April 4th, 2023 | 16:58 CEST

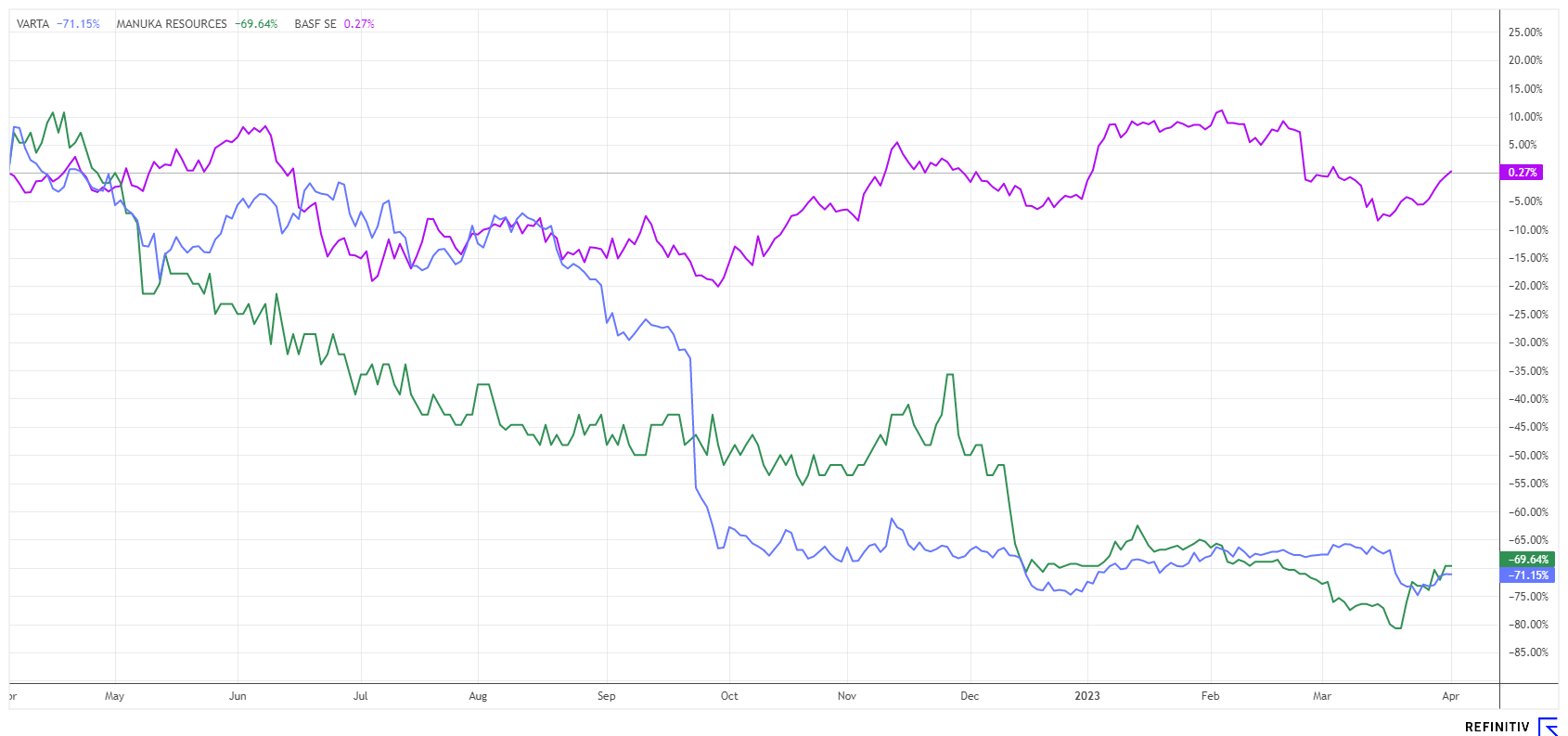

Watch out for these Greentech and battery stocks: Varta, Manuka Resources and BASF in turnaround

Tesla is currently considering building its own battery factory in the US. The Company wants to operate the plant itself, and the battery giant CATL is to contribute the latest technology. For Tesla, the Texas location would be a welcome addition to its assembly plant for electric vehicles. After the decision to phase out internal combustion vehicles in the EU from 2035, international pressure remains high to finally initiate climate change. E-mobility is seen as a pathfinder. Innovations are needed in the battery sector because the performance parameters are not yet convincing. However, there are many profitable conspicuous features for shareholders in the round trip through the industry.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , Manuka Resources Limited | AU0000090292 , BASF SE NA O.N. | DE000BASF111

Table of contents:

"[...] The transaction offers benefits to all parties: Shareholders now have three promising projects in their portfolio. [...]" Bradley Rourke, President, CEO and Director, Scottie Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF - Groundbreaking ceremony for the Chinese mega-site

Despite the enormous development efforts of the last 5 years, there is still no battery solution on the starting blocks that could achieve the technical performance characteristics of a diesel drive of the last generation, including all relevant environmental parameters. Major showstoppers continue to be sustainability criteria such as the procurement of raw materials, service life, range and safety, and above all, the problematic recycling of used batteries. First-generation batteries are already giving up the ghost and presenting owners with financial challenges.

