April 18th, 2024 | 07:00 CEST

Volkswagen, Altech Advanced Materials, BYD - who can benefit from China's rise

Chinese companies such as BYD benefit from state subsidies and domestic access to raw materials. BYD's subsidies have risen from EUR 220 million in just three years to EUR 2.1 billion. These sums are helping BYD dominate the Chinese electric vehicle market and increasingly penetrate the European market. Volkswagen cannot escape the pull of China either. As part of its "In China, for China" strategy, Volkswagen is expanding its cooperation network with Chinese partners. The aim is to reduce costs significantly in the development of EV technology. For companies like Altech Advanced Materials, close cooperation with Chinese market leaders such as BYD and Volkswagen offers the opportunity to commercialize innovative battery technologies that meet the needs of the changing market. One of these innovations, made in Germany by Altech Advanced Materials, increases the longevity of EV batteries by 30%. Here are the details.

time to read: 6 minutes

|

Author:

Juliane Zielonka

ISIN:

VOLKSWAGEN AG VZO O.N. | DE0007664039 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Volkswagen - 'China for China' collaboration with XPENG cuts costs by 40%

Volkswagen aims to significantly reduce the costs of electric vehicles with the newly planned compact car platform. Therefore, the new addition to the team is the Chinese cooperation partner XPENG. The "China Electrical Architecture" (CEA), specially designed for China, should reduce costs by 40% compared to the MEB platform developed in Germany, the car manufacturer revealed this week in Beijing. In part, the number of control units will be reduced by a central computer. This will not please automotive supplier Bosch, but innovation means change.

From 2026, two models specifically designed for the Chinese market are set to hit the market. One of them will be a compact SUV based on the CEA platform. "Competition is very tough, and we need to adjust our cost structure to remain competitive in this environment," says VW China CEO Ralf Brandstätter, explaining the strategic move. The new vehicle architecture is a decisive way of developing China-specific vehicles and advancing the "In China, for China" strategy.

The partnership was initiated in 2023 when the Wolfsburg-based carmaker acquired a 5% stake in XPENG for around EUR 657.8 million. Volkswagen would do well to bow to the wishes of Chinese consumers with its "In China, for China" strategy. The Group lost its top position as the leading automotive brand to none other than BYD.

Last year, Volkswagen sales in the Chinese market fell to 14%, compared to 18% in 2018. The reason: sales of combustion engines declined. Volkswagen now wants to appeal to a broader customer base and is focusing on the entry-level and mid-range segment of electric vehicles. However, the German car manufacturer's range is currently too expensive for the Chinese market. But thanks to a price reduction of around EUR 4,800, the VW ID.3 has become one of the best-selling e-models in China.

Altech Advanced Materials - 30% more power for EV batteries - innovation made in Germany

The increased interest in EVs abroad means great commercialization potential for innovative companies like Altech Advanced Materials. Electric vehicle customers from the entry-level and mid-range segments are looking at both the battery's price and longevity. The battery is an expensive and crucial component for e-mobility, acting at the tipping point in terms of cost and longevity. This is precisely where a division of Altech Advanced Materials, based in Heidelberg, Germany, is filling a gaping hole. Key factors include fast charging times of up to 20 minutes for 80% capacity and a range of around 600 km on a single charge, comparable with conventional combustion vehicles. Safety is also crucial, especially with regard to the risk of fire.

Only if these aspects are considered and broad consumer acceptance is achieved can electromobility be successful in the long term. Efficient and local battery materials are key to this.

The battery materials market is of central importance, as there are dependencies on raw materials from (critical) third countries. Silicon could be a game changer, as new coating technologies enable its use in the anode. Elon Musk, who relies on silicon batteries in Tesla, has also recognized this.

Silicon offers around ten times the capacity of graphite, thus increasing the performance and energy density of the batteries. The Altech Silumina anode process provides easy integration into existing battery architectures. The drop-in technology enables rapid implementation by coating the anode material with ceramic, whether graphite, silicon or another material. This process involves simply replacing one anode material with another without the need to change the battery architecture or manufacturing process. This approach enhances the performance of a coated anode in the battery by 30%.

This novel process can be easily scaled up and industrialized. Moreover, it is also certified as a green process by Cicero. The coating is uniform and flexible, adaptable to various customer requirements. Commercialization is already underway, with a pilot plant in operation in Germany and plans for a production plant. Investors can access the latest financial report for the past financial year from April 18, 2024, through this link.

Dominance through subsidies: State subsidies for BYD increase from EUR 220 million to EUR 2.1 billion in just 3 years

