June 12th, 2023 | 07:30 CEST

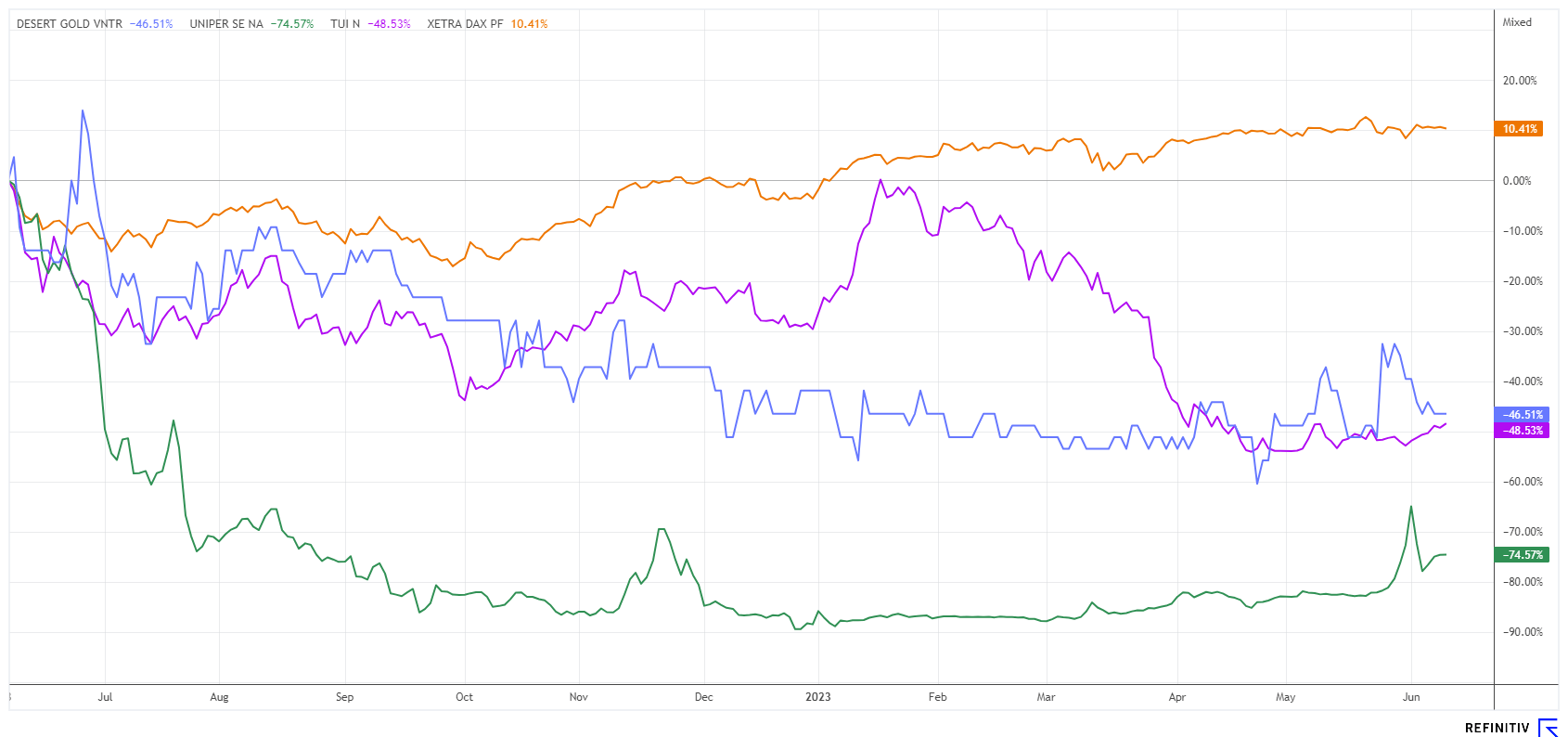

US debt limit suspended - Opportunity for gold: Uniper, Desert Gold, TUI - Turnaround within reach!

Shortly before the "bankruptcy" of the USA, Democrats and Republicans agreed to suspend the debt brake until mid-2025. Joe Biden explicitly praised the compromise - the Republicans, however, are in a less good mood, fearing a continuation of excessive spending, continued high inflation and too little pressure for massive budget cuts. After the House of Representatives, the Senate also voted at the last minute to suspend the statutory limit until mid-2025. In return, cuts in government spending of USD 800 billion over the next two years have been put on the table, but they are yet to be specified. What are the precious metals doing in this environment?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

UNIPER SE NA O.N. | DE000UNSE018 , DESERT GOLD VENTURES | CA25039N4084 , TUI AG NA O.N. | DE000TUAG505

Table of contents:

"[...] We can make a big increase in value with little capital. [...]" David Mason, Managing Director, CEO, NewPeak Metals Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Desert Gold Ventures - The story gets better and better

