before special items was EUR 1.0 billion, a full EUR 1.3 billion lower than in the same period of the previous year. Nevertheless, cash flow from operating activities was around EUR 2.2 billion, and free cash flow came to EUR 905 million, an improvement of EUR 569 million compared with the second quarter of 2022.

Bottom line, investor panic in the run-up to the figures was probably greater, as the final announcement sent the stock up 5% to over EUR 49. BASF aims to improve its competitiveness with a series of cost-cutting measures. Fixed costs are to be reduced by around EUR 1 billion per year. For the second half of the year, BASF expects operating improvements and stabilizing demand. With a 2024 P/E ratio of 10, the share is not expensive, and there is a 6.8% dividend on top. Below EUR 50, the share is interesting in the long term.

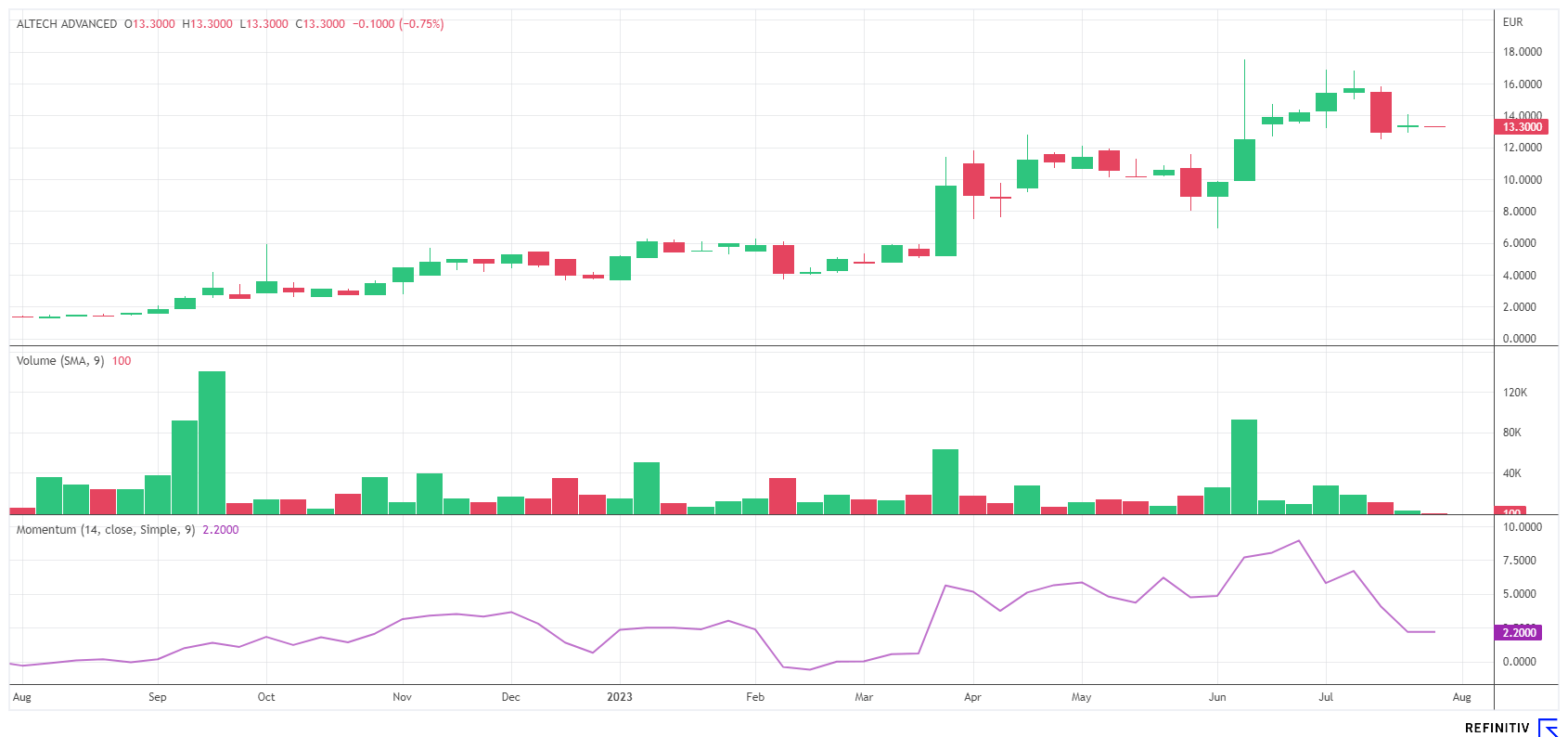

Altech Advanced Materials - High investments in the future

The Heidelberg-based holding company Altech Advanced Materials AG (AAM) had much to report about the future of batteries and energy storage in recent months. Now there were figures to report for the first half of the year. As of June 30, 2023, there is an expected half-year loss here, according to the German Commercial Code (HGB), of around EUR 0.99 million. In the previous year, the loss was a whole EUR 600,000 less. Personnel expenses have risen to around EUR 167,000, but other operating costs weigh heavily with an amount of EUR 765,000. These consist mainly of the expense for the formation of a provision for contingent losses in the amount of EUR 518,000, which is intended to service the cash claims for the options issued in the last financial year as part of the convertible bond issue. This is not an unusual occurrence, as research and development expenses are very high in the still-young company, which necessitates regular capital increases. Due to this balance sheet provision, the net loss for fiscal year 2023 will increase to between EUR 1.2 and 1.6 million.

Series production of a new type of solid-state battery for grid storage is on the agenda for the next few years. This will likely require considerable capital investment, but this product could also make the Heidelberg-based company a top climate change technology supplier for the automotive industry. There will be a press day at the Company's Schwarze Pumpe site in mid-September. Here, investors should receive an update on the current development status of the projects.

AAM shares are already up more than 400% in 2023, which requires courage to get in. But battery sector stocks are currently hot, which should also continue to boost AAM shares. After a delicate consolidation from the top at EUR 17.50, it is currently possible to buy shares again at EUR 13.50. In the long term, the lights are green.

BYD - Tesla and VW outperformed

