April 22nd, 2024 | 07:15 CEST

War in the Middle East and the explosive commodity cycle: Rheinmetall, Renk, Globex Mining, and Varta in focus!

Well, that escalated quickly. Just a week has passed since Iran carried out a nighttime attack on Israel. That was followed by a few days of commemoration, a few phone calls with Washington and the UN, and then last Friday, an Israeli counterattack was reported. While the agency news is not really clear yet, the stock markets are taking the current uncertainty as an opportunity to finally let some air out of the inflated system. Central banks are also stepping back from hoped-for interest rate cuts, as current inflation is too high and the negative signals from the economy are not yet excessive. All in all, defense stocks are holding up well, and a new upward cycle is beginning for commodities. It took a while, but now is the time to have the right stocks in the portfolio.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , RENK AG O.N. | DE000RENK730 , GLOBEX MINING ENTPRS INC. | CA3799005093 , VARTA AG O.N. | DE000A0TGJ55

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall and Renk Group - Beneficiaries of fear

When it comes to coping with fear, gold and silver are typically bought, but currently, it is also defense stocks. Due to various geopolitical trouble spots, investors are simply betting that the reordering of defensive or offensive military equipment will fall like warm rain on manufacturers' order books. In the case of Germany, a special fund - actually a loan - of an additional EUR 100 billion can be used for the Bundeswehr. **This puts stocks such as Rheinmetall, Renk Group and Hensoldt right at the top of investors' favourites.

However, there is one problem: staffing and supply chain issues. Germany, in particular, has also faced an energy and materials problem since the pandemic. As a result, progress is very slow overall. Orders from the German government leave the German procurement office by fax, and Rheinmetall's production lines are running at a snail's pace. That is how it is when you have been hitting the brakes for years due to disarmament and an unclear NATO policy. In short, significant jumps in revenue and earnings will take some time due to capacity adjustments.

