October 24th, 2023 | 07:00 CEST

Uranium with exploding demand! Uniper, GoviEx Uranium, Plug Power, RWE - The next 100% value in the portfolio

With a global alliance, the participants of the last climate conference in Cairo want to implement their NetZero targets by 2035 or 2045. The speed of adaptation to more sustainable energy production and use is, of course, dependent on the public investment budgets of governments. In Germany and the EU, eco-taxes are levied to fund other areas, such as transport, which are then to be invested in environmental projects. However, most participants in the climate agreement are overburdened because of the high costs of migration management and rising government spending. However, because many countries still have a good infrastructure for nuclear energy, this form of energy is now being used to achieve the desired climate neutrality somewhat earlier and more easily. The protagonists of this view in Europe are France, Spain, Poland and the Czech Republic - Germany is staying out of this issue. However, around 100 new reactors are to be built worldwide, so uranium as a raw material is once again at the top of the shopping list. Which stocks are at the forefront of this trend?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

UNIPER SE NA O.N. | DE000UNSE018 , GOVIEX URANIUM INC A | CA3837981057 , PLUG POWER INC. DL-_01 | US72919P2020 , RWE AG INH O.N. | DE0007037129

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

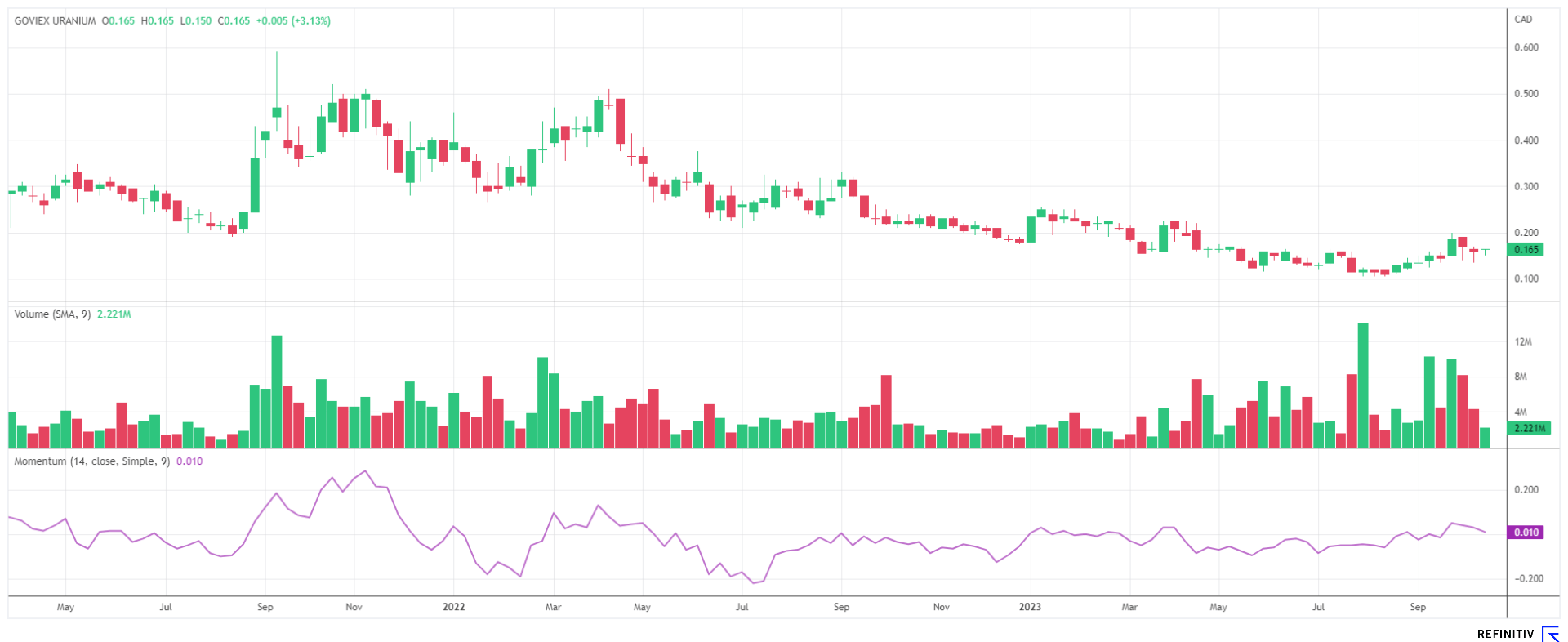

GoviEx Uranium - Full speed ahead towards production

**Around 200 km from Lusaka, the capital of Zambia in the southern half of Africa, lies the Muntanga project of uranium explorer GoviEx. The Company has held a mining license here for some time now, and production is scheduled to start by 2026. Currently, management is taking care of the necessary preliminary work in the region, all while complying with all ESG criteria, as confirmed by the latest sustainability report. In addition to Zambia, GoviEx is developing the promising Madaouela project near the extraction sites of French state-owned Orano in Niger and the multi-metal Falea project in Mali. However, the focus is currently clearly on the Muntanga project. The Company has a significant resource inventory at its properties, with over 130.6 million pounds of U3O8 in the Measured and Indicated categories and 30.5 million pounds of U3O8 in the Inferred category.

