March 21st, 2023 | 08:37 CET

Varta, Aspermont, Rheinmetall - Full speed ahead for expansion

Changing conditions in terms of broken supply chains, high raw material prices and an uncertain geopolitical situation have put many companies in dire straits since the Corona pandemic, leading to a collapse in sales and liquidity bottlenecks. Nevertheless, few managed to adapt their business models to emerge stronger from the crisis.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , ASPERMONT LTD | AU000000ASP3 , RHEINMETALL AG | DE0007030009

Table of contents:

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Varta - Back on track

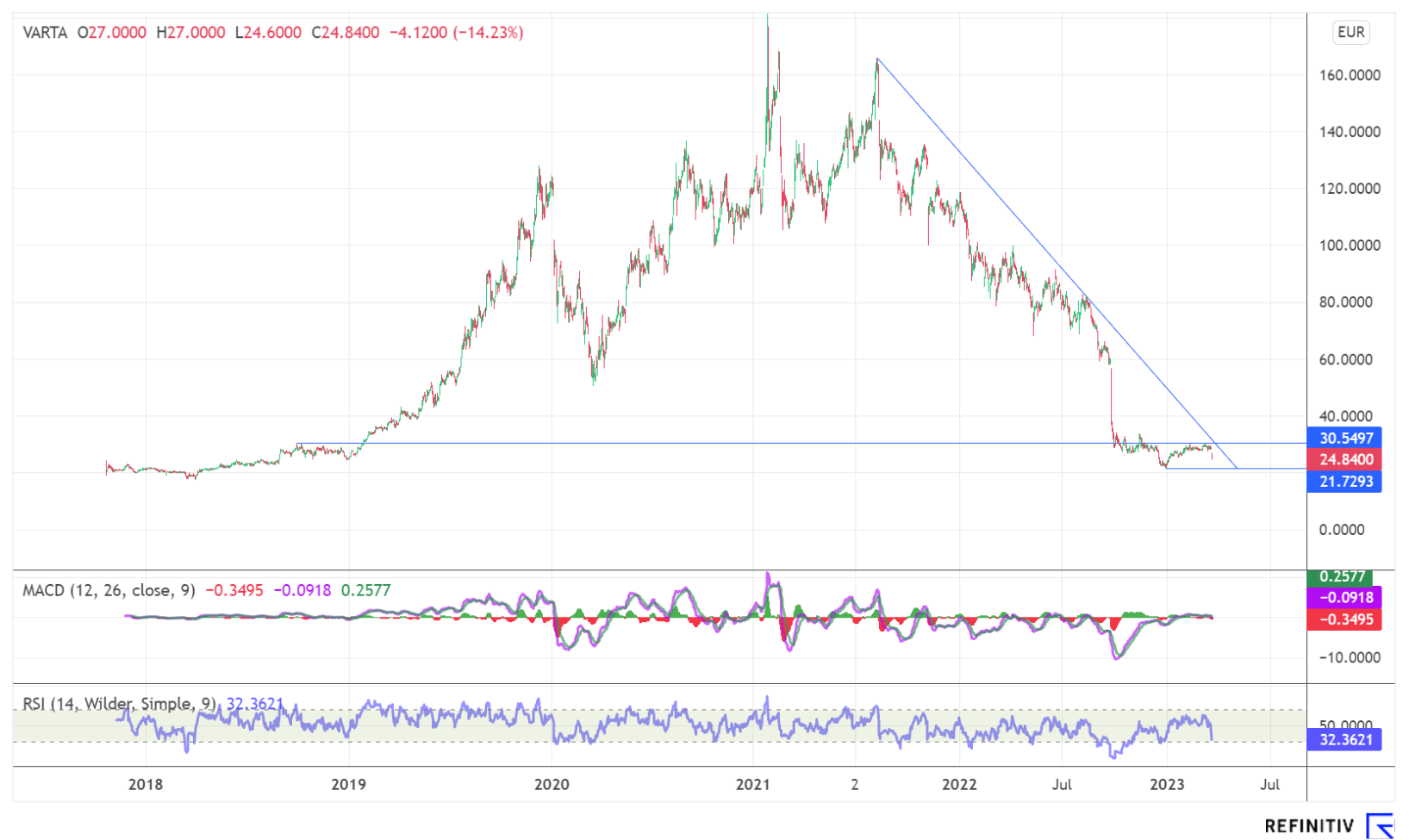

The chart of the battery company Varta shows a sad picture. After highs of EUR 181.30 in January 2021, the title lost around 85% of its value and, following the latest news, is trading at EUR 24.90 with a daily minus of more than 7%. The potential for further setbacks is still present. The next support is EUR 21.72, the low from last year.