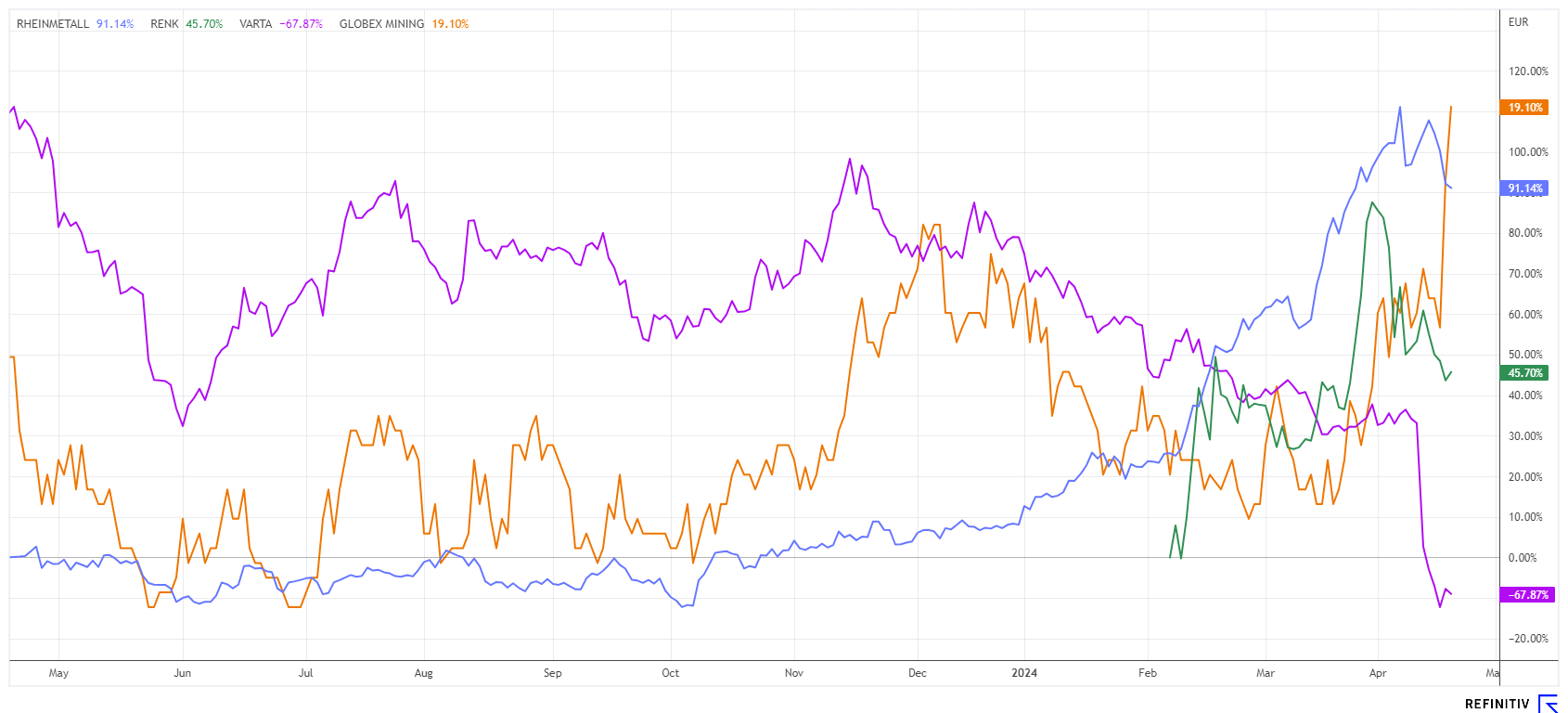

Unfortunately, shares like Rheinmetall and Renk have already adjusted their valuation significantly upwards. The anticipated positive growth for the next few years has already been priced in. The analysts on the Refinitiv Eikon platform are no longer following suit with their price targets. The average target for Rheinmetall is EUR 529, and for Renk, it is EUR 30.60. Unfortunately, both marks have already been reached or even exceeded. In the short term, the air is out. Conclusion: Sell or set profit-taking stops; there is plenty of room to the downside.

Globex Mining - The harvesting phase for commodities begins now

The situation in the commodities complex is quite different. The energy and climate turnaround, including the defense industry, has created a high demand for industrial metals and other resources. Added to this are purchases of gold and silver to calm nerves in uncertain times. On the price chart, gold has gained a good 20%, silver 30%, copper 35% and oil 10%, all since March 2024. This has brought about several technical breakouts, making follow-up buying and a continuation of the rally more likely.

Western governments have their eyes on the safe jurisdictions, as they need reliable supply relationships for the tasks ahead. The Canadian explorer and asset manager Globex Mining from Quebec is excellently positioned for this. Founder and CEO Jack Stoch has been building up his properties since the 1970s and has 249, as reported in the most recent presentation from the IIF (www.ii-forum.com). The strong cash and liquidity position of approximately CAD 20 million was also confirmed - an extraordinary quality feature of Globex.

Currently, there is enough room for further exploration or option and asset deals across North America. Globex does not produce itself but generates revenue streams from investments, the sale or lease of mining rights, and the pro rata collection of minerals extracted. Recently, another sodium sulphate-alkali deposit in Saskatchewan was sold to Edison Lithium Corp. for CAD 200,000 and CAD 50,000 in Edison shares. Last week, an option agreement with Victory Battery Metals worth CAD 400,000 and 1.5 million shares was also announced. The deal involved uranium claims in the Sept Iles region. It is evident that Globex's portfolio is dynamic and capable of generating cash flow at any time. Market interest is currently very much focused on precious metals, uranium, and battery materials.**

The share is currently jubilant, jumping from CAD 0.78 in March to over CAD 1.05 in April alone. Investors with long positions can be pleased with the 35% valuation adjustment, but there is still plenty of room for improvement compared to previous highs of over CAD 1.70. The commodity cycle is just starting - if not now, then when?

Varta in a downward spiral - Next restructuring ahead

The Ellwangen-based medium-sized company, Varta, is entering the next downward spiral. The share is now a staggering 95% away from its record high of EUR 181.30 set in 2022. Following several revenue and profit warnings, an emergency restructuring involving the loss of up to 800 jobs was announced in 2023. However, the measures taken to date are not yet sufficient to turn the Company around to profitability.

In mid-April, the downward trend in the share price accelerated once again, reaching a new record low of EUR 7.43. The market capitalization now stands at around EUR 300 million, but the increased pressure to adjust could result in further losses. The bank and promissory note loans of around EUR 485 million are now overwhelming. The investment bank Rothschild is now in demand and is desperately looking for alternative financing measures. Unfortunately, the competitive situation will not change for the better in the short term, as Germany as a business location has massive cost disadvantages in terms of energy, taxes and bureaucracy. Anyone hoping for an improvement in the figures should listen to new CEO Markus Hackstein's comments on the first quarter on May 15. There is no longer an active "Buy" recommendation for the Company on the Refinitiv Eikon platform.

The capital markets are pricing in a potpourri of influences. On the one hand, there is artificial intelligence and the wave of rearmament. However, the upward movements in both sectors are already very advanced and are tending towards consolidation. Globex Mining has an interesting position in the market, as its portfolio includes all the important metals for the energy transition. Only hardened turnaround speculators should get involved in Varta.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.