The Ludwigshafen-based chemical company BASF is one of the largest suppliers of raw materials for the Greentech industry. Substances are produced and mixed here with high-energy input, important chemical precursors for high-tech manufacturers in the alternative energy and e-mobility sectors. The German company has now begun construction of a complex for the production and further processing of acrylic acid at its Verbund site in Zhanjiang in the southern Chinese province of Guangdong. When fully completed, Zhanjiang will be BASF's third largest Verbund site worldwide, after Ludwigshafen and Antwerp. Once again, Germany is losing out in the race for cheap energy and labour factors.

The BASF share has yet to make any significant gains since the beginning of the year, but at currently EUR 48.8, the value is still very cheap from an analytical point of view. Because looking ahead to the end of 2023, investors are currently paying a P/E ratio of just under 11.5 and receiving a dividend payout of around 6.3%. Collect!

Manuka Resources - The future lies dormant here

Again and again, commodity companies come into the focus of environmental organizations because of sustainability criteria. It is, therefore, important that the metals urgently needed for climate change are mined particularly cleanly and with as small a CO2 footprint as possible. Manuka Resources Limited, based in the Cobar Basin, New South Wales, operates according to strict ESG criteria. The Company has two highly prospective projects in gold and silver with historical production. It is also positioning itself in the critical metals sector by acquiring the South Taranaki Bight project (STB), which is due to be completed in 2022.

Manuka has a long way to go in this sector but is expected to enter the world vanadium market in the medium term. Because of its size, the STB project could be responsible for 15% of global annual production in the future. A preliminary feasibility study for the highly interesting project has already been prepared. USD 50 million well invested, as the Australians now have a proven JORC resource of 3.8 billion tonnes on the balance sheet. The project already has a mining licence for 5 million tonnes per year, with an initial mine life of 20 years. The bankable feasibility study has already been initiated.

In the meantime, Manuka is taking care of the resumption of gold and silver production. This generates positive cash flow that can be reinvested into the STB project. As part of its recent strategic exploration review, Manuka is continuing gold production at Mt Boppy from April 2023, targeting about 25,000 ounces annually for three years. Manuka's gold production strategy includes several measures to extend the mine life and increase annual production. Drilling at Mt Boppy Deeps to evaluate underground mine development is expected to commence in the second half of 2023. Silver production has been put on hold in favour of gold until the spot silver price is in a more profitable relationship with gold.

The Manuka share price has stabilized at around AUD 0.085 after a temporary weakness. This brings the Australians to a market capitalization of just under AUD 42.7 million. With the vanadium STB asset, the Company owns a real blockbuster in the strategic metals sector.

Varta - Capital increase and unexpected postponement of annual figures

Varta postpones its annual report and agrees on a comprehensive restructuring with the banks in a night and fog action. The restructuring concept was drawn up based on an IDW-S6 expert opinion prepared by KPMG. The core points of the restructuring programme include an adjustment of production and structural costs as well as targeted investments in growth areas such as energy storage and e-mobility. The measures also include cost savings in the personnel area, the amount of which was not explained in detail.

The performance of the Varta share in 2023 has been anything but exhilarating. At the end of March, the share price fell from EUR 28 to a new low for the year of around EUR 21.60 after the group had issued more than 2.2 million new shares at EUR 22.85. This issue raised a gross amount of around EUR 51 million; the major shareholder Montana Tech was the sole subscriber to the new shares, excluding subscription rights. The money will be used for the realignment of the group.

Analysts had a mixed reaction to the postponement of the 2022 annual results by almost a month to 26 April. Warburg subsequently confirmed its "Sell" rating but raised the 12-month price target from EUR 17.50 to EUR 18.50. The capital increase and the thus secured restructuring of the group are welcomed positively. Nevertheless, analysts still see risks in the lithium-ion button cell segment, the most important margin contributor in the product universe. Berenberg is much more bullish and downgrades from EUR 31 to EUR 29 with a "hold" recommendation. The consensus on the Refinitiv Eikon platform is now at a low EUR 24.75, having expected EUR 101 at the beginning of 2022. This was followed by three profit warnings in a row. Stay on your guard with the Varta share, as the new CFO, Marc Hundsdorf, is considered a reorganizer. We expect first successes only in the second half of the year, but the stock market trades themes at least 6-9 months in advance.

Greentech stocks remain in vogue and can continue to perform well in a friendly stock market environment. However, clean selection and a consistent stop strategy remain important to avoid losing a larger position, as in the case of Varta. The potential of Manuka Resources has so far remained undiscovered by the stock market, although there is still a lot of future in the ground.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.