The reason for the further drop in the share price was the announcement of a capital increase and the planning of a far-reaching restructuring concept to stabilize the Company financially and operationally. As part of an expert opinion, a concept that includes targeted measures to increase profitability and improve the financing structure was drawn up. The Company plans to invest in important areas of innovation by selling new shares worth EUR 50 million.

The subscription of the new shares will be underwritten exclusively by VGG Beteiligungen SE, a wholly-owned subsidiary of Montana Tech Components. Varta plans to place approximately four million new shares at a selling price not significantly below the current stock exchange price of the Varta shares. The capital increase will be secured by a subscription guarantee of Montana Tech Components, which, however, depends on a final agreement with the financing banks.

Aspermont - Expansion picks up speed

The mediatech company Aspermont has already left restructuring far behind. In the past 26 quarters alone, the Company has seen rising subscriber numbers and an average annual growth rate of 20%. Since this year at the latest, it has taken significant steps towards exponential growth. In addition to adding staff, the market leader in B2B media for the global commodities industry continues to expand its business units. With the establishment of a content agency division, Aspermont aims to significantly increase its service offering to customers. Content Works has been developed through pilot tests supported by major customers such as IBM, Amazon, ThyssenKrupp, and SAP and through the recently announced partnership with the Kingdom of Saudi Arabia.

The division's mission is to develop products tailored to clients, such as audience identification, content creation and creative production, to deliver targeted marketing campaigns for clients with regional or global reach. Aspermont's goal is to strengthen recurring revenue, which is currently at a high 75%, through deeper client relationships. After Content Works contributed only 2% to total sales in the past fiscal year with a pilot project, a significant share of sales is already expected this year.

In addition to the establishment of the new division, the increase in margins and the quality of revenues and organic growth are at the top of CEO Alex Kent's agenda. However, this is not to be financed by raising new equity and debt capital but exclusively from the generated cash flow and the built-up cash reserves. In addition to further increasing the workforce, Aspermont is also looking to enter new markets. North America is the next target. In conjunction with this, a Nasdaq listing is likely to be targeted.

Rheinmetall - Profiting from the turn of the times

Since the beginning of the Russian invasion, the share price of the defence company Rheinmetall has developed magnificently. From around EUR 90 in mid-February of last year, Rheinmetall shares climbed by a staggering 180% to EUR 237. The Düsseldorf-based company's market capitalization exploded to EUR 10.37 billion. As a result, the Company has found itself in the leading index of the German stock exchange, the DAX, since the start of this week. The party to suffer was dialysis company FMC, which now finds itself in the MDAX.

It is well known that Rheinmetall benefits from the rearmament of NATO and its allies, which is already reflected in last year's figures. The outlook for 2023 also speaks in favor of a further expansion of the defence budgets of the individual states. Rheinmetall expects sales of between EUR 7.4 billion and EUR 7.6 billion in 2023, an increase of around 15% compared with the past fiscal year. The operating margin is expected to settle at 12%.

If Rheinmetall CEO Armin Papperger has his way, things could move much faster in terms of ammunition deliveries; the only thing that needs to be added are orders from European governments. "I need orders. Without orders, I do not produce anything," CEO Armin Papperger said in an interview with the Bloomberg news agency.

Despite the huge increase in recent months, analysts remain positive on the defense group. For example, the US investment bank JPMorgan raised its price target from EUR 265 to EUR 310 with an "overweight" rating. The reason for this is the continued high level of defense investments, with Rheinmetall being the primary beneficiary of the lavish ammunition deliveries to Ukraine.

Despite the strong share price increase, analysts remain positive on Rheinmetall. Varta continues to have downside risks, while the signs at Aspermont point to expansion.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.