After a pronounced consolidation, BYD shares are once again among the favorite stocks of Greentech investors. Since the low in November 2022 at around EUR 21, the stock has now gained a hefty 50% again. This is due to the outstanding sales figures of the Chinese car and battery producer. Tesla delivered around 889,000 e-vehicles in the first half of 2023, more than two and a half times as many as its German counterpart VW. But Chinese manufacturer BYD is advancing to become Tesla's next major adversary, including in Europe. Because in 2023, distribution points were opened in Norway, Germany, the Netherlands and Portugal, with more to follow.

Tesla has already lowered its sales prices three times and is slowly coming under pressure because of its margin. BYD, on the other hand, obviously still has resources for further price wars because of its integral production chain. In Germany, comparable models are now offered at around 25% cheaper than VW or Tesla. That is why German products like VW's ID series and Audi E-Tron do not make it into the top 10 cars sold. Tesla's most successful Model Y is also produced in China. The Company generates about 22% of its revenue here. There is much to be said for BYD's success story continuing and the competition falling further away.

Nikola Motors - Meme movements send their regards

The Nikola share, which many thought was already dead, came back to life in July. With gigantic turnover, it led the rally in the so-called meme shares last month. Yet little has changed in the Company's precarious financial situation, and there has been virtually no operational news to prompt buying.

But we remember GameStop. Here, too, a decent number of shares outstanding had been sold short, over 30% at the time. For Nikola, about 20% of the issued shares were sold short five weeks ago. The crux of this fact: If the shares jump strongly for whatever reason, the so-called "shorties" are forced to cover their positions, but they may not have enough cash to do so. This was the case with Nikola Motors. For no apparent reason, the entire share capital was traded four times, and the share gained almost 500%. Now, however, it should become exciting because, after highs around USD 2.95, the value was sold off again toward USD 2.00. With an order for 13 trucks to be delivered, there was a countermovement to about USD 2.76 yesterday. Now, the nerves of the short sellers are on edge once again.

**The primary goal of Nikola Motors continues to be fundraising because the research and development path to the first series product is still long. It is a challenging undertaking, especially when one of the test trucks unexpectedly catches fire on the company premises. Casino stock exchange at its best!

The stock market is currently in an absolute celebratory mood. Sectors like Greentech, alternative energies and artificial intelligence know no valuation parameters. There have been many such times, and no one knows how long such momentum phases will last. For the prudent investor, BASF, BYD and Altech Advanced Materials are suitable additions to a long-term future-oriented portfolio. Those who want to trade Nikola Motors need nerves and discipline.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.