The so-called debt limit had been hard fought over between Democrats and Republicans. Without this agreement, there would undoubtedly have been panic among the players, but instead, the capital markets, especially in the US and Japan, started a pronounced bull market, which allowed the NASDAQ to gain a whole 1,000 points by the end of last week. With the final agreement, gold and silver, the places of safety and refuge, first had to give way. The spot price of gold fell by a whole USD 75 to USD 1,960. This means an important support zone has been reached again in the 3-year chart. If this does not hold, a further correction towards USD 1,850 or even USD 1,650 is possible. Nevertheless, there are good reasons to increase the precious metal quota in the portfolio because purchasing power is declining, geopolitical uncertainties are increasing rather than decreasing, and both the economy and the real estate market are sending rather recessionary signals. And a suspension of the debt limit is still a long way from getting to the root of the evil of horrendously rising government spending.

If you want to diversify into precious metals accordingly, Canadian explorer Desert Gold Ventures (DAU) has a lot of fantasy about further gold mineralization in the highly focused Senegal-Mali-Shear Zone (SMSZ). In February 2023, they completed 445 holes totalling 2,067 m, and now a new resource estimate is being prepared. So far, the bar has been set at about 1 million ounces of indicated and suspected resources in gold. The current permit area covers a total of 440 sq km and is adjacent to larger mining operations in the immediate vicinity.

While Barrick, B2 Gold and others have been producing over 700,000 ounces for some time, another producer, Allied Gold, has focused on the SMSZ area in recent months. The Company, which is not yet listed, aims to go public in 2023 with a billion-dollar valuation. Over the past 10 years, the Canadians have amassed a portfolio of gold projects in Africa with current mineral reserves of about 10 million ounces of gold and have since been producing more than 300,000 ounces per year. Not far from the border in Senegal, Endeavour Mining is setting the next milestones. The existing Sabodala-Massawa mine is to be expanded, and in 2024 the giant Lafigué project will be brought into production.

With a market cap of just CAD 11.5 million, Desert Gold's SMSZ project will soon be in the sight of the majors because what could be cheaper than adding good groundwork to your balance sheet for a steal? The cash flow should be there, with production costs below USD 800 in this region. Desert Gold should weigh in at more than USD 100 million in the M&A scenario. Due to the current weakness in the junior market, now is a good time for a speculative entry. Investors usually only discover what is happening secretly in the background when the takeover conditions are made public.

Uniper - Speculation on a knife edge

The speculation around Uniper is likely going into the next round if one takes a closer look at the 100% increase in recent weeks. At the end of May, the share was still at EUR 4, but in the first week of June, it was already above EUR 8 and is now back at EUR 5.75. The rollercoaster ride has been characterized by speculation, as the news currently provides few fundamental buying arguments. At the end of May, the nationalized company let investors know that further capital increases by the government were not necessary. Then CFO Jutta Dönges also commented on a possible re-privatization of the Company.

I beg your pardon? The group was saved from insolvency in mid-2022 with state aid and guarantees totalling almost EUR 50 billion, and now the Company is supposed to be worth EUR 66 billion? Nevertheless, the state-owned company is now making lavish profits from gas trading because the futures price plummeted by over 80% after the lunar pricing in 2022, but household gas prices have not decreased by a single cent. The state is currently recovering the subsidies that were paid out, but this could take several more years. Conclusion: Only 45 million of the 8.33 billion shares are in free float. All experts on the Refinitiv Eikon platform advise against the share and see a median price target of EUR 3.27. Thus, Uniper is, at best, a trading stock being passed around like a hot potato due to the limited amount of free capital. A casino-like experience for specialists!

TUI - The turnaround is delayed

After several painful capital increases, TUI is finding it difficult to make a positive impact among investors. But the worst months of gloom are over, and the booking situation has stabilized for now. However, the margins still have to increase due to considerable price increases. Due to the pandemic, many hotel businesses had to close because costs were too high and staffing levels were low. Along with general inflation, both accommodation and airfares have risen significantly. While private households felt a certain desire to make up for missed vacations, they are now facing budget constraints, which could be spent on expensive long-haul trips.

Nevertheless, there are tentative thumbs up from analysts. The analysts at Deutsche Bank see a profitable second half of the year and raise their rating from "Hold" to "Buy" with a 12-month price target of EUR 9.80, which is still a 50% premium to the last price. The experts at Refinitiv Eikon are a little more cautious, with a median target price of EUR 8.80. The debt situation is improving, but it will take a lot of management skill to coax money from those willing to travel again. The economic environment is not conducive to an imminent travel boom. Therefore, TUI's balance sheet consolidation and debt repayment will likely proceed relatively slowly.

After a long sideways movement, financial players are breathing a sigh of relief. The insolvency of the largest economy has been averted. In return, speculators now expect the appreciation of equities to continue into the autumn and new highs to be reached. Whether this will happen depends on many factors. Uniper and TUI are rehearsing the turnaround, and Desert Gold Ventures is a speculative addition to the gold segment with excellent prospects of an M&A deal in the next 24 months.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.