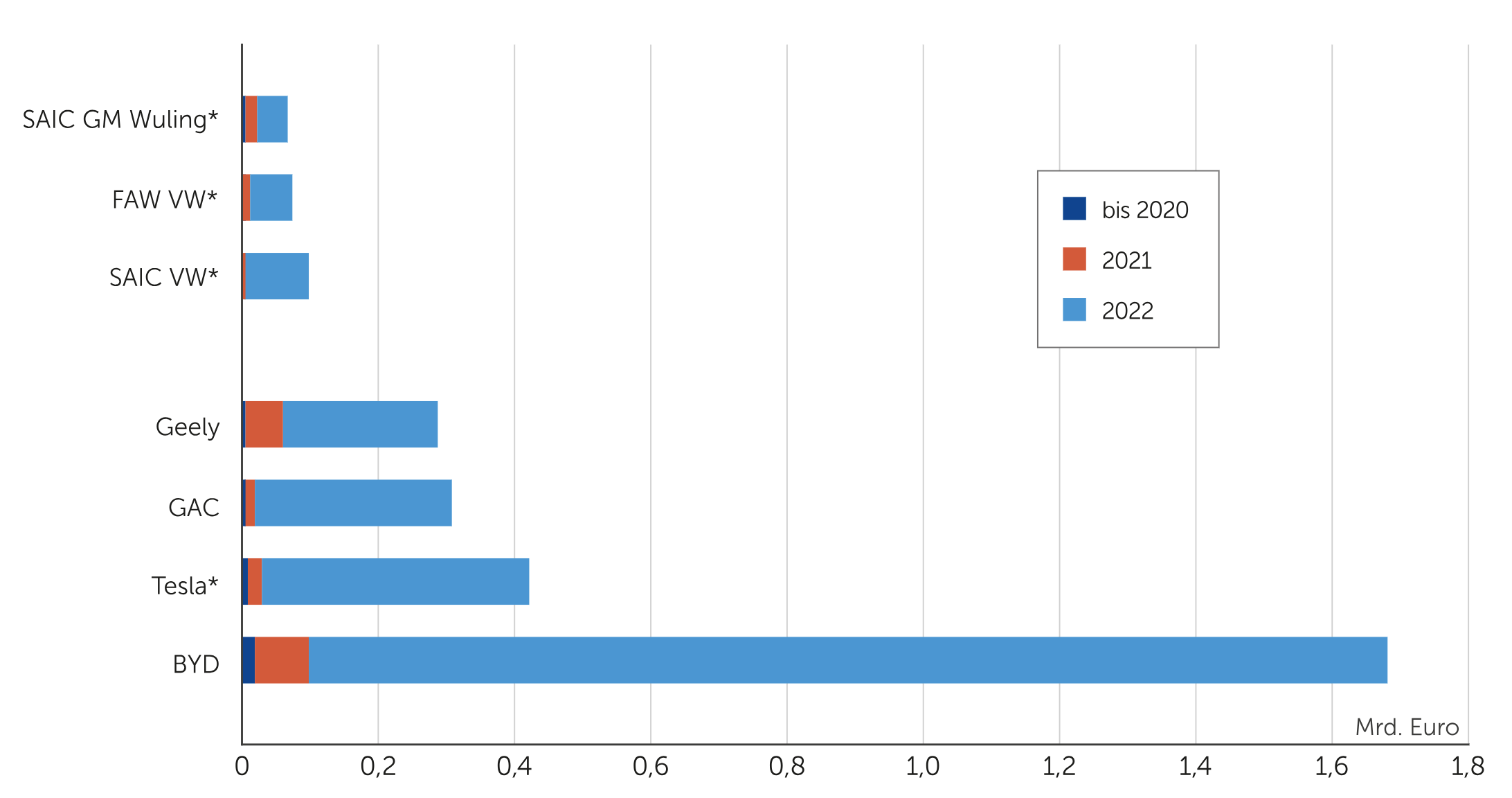

According to a recent report by the Kiel Institute for the World Economy in Germany, Chinese subsidies for BYD, China's leading EV manufacturer, have risen from EUR 220 million in 2020 to EUR 2.1 billion in 2023. In terms of revenue, this corresponds to an increase in direct subsidies from 1.1% in 2020 to 3.5% in 2022, with BYD also benefiting from support for local battery manufacturers and discounts for buyers of its vehicles**. This report comes at a time when the European Union is investigating alleged unfair support for the Chinese EV sector.

Now, investors may wonder what is unfair about government subsidies. A look at the US Inflation Reduction Act shows the government's efforts to decarbonize its own economy with government subsidies.

**China's subsidy policy has been a controversial topic for years: While the European industry often struggles to compete with Chinese rivals on price, without China's subsidized technology, products crucial for Germany's green transformation would also become more expensive and scarcer," in terms of price against the competition from China. However, without China's subsidized technology, products that Germany needs for the green transformation would also become more expensive and scarcer," says Dirk Dohse, Research Director at the Kiel Institute for the World Economy (IfW Kiel).

BYD receives more purchase incentives for electric vehicles in China than all other domestic manufacturers or locally producing foreign companies such as Tesla or Volkswagen joint ventures (see chart):

Chinese companies have expanded enormously into green technology sectors and continue to penetrate the Chinese market. They are using their raw material sources at home and seem to be given preferential treatment in public procedures. China is a leader in the production of photovoltaic systems and battery cells and is now aiming to become a leader in electric vehicles and wind turbines. BYD and Volkswagen could become good partners for Altech Advanced Materials. In the end, performance, price and durability are what count for the buyers of the products.

In a dynamic automotive and technology landscape, strategic partnerships and innovative solutions are crucial. The acceptance of electric mobility depends on the manufacturing costs and the efficiency of the energy sources. Volkswagen and XPENG are significantly reducing the cost of electric vehicles with their "China for China" collaboration. The introduction of the "China Electrical Architecture" (CEA) will enable a cost reduction of 40% compared to the German MEB platform. Altech Advanced Materials, on the other hand, is leveling up e-mobility with an innovative battery technology that increases performance by 30% while focusing on rapid implementation and environmental sustainability. And even in Germany. The state subsidies for BYD in China are triggering debates about fairness and influencing the international market structure. China is proving its leading role in e-mobility. Consumers attach great importance to performance and price. In this setting, Altech Advanced Materials appears to be increasingly important for both car manufacturers. Investors who take a look at the macroeconomic aspects and adjust their portfolio accordingly stand to benefit.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.