Global uranium production is already below the needs of power companies today and, according to the World Nuclear Association, will reach a critical stage as early as 2025 because there are not enough new mines to even come close to meeting the growing demand. At the moment, power producers can only stay afloat because of recycling and sales activities of strategic stockpiles. In perspective, there is a shortfall of about 25% of the demand for uranium in 2030. This provides excellent prospects for mining development. With nearly 726 million shares outstanding, GoviEx's current market value is about CAD 117 million - A pittance when assessed against the market opportunity over the next few years. GoviEx is determined to bring its flagship projects into production with great energy. The uranium price has climbed by over 60% since August, giving the projects a corresponding tailwind. CEO Daniel Major recently outlined his upcoming plans at the 8th International Investment Forum.

Plug Power - The sellout continues

Beyond uranium production, Plug Power continues to seek public budgets for its hydrogen electrolyser business. The Company from the state of New York recently took a huge hit because the rise in interest rates over the past 6 months meant all projects had to be priced at lower present values. In addition, public-sector contracting has stalled significantly of late. Investors have already voted with their feet because of the consistently poor performance, the inconsistencies because of missed business plans and doubts about the near future. They sent the share to a new 36-month low of EUR 5.75 last week. On November 9, Plug Power is set to report on the third quarter. **One can only hope that a positive outlook from management will follow the renewed loss announcement; otherwise, the sell-off of the PLUG share is likely to continue unabated.

Uniper - Many seem to have miscalculated here

The hard-hit energy group Uniper remains a mystery. Because of its focus on international gas business, the German government had to rescue the Company from bankruptcy with a cover commitment of EUR 25 billion. By acquiring the shares of Finnish state-owned Fortum, the federal government obtained around 99% of the outstanding shares at the end of 2022. Uniper is now considered to have been restructured and is to be made fit for the stock market again with a capital consolidation of 20 to 1. Currently, only 1% of the shares are still in the hands of speculators. Over the last 12 months, the share price has been on a roller coaster ride between EUR 3 and EUR 7. Due to the high shareholding of the state and the low free float, the market value is calculated at an incredible EUR 33.6 billion. With the merger, the number of shares will shrink from 14.16 billion to just 416 million, and the calculated par value per share will fall from EUR 1.70 to EUR 1.00. By 2028, the state's shareholding is to be reduced to 25%. Because of the crazy loss carryforwards, the current listing is completely disconnected from reality. A revaluation is therefore pending, and fresh quarterly figures are expected from Uniper on October 30.

RWE - Analysts give the thumbs up

The RWE share is currently experiencing a renaissance. On Saturday, the energy giant celebrated its 125th anniversary and invited superstar Robbie Williams to Essen for an employee celebration. In the run-up, there had been criticism of the engagement of the expensive star guest in times of crisis. Little disturbed by climate activists, German Chancellor Olaf Scholz was also expected at the party with top police protection. Due to the recent consolidation of about 20% from the peak of EUR 43.40, analysts have increasingly given their approval. Currently, the Company is one of the most affordable stocks on the DAX 40 with a P/E ratio of 7 and a dividend yield of 3%. Both JP Morgan and Deutsche Bank see price targets of EUR 53.50 and EUR 51.00, respectively and recommend buying. The average 12-month price target of the experts on the Refinitiv Eikon platform is EUR 50.45. All 24 ratings are in the upper recommendation range. So, not much can go wrong in the medium term with an entry price of EUR 34.

It remains exciting in the energy market. Never before have there been so many distortions and valuation irritations in such a short time. The fact is that the favorable gas supply of the last 70 years must now be put aside. Germany will have to stock up on the market or tap into its own sources through fracking. However, this plan will likely fail due to the convictions of the current traffic light government. Investors should, therefore, remain vigilant and make opportunity-oriented investments. This includes a high degree of investment in standard stocks and interesting admixtures such as the Canadian company GoviEx.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.